*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

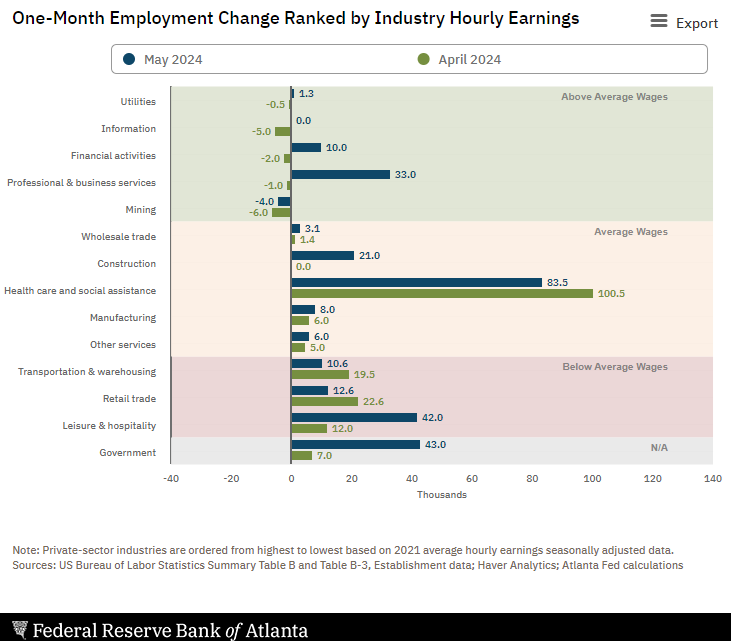

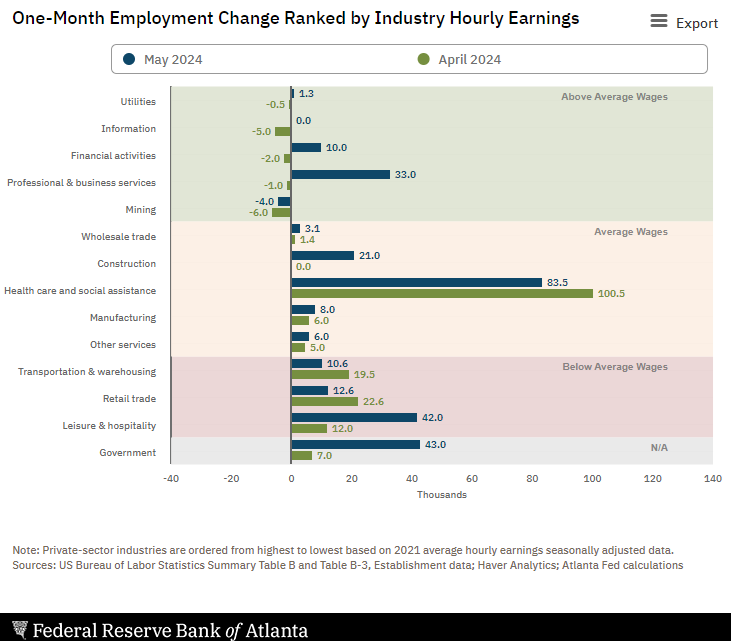

Total nonfarm payroll employment increased by 272,000 in May 2024, and the unemployment rate changed little at 4.0%. Employment continued to trend up in several industries, led by health care; government; leisure and hospitality; and professional, scientific, and technical services. Talk about crazy, the headline establishment survey showing employment gain of 272,000 (blue bars on the graph below) – the household survey shows an employment DECREASE of 408,000 (red bars on the graph below). Either one or both of the surveys must be wrong as they do not agree. And the household survey (which is the basis of the headline unemployment rate) shows the total workforce fell by 250,000 whilst the number of unemployed increased by 157,000. Also worth noting that the temporary help services fell for the third month in a row which is indicative of a slowing economy.

April 2024 sales of merchant wholesalers were up 1.4% from the revised April 2023 level. Total inventories of merchant wholesalers were down 1.7% from the revised April 2023 level

The April inventories/sales ratio for merchant wholesalers was 1.35. The April 2023 ratio was 1.39. A rising inventory/sales ratio is indicative of a slowing economy – but the amount of rise is currently insignificant – and my takeaway from this and employment levels in this industry is that the economy remains little changed.

U.S. homeowners with a mortgage pulled in $28,000 in equity gains year over year in first quarter of 2024, the highest number since late 2022. California ($64,000), Massachusetts ($61,000) and New Jersey ($59,000) led the country for annual home equity gains in the first quarter. Dr. Selma Hepp, chief economist for CoreLogic added:

With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner. Importantly, higher prices have also lifted some 190,000 homeowners out of negative equity, leaving only about 1.8% of those with mortgages underwater. Home equity is key to mortgage holders who have seen other homeownership costs soar, including insurance, taxes and HOA fees, as a source of financial buffer. Also, low amounts of negative equity are welcomed in markets that have shown price weaknesses this spring, such as Florida (1.1% of homes underwater) and Texas (1.7% of homes underwater) — both of which are below the national rate — as further price declines could drive more homeowners to lose their equity.

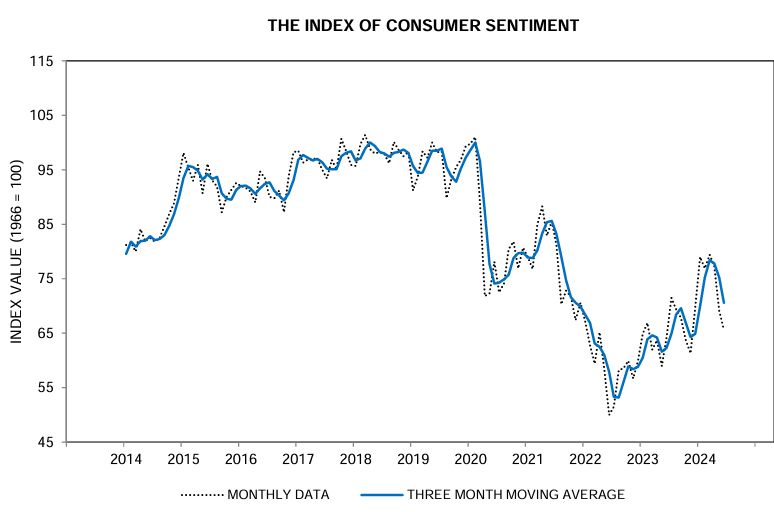

Holy crap Batman – the Federal Reserve says consumer credit increased at a seasonally adjusted annual rate of 1.5 percent in April 2024. Revolving credit decreased at an annual rate of 0.4 percent, while nonrevolving credit increased at an annual rate of 2.2 percent. My preferred method of calculating consumer credit growth is 2.0% growth year-over-year. And a 2.0% growth taking inflation into account is a decline of 0.2% year-over-year. This is a major warning sign that the consumer is reducing its use of credit – and that translates into fewer purchases. Fewer purchases = a slowing economy. The slowing is most noticeable in non-revolving credit (cars, student loans, and personal loans) but revolving credit (credit cards) is also slowing.

Here are some of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.