24Dec2024 Market Close & Major Financial Headlines: Merry Christmas Came To Wall Street As The Santa Claus Rally Begins

Summary Of the Markets Today:

- The Dow closed up 390 points or 0.91%,

- Nasdaq closed up 266 points or 1.35%,

- S&P 500 closed up 66 points or 1.10%,

- Gold $2,633 up $5.00 or 0.19%,

- WTI crude oil settled at $70 up $0.83 or 1.20%,

- 10-year U.S. Treasury 4.593 down 0.006 points or 0.131%,

- USD index $108.23 up $0.19 or 0.18%,

- Bitcoin $98,566 up $3,814 or 4.03%

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

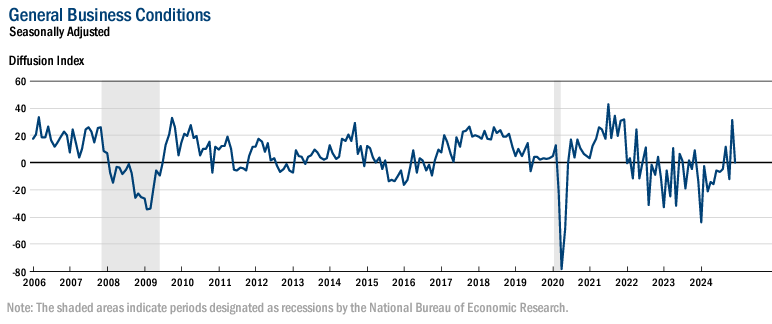

US stocks experienced a notable rally in the final trading session before the Christmas holiday, marking the beginning of the “Santa Claus” rally. This surge was largely driven by strong performances in technology stocks, particularly Nvidia, which has seen significant gains throughout 2024. The market’s positive momentum comes after a challenging week influenced by Federal Reserve actions, which had previously caused a decline in stock prices. Investors are now reassessing interest rate expectations for the upcoming year, with most anticipating that the Fed will hold rates steady at its January and March meetings, followed by uncertainty regarding future actions. The past three trading sessions have propelled major indexes closer to their record highs, reflecting a recovery from last week’s downturn. Analysts suggest that inflation concerns will persist into 2025, complicating the Fed’s monetary policy decisions as it navigates economic pressures. Overall, Wall Street enters the holiday break with renewed optimism, buoyed by a strong performance from tech stocks and historical patterns that suggest further gains during this festive trading period.

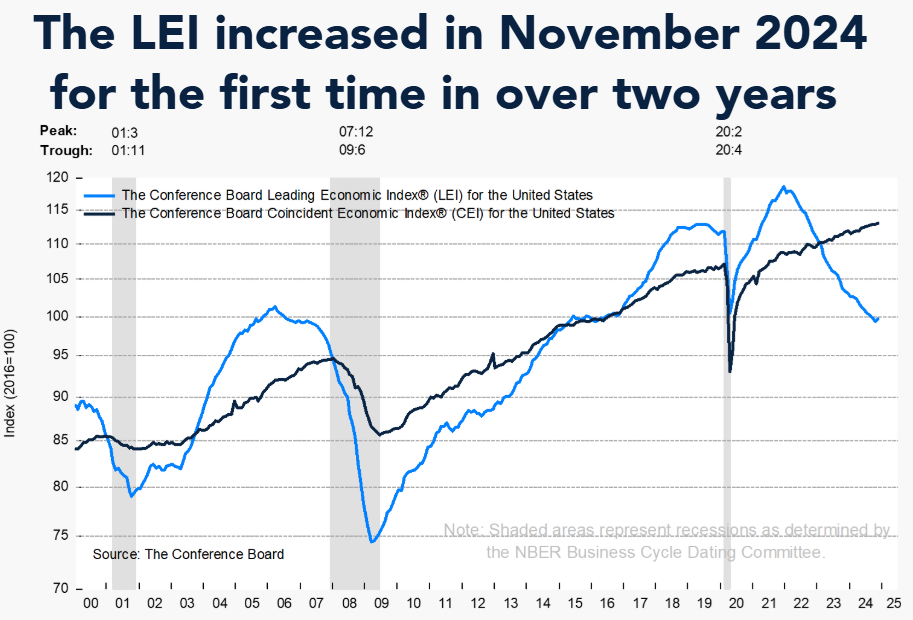

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

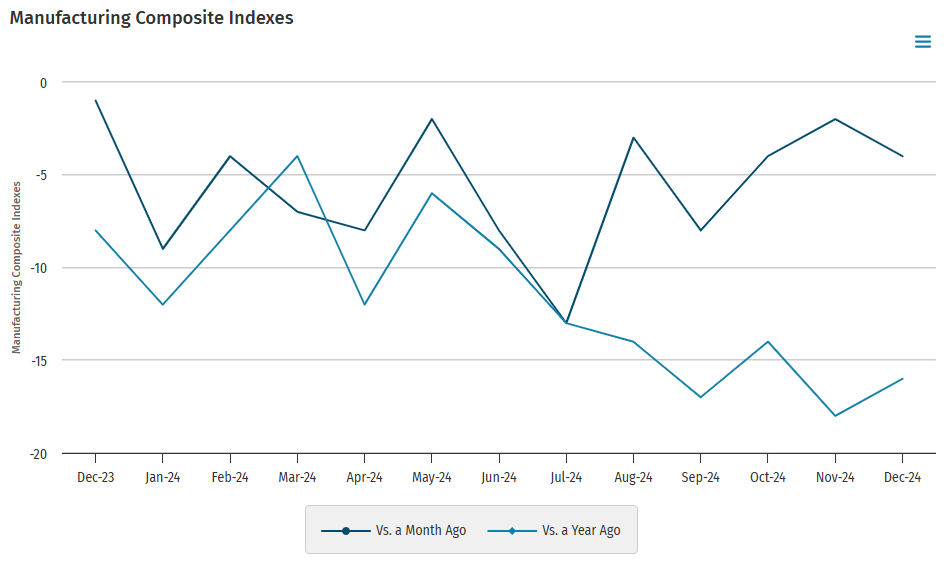

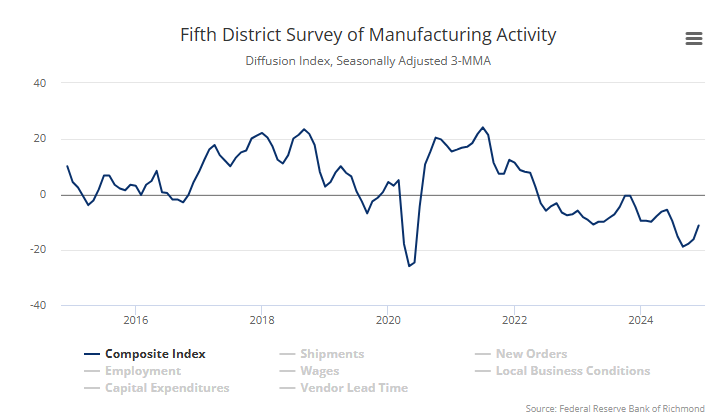

Federal Reserve Bank of Richmond manufacturing survey remained in contractionary territory in December 2024. The composite manufacturing index ticked up slightly to −10 in December from −14 in November. Of its three component indexes, shipments and employment were relatively flat, while new orders improved to −11 from −19 in November. Manufacturing remains in a recession in the US.

Here is a summary of headlines we are reading today:

- Will AI End the Utility Monopoly?

- The Future of Home Heating: Challenges and Opportunities

- Big Oil Looks to The Eastern Mediterranean as Replacement for Russian Gas

- Hydrogen Fuel Cells: A Promising Green Alternative to Battery Electric Vehicles

- Green Hydrogen Costs Set to Stay Too High For Too Long

- Biggest banks sue the Federal Reserve over annual stress tests

- FDA says the Zepbound shortage is over. Here’s what that means for compounding pharmacies, patients who used off-brand versions

- American Airlines temporarily grounded U.S. flights because of technical glitch

- Starbucks barista strike expands to more than 300 stores in 45 states

- As older Americans downsize, over 20 million homes could become available—but they’re not where young people want to move

- Here’s why business leaders are spending big on Trump’s inaugural committee

- What it would cost to live like the ‘Home Alone’ family today, according to financial advisors

- Russia Bans Crypto Mining For 6 Years In 10 Regions

- Rand Paul’s Annual Festivus List Highlights Over One Trillion Dollars In Government Waste

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.