13Dec2022 Market Close & Major Financial Headlines: Wall Street Major Indexes Closed In The Green Near Session Lows. CPI Continues To Moderate.

Summary Of the Markets Today:

- The Dow closed up 104 points or 0.30%,

- Nasdaq closed up 1.01%,

- S&P 500 up 0.73%,

- WTI crude oil settled at $75 up $2.25,

- USD $104.97 up $1.10,

- Gold $1823 up $30.40,

- Bitcoin $17,751 up 3.86% – Session Low 17,107,

- 10-year U.S. Treasury 3.519% down 0.095%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

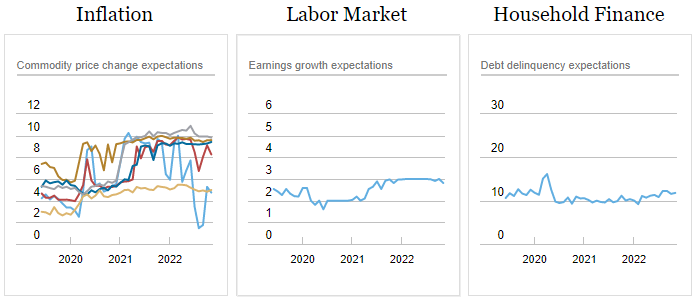

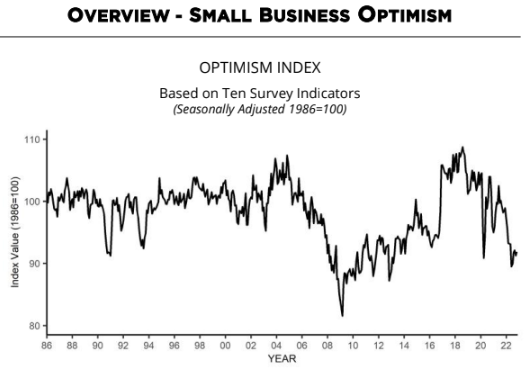

Inflation Pressures Ease Slightly on Main Street but Remains the Top Business Problem according to November’s Optimism Index reading stays below 49-year average. Inflation remains the top business problem for small business owners, with 32% of owners reporting it as their single most important problem in operating their business, five points lower than July’s highest reading since the fourth quarter of 1979. The Small Business Optimism Index rose 0.6 points in November to 91.9.

The Consumer Price Index for All Urban Consumers (CPI-U) over the last 12 months increased by 7.1% (blue line in the graph below) – but has declined almost 2% from the high mark this year AND is now at the lowest level in 2022. The index for all items less food and energy declined to 6.0% (red line in the graph below). This does take some pressure off of the Federal Reserve as it is beginning to show their policies are making progress in lowering inflation.

A summary of headlines we are reading today:

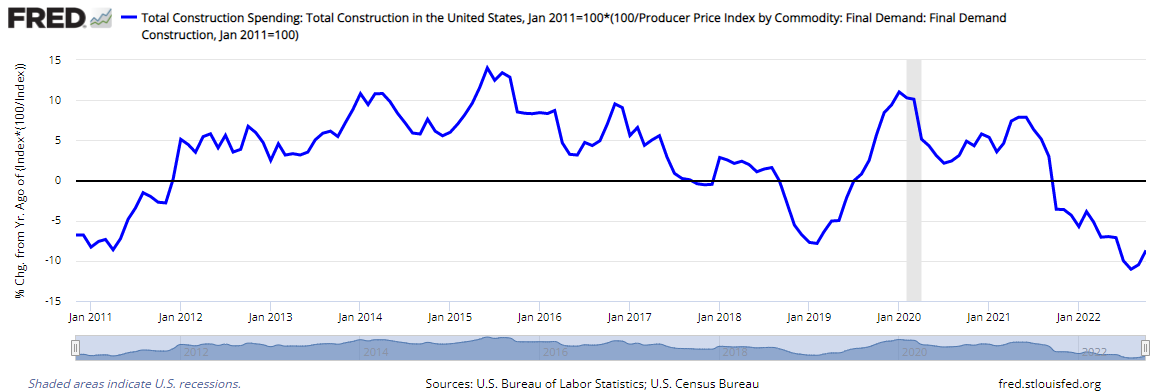

- Can Supply Chains Keep Up With A Looming Construction Boom?

- Supply Chain Woes Slow U.S. Solar Boom

- Ford boosts the production of the electric F-150 Lightning pickup truck

- Boeing airplane deliveries picked up in November

- United Airlines is buying at least 100 Boeing Dreamliners to replace aging wide-body jets

- Hotel prices and airfare decline as travel demand cools after a summer surge

- Supreme Court upholds California ban on flavored tobacco

- OPEC Production Fell In November, But 3 Members Actually Boosted Output

- Futures Movers: Oil prices end at a more than 1-week high on cold weather forecasts, CPI reading

These and other headlines and news summaries moving the markets today are included below.