27 July 2023 Market Close & Major Financial Headlines: Wall Street Closes Moderately Down As The Dow End Its 13 Session Historic Bull Run

Summary Of the Markets Today:

- The Dow closed down 237 points or 0.67%,

- Nasdaq closed down 0.55%,

- S&P 500 closed down 0.64%,

- Gold $1,944 down $26.50,

- WTI crude oil settled at $80 up $1.01,

- 10-year U.S. Treasury 4.010% up 0.159 points,

- USD Index $101.79 up $0.91,

- Bitcoin $29,162 down $285,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods increased again in June 2023 to 10.5% year-over-year compared to 9.25% last month. What other sources of this data may not be telling you is that the majority of the recent increases are from the aircraft sector. Still, durable goods appear to be doing better than other economic sectors. No sign of a recession in this data set.

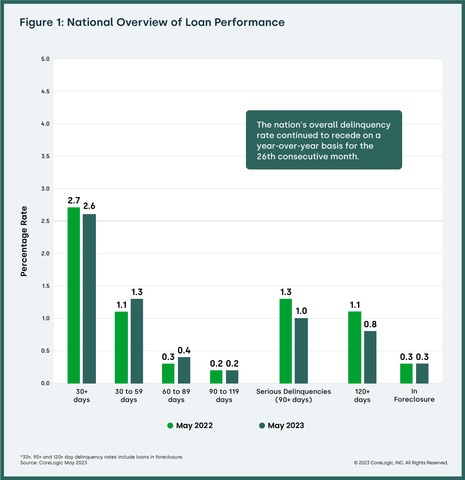

According to CoreLogic, for the month of May, 2.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due. The rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020. No sign of recession in this data set.

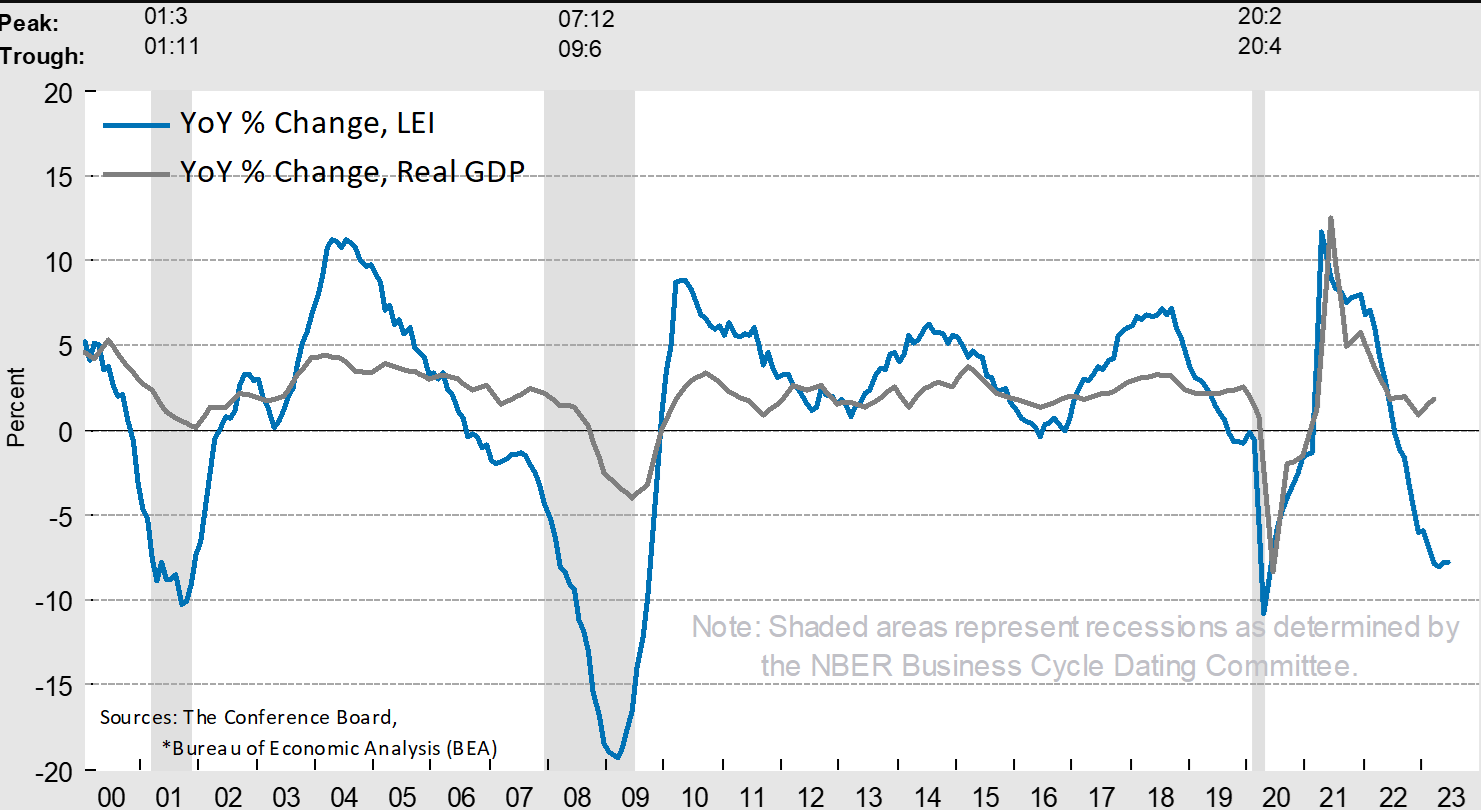

Real gross domestic product (GDP) increased 2.6% year-over-year in the second quarter of 2023 according to the “advance” estimate. The implicit price deflator – which measures inflation in the GDP – has fallen to 3.6% year-over-year. Advance estimates historically can be wild guesses – but my take is that the next two estimates of 2Q2023 GDP will be stronger as the economy seems to be modestly accelerating. Inflation is a different issue as I expect the deceleration in inflation to begin to be more modest as the year-over-year growth will be compared to the decreasing inflation which began one year ago.

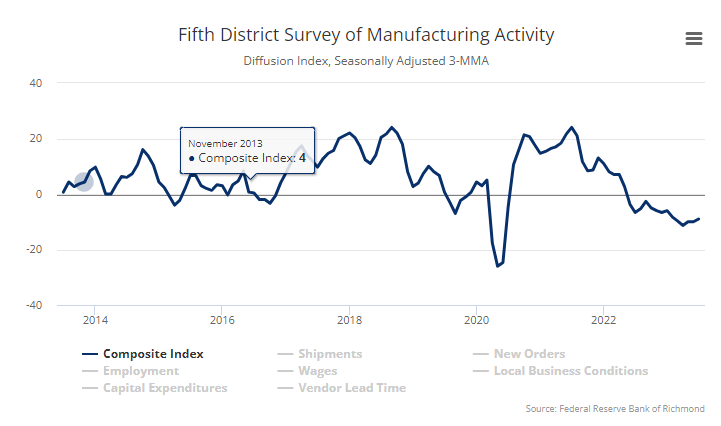

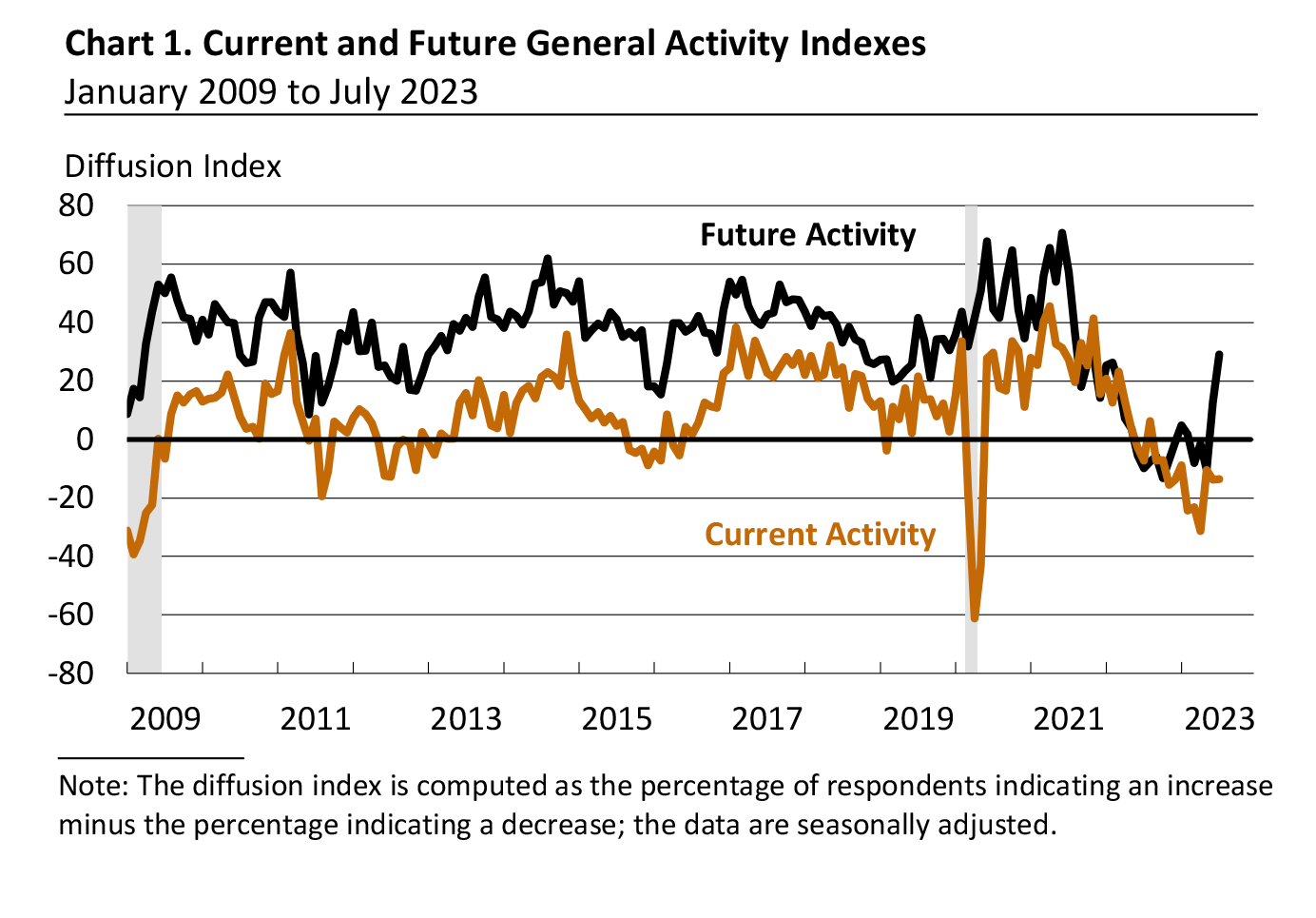

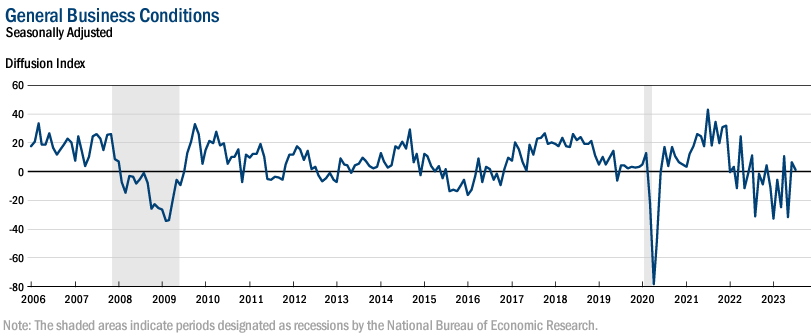

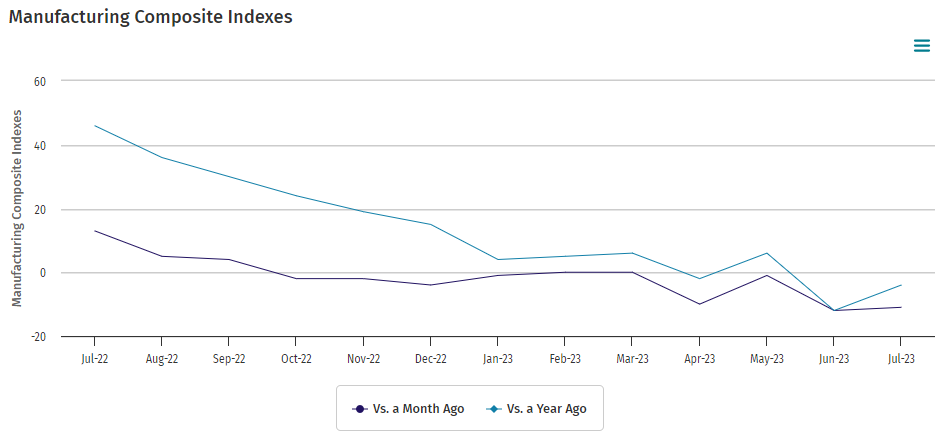

The Kansas City Fed manufacturing activity continued to decline in July 2023, and expectations for future activity stayed mostly flat. The manufacturing sector overall remains in a recession.

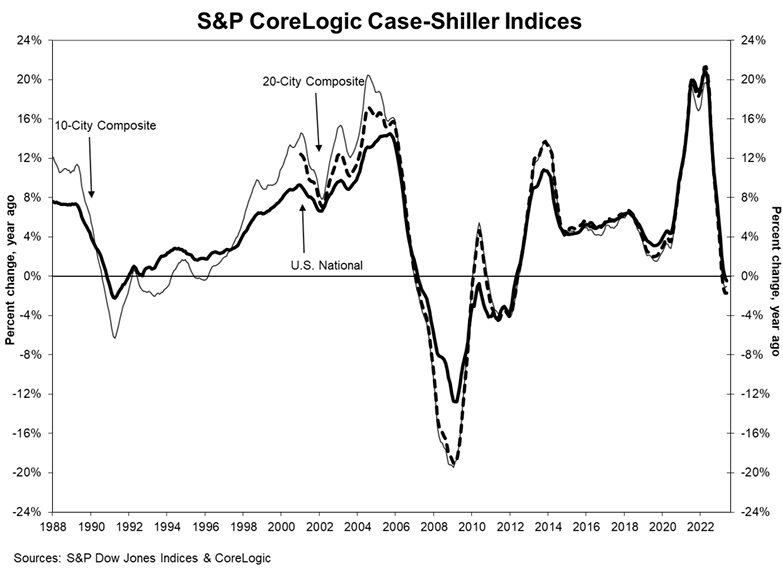

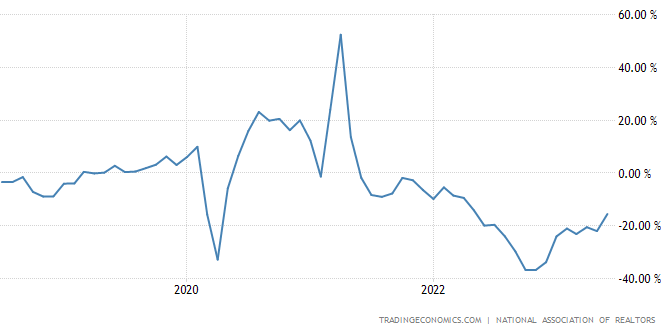

Pending Home Sales fell by 15.6% year-over-year which is an improvement. Pending home sales should begin to improve as it will now be compared to bad data from a year ago.

In the week ending July 22, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 233,750, a decrease of 3,750 from the previous week’s unrevised average of 237,500.

Here is a summary of headlines we are reading today:

- Cobalt Prices Rally As Battery Demand Booms

- New Catalyst Efficiently Cleans Methane From Natural Gas Exhaust

- Oil Ignores Fed Hike As WTI Hits $80

- Largest U.S. Power Grid Declares Emergency Alert

- Global Coal Demand To Stay At Record-High Levels In 2023

- Dow loses more than 200 points Thursday to snap historic 13-day rally: Live updates

- Bud Light maker Anheuser-Busch to lay off hundreds of corporate staff

- SpaceX aims to break a 56-year rocket record with back-to-back launches

- Bond Report: 10-, 30-year Treasury yields end above 4% after U.S. GDP, report on BOJ

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.