25 NOV 2024 Market Close & Major Financial Headlines: Wall Street’s Three Main Indexes Opened In The Green, The Dow And The S&P 500 recorded New Historic Highs, Finally Closing Fractionally Higher

Summary Of the Markets Today:

- The Dow closed up 440 points or 0.99%,

- Nasdaq closed up 51 points or 0.27%,

- S&P 500 closed up 18 points or 0.30%,

- Gold $2,629 down $84.30 or 3.12%,

- WTI crude oil settled at $69 down $2.17 or 3.05%,

- 10-year U.S. Treasury 4.265 down 0.147 points or 3.288%,

- USD index $106.88 down $0.67 or 0.63%,

- Bitcoin $94,959 down $1,700 or 1.79%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

U.S. stocks rose on Monday, driven by optimism over President-elect Donald Trump’s nomination of Scott Bessent for Treasury secretary. This announcement boosted investor sentiment, leading to significant gains across major indices: Dow Jones Industrial Average closing at a new record high. Russell 2000 surged over 2%, reaching a record high, as small-cap stocks rallied strongly. The market’s positive reaction was partly due to the perception that Bessent might moderate fiscal policies, which helped ease concerns about inflationary pressures. Additionally, investors are looking forward to the Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures price index, set for release on Wednesday. Bitcoin was attempting to reach the $100,000 mark but fell back below $95,000.

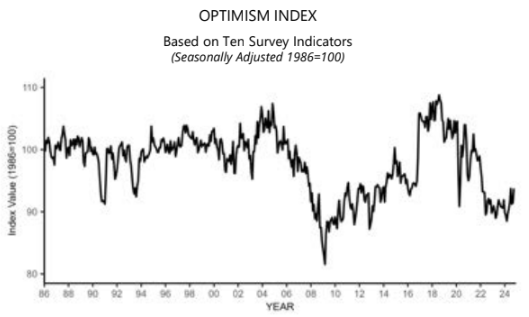

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

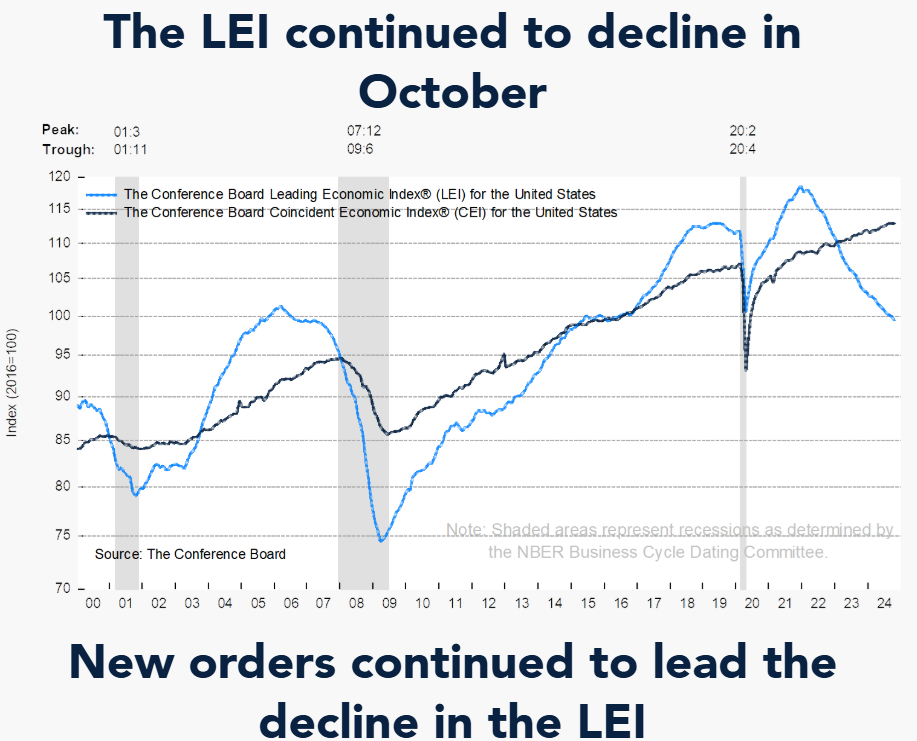

The Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, decreased to –0.24 in October 2024 from –0.21 in September. This is my favorite coincident indicator although like all indicators – at times, it is wrong in trend and value. And the 85 individual indicators it monitors will be revised for decades. That is why the CFNAI looks like it parallels GDP – but in real time it missed the start of the Great Recession. Consider this a tea leaf to be read in conjunction with other tea leaves. According to the Chicago Fed: “a recession has historically been associated with a CFNAI-MA3 value below –0.70. Conversely, following a period of economic contraction, an increasing likelihood of an expansion has historically been associated with a CFNAI-MA3 value above –0.70 and a significant likelihood of an expansion has historically been associated with a CFNAI-MA3 value above +0.20.” Bottom line – there is little change in October which means the economy is not strong.

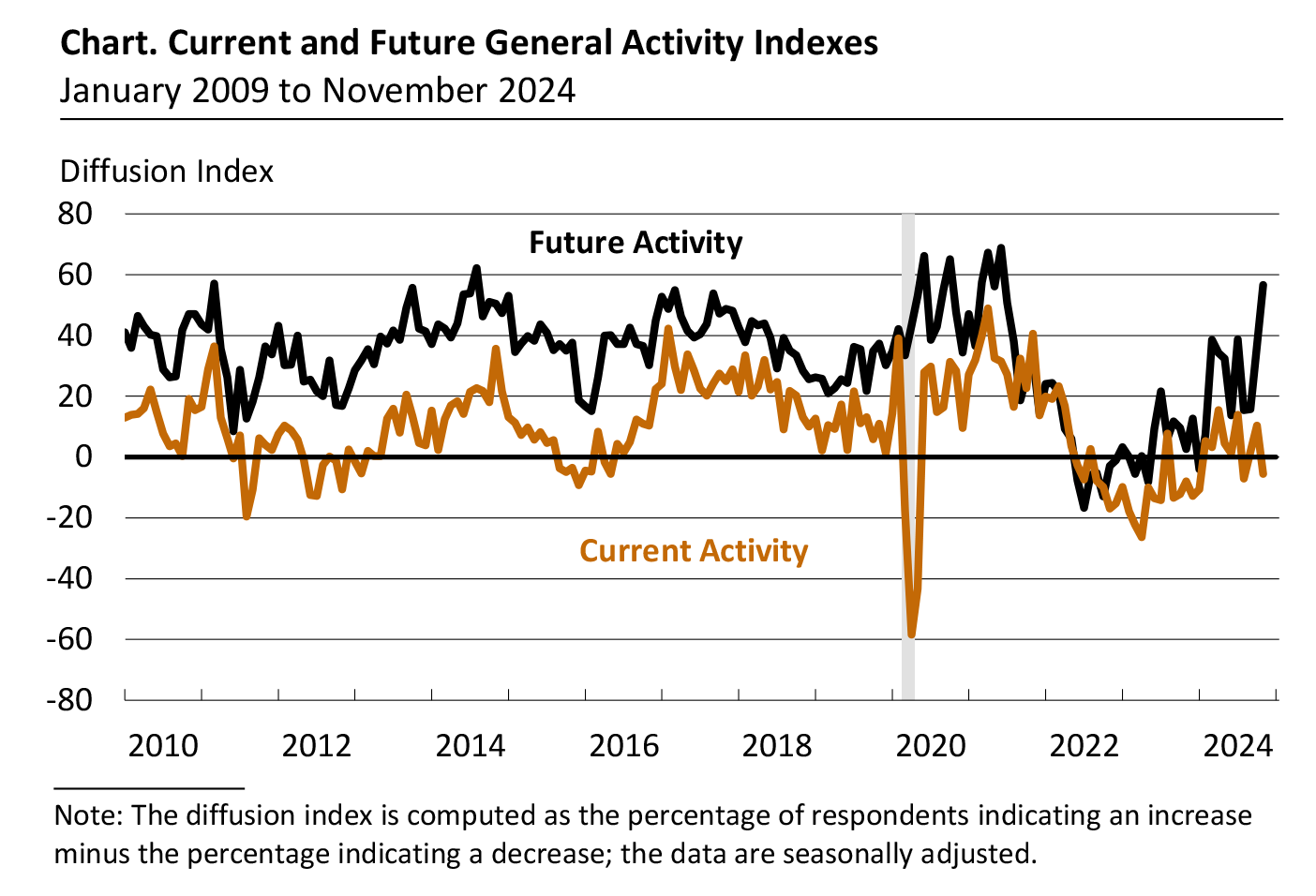

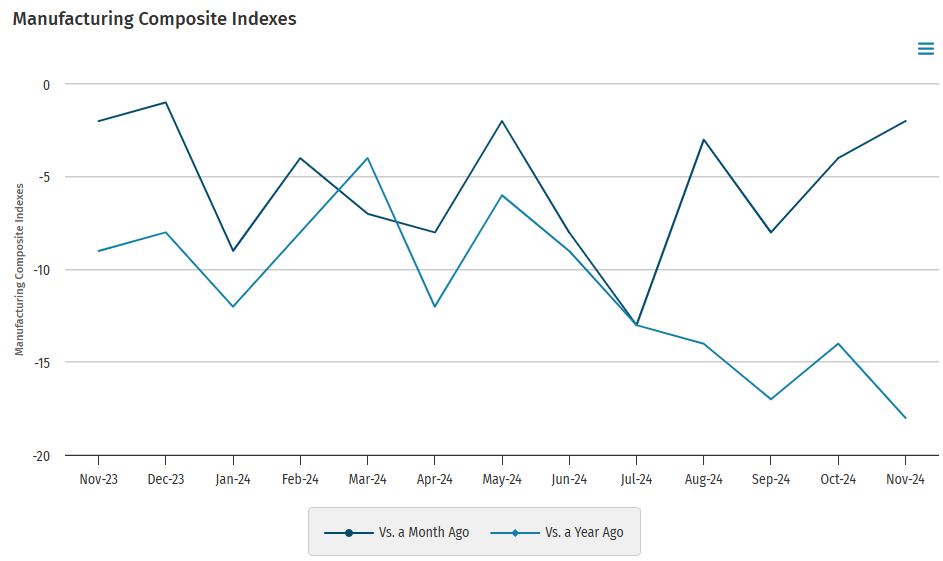

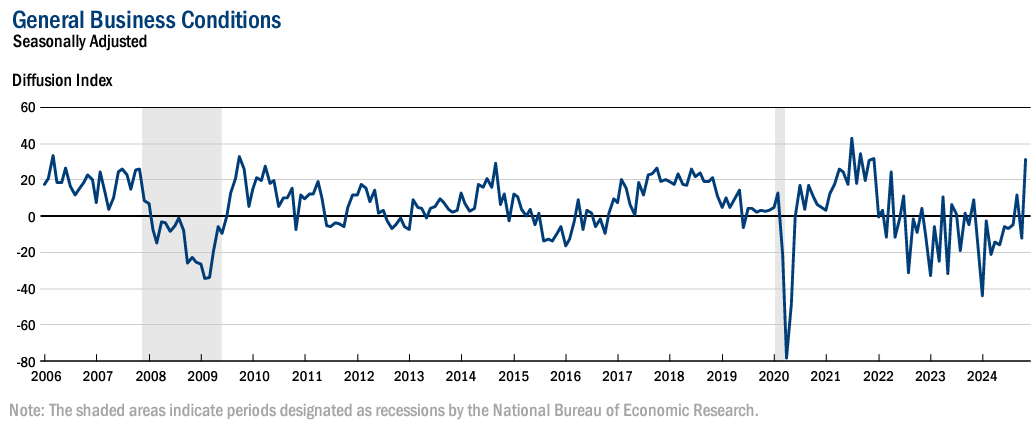

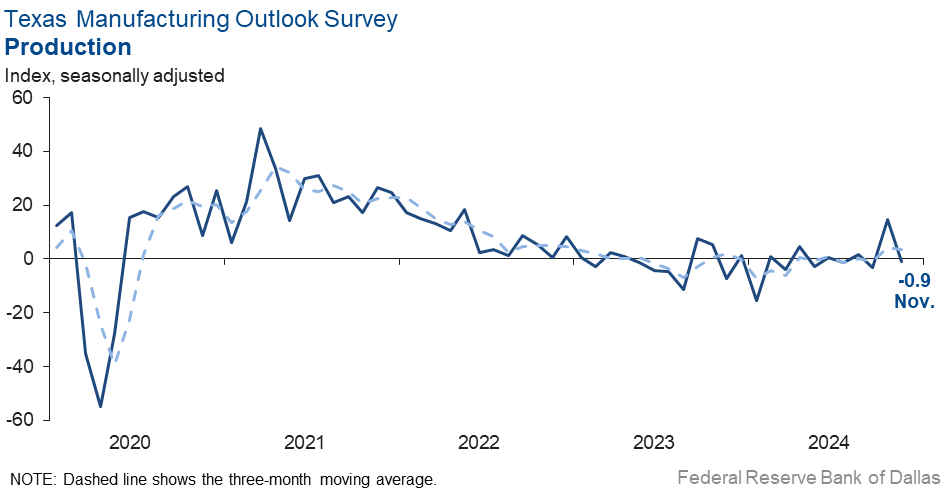

Texas Manufacturing Outlook Survey was flat in November 2024 falling to a -0.9 level after rising to 14.6 last month. The new orders index pushed further negative to -11.9, indicating continued declines in demand. The capacity utilization and shipments indexes slipped back into negative territory, coming in at -4.8 and -5.9, respectively. Not a question in my mind that the manufacturing recession continues.

Here is a summary of headlines we are reading today:

- Russia’s Uranium Gambit: A Wake-Up Call for U.S. Energy Independence

- Oil for Troops: Russia’s Barter System with North Korea Exposed

- Oil Prices Fall On Possible Mid-East Peace Deal

- UK Slaps Largest Sanctions Package Yet on Russia’s Shadow Tanker Fleet

- IMF’s Proposed Carbon Restrictions Could Have Major Economic Repercussions

- U.S. stock and bond markets love Trump’s pick of Bessent for Treasury — here’s why

- Dow jumps 400 points to new record close, Russell 2000 hits all-time high as investors cheer Trump’s Treasury pick

- Warren Buffett speaks out against creating family wealth dynasties, gives away another $1.1 billion

- MicroStrategy acquires 55,500 more bitcoin amid stock volatility: CNBC Crypto World

- Arabica Futs “Bull Run” Surges To 13-Year High Amid Panic About Brazilian Stockpiles

- Gold tumbles 3% on reports of Israel-Hezbollah ceasefire, US Treasury pick

- Long-term Treasury bonds log biggest rally in nearly 4 months after Trump picks Bessent

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.