03 July 2024 Market Close & Major Financial Headlines: The S&P 500 And The Nasdaq Fly To New Historic Highs. The DOW Was Moderately Down.

Summary Of the Markets Today:

- The Dow closed down 24 points or 0.06%,

- Nasdaq closed up 0.88%, (Closed at 18,188, New Historic high 18,188)

- S&P 500 closed up 0.51%, (Closed at 5,537, New Historic high 5,539)

- Gold $2,365 up $31.10,

- WTI crude oil settled at $84 up $0.99,

- 10-year U.S. Treasury 4.354 down 0.081 points,

- USD index $105.35 down $0.37,

- Bitcoin $59,862 down $2,178 or 3.51%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

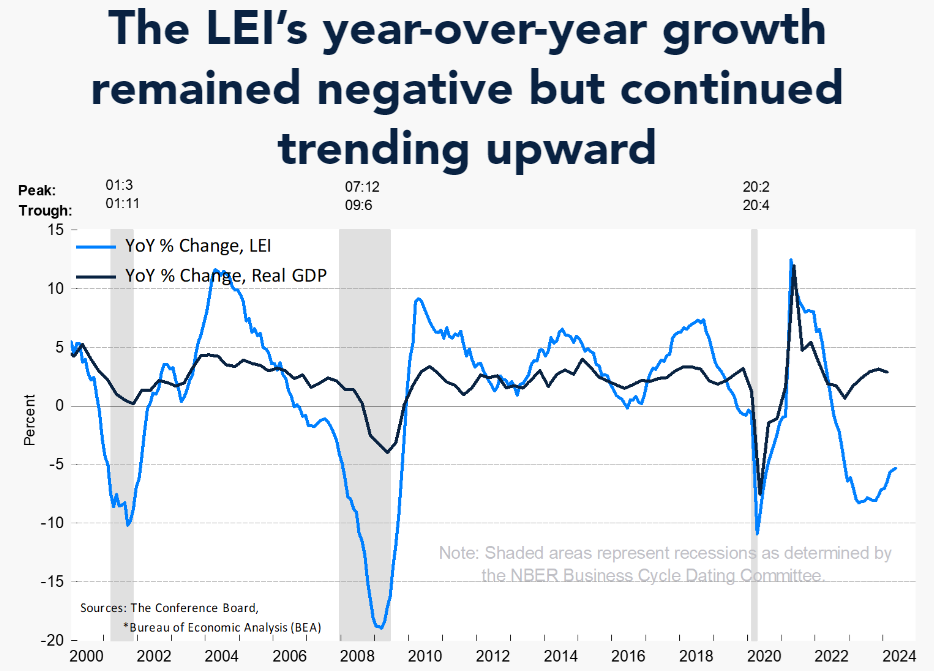

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Private sector employment increased by 150,000 jobs in June 2024 and annual pay was up 4.9% year-over-year, according to the ADP® National Employment Report. I know some are spinning this as a low number – the facts are that 150,000 employment gains supports economic growth; If anything, the ADP numbers are slightly trending up; And overall both ADP and the BLS’s numbers are showing adequate employment growth. Nela Richardson, chief economist, ADP adds:

Job growth has been solid, but not broad-based. Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month.

U.S.-based employers announced 48,786 cuts in June 2024, down 23.6% from the 63,816 cuts announced one month prior. It is 19.8% higher than the 40,709 cuts announced in the same month in 2023. Andrew Challenger, Senior Vice President and workplace expert for Challenger, Gray & Christmas, Inc. stated:

June is typically a low month for job cut announcements, as most companies are midyear or at the end of their fiscal years. The months following fiscal year ends tend to have a spike in cuts, as those plans are implemented. Over the last decade, job cuts have primarily been announced during the first half of the year. Prior to 2013, major announcements would bookend the year.

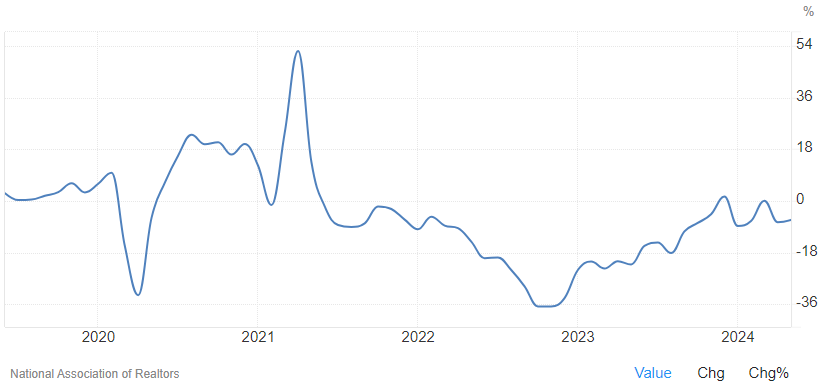

The US trade balance was improving until March 2023 but recently the trade balance has been deteriorating. The deficit increased from $74.5 billion in April (revised) to $75.1 billion in May 2024, as exports decreased more than imports. The graph below shows imports are growing much faster than exports.

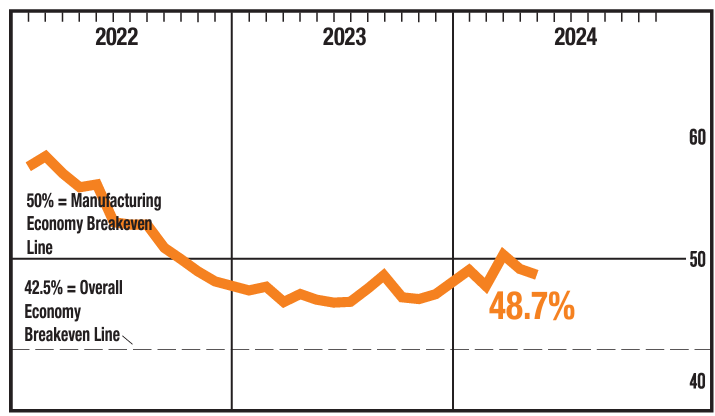

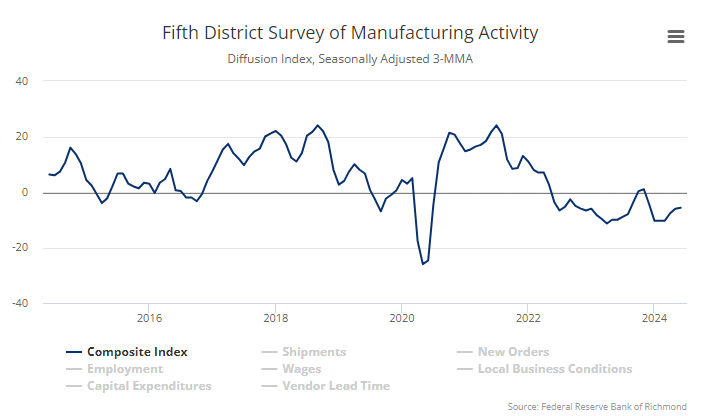

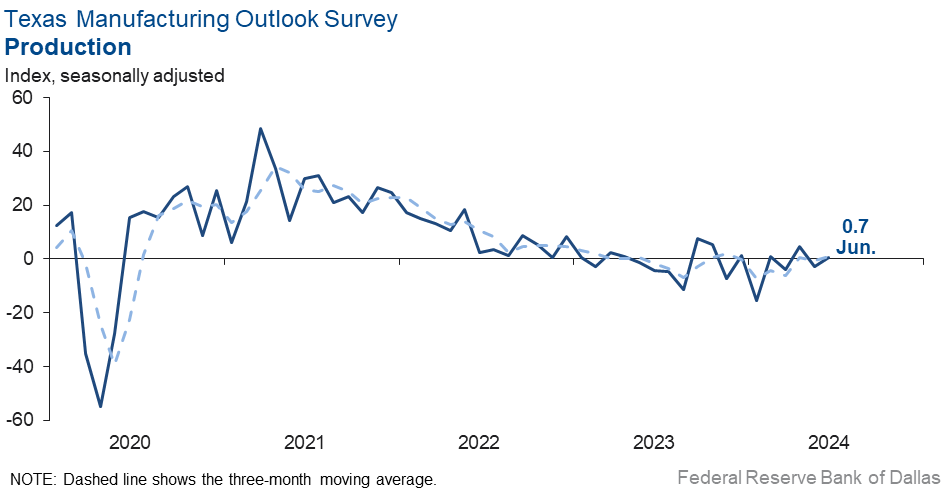

New orders for manufactured goods in May 2024 was up 0.9% year-over-year (down 0.3% year-over-year inflation adjusted). Manufacturing remained in a recession in May.

In the week ending June 29, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 238,500, an increase of 2,250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,000 to 236,250.

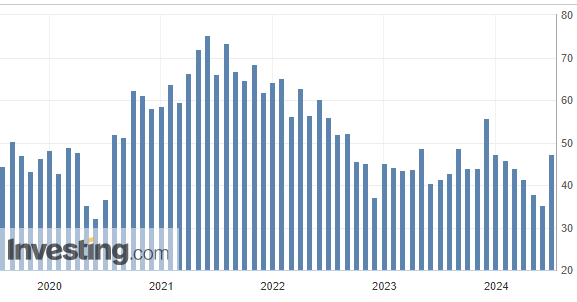

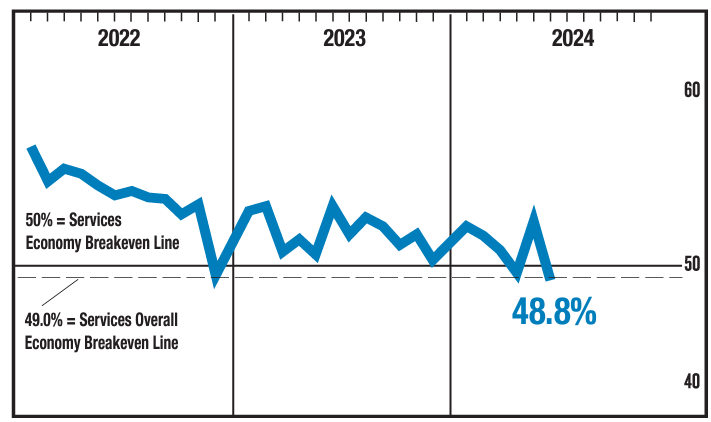

In June 2024, the Services Purchasing Manager Index registered 48.8%, 5 percentage points lower than May’s figure of 53.8%. The reading in June was a reversal compared to May and the second in contraction territory in the last three months. Before April, the services sector grew for 15 straight months following a composite index reading of 49 percent in December 2022; the last contraction before that was in May 2020 (45.4 percent). The Business Activity Index registered 49.6 percent in June, which is 11.6 percentage points lower than the 61.2 percent recorded in May and the first month of contraction since May 2020. The New Orders Index contracted in June for the first time since December 2022; the figure of 47.3 percent is 6.8 percentage points lower than the May reading of 54.1 percent. The takeaway here is that the services industry entering contraction territory is a recession flag.

The Minutes of the Federal Open Market Committee for June 11–12, 2024 shows significant discussion on inflation and the federal funds rate which pundits want reduced. Highlights of the minutes which I think are significant are detailed below:

In their discussion of inflation developments, participants noted that after a significant decline in inflation during the second half of 2023, the early part of this year had seen a lack of further progress toward the Committee’s 2 percent objective. Participants judged that although inflation remained elevated, there had been modest further progress toward the 2 percent goal in recent months … participants suggested that a number of developments in the product and labor markets supported their judgment that price pressures were diminishing. In particular, a few participants emphasized that nominal wage growth, though still above rates consistent with price stability, had declined, notably in labor-intensive sectors.

… Participants remarked that demand and supply in the labor market had continued to come into better balance. Participants observed that many labor market indicators pointed to a reduced degree of tightness in labor market conditions. These included a declining job openings rate, a lower quits rate, increases in part-time employment for economic reasons, a lower hiring rate, a further step-down in the ratio of job vacancies to unemployed workers, and a gradual uptick in the unemployment rate.

… Several participants also suggested that the [BLS] establishment survey may have overstated actual job gains.

… Participants generally observed that continued labor market strength could be consistent with the Committee achieving both its employment and inflation goals, though they noted that some further gradual cooling in the labor market may be required.

… Participants observed that a lower rate of output growth this year could aid the disinflation process while also being consistent with a strong labor market. Participants generally viewed the Committee’s restrictive monetary policy stance as having a restraining effect on growth in consumption and investment spending and as contributing to a gradual slowing in the pace of economic activity. A couple of participants particularly stressed that the Committee’s past policy tightening had contributed to higher rates for home mortgage loans and other longer-term borrowing, which were moderating spending and production, including households’ discretionary purchases and residential construction activity.

… Some participants highlighted reasons why inflation could remain above 2 percent for longer than expected. These participants pointed to risks that inflation could stay elevated as a result of worsening geopolitical developments, heightened trade tensions, more persistent shelter price inflation, financial conditions that might be or could become insufficiently restrictive, or U.S. fiscal policy becoming more expansionary than expected; the latter two scenarios were also seen as implying upside risks to economic activity.

… In discussing the outlook for monetary policy, participants noted that progress in reducing inflation had been slower this year than they had expected last December. They emphasized that they did not expect that it would be appropriate to lower the target range for the federal funds rate until additional information had emerged to give them greater confidence that inflation was moving sustainably toward the Committee’s 2 percent objective.

… Some remarked that the continued strength of the economy, as well as other factors, could mean that the longer-run equilibrium interest rate was higher than previously assessed, in which case both the stance of monetary policy and overall financial conditions may be less restrictive than they might appear. A couple of participants noted that the longer-run equilibrium interest rate was a better guide for determining where the federal funds rate may need to move over the longer run than for assessing the restrictiveness of current policy. Participants noted the uncertainty associated with the economic outlook and with how long it would be appropriate to maintain a restrictive policy stance.

Here is a summary of headlines we are reading today:

- Google’s Emissions Have Surged Nearly 50% Due to AI Energy Demand

- Shell Begins Perdido Evacuation As Hurricane Beryl Threatens Operations

- Tech Giants’ Power Needs Could Jeopardize U.S. Grid Reliability

- Oil Prices Rise As EIA Confirms Huge Crude Draw

- Oil Prices Surge as Geopolitical Risk and Crude Demand Both Rise

- Red States Win Legal Battle Against Biden’s LNG Export Restrictions

- New Field Starts Oil Production in U.S. Gulf of Mexico

- Fed says it’s not ready to cut rates until ‘greater confidence’ inflation is moving to 2% goal

- S&P 500, Nasdaq close at fresh records as investors look past soft economic data: Live updates

- 10-year Treasury yield tumbles after weak economic data

- FOMC Minutes Show “Vast Majority” Expect Economy To Cool, See Deflationary Effects Of AI

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.