11 NOV 2024 Market Close & Major Financial Headlines: Wall Street’s Three Main Indexes Gapped Up At The Opening Bell To, Again, Record New Historic Highs, Finally Closing With New Closing Highs

Summary Of the Markets Today:

- The Dow closed up 304 points or 0.69%, (Closed at 44,293, New Historic high 44,867)

- Nasdaq closed up 12 points or 0.06%, (Closed at 19,299, New Historic high 19,366)

- S&P 500 closed up 10 points or 0.06%, (Closed at 6,001, New Historic high 6,017)

- Gold $2,630 down $64.80 or 2.40%,

- WTI crude oil settled at $68 down $2.16 or 3.07%,

- 10-year U.S. Treasury 4.304 down 0.039 points or 0.898%,

- USD index $105.49 up $0.49 or 047%,

- Bitcoin $87,209 up $9,166 or 10.51%, (24 Hours) , (New Bitcoin Historic high 87,401)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

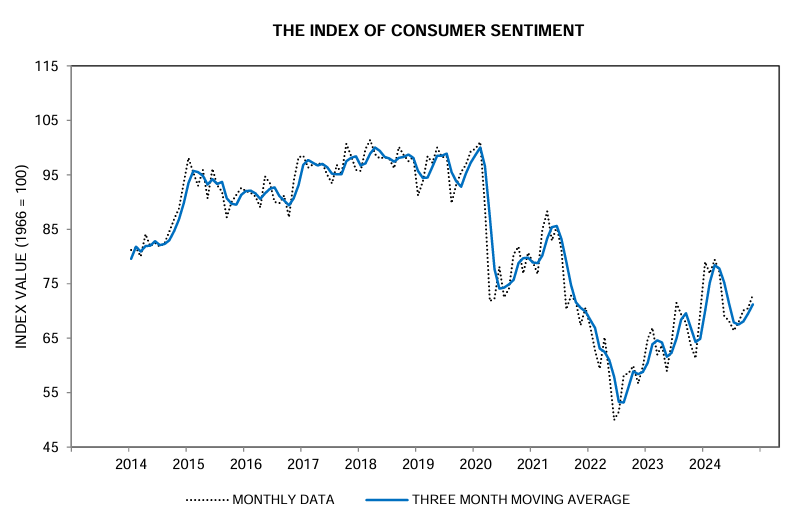

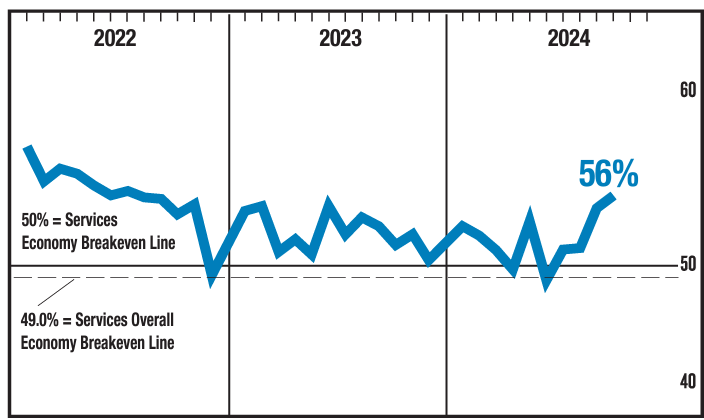

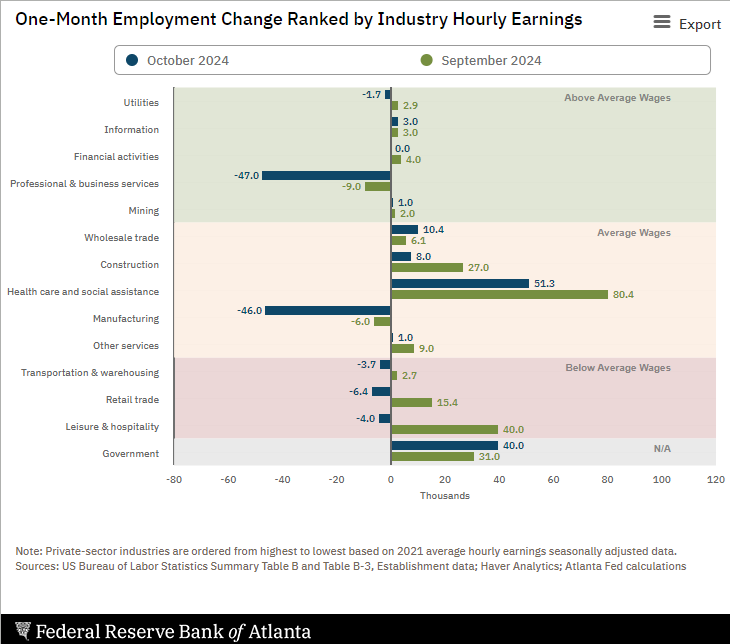

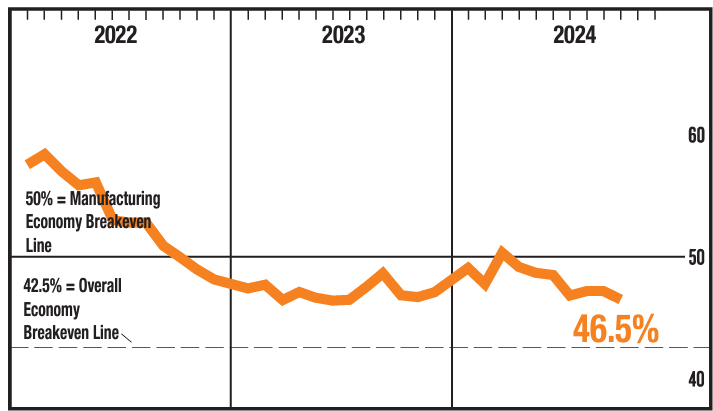

The stock market experienced significant gains on Monday, continuing a robust post-election rally. The Dow Jones Industrial Average closed above 44,000 for the first time, while the S&P 500 closed surpassing the 6,000 mark. Both indexes had just recorded their best week of the year, driven by optimism surrounding lower corporate taxes and deregulation anticipated from President-elect Donald Trump. Bitcoin reached a new high of $86,000, fueled by expectations of a crypto-friendly administration under Trump. Other cryptocurrencies like Dogecoin also saw gains. Tesla’s stock surged for the fifth consecutive session, climbing over 8%, reflecting investor confidence in its potential benefits from Trump’s presidency. In contrast, the Nasdaq Composite struggled, closing slightly down due to underperformance from major tech stocks like Nvidia, Apple, and Meta. Small-cap stocks also thrived, with the Russell 2000 index achieving its highest level since November 2021. Market sentiment was bolstered by the Federal Reserve’s recent interest rate cut and positive consumer sentiment data released last week. However, some analysts express caution regarding the sustainability of this rally as they await upcoming inflation data that could influence future Federal Reserve policy decisions.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

No releases on Veteran’s Day

Here is a summary of headlines we are reading today:

- Shippers Brace for Impact as Freight Rates Climb

- Venezuela’s Gas Pipeline Explosion Highlights Crumbling Infrastructure

- U.S. Natural Gas Prices Jump Over 10% After Hurricane Rafael Hits

- National Gasoline Prices Fall To 3-Year Low

- Saudi-Iranian Relations Warm as Middle East Braces for Trump’s Return

- Tesla shares pop 6% as postelection rally continues

- Bitcoin tops $87,000 as crypto euphoria over Trump win shows no sign of waning

- GM’s Wall Street vindication is happening as it outperforms its peers in 2024

- Gunfire Hits Spirit Airlines Jet On Final Approach In Haiti, Crew Wounded

- China’s Foreign Direct Investment Set For First Negative Year In History

- ‘I’ve no interest in investing more money in the stock market’: I’m debt-free, retired, and ignoring the ‘Trump bump.’ What should I do with $400,000 in cash?

- U.S. oil benchmark settles below $70 a barrel on China stimulus disappointment

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.