Summary Of the Markets Today:

- The Dow closed down 219 points or 0.54%,

- Nasdaq closed up 0.25%,

- S&P 500 closed down 0.30%,

- Gold $2,544 up $18.30,

- WTI crude oil settled at $69 down $0.04,

- 10-year U.S. Treasury 3.733 down 0.035 points,

- USD index $101.11 down $0.24,

- Bitcoin $56,071 down $1,914 or 3.30%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights

US stocks showed mixed performance on Thursday as investors processed weaker-than-expected labor market data ahead of Friday’s crucial jobs report. The market remains cautious as it awaits Friday’s August jobs report, which will be crucial for assessing the state of the economy and potential Fed actions.

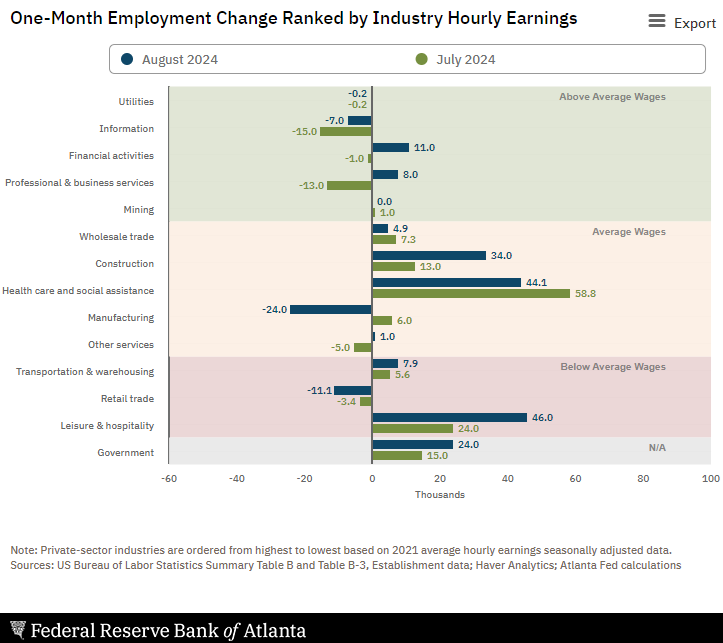

Labor market data: ADP reported private payrolls grew by only 99,000 in August, the smallest monthly increase since January 2021. Slightly fewer Americans filed new unemployment claims last week. Job openings declined according to Wednesday’s government data. The weak labor data could support the case for deeper interest rate cuts by the Federal Reserve. However, it may also signal a potential recession, challenging hopes for a “soft landing”.

Federal Reserve expectations: Traders see a nearly 50-50 chance of a 0.5% rate cut at the Fed’s September meeting.

Corporate news: C3.ai shares fell 8% after weak subscription revenue. HPE stock slipped on disappointing profitability. Tesla pared earlier gains but still rose nearly 5% on plans to launch Full Self-Driving software in China and Europe.

Sector performance: Information Technology has fallen nearly 4% over the past four days. Apple is down 3% and Nvidia down nearly 9% in the same period.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

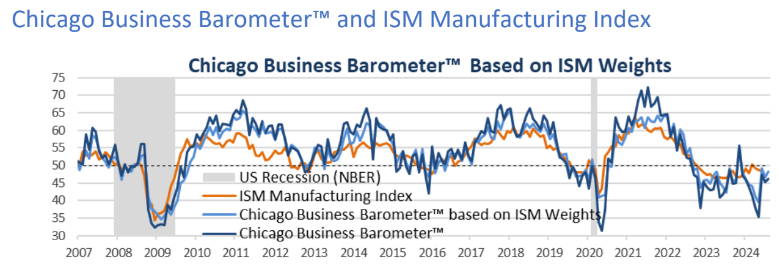

Private employers added 99,000 jobs in August 2024 according to ADP. Now, it seems, that the BLS employment numbers now resemble the numbers ADP was releasing for the past year (over this past month the BLS has significantly revised their numbers downward). On the following graph, the blue line is ADP whilst the red line is the BLS’ numbers. Likely the ADP management are giving each other high fives. 99,000 is not a great number but it is not recessionary either. An adequate monthly employment growth number would be at least 150,000 to account for population growth. Nela Richardson, Chief Economist, ADP added:

The job market’s downward drift brought us to slower-than-normal hiring after two years of outsized growth. The next indicator to watch is wage growth, which is stabilizing after a dramatic post-pandemic slowdown.

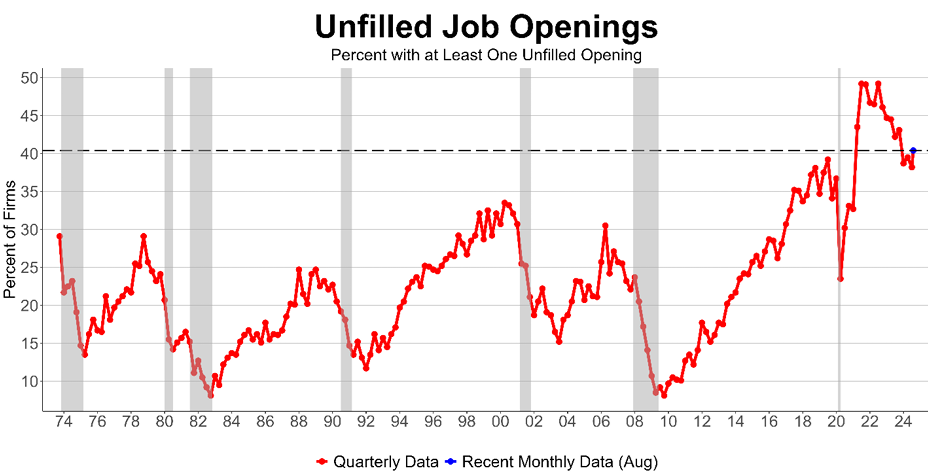

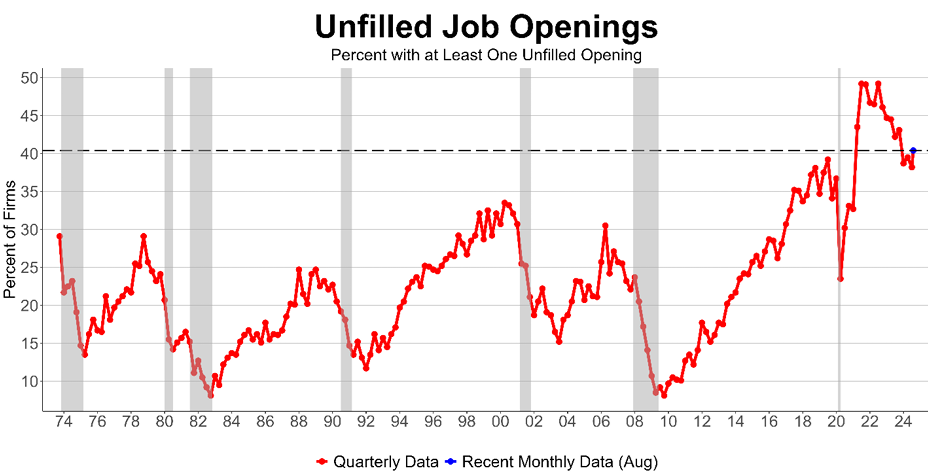

NFIB’s August 2024 jobs report found that 40% (seasonally adjusted) of small business owners reported job openings they could not fill in August, up two points from July. Labor quality as the top small business operating problem rose two points from July to 21%, the highest level reported since January of this year. NFIB Chief Economist Bill Dunkelberg stated:

Job openings on Main Street remain historically high as small business owners continue to lament the lack of qualified applicants for their open positions. Owners have grown understandably frustrated as attempts to fill their workforce repeatedly stall and cost pressures continue to rise.

U.S.-based employers announced 75,891 cuts in August 2024, a 193% increase from the 25,885 cuts announced one month prior. It is up 1% from the 75,151 cuts announced in the same month in 2023. For the year, companies have announced 536,421 job cuts, down 3.7% from 557,057 announced through August of last year. Excluding the 115,762 job cuts announced in August of 2020, last month was the highest August total since 2009, when 76,456 layoffs were recorded. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. added:

August’s surge in job cuts reflects growing economic uncertainty and shifting market dynamics. Companies are facing a variety of pressures, from rising operational costs to concerns about a potential economic slowdown, leading them to make tough decisions about workforce management. Cuts are following a very similar trend from last year as ongoing pressures have challenged labor decisions.

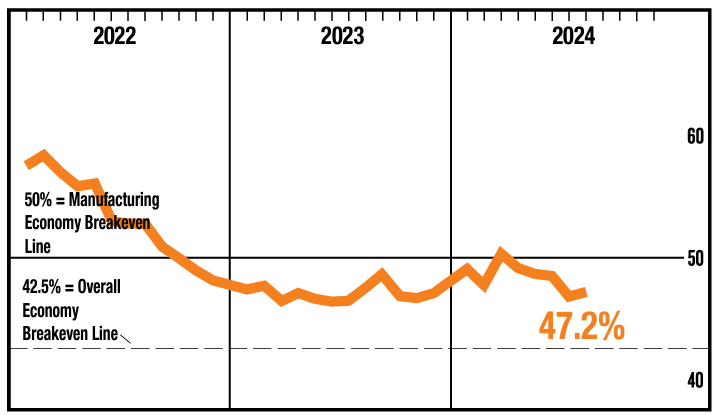

Nonfarm business sector labor productivity increased 2.7 percent year-over-year in the second quarter of 2024 with unit labor costs growing 0.3% year-over-year. Whenever productivity grows faster than labor costs – companies are becoming more competitive internationally. Unfortunately, the methodology used for determining productivity bears little resemblance to the methodology used by industrial engineers – and my best guess is productivity gains are a result of AI gains in the service industry or in the financial sector. According to this report, manufacturing labor productivity increased only 0.4% year-over-year while unit labor costs increased a massive 4.3% year-over-year.

In the week ending August 31, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 230,000, a decrease of 1,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 231,500 to 231,750. No sign of economic slowing in these unemployment numbers.

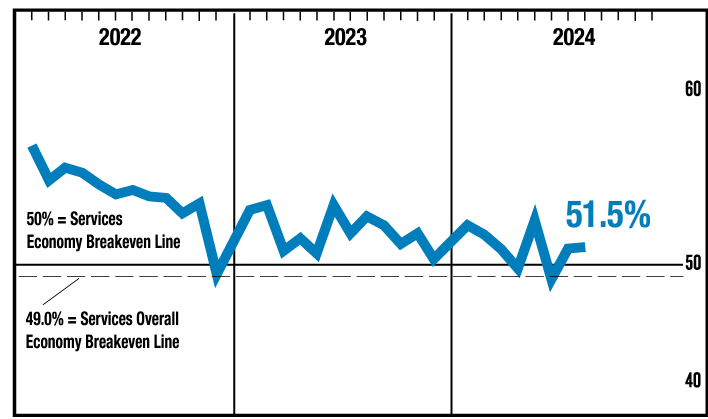

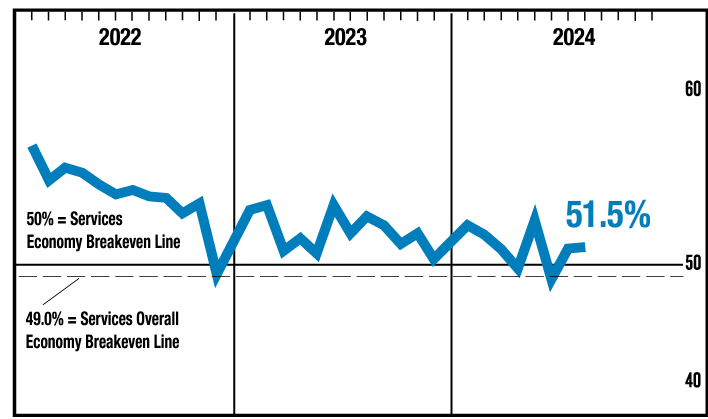

In August 2024, the Institute of Supply Management’s Services PMI® registered 51.5 percent, 0.1 percentage point higher than July’s figure of 51.4 percent. The reading in August marked the sixth time the composite index has been in expansion territory in 2024. The Business Activity Index registered 53.3 percent in August, which is 1.2 percentage points lower than the 54.5 percent recorded in July and indicated continuing expansion after one month of contraction in June. As the US is a service based economy, a reading so close to 50 (the line between expansion and contraction) means real economic growth is marginal.

Here is a summary of headlines we are reading today:

- Billions Being Pumped Into Unproven “Climate Solutions”

- U.S. Cracks Down on Russian Disinformation Campaign

- The World’s 10 Most Expensive Megaprojects

- Africa’s Largest Refinery Could Soon Be Allowed to Set Its Own Gasoline Prices

- Singapore Raises Its Clean Power Import Target as Demand Soars

- Russia Ships LNG Straight to Storage as Sanctions Bite

- Dow falls 200 points, S&P 500 posts third straight loss as growth fears plague investors: Live updates

- Friday’s jobs report for August is going to be huge. Here’s what to expect

- The Fed won’t save stocks, sell the first rate cut, says Stifel

- Family offices are about to surpass hedge funds, with $5.4 trillion in assets by 2030

- Rising NFL valuations mean massive returns for owners. Here’s how good the investment is

- After its August selloff, the U.S. dollar may face more downside risk ahead

- 2-, 10-year Treasury yields finish at lowest levels in more than a year again after ADP payrolls report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.