13 July 2023 Market Close & Major Financial Headlines: Wall Street Rallies Into Fourth Day Closing At Session Highs

Summary Of the Markets Today:

- The Dow closed up 48 points or 0.14%,

- Nasdaq closed up 1.58%,

- S&P 500 closed up 0.85%,

- Gold $1,965 up $2.80,

- WTI crude oil settled at $77 up $1.46,

- 10-year U.S. Treasury 3.761% down 0.100 points,

- USD Index $99.76 down $0.76,

- Bitcoin $31,675 up $1412,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Producer Price Index‘s (PPI) growth has declined to 0.1% year-over-year (PPI less foods, energy, and trade is up 2.6% year-over-year). The goods portion of the PPI growth is now DOWN 4.2% year-over-year whilst the services portion is up 2.3% year-over-year. The bottom line here is that except for labor costs – inflation has mostly disappeared in the production portion of the economy. Interestingly, there is little correlation between inflation and the change in the cost of labor.

In the week ending July 8, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 246,750, a decrease of 6,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 253,250 to 253,500.

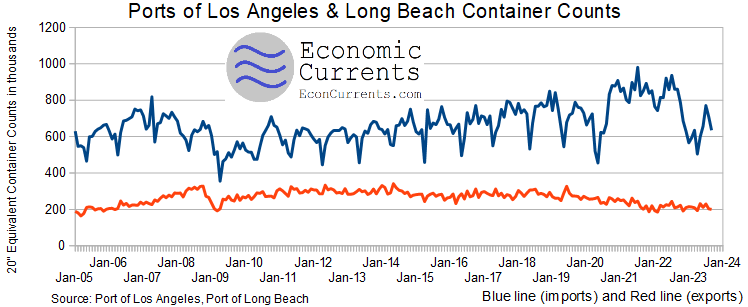

My worries last month that a dockworker’s strike would affect trade fortunately never materialized. The Ports of Los Angeles and Long Beach handle over 40% of all containerized cargo entering the United States. In June 2023 imports declined 18% year-over-year (same as last month) whilst exports declined 3% year-over-year (improved from -6% last month). In general, a decline in imports normally signals a slowing of consumer demand.

Here is a summary of headlines we are reading today:

- Oil Prices Jump As Libya’s Largest Oilfield Goes Offline

- Future Of Oil Demand Is Brighter Than You’ve Been Told

- U.S. Natural Gas Loses Ground As Europe Leans On Solar Power

- Russia’s Oil Exports Plunge To The Lowest Level Since March 2021

- Actors union will join writers on strike, shutting down Hollywood

- Stocks rise a fourth day on upbeat inflation data, S&P 500 and Nasdaq close at highest levels in 2023: Live updates

- June wholesale prices rise less than expected in another encouraging inflation report

- Russia To Overtake Saudi Arabia As The Largest OPEC+ Oil Producer

- Market Snapshot: S&P 500 hovers near 4,500 as U.S. stocks climb for 4th day

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.