03 May 2023 Market Close & Major Financial Headlines: Wall Streets Major Indexes Looked Like A Seismic Earthquake Recording After Chair Powell Raised Interest Rates, Finally Closing Deep In The Red At Session Lows

Summary Of the Markets Today:

- The Dow closed down 270 points or 0.80%,

- Nasdaq closed down 0.46%,

- S&P 500 closed down 0.70%,

- Gold $2,037 up $13.60,

- WTI crude oil settled at $68 down $3.49,

- 10-year U.S. Treasury 3.352% down 0.087 points,

- EUR/USD $1.105 up $0.005,

- Bitcoin $28,351 down $384,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases:

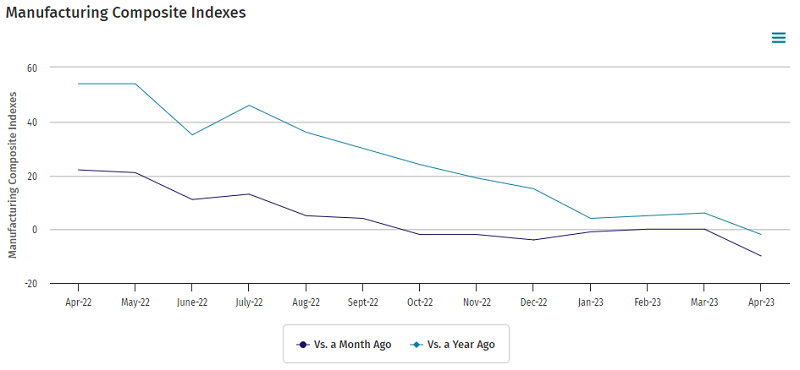

The ADP National Employment Report for April 2023 showed that private payrolls increased by 296,000 (blue line on the graph below), much higher than expected. This was the largest gain since July 2022. The services sector added 229,000 jobs, led by leisure/hospitality (154,000), education/health services (69,000), and trade/transportation/utilities (32,000). Meanwhile, the goods-producing industry added 67,000 jobs due to construction (53,000) and mining (52,000) while manufacturing shed 38,000 jobs. Medium establishments created 122,000 jobs, small-sized companies 121,000 jobs only large firms 47,000 jobs. Job changers in particular saw a dramatic decline in pay growth to 13.2%, the slowest pace of growth since November 2021, from 14.2%. For job stayers, pay growth eased to 6.7% from 6.9%. The report also showed that average hourly earnings for private employees rose 5.4% from a year ago, down from 5.5% in March. The deceleration in wage growth is a sign that labor market tightness is easing.

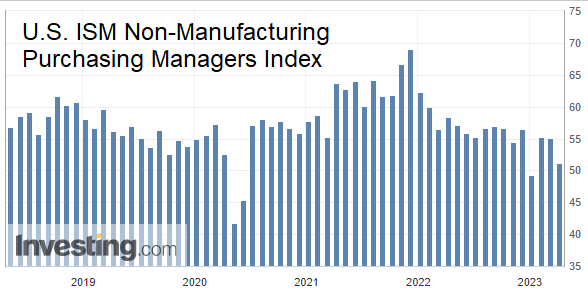

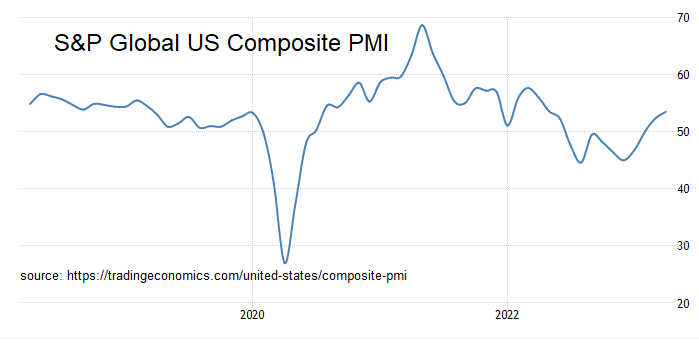

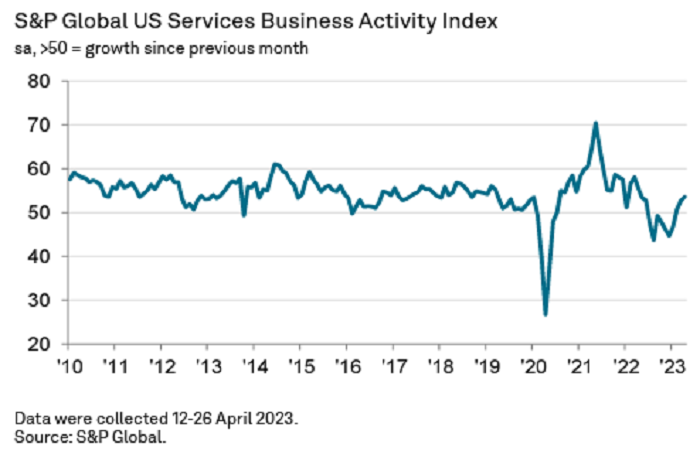

The S&P Global US Services PMI for April 2023 came in at 53.6, up from 52.6 in March. This was the fastest pace of expansion in the country’s service sector since April 2022. The increase in the S&P Global US Services PMI suggests that the services sector is growing at a faster pace.

The Federal Open Market Committee (FOMC) met on May 3-4, 2023, and decided to raise the target range for the federal funds rate by 0.25 percentage points to a range of 5.00 to 5.25 percent. The FOMC’s decision to raise interest rates was in response to high inflation which is not moderating quickly. There were few word changes in the meeting statement so there are no clues on how many more rate increases are projected. For a commentary on Chair Powell’s market-moving comments after the latest rate hike – [click here].

A summary of headlines we are reading today:

- TotalEnergies To Launch $27 Billion Energy Project In Iraq This Month

- Rare Earth Metals See Prices Plunge

- Oil Prices Crash As Demand Fears Mount

- Iran Seizes Second Oil Tanker In Arabian Gulf

- Fed recap: Here are Chair Powell’s market-moving comments after the latest rate hike

- Dow closes more than 250 points lower Wednesday after Fed hikes rates for a 10th time: Live updates

- The market is looking for the next ‘domino’ to fall, keeping banks under pressure

- Private payrolls surged by 296,000 in April, much higher than expected, ADP says

- Watch Live: Fed Chair Powell Attempt To Explain If The Pause Is Hawkish Or Dovish

- Fed’s Powell says U.S. banking system is ‘sound and resilient’ after First Republic failure

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.