14 June 2023 Market Close & Major Financial Headlines: Feds Promises Two More Rate Hikes Sinking The DOW, Sending The SP 500 To Flat Territory With The Nasdaq Closing Moderately Higher

Summary Of the Markets Today:

- The Dow closed down 233 points or 0.68%,

- Nasdaq closed up 0.39%,

- S&P 500 closed up 0.08%,

- Gold $1,960 up $1.00,

- WTI crude oil settled at $69 down $0.72,

- 10-year U.S. Treasury 3.800% down 0.041 points,

- USD Index $103.06 down $0.28,

- Bitcoin $25,853 up $21,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Federal Reserve did what the market expected holding the federal funds rate steady stating in part:

… the Committee decided to maintain the target range for the federal funds rate at 5 to 5-1/4 percent. Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

Their forward-looking words on what happens next:

;;; In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The bottom line is that this statement really gives you no clues on the future of the federal funds rate. However, Fed Chair Powell’s press conference did indicate future rate hikes as well as well as dot-plots which show 2 more increases. Further, Chair Powell said he doesn’t see a rate cut until inflation comes down meaningfully and significantly, and that can take a couple of years.

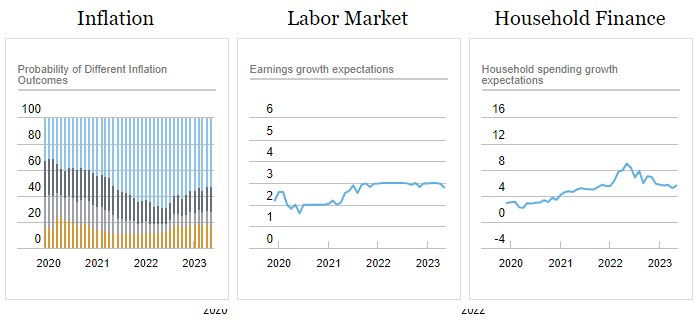

Inflation seems to have been tamed as the producer price index (PPI) has fallen from 2.3% in April to 1.1% in May 2023. The PPI less foods and energy declined from 3.3% to 2.8% in May.

Here is a summary of headlines we are reading today:

- Rystad Sees Major Jump In Battery Storage Capacity Through 2030

- Polysilicon Price Surge: A Challenge For Emerging Solar Markets

- Oil Moves Lower After EIA Confirms Large Crude Build

- JP Morgan Slashes Oil Price Forecast To $81 This Year

- Shell To Raise Dividend By 15% As It Doubles Down On Oil And Gas

- Fed recap: Breaking down the market’s reaction to the Fed’s pause and all of Powell’s key comments

- S&P 500 closes little changed after Fed leaves rates unchanged, signals more hikes are coming: Live updates

- Treasury yields waver as traders weigh latest Fed decision and potential moves going forward

- Stocks & Gold Slump After Hawkish Fed Sends Rate-Hike Odds Soaring

- The Fed: Fed skips June interest-rate hike, but points to two more increases this year

- Futures Movers: Oil settles lower as an ‘adjustment’ contributes to a nearly 8 million-barrel weekly U.S. crude supply climb

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.