02 AUG 2024 Market Close & Major Financial Headlines: Markets Opened Sharply Lower, Traded Sideways, Closing About 2% In The Red After Weak Jobs Report

Summary Of the Markets Today:

- The Dow closed down 611 points or 1.51%,

- Nasdaq closed down 2.43%,

- S&P 500 closed down 1.84%,

- Gold $2,479 down $1.10,

- WTI crude oil settled at $74 down $2.41,

- 10-year U.S. Treasury 3.799 down 0.178 points,

- USD index $103.21 down $1.210,

- Bitcoin $62,550 down $2,747 or 4.21%,

- Baker Hughes Rig Count: U.S. -3 to 586 Canada +8 to 219

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

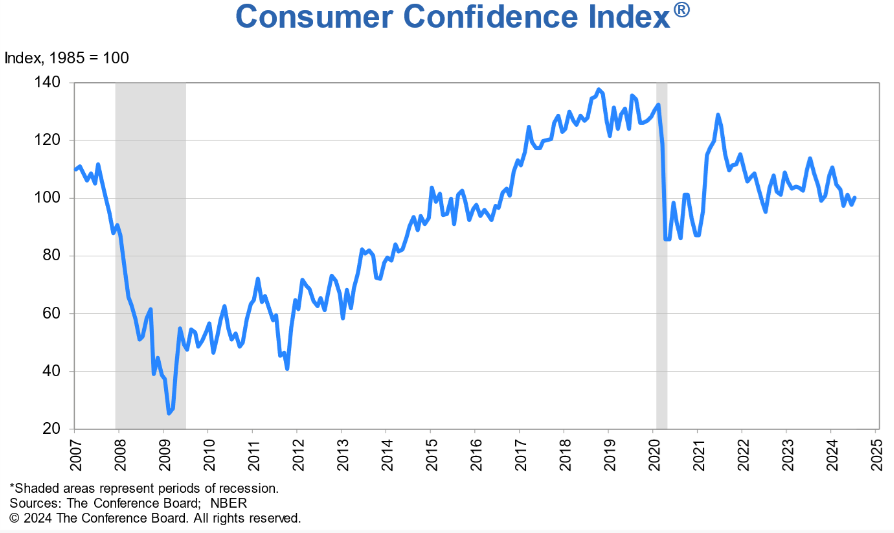

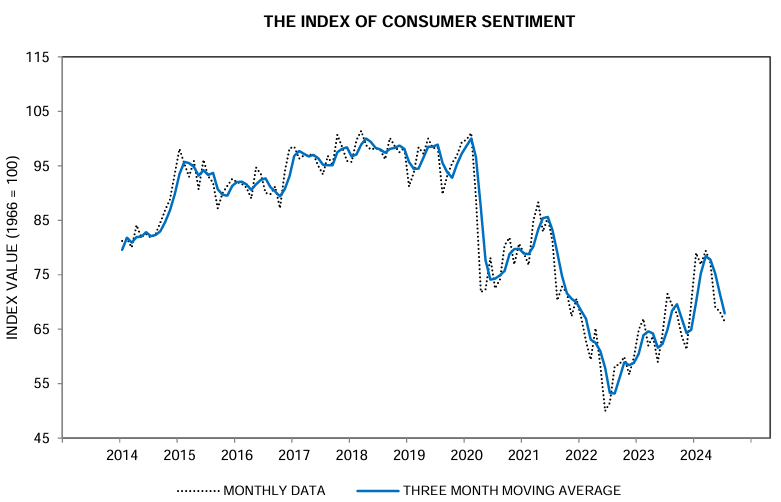

The US stock market experienced a significant downturn today following the release of the July jobs report, which indicated further cooling in the labor market. This development has intensified concerns about a potential recession and raised questions about the Federal Reserve’s interest rate strategy. Key points from the market reaction:

Economic concerns:

- The weak jobs report has fueled fears of an economic slowdown

- Investors are worried that the Federal Reserve may have maintained high interest rates for too long

Interest rate expectations:

- Market forecasts now indicate a higher likelihood of a 0.5 percentage point rate cut in September

- Treasury yields declined, with the 10-year yield falling below 4%

Tech sector impact:

- Intel’s stock plummeted by 29% following disappointing guidance and layoff announcements

- Amazon’s shares fell by 12.5% after missing quarterly financial projections

Broader economic indicators:

- Factory orders declined by 3.3%, the largest drop since April 2020

- Manufacturing activity and construction spending were lower than expected

The market reaction reflects growing uncertainty about the economic outlook and concerns that the Federal Reserve’s monetary policy may be too restrictive, potentially risking a “hard landing” for the economy.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

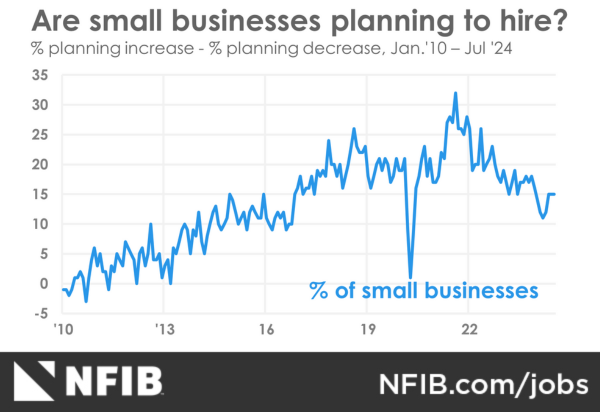

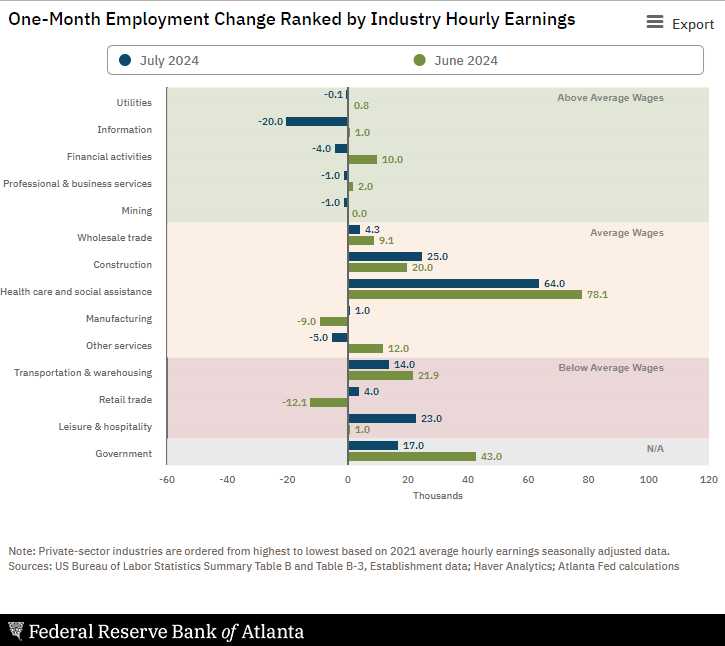

The unemployment rate rose to 4.3% in July 2024, and nonfarm payroll employment grew by 114,000 – the second-worst growth this year. Employment continued to trend up in health care, in construction, and in transportation and warehousing, while information lost jobs (see employment change bar chart in second graph below). The household survey (which produces the unemployment rate) shows employment growth of only 67,000 – versus the headline establishment survey’s 114,000 (see red bar on graph below). Further, the primary reason for the significant jump in the unemployment rate is because the household survey added 420,000 people to the workforce – not that a lot of people lost their jobs. Looking at the employment-population ratio which has been worsening since April 2024, it declined this month and remains below the levels seen from 2018 to 2020. Also from the establishment survey, Over the last year – the number of people unemployed has increased 380,000 or 21% year-over-year. To say the economy is stumbling at this point may turn out to be an understatement.

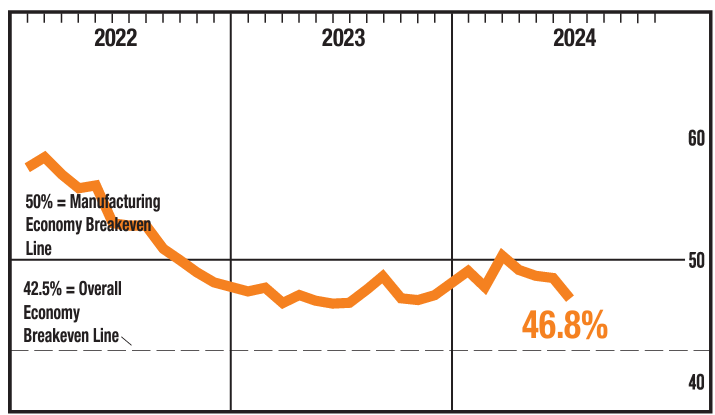

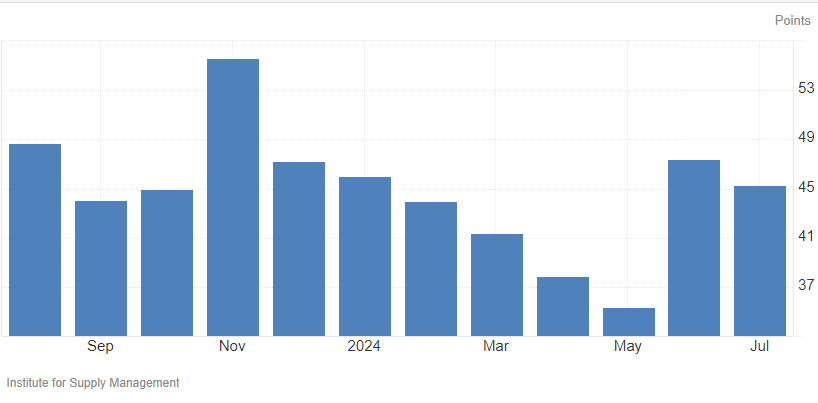

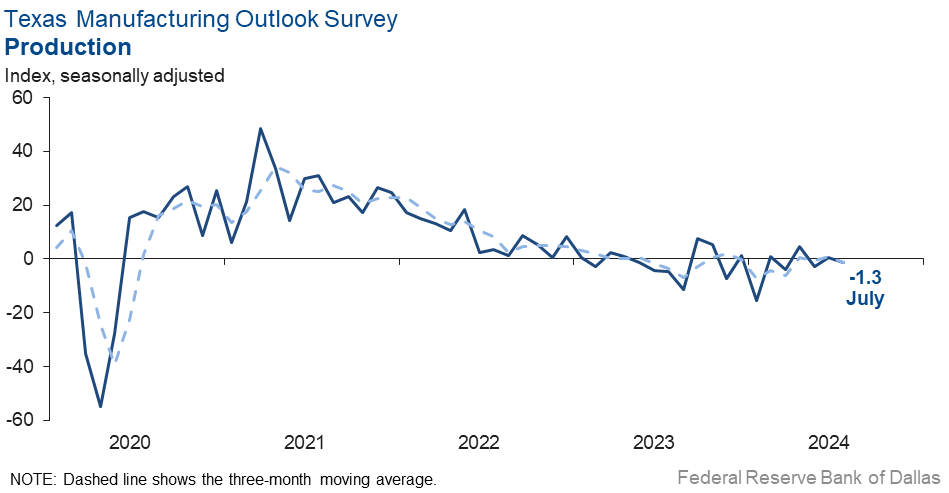

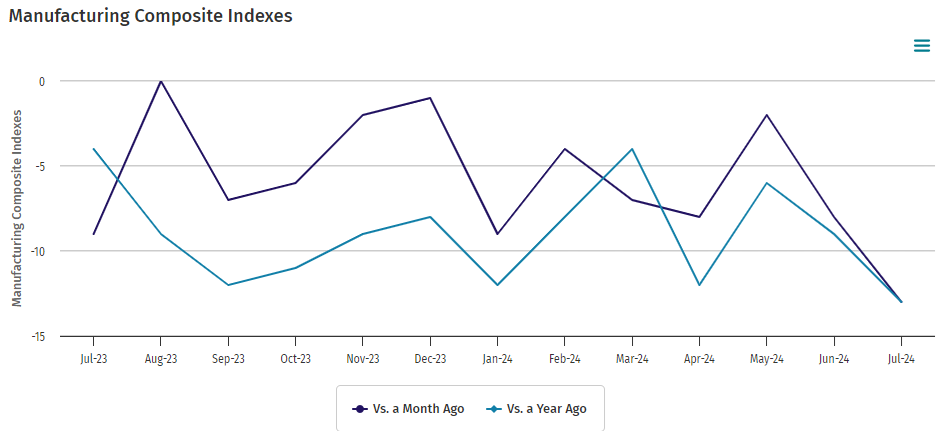

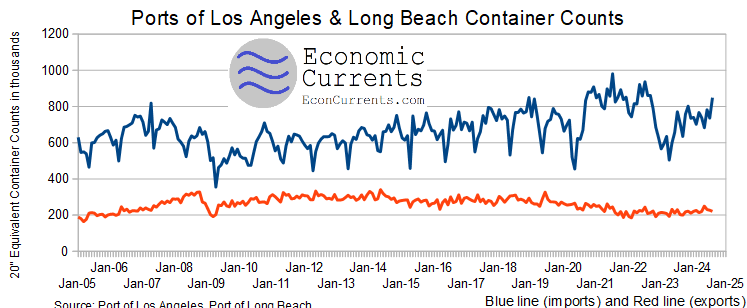

Contrary to the June 2024 Federal Reserve Industrial Production 1.1% year-over-year growth, the US Census manufacturing data shows new orders for manufactured goods in June 2024 declined 5.2% year-over-year. This data moves industrial production into a significant recession in June 2024, and early data has July 2024 manufacturing data also in a recession. Remember that imports are increasing which only suggests that despite the current policy to increase US manufacturing – manufacturing is leaving the country.

Here is a summary of headlines we are reading today:

- U.S. Oil and Gas Drilling Activity Slows Amidst Price Plunge

- Imperial Oil Q2 Earnings Surge by 68%

- Chevron Ditches California for Texas

- The Risk of a Regional War in the Middle East

- Dow closes down 600 points, Nasdaq enters correction after weak jobs report: Live updates

- Intel heads for worst day on Wall Street in 50 years, falls to lowest price in over a decade

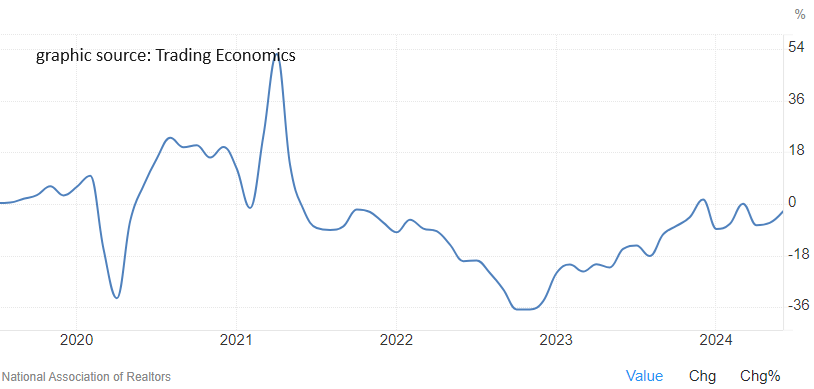

- Mortgage rates plunge to the lowest level in over a year after weak employment report

- Berkshire’s mounting cash pile could top $200 billion as Buffett continues selling stock

- Car Repos Rise 23% YoY

- Financial Strain On American Households Hits Retailers Hard

- Recession fears fuel swings in interest-rate expectations and 2-year Treasury yield

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.