31 October 2022 Market Close & Major Financial Headlines: Wall Street Closed Down Marginally As Investors Await Fed Meeting

Summary Of the Markets Today:

- The Dow closed down 129 points or 0.39%,

- Nasdaq closed down 1.03%,

- S&P 500 down 0.75%,

- WTI crude oil settled at $86 down $1.91,

- USD $111.59 up $0.82,

- Gold $1636 down $9.40,

- Bitcoin $20,358 down 1.38% – Session Low 20,268,

- 10-year U.S. Treasury 4.05% up 0.044%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

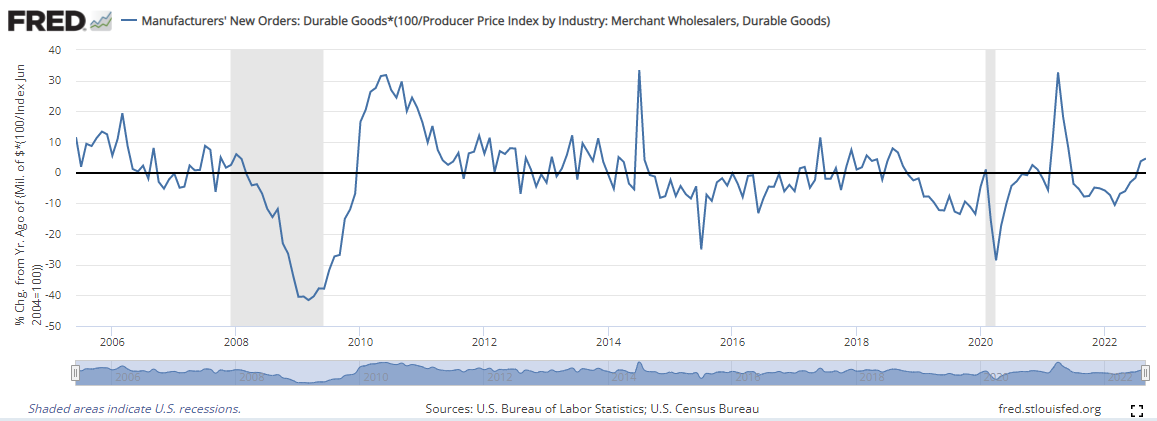

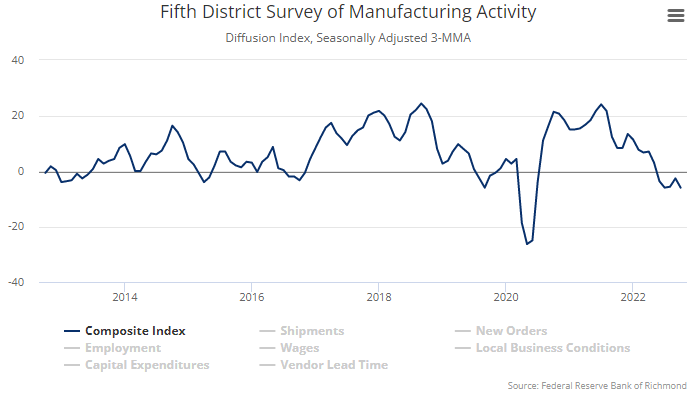

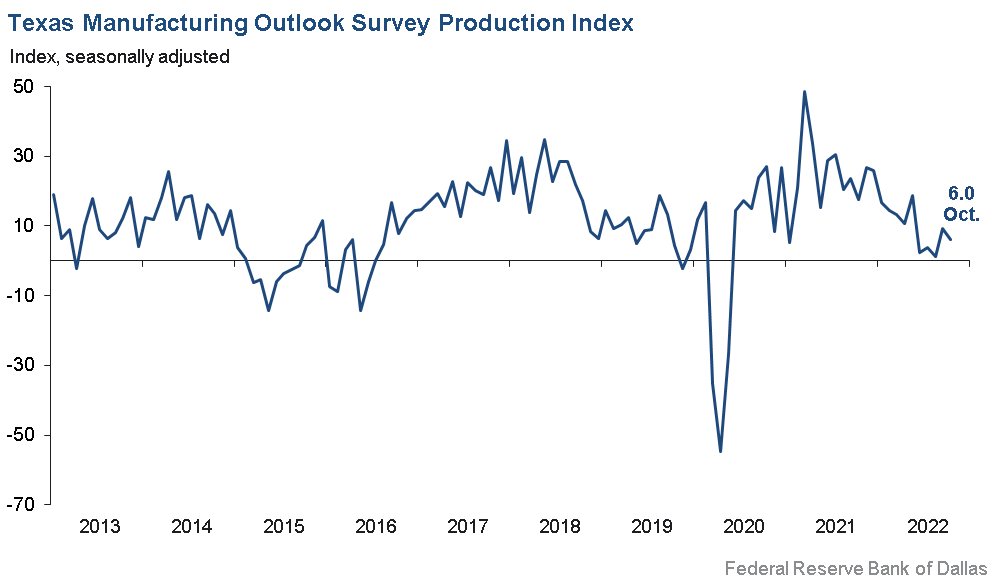

The Dallas Fed’s Texas Manufacturing Outlook Survey show conditions, edged down three points to 6.0, suggesting a slight deceleration in output growth. Other measures of manufacturing activity also moved down this month. The new orders index slipped to -8.8―its fifth month in a row in negative territory—suggesting a continued decrease in demand. The growth rate of orders index also remained negative and dropped 12 points to -13.2.

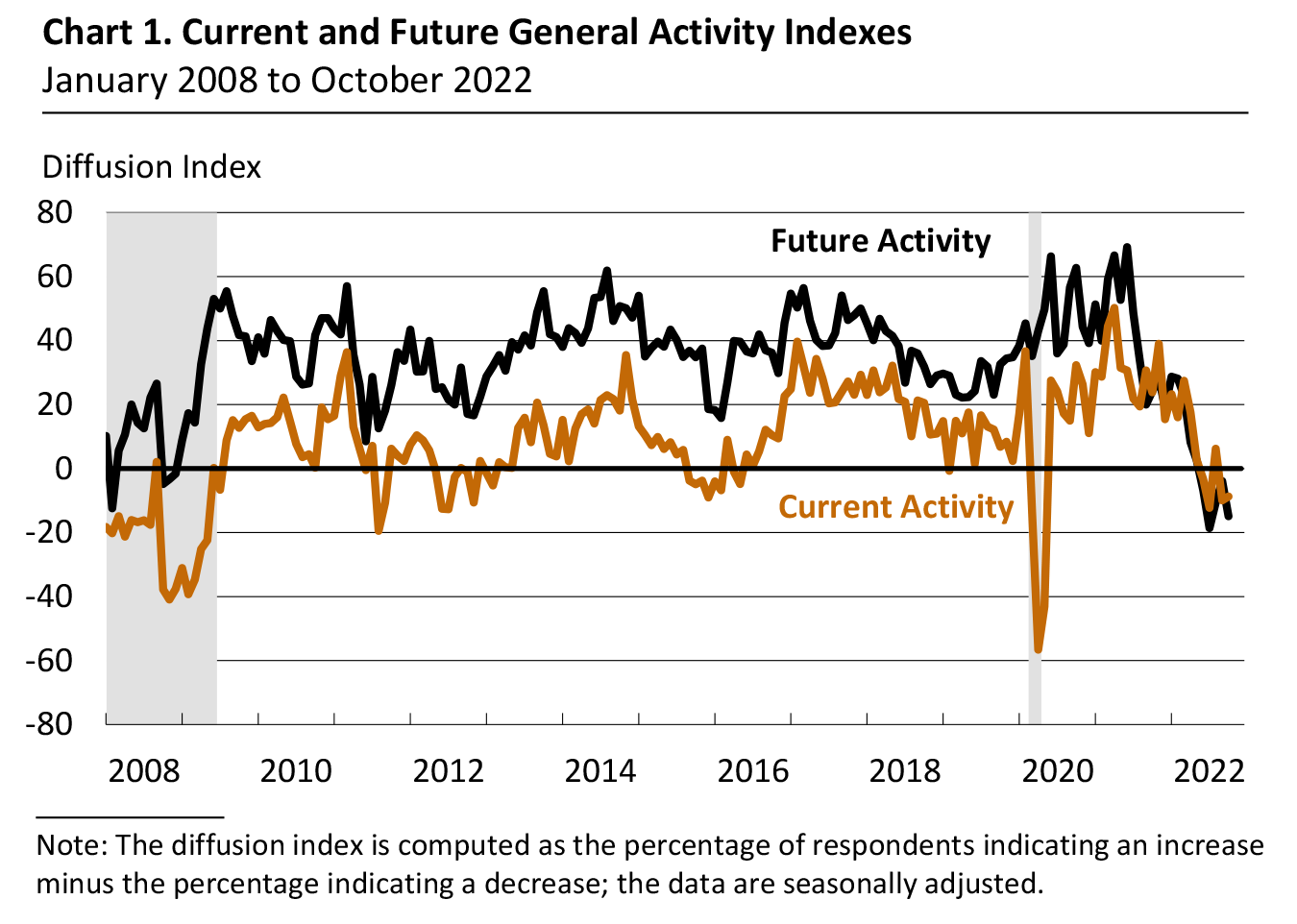

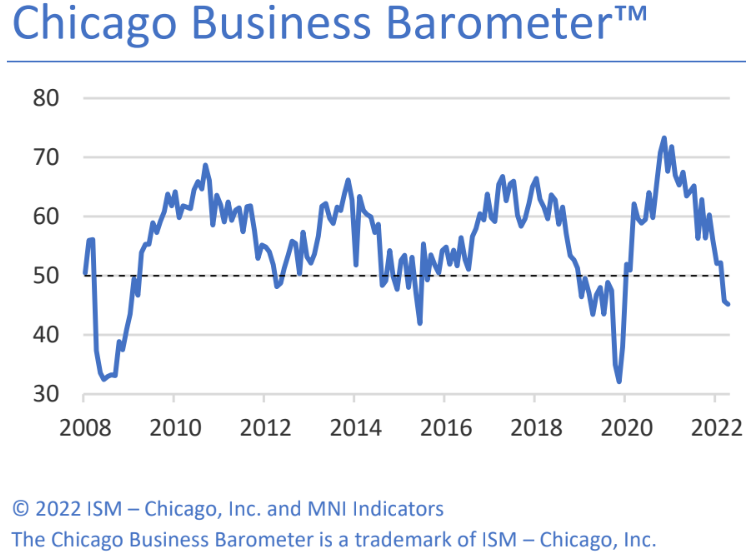

The Chicago Business Barometer dipped a further half-point to 45.2 in October 2022, contracting for a second consecutive month. This indicator sponsored by the Institute of Supply Management – Chicago (ISM-Chicago) has a good correlation to the national indicator produced by the ISM mother organization which will be released shortly.

A summary of headlines we are reading today:

- Prices At The Pump Fall For the Third Straight Week

- East Coast Diesel Prices Are Soaring

- Long Covid is affecting women more than men, national survey finds

- The Scariest Thing On Halloween – Inflation

- Inflation is coming for your Christmas tree

These and other headlines and news summaries moving the markets today are included below.