24 Aug 2023 Market Close & Major Financial Headlines: Wall Street’s Opening High Hopes Turn Sour As Previous Gains Slide Dramatically Down Closing In The Red

Summary Of the Markets Today:

- The Dow closed down 373 points or 1.08%,

- Nasdaq closed down 1.87%,

- S&P 500 closed down 1.35%,

- Gold $1,945 down $2.70,

- WTI crude oil settled at $79 up $0.09,

- 10-year U.S. Treasury 4.235% up 0.037 points,

- USD Index $104.01 up $0.590,

- Bitcoin $26,024 down $659,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies surged in July, as 197 CEOs left their posts last month. It is the highest total since record-setting May, when 224 CEOs exited the top spot, according to a report released by Challenger, Gray & Christmas, Inc. July’s total is 67% higher than the 118 CEO exits recorded in June. It is 240% higher than the 58 CEO exits recorded in the same month in 2022. So far this year, 1,104 CEOs have left their posts, up 33% from the 832 CEO changes during the same period in 2022. It is the highest total in the first seven months of the year since the firm began tracking in 2002. Andrew Challenger, workplace expert and Senior Vice President of Challenger stated:

As layoffs slow, we’re beginning to see an increased pace of changes at the top. As staffing needs and hiring normalizes, Boards are looking for leadership with staying power.

New orders for manufactured durable goods in July decreased to 3.8% increase year-over-year in July 2023 (up 2.2% year-over-year inflation adjusted). This decline was entirely due to the civilian aircraft sector. Overall, durable goods is the only sector in manufacturing that is not in a recession.

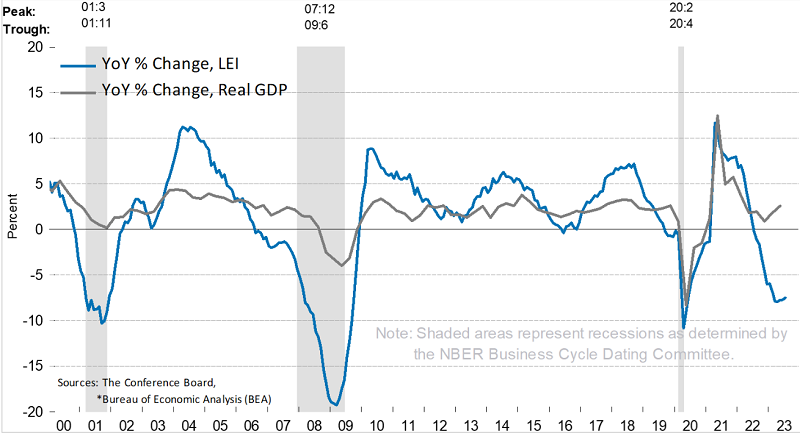

Led by improvements in production-related indicators (orange line on the graph below), the Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, modestly improved to –0.13 in July from –0.15 in June (purple line on the graph below). The CFNAI is my preferred coincident indicator – and it shows a modestly improving economy expanding below its historical trend (average) rate of growth but well above levels associated with recessions.

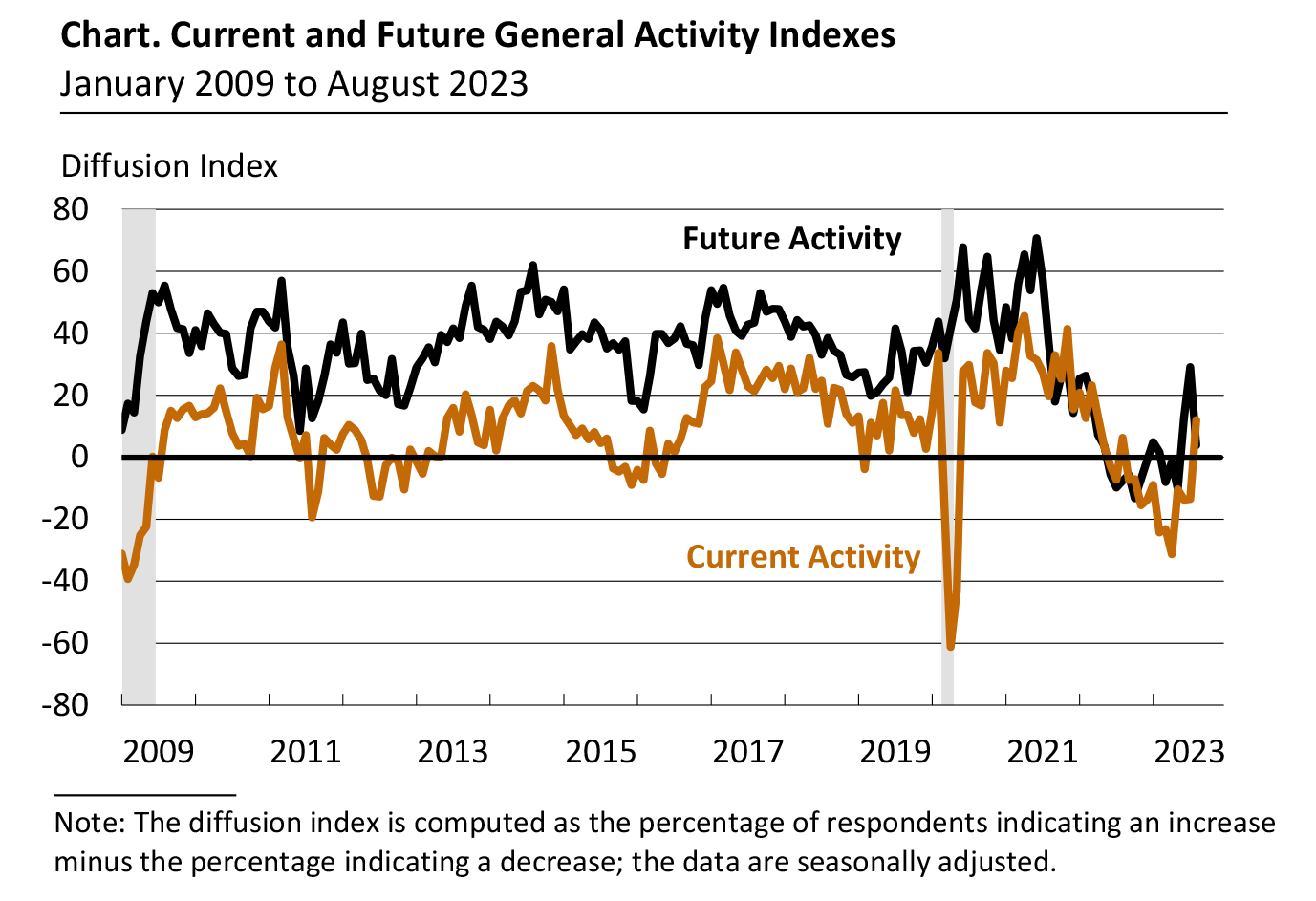

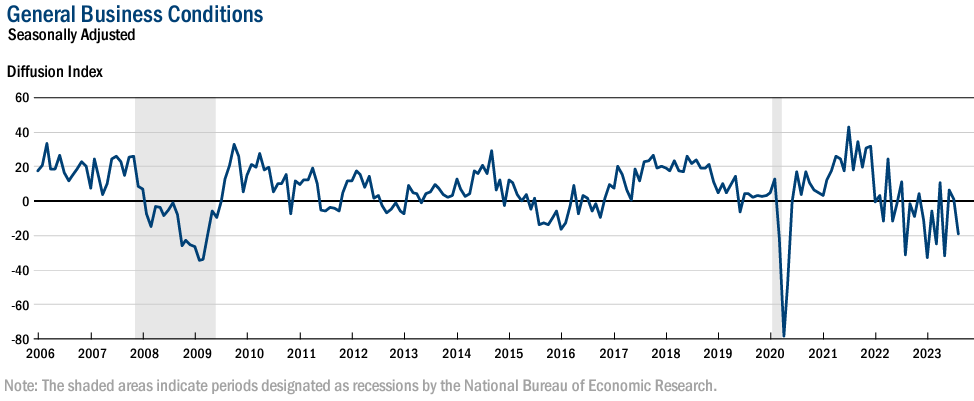

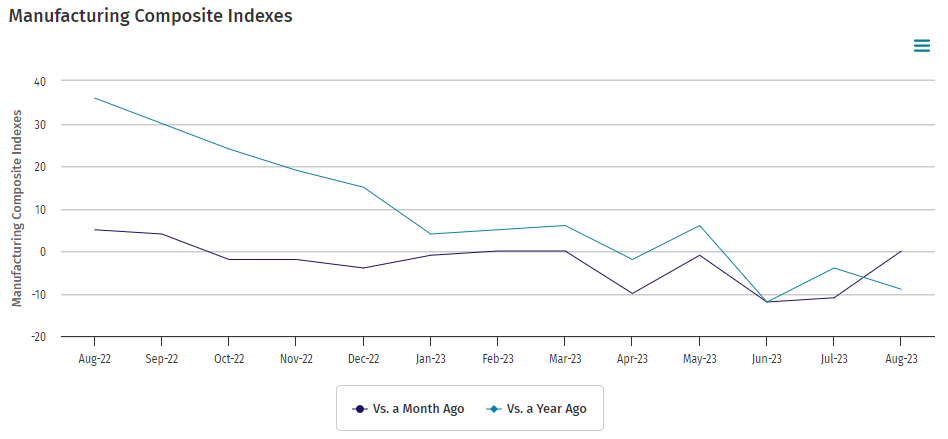

The Kansas City Fed’s manufacturing activity was unchanged in August 2023. The month-over-month composite index was 0 in August, up from -11 in July and -12 in June. Overall manufacturing appears in the US remains in a recession.

In the week ending August 19, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 236,750, an increase of 2,250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 234,250 to 234,500.

Here is a summary of headlines we are reading today:

- Nigerian Military Destroys 8 Illegal Refining Sites In Niger Delta

- India’s Slowing Oil Demand Growth To Weigh On Oil Prices

- Saudi Arabia, OPEC Powers Invited To Join BRICS

- New Mexico’s Record Oil Output To Generate $3.5 Billion Budget Surplus

- August once again lives up to its dismal reputation for stocks

- Nvidia earnings scare away AMD, Intel investors as legacy chipmakers lose ground in AI

- Bitcoin ordinals inscriptions have been climbing steadily this summer despite lull in prices

- Lionel Messi lifts MLS to new heights, but the league needs more than ‘the GOAT’ to grow

- Elon Musk Vows To Sue Soros-Funded NGOs Over Free Speech

- Jackson Hole Preview: “Do We Receive Another Hawkish Surprise?”

- Why AMD, Marvell, Intel and other chip stocks are falling after Nvidia earnings

- Movers & Shakers: Nvidia stock jumps after blowout quarter, while Dollar Tree and Boeing fall

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.