30 AUG 2024 Market Close & Major Financial Headlines: Markets Opened Sharply Higher, Dipped Into The Red Mid Session, Continued To Trend Higher To see The Dow Report Another Historic High And Closing Near Session Highs

Summary Of the Markets Today:

- The Dow closed up 228 points or 0.55%, (Closed at 41,563, New Historic high 41.585)

- Nasdaq closed up 1.13%,

- S&P 500 closed up 1.01%,

- Gold $2,535 down $25.30,

- WTI crude oil settled at $74 down $2.40,

- 10-year U.S. Treasury 3.909 up 0.042 points,

- USD index $101.67 up $0.33,

- Bitcoin $58,806 down $550 or 0.93%,

- Baker Hughes Rig Count: U.S. -2 to 583 Canada +1 to 220

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights

US stocks ended August on a positive note, with all three major indexes posting gains for the month despite earlier volatility. Here are the key points:

Inflation Data and Rate Cut Expectations

-

- The Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge, showed prices increased in line with expectations in July.

- Core inflation rose 0.2% month-over-month and 2.6% annually, matching June’s level.

- This data kept hopes alive for a 0.25% interest rate cut in September, as hinted by Fed Chair Jerome Powell last week.

Market Sentiment

-

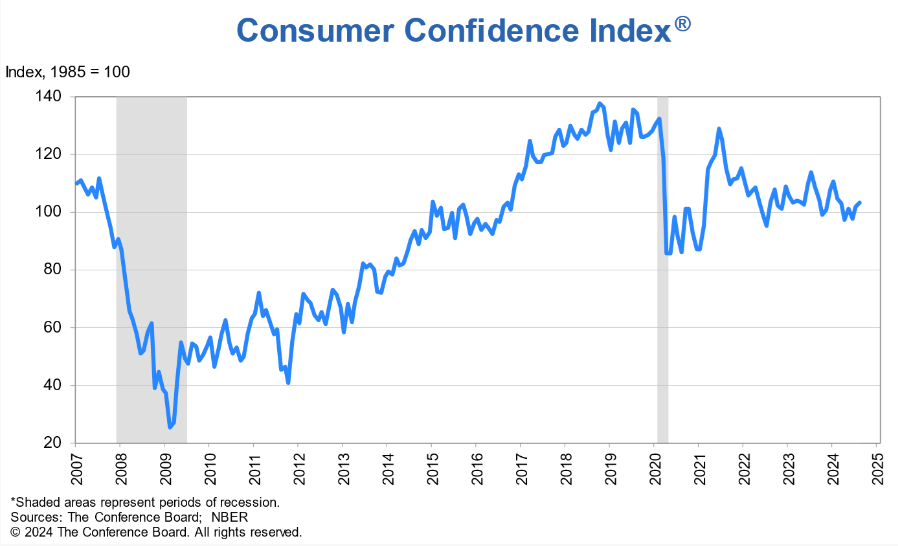

- Stocks took an upbeat tone as recession fears receded and expectations grew for the Fed to begin easing monetary policy.

- Investors have moved past the focus on Nvidia’s earnings that dominated earlier in the week.

Looking Ahead

-

- September could bring more volatility, as it has historically been a weak month for stocks.

- The market will be closely watching for further signs of the Fed’s policy pivot and its impact on the economy.

Despite a bumpy August, the stock market ended the month on a high note, with inflation data supporting expectations for a Fed rate cut in September. However, investors should be prepared for potential volatility in the coming month.

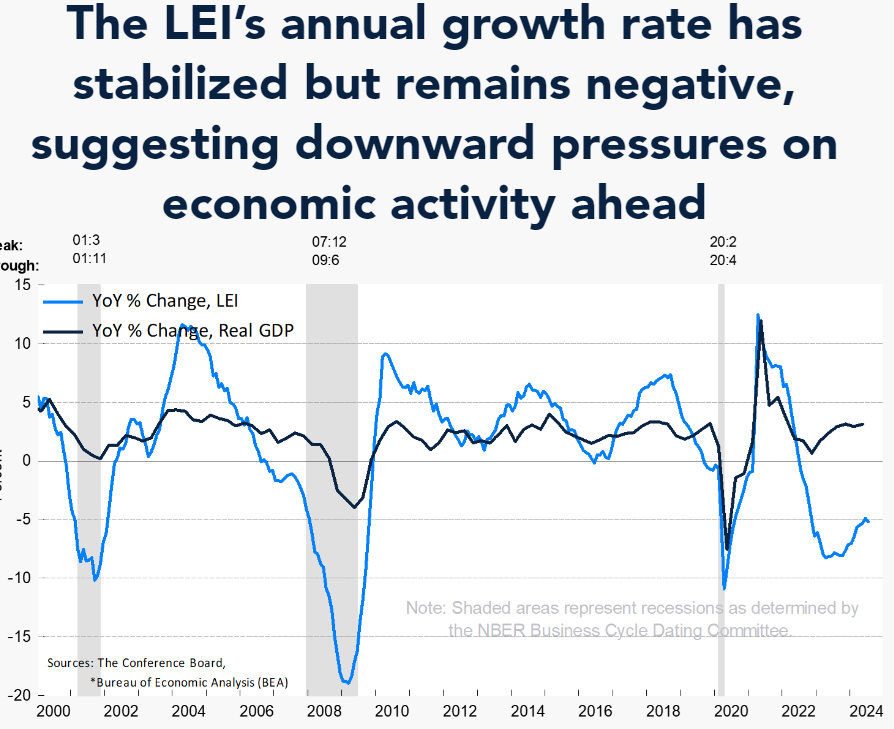

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Real disposable personal income (DPI), inflation adjusted personal income less personal current taxes, increased 1.1% year-over-year – up from last month’s 1.0%. Real personal consumption expenditures increased 2.7% year-over-year – down from last month’s 2.8%. The PCE price index (aka “inflation”) was unchanged at 2.5%. Excluding food and energy, the PCE price index also was unchanged at 2.6%. The bottom line is that neither consumption or inflation is changing. As I continue to state, there is ZERO evidence that the underlying inflationary forces are moderating today. Every day, consumers are getting poorer as their income is only up 1.1% year-over-year whilst their spending is up 2.8%. Wall Street is pressuring the Federal Reserve to cut rates for the benefit of traders while the real burden of inflation is being born by the working who are made poorer every day.

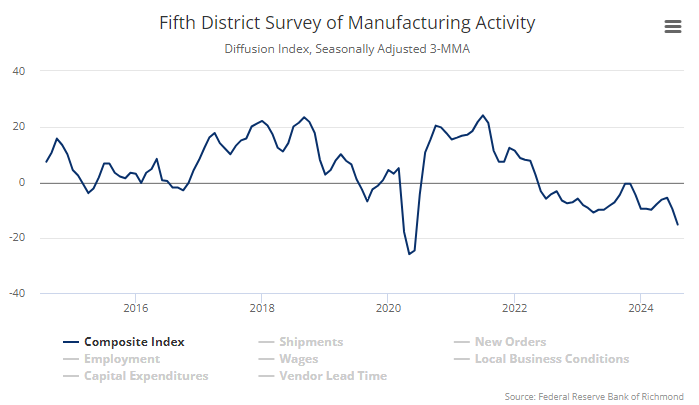

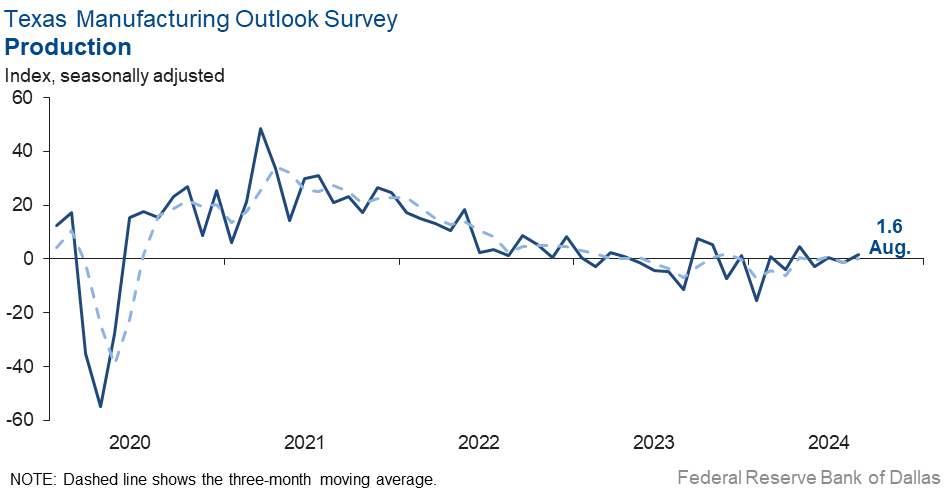

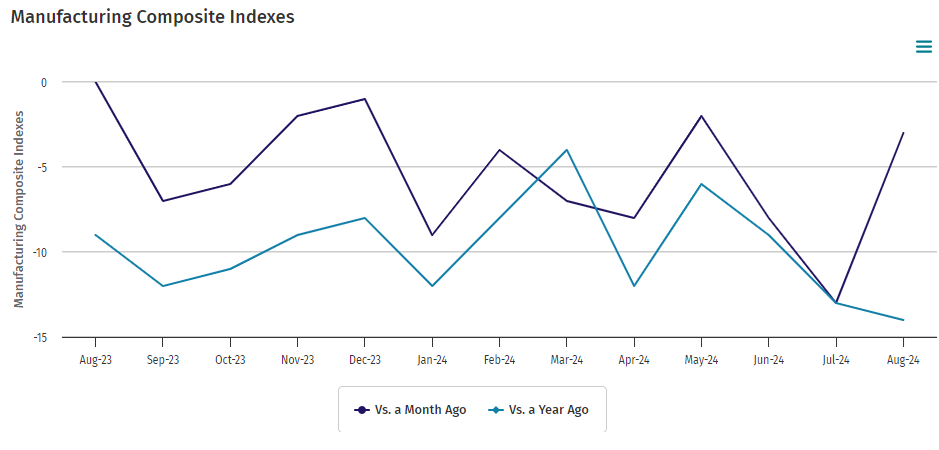

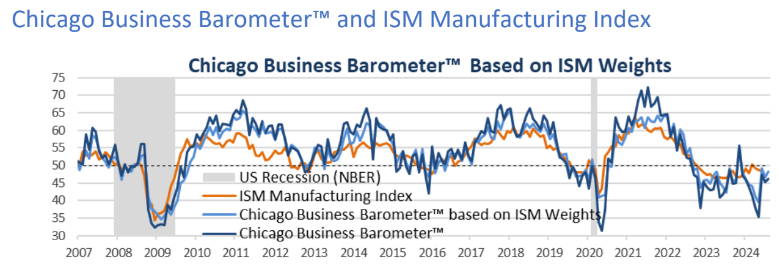

The Chicago Business Barometer moved up 0.8 points in August 2024 to 46.1. Any value below 50 shows contraction. The reason this minor indicator is important is that pundits believe it is indicative of the ISM manufacturing survey which will be released next week. The bottom line here is that manufacturing is not doing well.

Here is a summary of headlines we are reading today:

- EPA Extends Emergency Waiver for Midwest Gasoline Supply

- U.S. Oil, Gas Drilling Activity. Oil Production Slip

- Texas to Consider $5.4 Billion Loans for New Natural Gas Plants

- Libya Is Back on the Brink of Civil War

- Maduro Clings to Power in Venezuela

- Stocks close higher Friday, S&P 500 posts fourth straight winning month: Live updates

- The Fed’s favorite inflation indicator increased 0.2% in July, as expected

- FDA authorizes Novavax’s updated Covid vaccine, paving way for fall rollout

- Ether heads for over 20% loss in August, bitcoin faces fourth weekly loss in five: CNBC Crypto World

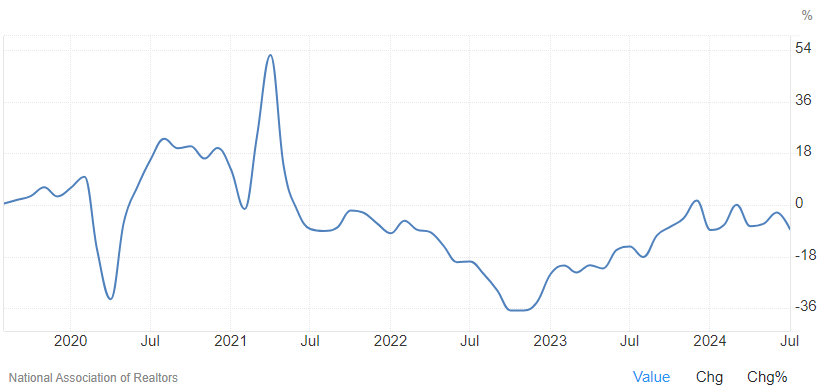

- Fewer people are purchasing homes, despite high demand—buyers are in ‘wait and see’ mode

- The Fed’s Fiat Money Is The Real Cause Of Price Inflation

- Extreme Gaslighting: Here Are 7 Signs That The Mainstream Media Is Flat Out Lying To Us About The Economy

- Social Security’s return on investment is a joke compared with state and local pension funds. Where is our money going?

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.