03 Jan 2023 Market Close & Major Financial Headlines: Wall Street’s Major Indexes Gapped Down At The Opening Bell And Traded Mostly Sideways Before Closing Moderately In The Red At Session Lows

Summary Of the Markets Today:

- The Dow closed down 285 points or 0.76%,

- Nasdaq closed down 1.18%,

- S&P 500 closed down 0.80%,

- Gold $2049 down $24.00,

- WTI crude oil settled at $73 up $2.71,

- 10-year U.S. Treasury 3.903% down 0.037 points,

- USD index $102.45 up $0.27,

- Bitcoin $42,740 down $2,078 (4.64%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

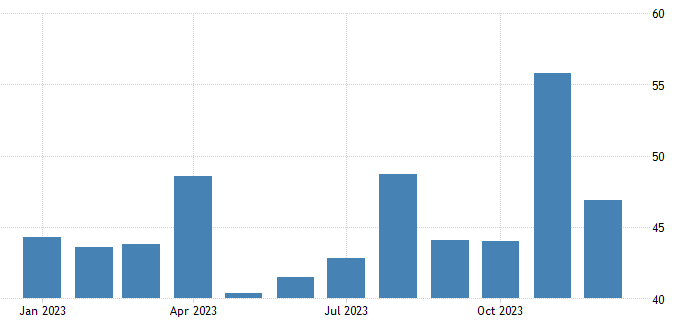

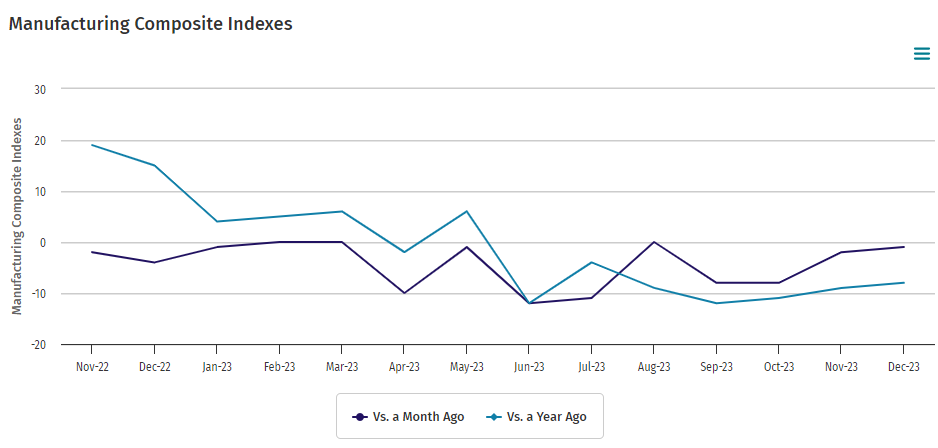

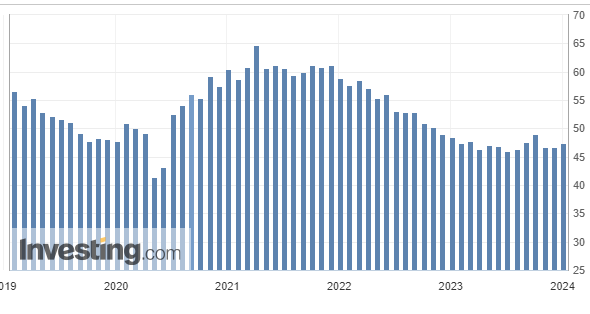

The ISM Manufacturing PMI registered 47.4% in December 2023, up 0.7 percentage points from the 46.7% recorded in November. The overall economy continued in contraction for a third month after one month of weak expansion preceded by nine months of contraction and 30 months of expansion before that. According to the ISM, a Manufacturing PMI above 48.7% over some time generally indicates an expansion of the overall economy. As the overall economy has been expanding whilst manufacturing is in a recession – one can assume that this rule is not applicable.

The number of job openings changed little at 8.8 million on the last business day of November 2023. Over the month, the number of hires and total separations decreased to 5.5 million and 5.3 million, respectively. Within separations, quits (3.5 million) edged down and layoffs and discharges (1.5 million) changed little. The general trend of job openings is falling which correlates to employment gains.

The highlights of the minutes of the Federal Open Market Committee for December 12–13, 2023 show: [note: that these minutes state that the Fed is likely done raising the federal funds rate. But I have a hard time reading into these minutes that the Fed will soon begin cutting rates.]

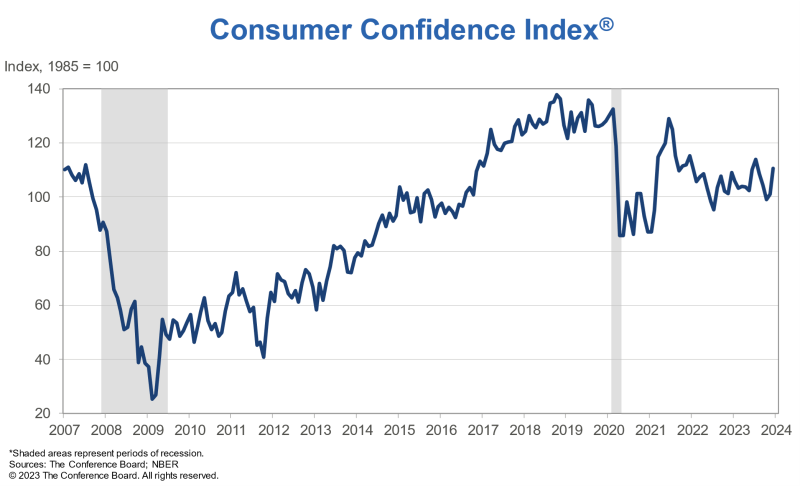

… Regarding the economic outlook, participants generally judged that, in 2024, real GDP growth would cool and that rebalancing of the labor market would continue, with the unemployment rate rising somewhat from its current level.

… participants noted the improvement in both headline and core inflation and discussed the developments in components of these aggregate measures. They observed that progress had been uneven across components, with energy and core goods prices falling or changing little recently, but core services prices still increasing at an elevated pace.

… Participants generally perceived a high degree of uncertainty surrounding the economic outlook. As an upside risk to both inflation and economic activity, participants noted that the momentum of economic activity may be stronger than currently assessed, possibly on account of the continued balance sheet strength of many households. Furthermore, participants observed that, after a sharp tightening since the summer, financial conditions had eased over the intermeeting period. Many participants remarked that an easing in financial conditions beyond what is appropriate could make it more difficult for the Committee to reach its inflation goal

… participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves. Participants pointed to the decline in inflation seen during 2023, noting the recent shift down in six-month inflation readings in particular, and to growing signs of demand and supply coming into better balance in product and labor markets as informing that view. Several participants remarked that the Committee’s past policy actions were having their intended effect of helping to slow the growth of aggregate demand and cool labor market conditions. They judged that, in combination with improvements in the supply situation, these developments were helping to bring inflation back to 2 percent over time. Most participants noted that, as indicated in their submissions to the SEP, they expected the Committee’s restrictive policy stance to continue to soften household and business spending, helping to promote further reductions in inflation over the next few years.

Here is a summary of headlines we are reading today:

- UK Manufacturing Sector Plunges Deeper Into Crisis

- Oil Gains Over 3% On Libya, OPEC and Middle East Escalation

- Argentina’s New President Is Looking To Shake Up Its Oil Industry

- BYD’s Record-Breaking Quarter Challenges Tesla’s EV Dominance

- MidEast Conflict Escalates with 2 Explosions in Iran Killing 100

- Dow tumbles nearly 300 points Wednesday, Nasdaq closes lower for a 2nd straight day in 2024: Live updates

- Xerox to cut 15% of its workforce

- Mortgages, auto loans, credit cards: Expert predictions for interest rates in 2024

- U.S. recession still a threat; China growth stalls, and other 2024 investing risks

- 10-year Treasury yield slips after December Fed minutes show officials didn’t rule out further rate hikes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.