10 DEC 2024 Market Close & Major Financial Headlines: Again, Nasdaq Recorded A New Historic High But Ends Session Slipping Deep Into The Red Along With The Dow And The S&P 500

Summary Of the Markets Today:

- The Dow closed down 154 points or 0.35%,

- Nasdaq closed down 49 points or 0.25%, (New Historic high 19,887, Closed at 19,737)

- S&P 500 closed down 18 points or 0.30%,

- Gold $2,719 up $32.70 or 1.21%,

- WTI crude oil settled at $68 up $0.03 or 0.04%,

- 10-year U.S. Treasury 4.224 up 0.025 points or 0.595%,

- USD index $106.41 up $0.27 or 1.24%,

- Bitcoin $96,576 down $1,198 or 1.21%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stock markets experienced slight declines. Alphabet’s shares (Google’s parent company) jumped by over 4% following the announcement of breakthroughs in quantum computing with its new Willow quantum chip. This development initially boosted the tech sector but failed to sustain overall market gains. Oracle shares fell more than 7% after reporting quarterly revenue that fell short of expectations due to intense competition in the cloud computing space. Despite reporting a 34% year-on-year increase in November revenue, Taiwan Semiconductor Manufacturing Co.’s stock slipped nearly 3% as the figure represented a decline from the previous month. Anticipation of CPI Report Investors are keenly awaiting Wednesday’s Consumer Price Index (CPI) report, which is expected to show: Headline inflation of 2.7%, slightly up from October’s 2.6%. Core inflation (excluding food and gas) of 3.3% year-over-year. The CPI report is crucial for the Federal Reserve’s upcoming interest rate decision, with many anticipating a potential rate cut in December if inflation continues to show signs of cooling.

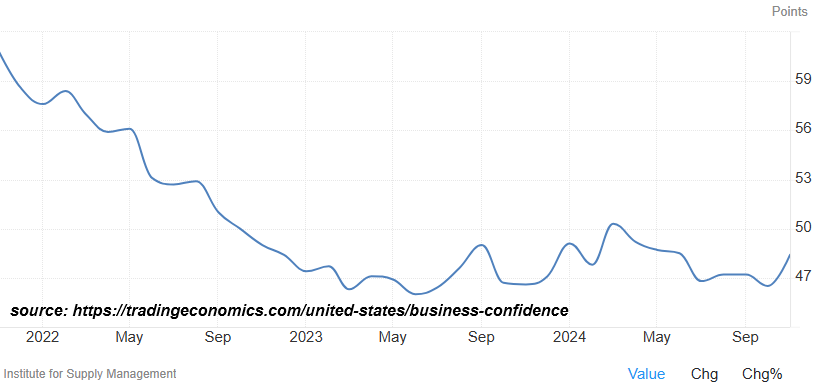

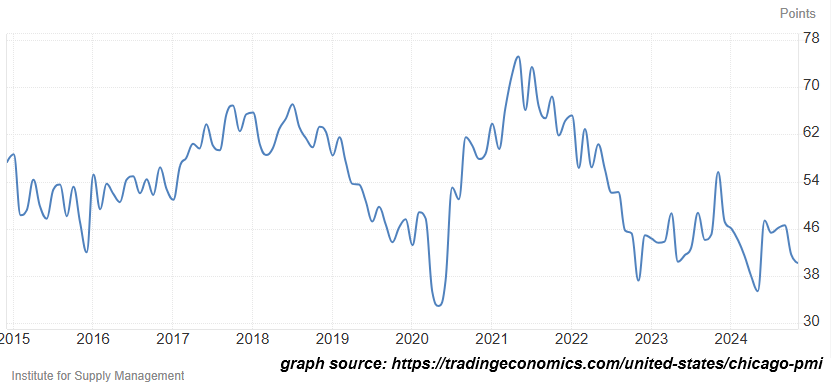

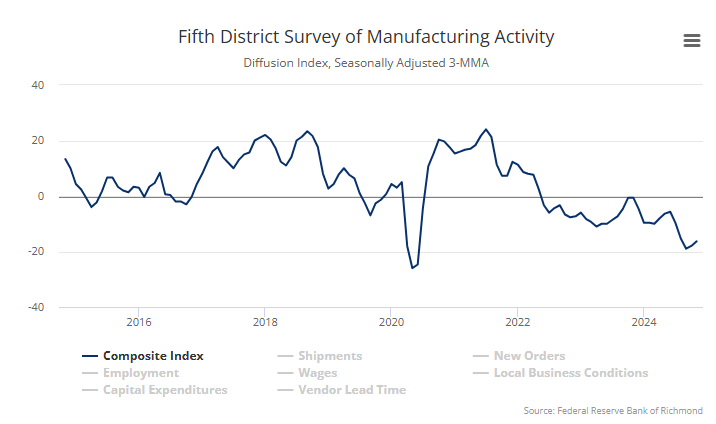

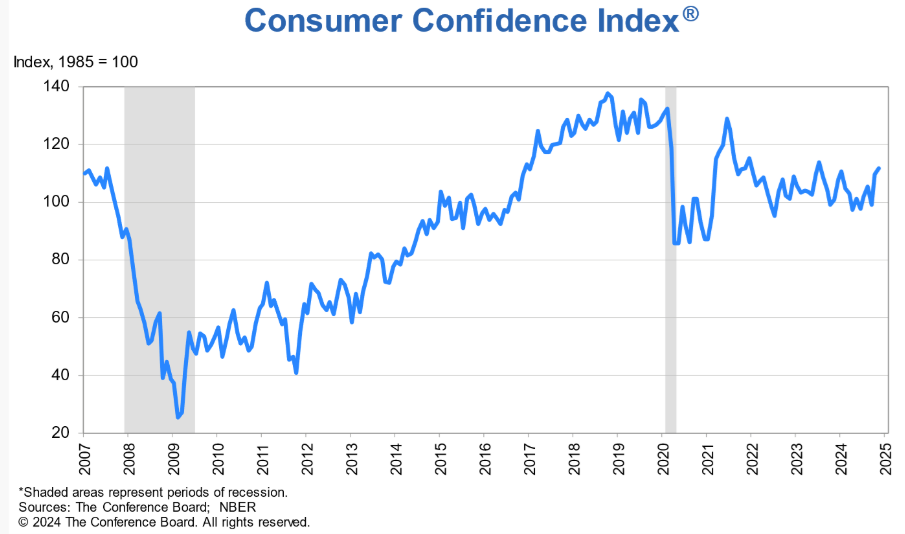

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

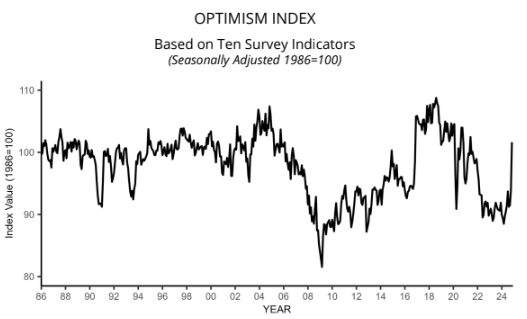

The NFIB Small Business Optimism Index rose by eight points in November to 101.7, after 34 months of remaining below the 50-year average of 98. This is the highest reading since June 2021. Of the 10 Optimism Index components, nine increased, none decreased, and one was unchanged. Not a fan of surveys – but business confidence indices above 100 suggest increased confidence in near-future business performance, which can be used to anticipate turning points in economic activity. NFIB Chief Economist Bill Dunkelberg added:

The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners. Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty. Owners are particularly hopeful for tax and regulation policies that favor strong economic growth as well as relief from inflationary pressures. In addition, small business owners are eager to expand their operations.

Here is a summary of headlines we are reading today:

- Iran’s ‘Axis of Resistance’ Crumbles

- CME’s New 1-Ounce Gold Futures: A Game-Changer or a Paper Tiger?

- Trump Urges Putin to Seize Moment, Make Ukraine Deal

- EV Battery Pack Prices Drop the Most in Seven Years

- Saudi Arabia Accelerates $2.5 Trillion Mining Plans To Cut Oil Reliance

- Oil Prices Remain Under Pressure Despite Geopolitical Risk

- Alphabet shares jump 5% after Google touts ‘breakthrough’ quantum chip

- Dow falls more than 100 points to notch four losing days as year-end rally takes a breather: Live updates

- The CPI report Wednesday is expected to show progress on inflation has hit a wall

- Bitcoin continues pullback from all-time highs, trading near $96,000: CNBC Crypto World

- Treasury Yields Drop After 3Y Auction Tails But Is Otherwise Solid

- UnitedHealth shooting sparks security fears for execs but fixes are expensive and complicated

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.