21 Sept 2023 Market Close & Major Financial Headlines: Dow Closes Sharply Lower For Third Session Sinking the S&P And Nasdaq Down Almost 2%

Summary Of the Markets Today:

- The Dow closed down 370 points or 1.08%,

- Nasdaq closed down 1.82%,

- S&P 500 closed down 1.64%,

- Gold $1,940 down $27.20,

- WTI crude oil settled at $90 down $0.02,

- 10-year U.S. Treasury 4.486% up 0.139 points,

- USD Index $105.39 up $0.270,

- Bitcoin $26,596 down $368,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

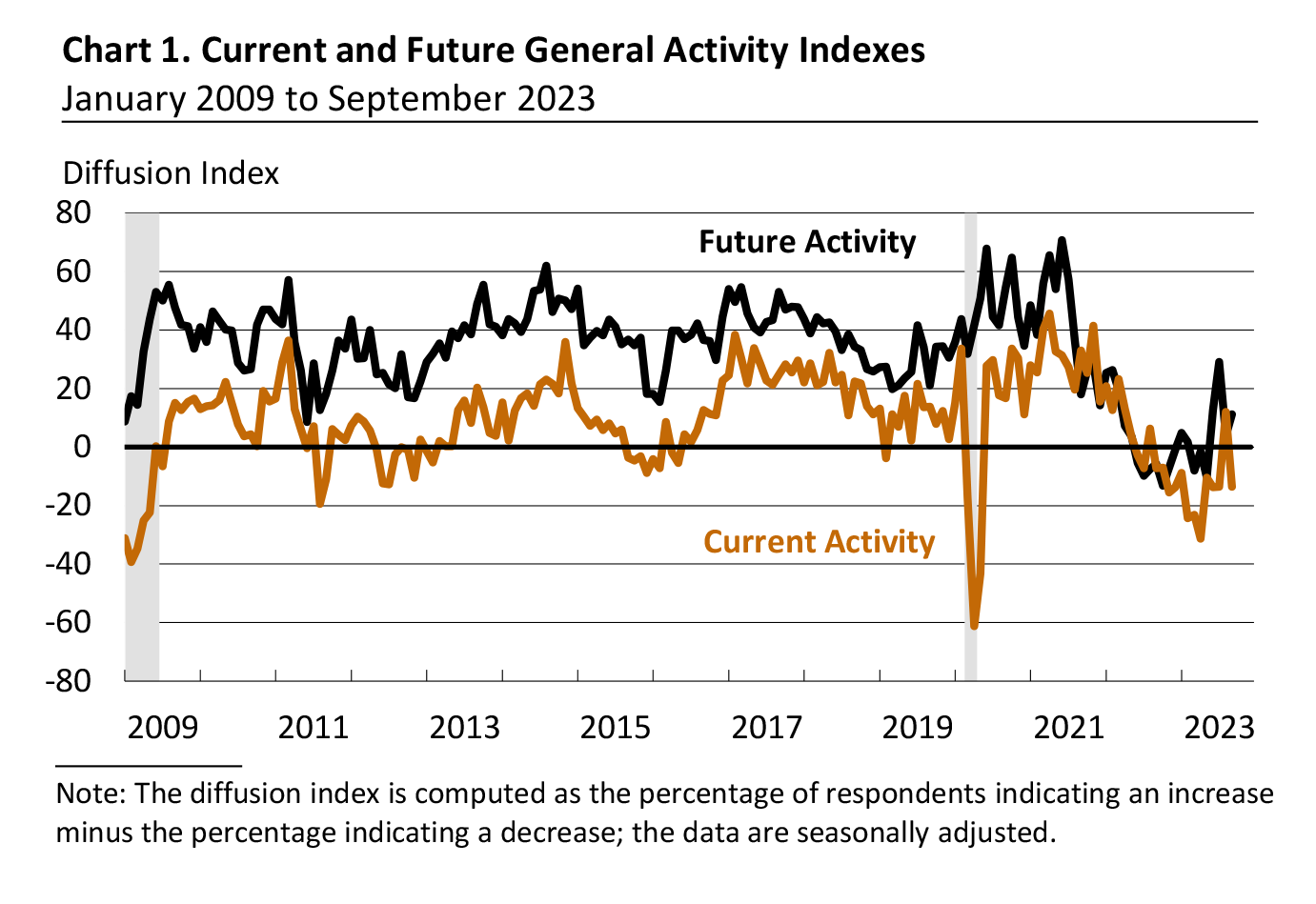

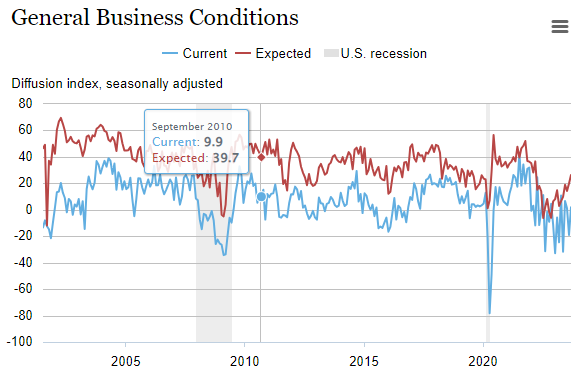

The Philly Fed’s September 2023 Manufacturing Business Outlook Survey declined as indicators for general activity, new orders, and shipments returned to negative territory after turning positive in August. Manufacturing remains in a recession.

In the week ending September 16, the advance figure for seasonally adjusted unemployment initial claims 4-week moving average was 217,000, a decrease of 7,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 224,500 to 224,750. There is no indication of an economic slowdown in these unemployment claims.

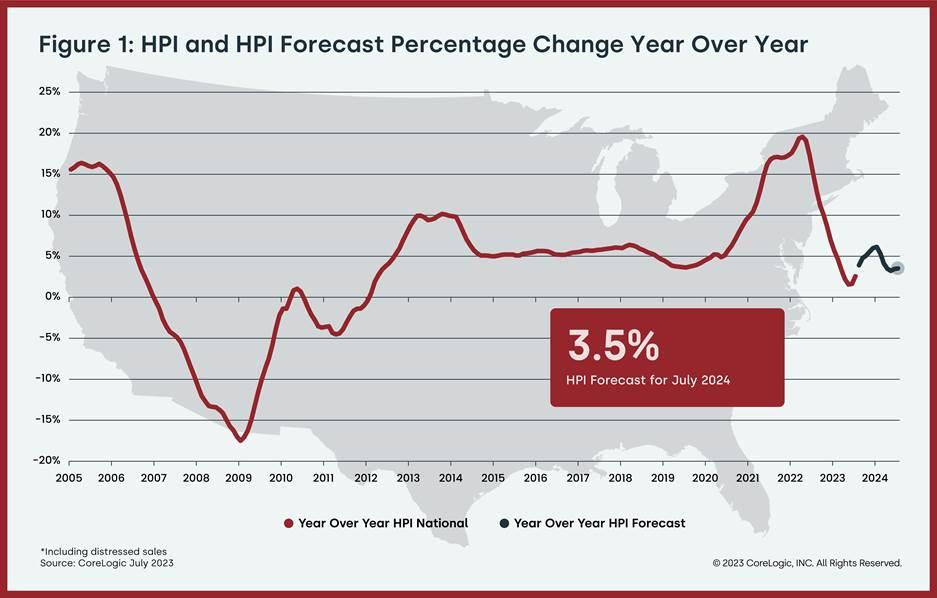

Existing-home sales moved lower in August, according to the National Association of REALTORS®. Among the four major U.S. regions, sales improved in the Midwest, were unchanged in the Northeast, and slipped in the South and West. All four regions recorded year-over-year sales declines.

The National Association of Realtor’s existing home sales declined 0.7% month-over-month and down 15.3% year-over-year. Total housing inventory declined 14.1% from one year ago. The median existing-home price for all housing types in August was $407,100, an increase of 3.9% from August 2022. NAR Chief Economist Lawrence Yun added:

Home sales have been stable for several months, neither rising nor falling in any meaningful way. Mortgage rate changes will have a big impact over the short run, while job gains will have a steady, positive impact over the long run. The South had a lighter decline in sales from a year ago due to greater regional job growth since coming out of the pandemic lockdown.

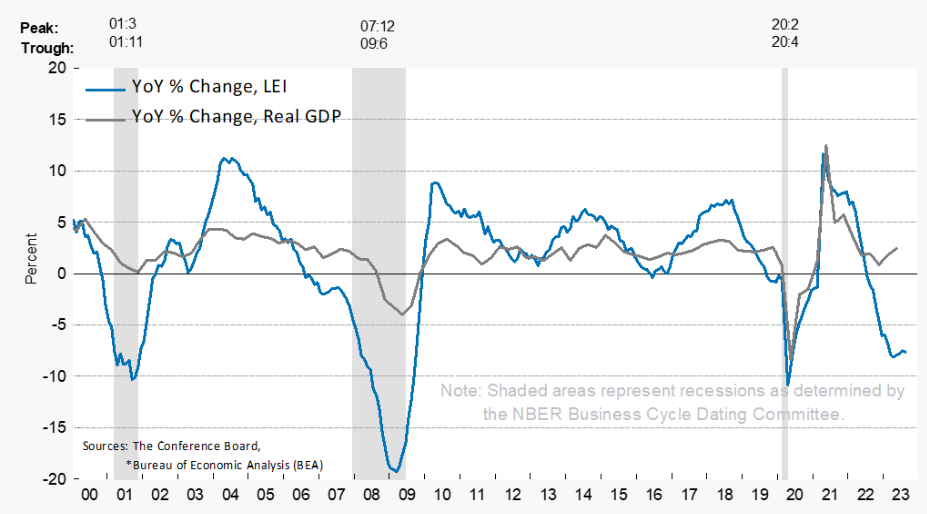

The Conference Board Leading Economic Index (LEI) for the U.S. declined by 0.4 percent in August 2023 to 105.4 (2016=100), following a decline of 0.3 percent in July. The LEI is down 3.8 percent over the six-month period between February and August 2023—little changed from its 3.9 percent contraction over the previous six months (August 2022 to February 2023). Note that the authors of this index continue to project a recession but I have yet to see any recession indication in the broad economy inside the data I review. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board stated:

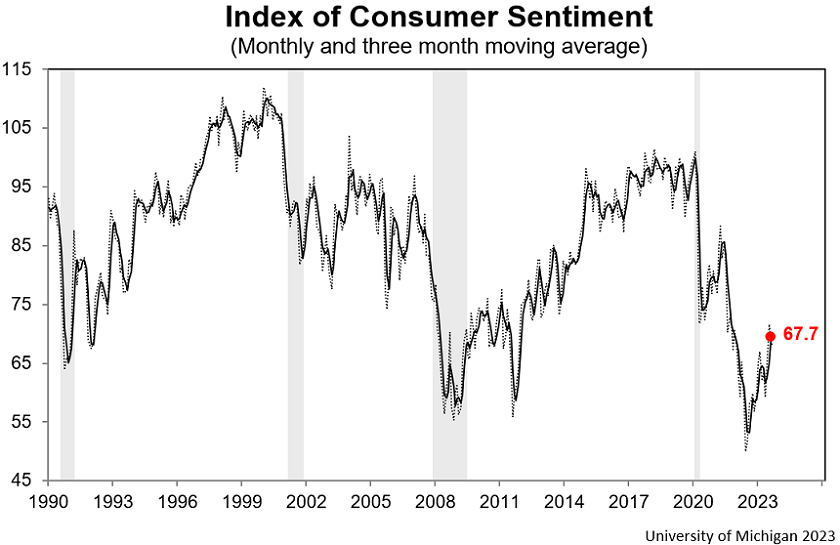

With August’s decline, the US Leading Economic Index has now fallen for nearly a year and a half straight, indicating the economy is heading into a challenging growth period and possible recession over the next year. The leading index continued to be negatively impacted in August by weak new orders, deteriorating consumer expectations of business conditions, high interest rates, and tight credit conditions. All these factors suggest that going forward economic activity probably will decelerate and experience a brief but mild contraction. The Conference Board forecasts real GDP will grow by 2.2 percent in 2023, and then fall to 0.8 percent in 2024.

Here is a summary of headlines we are reading today:

- Germany Makes New Energy Savings Measures Mandatory

- New BRICS Members Solidify The Bloc’s Renewable Leadership

- MBS To Fox: Saudi Arabia Will Get Nuclear Arms If Iran Does

- Russia Attacks Ukraine’s Energy Infrastructure Ahead Of Winter

- Russia Curbs Gasoline And Diesel Exports To Stabilize Domestic Prices

- ow tumbles more than 300 points to notch third day of losses amid fears of higher rates, government shutdown

- Here’s everything Microsoft announced at its Surface and Copilot event in New York

- Bitcoin sinks below $27,000 after Fed signals keeping rates higher for longer: CNBC Crypto World

- 10-year Treasury yield hits its highest level since 2007 as jobless claims decline

- Musk’s SpaceX Countersues DOJ, Says Case Over Refusal To Hire Refugees Is Unconstitutional

- Bitcoin Vs Ethereum: A Culture War Rooted In First Principles

- Bond Report: 2-year Treasury yield carves out another 17-year high after hawkish Fed meeting

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.