31 May 2023 Market Close & Major Financial Headlines: Wall Street Three Major Indexes Close Moderately Down In The Red As The Month Of May Goes Away

Summary Of the Markets Today:

- The Dow closed down 135 points or 0.41%,

- Nasdaq closed down 0.63%,

- S&P 500 closed down 0.61%,

- Gold $1,982 up $5.40,

- WTI crude oil settled at $68 down $1.58,

- 10-year U.S. Treasury 3.631% down 0.065 points,

- USD Index $104.22 up $0.05,

- Bitcoin $27,015 down $840,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of job openings edged up to 10.1 million on the last business day of April 2023. Over the month, the number of hires changed little at 6.1 million. Total separations decreased to 5.7 million. The trend lines for jobs growth are declining after peaking in March 2022.

The Summary of Commentary on Current Economic Conditions (known as the Beige Book) shows economic activity was little changed overall in April and early May. It was summarized as follows:

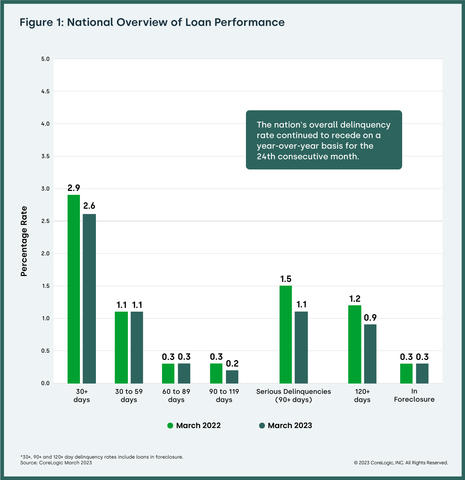

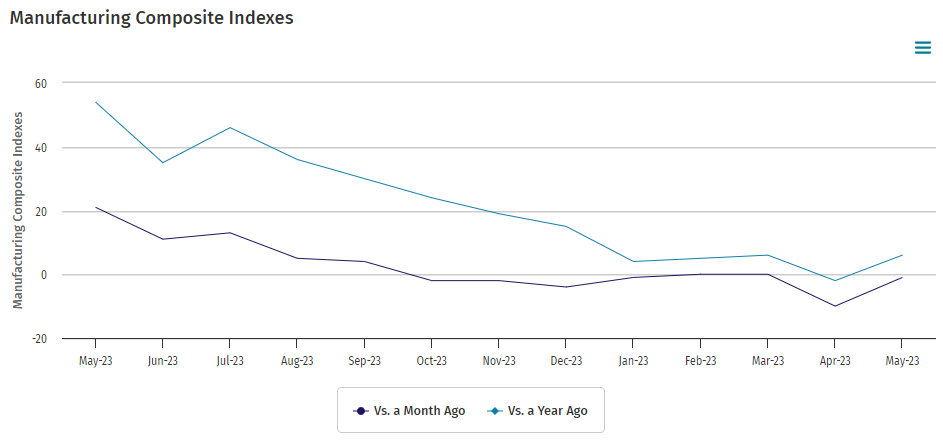

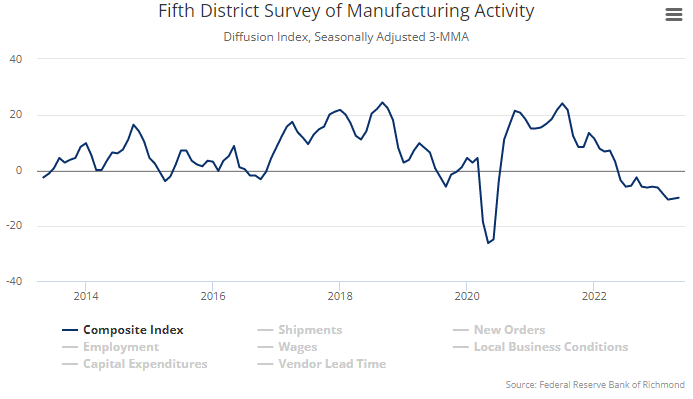

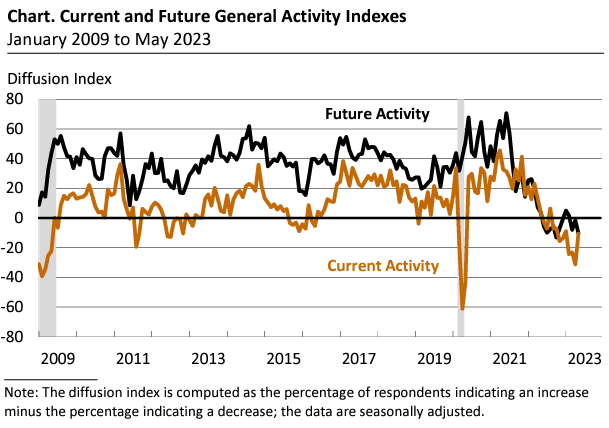

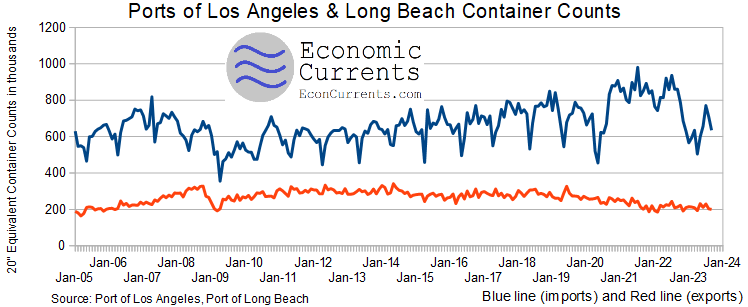

Four Districts reported small increases in activity, six no change, and two slight to moderate declines. Expectations for future growth deteriorated a little, though contacts still largely expected a further expansion in activity. Consumer expenditures were steady or higher in most Districts, with many noting growth in spending on leisure and hospitality. Education and healthcare organizations saw steady activity on balance. Manufacturing activity was flat to up in most Districts, and supply chain issues continued to improve. Demand for transportation services was down, especially in trucking, where contacts reported there was a “freight recession.” Residential real estate activity picked up in most Districts despite continued low inventories of homes for sale. Commercial construction and real estate activity decreased overall, with the office segment continuing to be a weak spot. Outlooks for farm income fell in most districts, and energy activity was flat to down amidst lower natural gas prices. Financial conditions were stable or somewhat tighter in most Districts. Contacts in several Districts noted a rise in consumer loan delinquencies, which were returning closer to pre-pandemic levels. High inflation and the end of Covid-19 benefits continued to stress the budgets of low- and moderate-income households, driving increased demand for social services, including food and housing.

Here is a summary of headlines we are reading today:

- Argentina’s Vaca Muerta Shale Play Could Produce 1 Million Bpd In 2030

- Colombia’s President May Have To Rethink His Oil And Gas Exploration Ban

- American Offshore Wind Gets Gulf Of Mexico Green Light

- Reuters Survey: OPEC Output Down 460,00 BPD This Month

- Goldman And Others See Rising Odds Of Another OPEC+ Output Cut

- Gasoline Prices Tick Up For The Summer

- Singapore Detains Record Number Of Oil Tankers As Shadow Fleet Expands

- Stocks slip as investors look to House vote on the debt ceiling, Nasdaq pops nearly 6% in May: Live updates

- Debt ceiling bill poised to pass the House as Senate aims for a Friday vote

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.