Summary Of the Markets Today:

- The Dow closed down 168 points or 0.48%,

- Nasdaq closed up 0.11%,

- S&P 500 closed down 0.16%,

- Gold $1,967 down $6.10,

- WTI crude oil settled at $84 up $1.87,

- 10-year U.S. Treasury 4.100% down 0.018 points,

- USD Index $103.62 up $0.460,

- Bitcoin $26,100 down $1,102,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

According to NFIB’s monthly jobs report, 40% (seasonally adjusted) of small business owners reported job openings they could not fill in the current period, down two points from last month and the lowest level since February 2021. Seasonally adjusted, a net 36% of owners reported raising compensation in August, tying June’s reading, and marking the lowest reading since May 2021. A net 26% of owners plan to raise compensation in the next three months, up five points from July. Bill Dunkelberg, NFIB Chief Economist stated:

More small business owners are planning to increase compensation in the next three months as unfilled job openings slipped in August. Even as openings fell on Main Street, owners are actively working to retain current employees and attract qualified applicants.

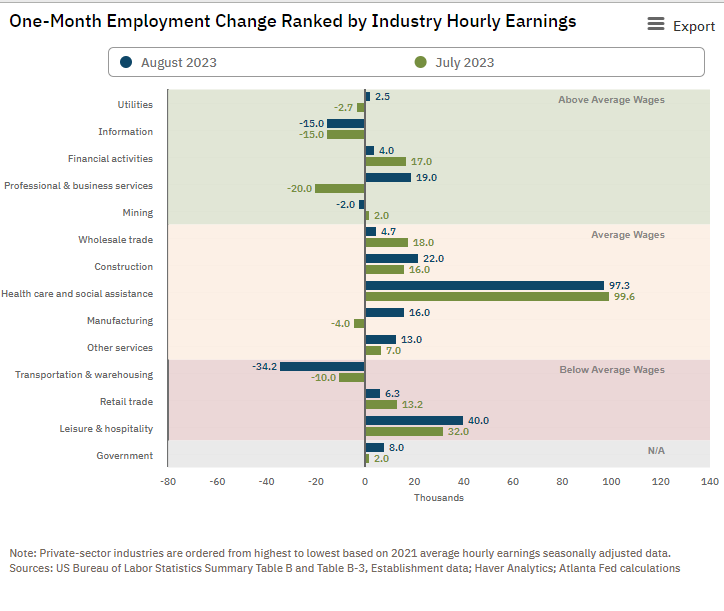

U.S.-based employers announced 75,151 cuts in August, a 217% increase from the 23,697 cuts announced one month prior. It is 267% higher than the 20,485 cuts announced in the same month in 2022, According to Challenger: “Job openings are falling, and American workers are more reluctant to leave their positions right now. The job market is resetting after the pandemic and post-pandemic hiring frenzy. Job openings are falling, and American workers are more reluctant to leave their positions right now. The job market is resetting after the pandemic and post-pandemic hiring frenzy.”

Real Disposable personal income (DPI) for July 2023 declined to 3.8% increase year-over-year (blue line on the graph below) and real personal consumption expenditures (PCE) moved up to 3.0% increase year-over-year (red line on the graph below). The price index which measures inflation for personal consumption expenditures INCREASED to 3.3% growth year-over-year (green line on the graph below. The price index for personal consumption expenditures excluding food and energy likewise grew to 4.1% year-over-year. Like I have been predicting, inflation is no longer falling but will be rising in the coming months.

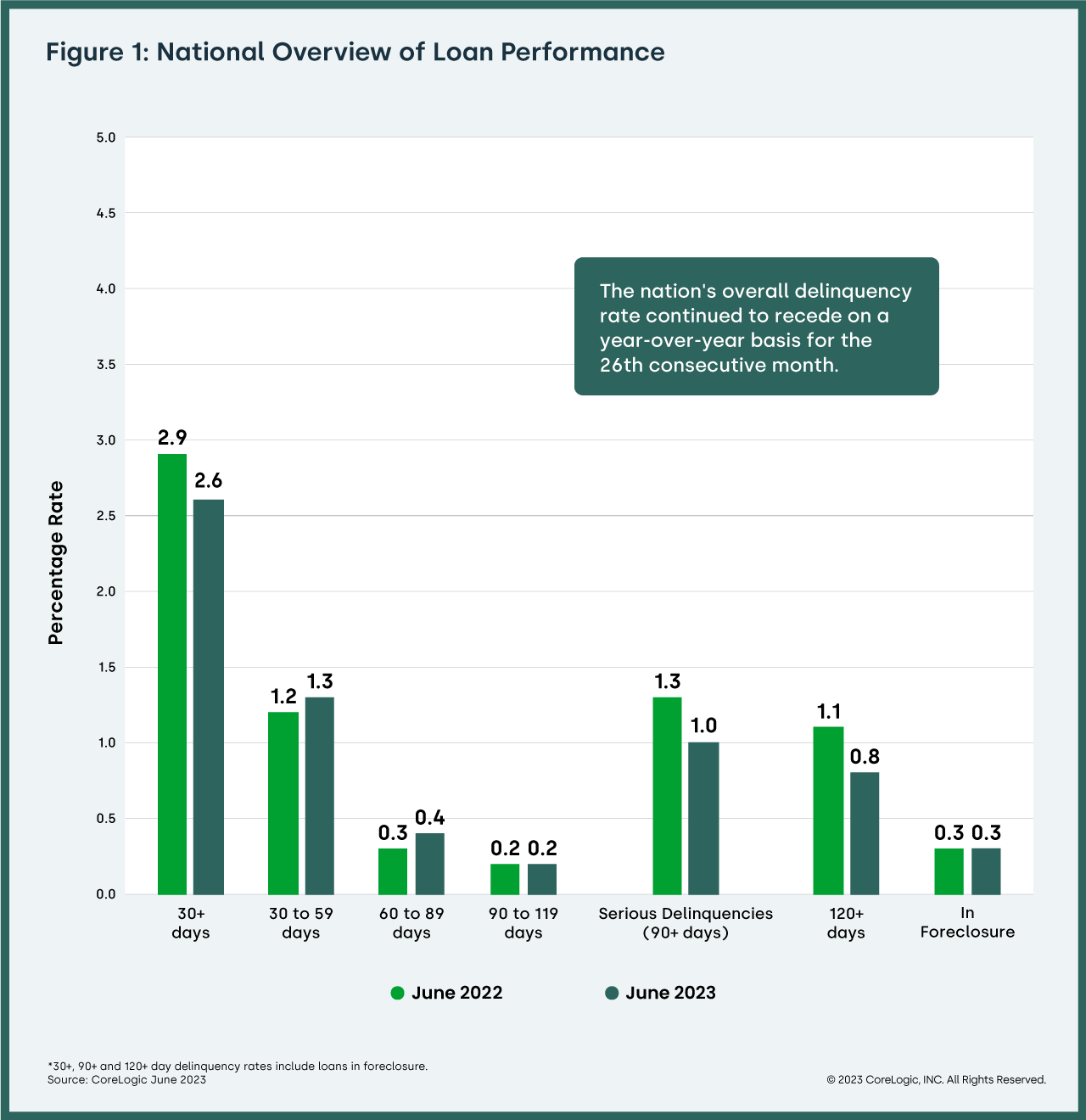

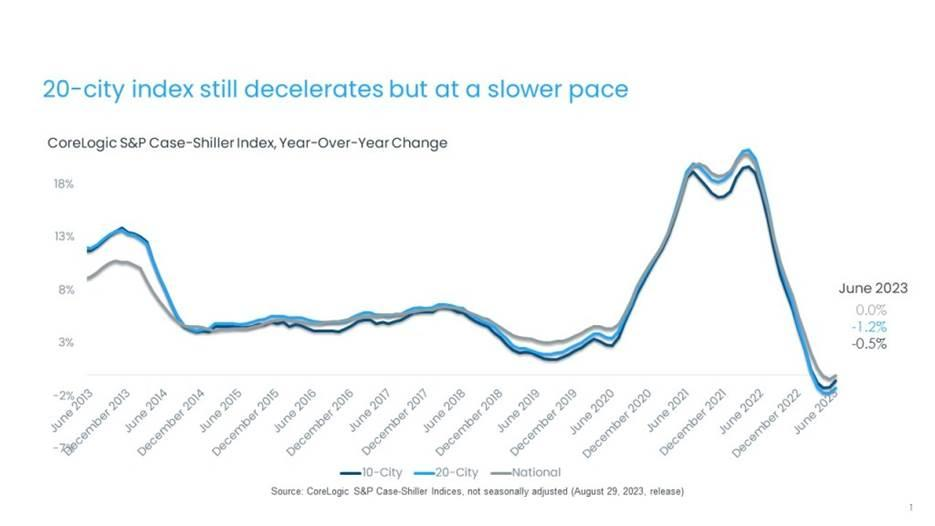

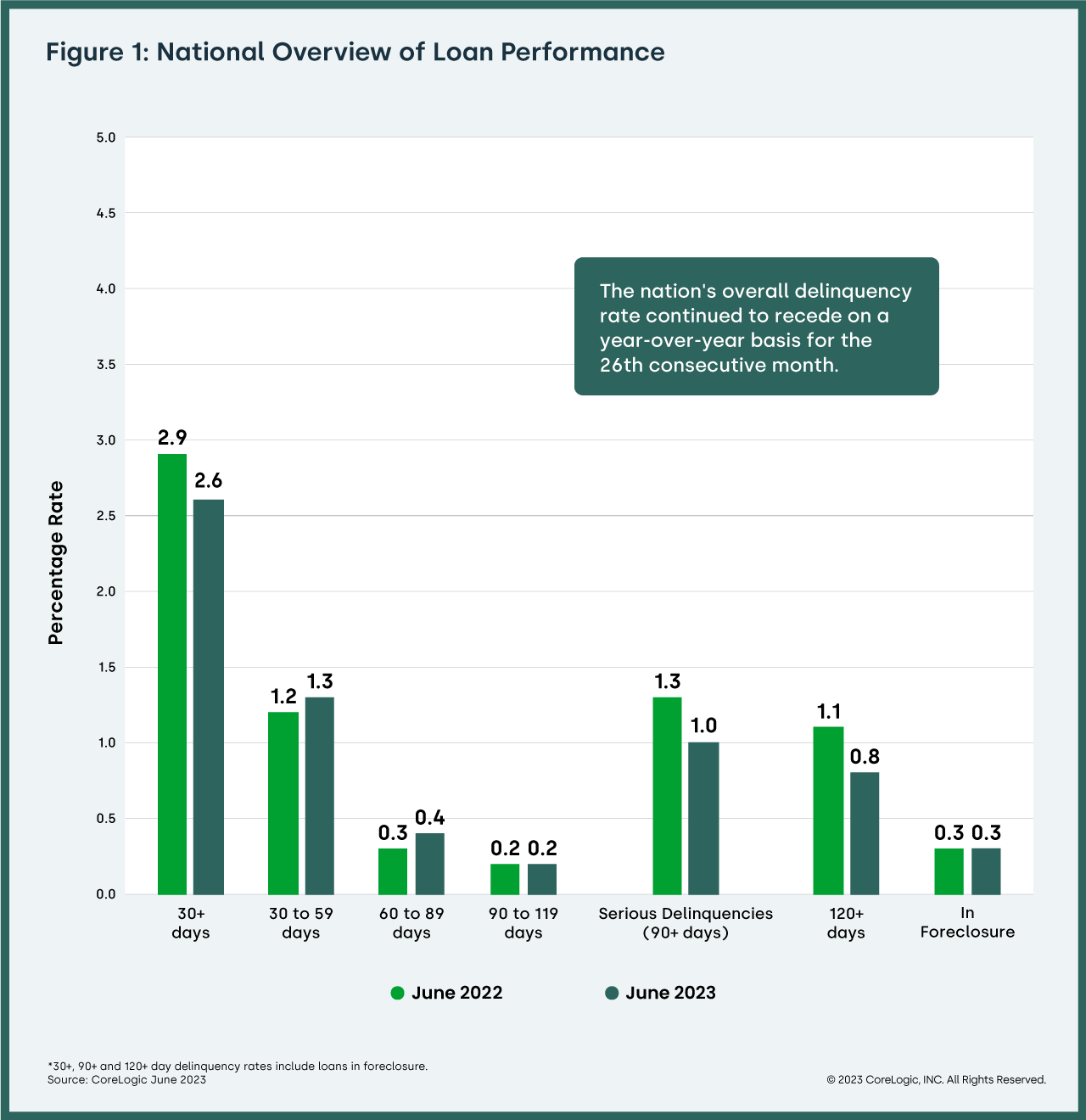

CoreLogic reports that for the month of June, 2.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.3 percentage point decrease compared with 2.9% in June 2022 and unchanged from May 2023.

- Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.2% in June 2022

- Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in June 2022.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1%, down from 1.3% in June 2022 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from June 2022.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, down from 0.7% in June 2022.

In the week ending August 26, the advance figure for seasonally adjusted unemployment initial claims 4-week moving average was 237,500, an increase of 250 from the previous week’s revised average. The previous week’s average was revised up by 500 from 236,750 to 237,250.

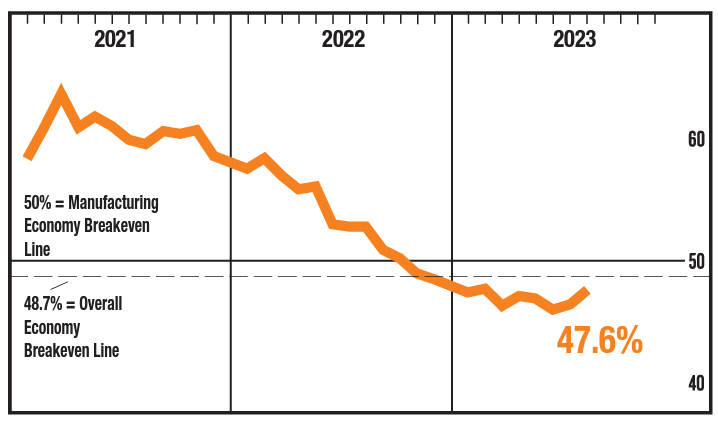

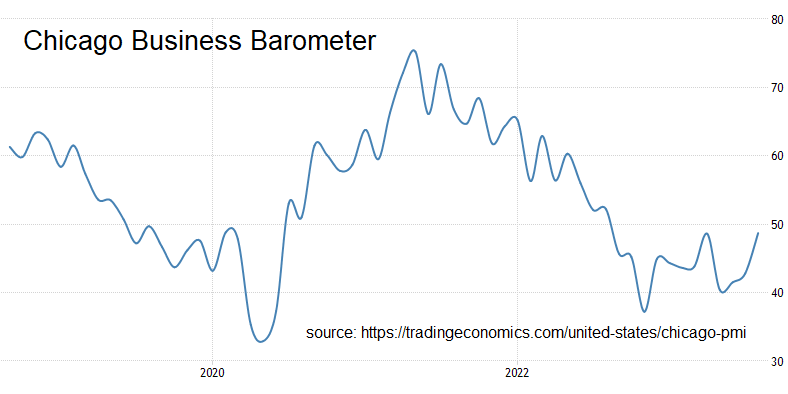

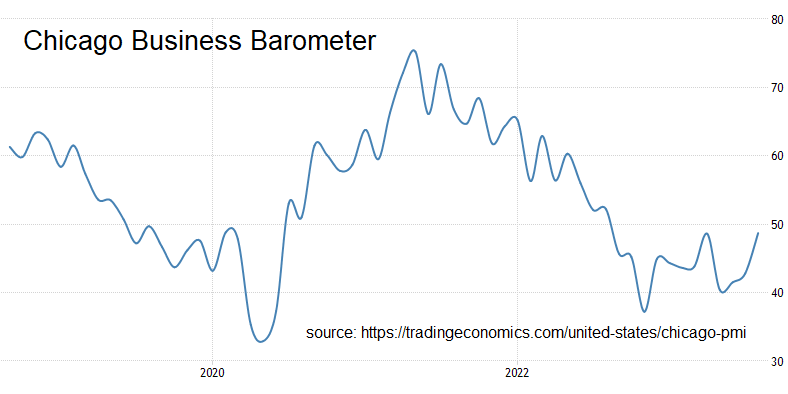

The Chicago Business Barometer rose to 48.7 in August of 2023 from 42.8 in July. The reading marked the 12th consecutive month of contraction in business activity in the Chicago region but the smallest in the current sequence that began in September 2022.

Here is a summary of headlines we are reading today:

- Analyst: BRICS Currency Unlikely To Undermine Dollar Dominance

- Fluorinated Aniliniums Lead To A Breakthrough In Perovskite Solar Cells

- Tesla Faces New Competition As European Auto Sales Soar

- Refiners Are Raking It In Amid Surge In Diesel Margins

- U.S. Gasoline Prices Rise Ahead Of Labor Day Weekend

- U.S. health officials want to loosen marijuana restrictions. Here’s what it means

- Shopify stock pops after company strikes ‘Buy with Prime’ deal with Amazon

- Here’s why some economists are concerned student loans may cause the next big bubble

- Philly Fed GDPplus Measure Sure Looks Like Recession Started In Q4 2022

- Ex-CIA Agent Who Signed Propaganda Letter About Hunter Biden Laptop Tried To Conceal Twitter Job

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.