16 AUG 2024 Market Close & Major Financial Headlines: Wall Street Opened Fractionally Higher, Continued To Trade Upward In A More Or Less Sideways Fashion Closing Fractionally Higher

Summary Of the Markets Today:

- The Dow closed up 97 points or 0.24%,

- Nasdaq closed up 0.21%,

- S&P 500 closed up 0.20%,

- Gold $2,546 up $53.00,

- WTI crude oil settled at $77 down $1.44,

- 10-year U.S. Treasury 3.883 down 0.043 points,

- USD index $102.44 down $0.54,

- Bitcoin $59,665 up $2,114 or 3.67%,

- Baker Hughes Rig Count: U.S. -2 to 586 Canada unchanged at 217

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

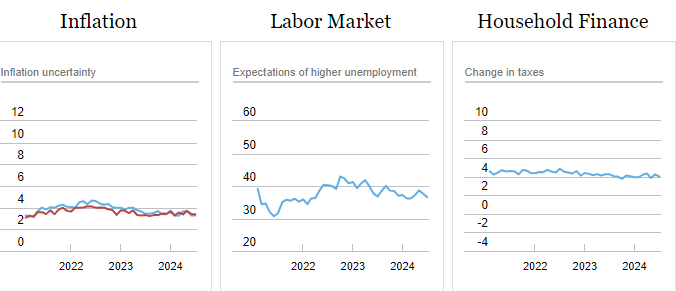

Stocks End in the Green: On Friday, the S&P 500 and Nasdaq Composite closed modestly higher, securing their best week of the year. Consumer Sentiment and Economic Data: The main economic data release on Friday showed an increase in consumer sentiment in August, marking the first rebound in five months. This positive sentiment, along with strong retail sales and Walmart’s earnings report, helped alleviate recession fears. Federal Reserve Rate Cut Expectations: Following the positive economic data, investors adjusted their expectations for Federal Reserve rate cuts. The odds of a 0.25% rate cut next month are now at 66%, while a 0.50% cut stands at 33%. This is a shift from the previous near-certainty of a 0.50% cut amid market turbulence. Upcoming Federal Reserve Update: Investors are looking ahead to next Friday when Fed Chair Jay Powell will speak at the annual Jackson Hole Symposium, which could provide further insights into the Fed’s monetary policy direction.

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Privately-owned housing units authorized by building permits in July 2024 was 7.0% below July 2023 rate. Privately-owned housing starts 16.0% below July 2023. Privately-owned housing completions was 13.8 % above July 2023 rate. Let’s put these numbers in perspective: permits, starts and completions are on the high side for the period since the 2007 Great Recession. So whilst the umbers are lower than the previous months – they are still economically positive.

Here is a summary of headlines we are reading today:

- China’s Steel Industry Braces for Painful Consolidation

- U.S. Oil and Gas Rig Count Falls for Second Week

- China and Saudi Arabia Emerge as Largest Buyers of Russia’s Fuel Oil

- Red Sea Ship Detours Boost Fuel Consumption by 500,000 Bpd

- A Review of Geopolitical Risk in Russia and the Middle East

- Stocks close higher Friday as market comeback lifts S&P 500 to best week of 2024: Live updates

- The 60/40 portfolio excelled during the market storm — and Vanguard sees a strong decade ahead

- Cadillac reveals new ‘Opulent Velocity’ performance EV concept

- Ford upgrades Lincoln Navigator to include spa mode, 48-inch display for videos and gaming

- Bayer shares soar 11% after key U.S. legal win against Roundup cancer claims

- Gold Price Today: Yellow metal jumps by Rs 1,200/10 gram, silver dearer by Rs 2,500/kg. Here’s why

- Treasury yields finish mostly lower following big spike on Thursday

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.