Summary Of the Markets Today:

- The Dow closed up 63 points or 0.17%,

- Nasdaq closed up 1.37%,

- S&P 500 closed up 0.80%,

- Gold $2,046 down $1.70,

- WTI crude oil settled at $70 up $0.30,

- 10-year U.S. Treasury 4.146% up 0.023 points,

- USD Index $103.61 down $0.550,

- Bitcoin $43,260 down $529 ( 1.21% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

October 2023 sales of merchant wholesalers were down 0.4% from the revised October 2022 level. Total inventories of merchant wholesalers were down 2.3% from the revised October 2022 level. The October inventories/sales ratio for merchant wholesalers was 1.34. The October 2022 ratio was 1.37. As I have been saying, I know the wholesaling sector is in flux – and IMO you cannot say the sector is contracting as the scope is different. The sales-to-inventory levels (green line on the graph below) do not indicate an inventory build which historically has been an indicator of a pending recession.

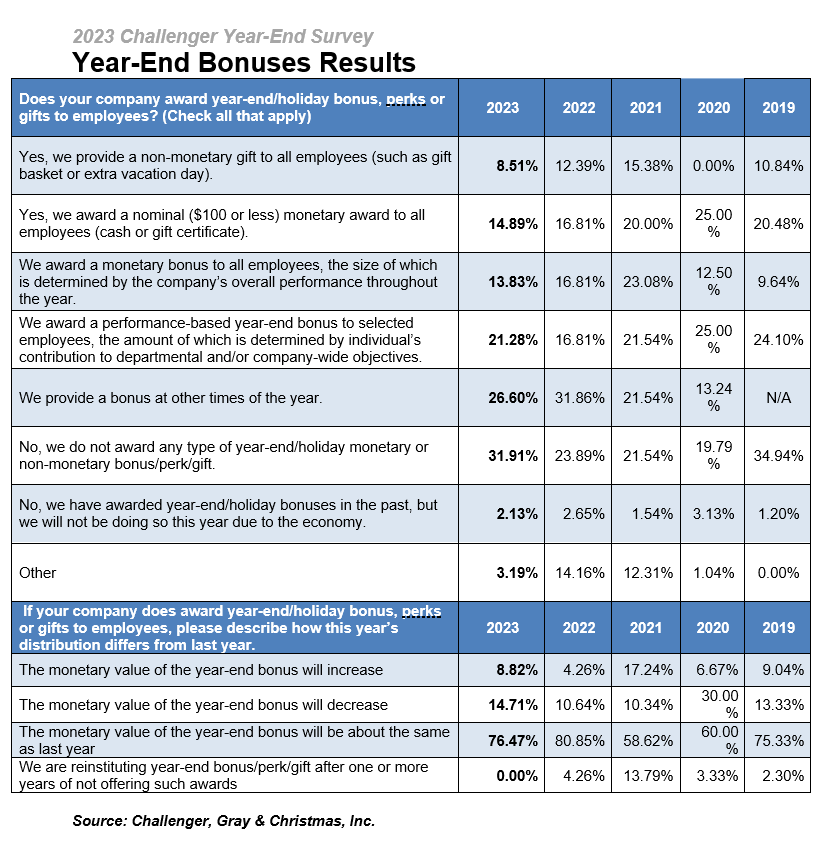

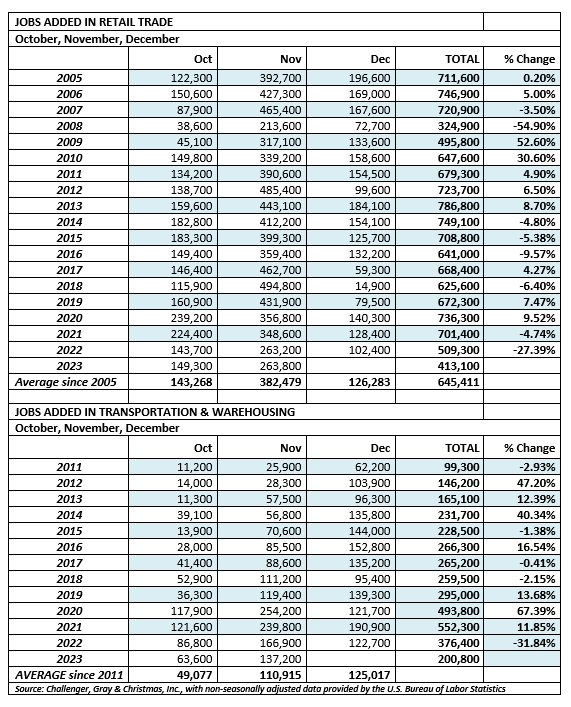

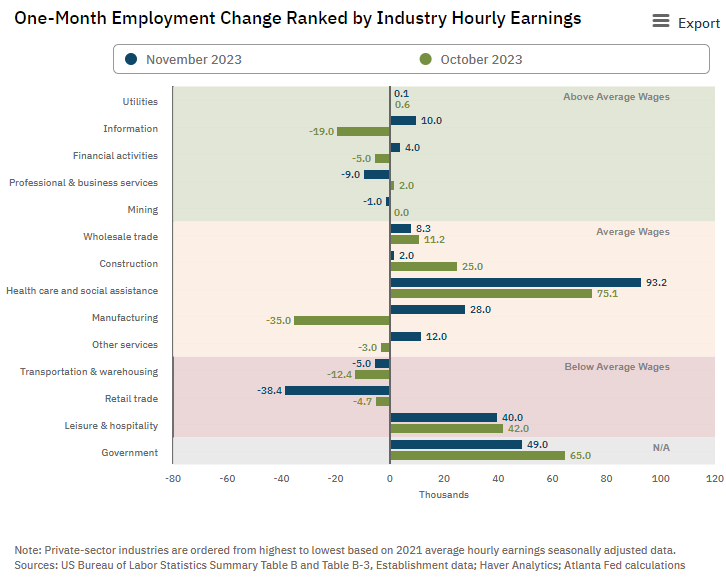

U.S.-based employers announced 45,510 job cuts in November 2023, a 24% increase from the 36,836 cuts >announced one month prior. It is 41% lower than the 76,835 cuts announced in the same month in 2022, and marks the first time cuts were lower than the corresponding month a year ago since July. So far this year, companies have announced plans to cut 686,860 jobs, a 115% increase from the 320,173 cuts announced in the same period last year. It is the highest January-November total since 2020, when 2,227,725 cuts were recorded. Andrew Challenger, labor expert and Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

The job market is loosening, and employers are not as quick to hire. The labor market appears to be stabilizing with a more normal churn, though we expect to continue to see layoffs going into the New Year.

In the week ending December 2, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 220,750, an increase of 500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 220,000 to 220,250.

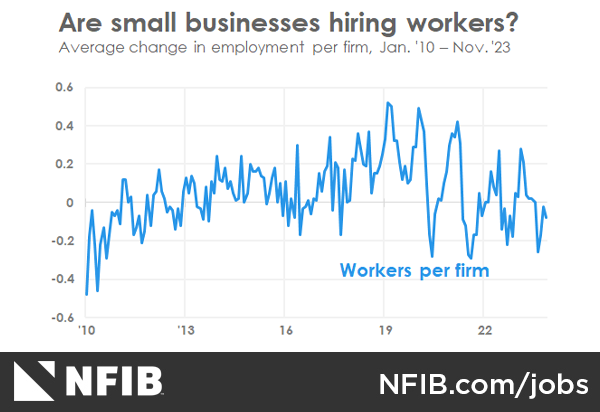

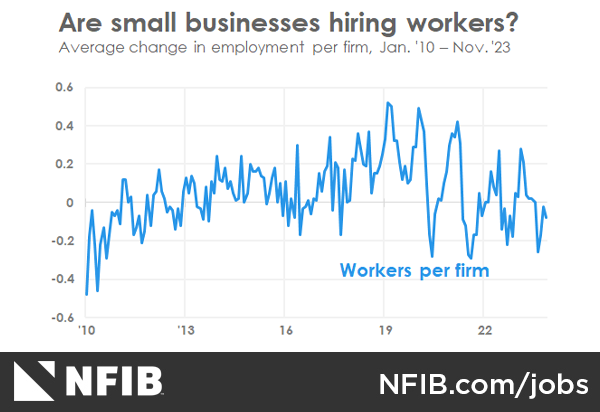

According to NFIB’s monthly jobs report, 40% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down three points from October. The percent of small business owners reporting labor quality as their top small business operating problem remains elevated at 24%. Labor costs reported as the single most important problem for business owners decreased one point to 8%, five points below the highest reading of 13% reached in December 2021. NFIB Chief Economist Bill Dunkelberg stated:

Despite the slight decline in November, small business job openings remain stuck in historical territory. For owners across the country, there are not enough workers to maintain current operations for small businesses, much less chase new opportunities. As we near the end of the year, small business owners continue to raise compensation in order to attract and retain qualified employees.

In October 2023, the Federal Reserve’s headline consumer credit increased at a seasonally adjusted annual rate of 1.2 percent. Revolving credit increased at an annual rate of 2.7 percent, while nonrevolving credit increased at an annual rate of 0.7 percent. I hate interpreting the volatile extrapolation of a single month’s change – and prefer to look at year-over-year change. The year-over-year growth in consumer credit was 3.1% which is the blue line on the graph below (1.6% inflation-adjusted – red line on the graph below). The bottom line is that consumer credit growth is slowing – and this is usually associated with a slowing economy.

Here is a summary of headlines we are reading today:

- Global Airlines To See Record Revenues This Year

- New Supercrystals Set World Record for Solar Hydrogen Production

- U.S. Natural Gas Inventories Highest at Winter’s Start Since 2020

- U.S. Cements Position as Energy Superpower with Soaring Oil Exports

- Nasdaq closes 1% higher, Dow and S&P 500 snap 3-day losing streak: Live updates

- Biden administration asserts power to seize drug patents in move to slash high prices

- Google shares pop 5% after company announces Gemini AI model

- PayPal shares slide after Amazon drops Venmo as payment option

- Consumer Credit Expansion Slowed Dramatically In October

- Predictably, The Rush To Electric Cars Is Imploding

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.