Summary Of the Markets Today:

- The Dow closed down 5 points or 0.01%,

- Nasdaq closed up 0.95%,

- S&P 500 closed up 0.37%,

- Gold $1,924 down $21.20,

- WTI crude oil settled at $69 down $3.11,

- 10-year U.S. Treasury 3.795% up 0.072 points,

- USD Index $102.41 up $0.34,

- Bitcoin $30,234 up $59,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies hit the highest total for a single month on record in May with 224, up 52% from the 147 in April. May’s total is up 49% from the 150 CEOs who left their posts in the same month one year prior. May’s total is the highest total for a month since Challenger began tracking CEO exits in 2002, after three consecutive months where CEO exits were the highest for that month on record. The next highest month for CEO exits occurred in January 2019 when 219 CEOs left their posts.

Led by declines in production-related indicators, the

Chicago Fed National Activity Index (CFNAI) decreased to –0.15 in May from +0.14 in April (this is volatile and the 3-month moving average is used for economic forecasting). Two of the four broad categories of indicators used to construct the index decreased from April, and three of the four categories made negative contributions in May. The index’s three-month moving average, CFNAI-MA3, increased to –0.14 in May from –0.20 in April. Note that these values show a modestly expanding economy as periods of economic expansion have historically been associated with values of the CFNAI-MA3 above –0.70.

In the week ending June 17, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 255,750, an increase of 8,500 from the previous week’s revised average. This is the highest level for this average since November 13, 2021 when it was 260,000. The previous week’s average was revised up by 500 from 246,750 to 247,250.

Existing-home sales rose insignificantly month-over-month in May 2023, with gains in the South and West and declined in the Northeast and Midwest regions of the U.S. Sales in all four regions combined fell 20.4% year-over-year. The median existing-home price declined by 3.1% from May 2022.

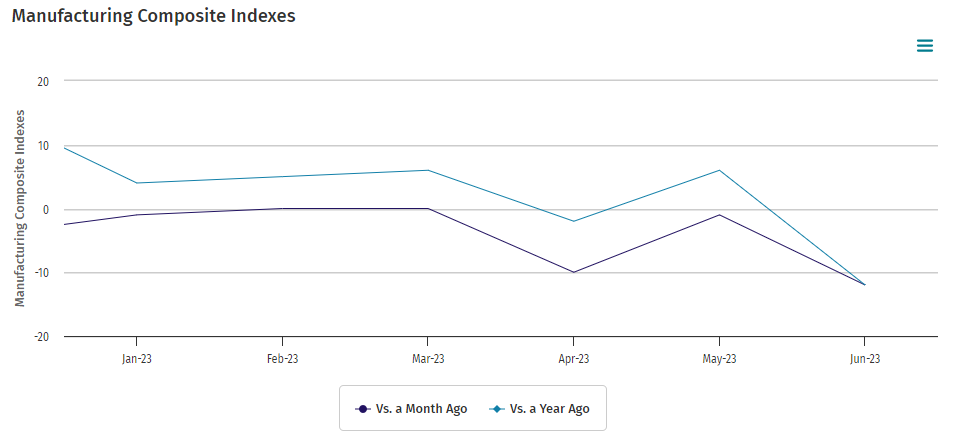

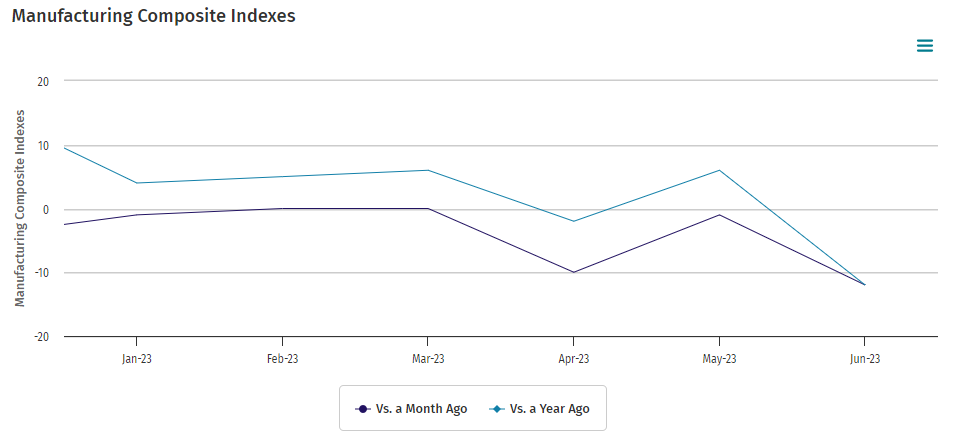

The Kansas City Fed manufacturing area declined further in June 2023. The month-over-month composite index was -12 in June, down from -1 in May and from -10 in April. This indicates a contraction in manufacturing activity.

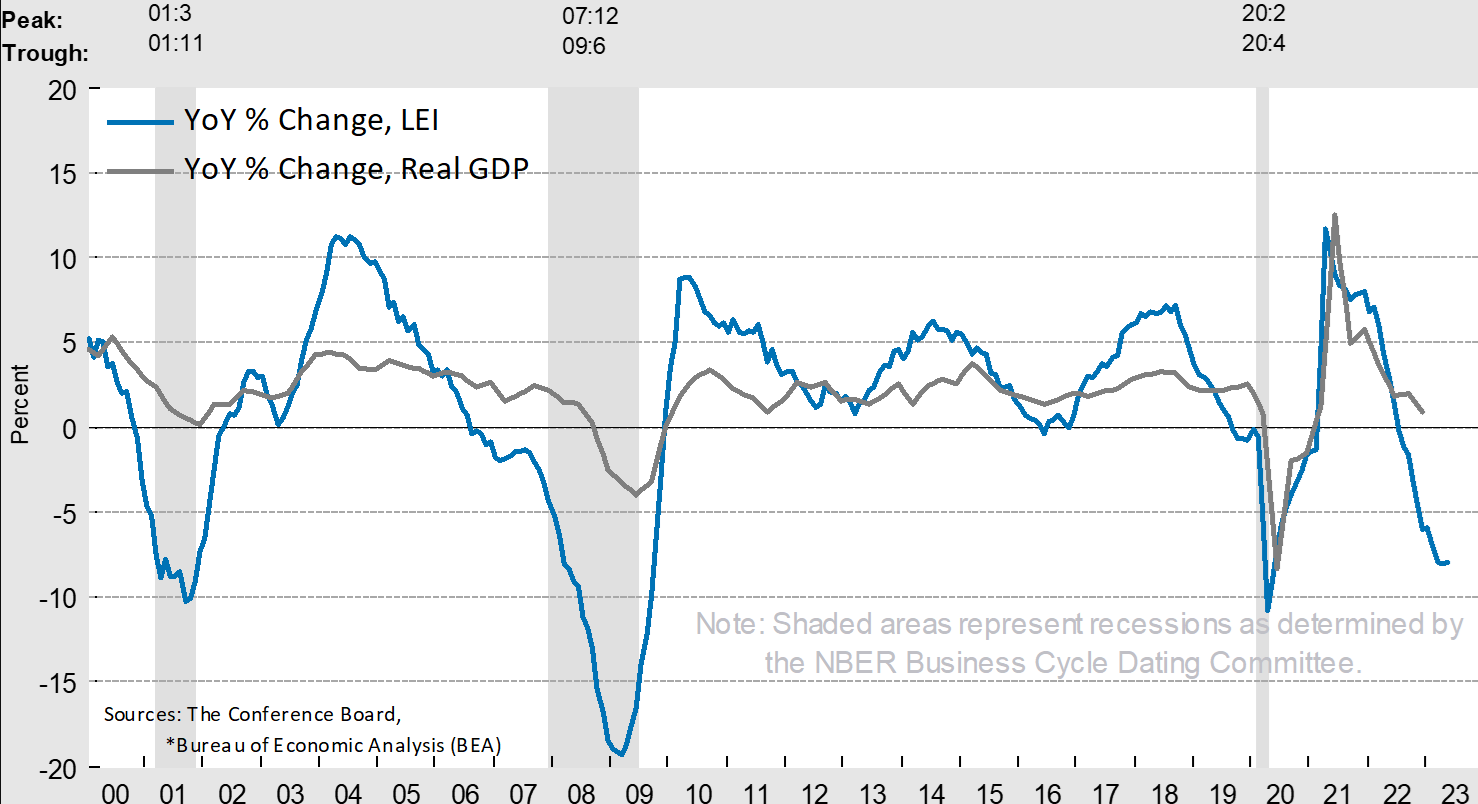

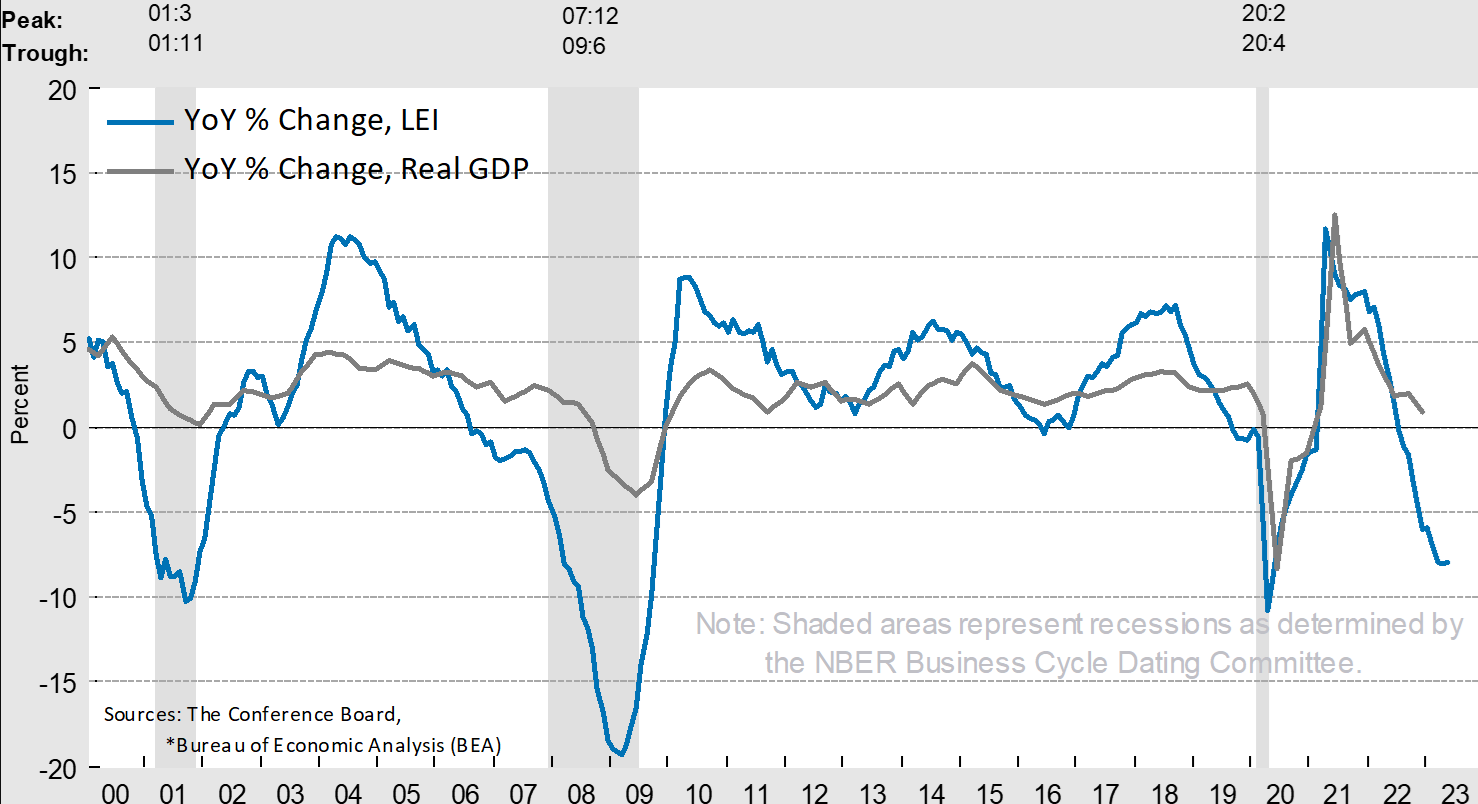

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.7 percent in May 2023 to 106.7, following a decline of 0.6 percent in April. The LEI is down 4.3 percent over the six-month period between November 2022 and May 2023—a steeper rate of decline than its 3.8 percent contraction over the previous six months from May to November 2022. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board said a recession is coming:

The US LEI continued to fall in May as a result of deterioration in the gauges of consumer expectations for business conditions, ISM® New Orders Index, a negative yield spread, and worsening credit conditions. The US Leading Index has declined in each of the last fourteen months and continues to point to weaker economic activity ahead. Rising interest rates paired with persistent inflation will continue to further dampen economic activity. While we revised our Q2 GDP forecast from negative to slight growth, we project that the US economy will contract over the Q3 2023 to Q1 2024 period. The recession likely will be due to continued tightness in monetary policy and lower government spending.

Here is a summary of headlines we are reading today:

- How Renewable Energy Prosumers Are Decentralizing The Power Grid

- U.S. Department Of Energy Splashes $9.2B On Ford EV Batteries

- Soaring Car Prices Put American Auto Loans Underwater

- Oil Falls Despite Moderate Draw In Crude Inventories

- Oil Prices Dip As Further Interest Rate Hikes Loom

- S&P 500, Nasdaq rise to end 3-day losing streak as investors snap up tech shares: Live updates

- Fed Chair Powell says smaller banks likely will be exempt from higher capital requirements

- New technologies hurt car quality as EV brands fare poorly, J.D. Power says

- Ghosts Of 2000 And 2007 Market Tops Are Absent Today

- Movers & Shakers: Tesla, Anheuser-Busch, Logitech stocks rise, AMC, iRobot, Virgin Galactic shares fall, and other stocks on the move

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.