05 Oct 2023 Market Close & Major Financial Headlines: Wall Street Investors Traded Along The Unchanged Line, Pausing For The Fridays Job Report Finally Closing Mostly Flat In The Red

Summary Of the Markets Today:

- The Dow closed down 10 points or 0.03%,

- Nasdaq closed down 0.12%,

- S&P 500 closed down 0.13%, (low 4,226)

- Gold $1,835 down $0.30,

- WTI crude oil settled at $82 down $1.73,

- 10-year U.S. Treasury 4.712% down 0.023 points,

- USD Index $106.33 down $0.470,

- Bitcoin $27,475 down $175,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

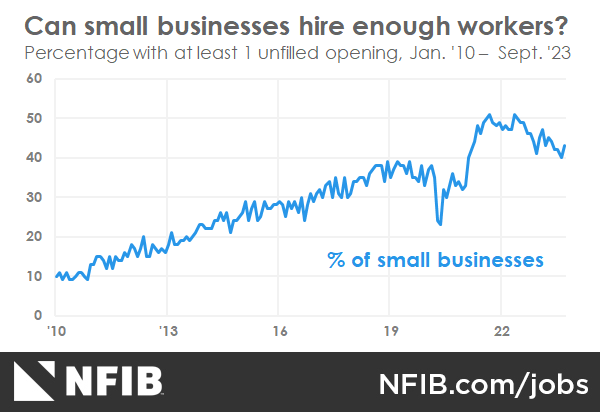

The labor shortage continues to hinder Main Street as 43% (seasonally adjusted) of all small business owners reported job openings they could not fill in the current period, up three points from August. Bill Dunkelberg, NFIB Chief Economist stated:

Small business owners have spent the first three quarters of 2023 working to recruit and retain qualified employees for their businesses, but it still remains a top challenge. Owners continue to raise compensation to attract the right employees.

The goods and services deficit was $58.3 billion in August, down $6.4 billion from $64.7 billion in July. August exports were down 6.9% year-over-year. August imports were down 6.3% year-over-year. The graph below adjusts the import and export year-over-year values for inflation and deflation. The bottom line is that imports are telling us that consumer spending is weak.

In the week ending September 30, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 208,750, a decrease of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 211,000 to 211,250.

Here is a summary of headlines we are reading today:

- Zirconium Nitride Outshines Platinum In Fuel Cell Performance

- The Rise Of Nuclear Power In The Middle East

- Argentina’s Oil Production Surges As Political Instability Soars

- India Warns That OPEC+ Oil Supply Cuts Could Have Unintended Consequences

- U.S. Shale Is Reluctant To Drill Despite Rising Oil Prices

- S&P 500 closes slightly lower as traders brace for Friday’s big jobs report: Live updates

- GM’s stock hits three-year low amid UAW strike, potential air bag recall

- Trust In Congress Below 20% Third Month In A Row

- As 75,000 Kaiser healthcare workers walk off the job, Tenet Healthcare could be next to face a strike

- Cathie Woods’ ETFs sold more than $25 million worth of Tesla stock

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.