27 SEPT 2024 Market Close & Major Financial Headlines: The Three Major Indexes Opened Sharply Higher With The Dow Recording A New Historic High, Closing In The Green While The Small Caps Closed Moderately Below The Unchanged Line

Summary Of the Markets Today:

- The Dow closed up 138 points or 0.33%, (Closed at 42,313, New Historic high 42,628)

- Nasdaq closed down 0.39%,

- S&P 500 closed down 0.13%,

- Gold $2,674 down $20.70,

- WTI crude oil settled at $69 up $0.92,

- 10-year U.S. Treasury 3.754 down 0.035 points,

- USD index $100.42 down $0.10,

- Bitcoin $65,672 up $581 or 0.89%,

- Baker Hughes Rig Count: U.S. -1 to 587 Canada +7 to 218

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The major stock indexes traded mixed on Friday but closed the week on a positive note. The mixed performance on Friday came as investors reacted to the latest Personal Consumption Expenditures (PCE) inflation report, which is closely watched by the Federal Reserve. This inflation data boosted expectations for potential interest rate cuts by the Fed, with over 50% of traders now anticipating a 50 basis point cut at the next meeting. Despite Friday’s mixed trading, all three major indexes recorded gains for the week, buoyed by renewed economic confidence. A strong GDP report and moderating inflation have increased belief that the Fed can achieve a “soft landing” while beginning to cut interest rates. The PCE report showed continued easing of price pressures, supporting expectations for Fed rate cuts. Additional stimulus measures from China provided further support to markets. Chip stocks closed lower on Friday, with the PHLX Semiconductor Index dropping 1.8%, though it remained up 4.3% for the week.

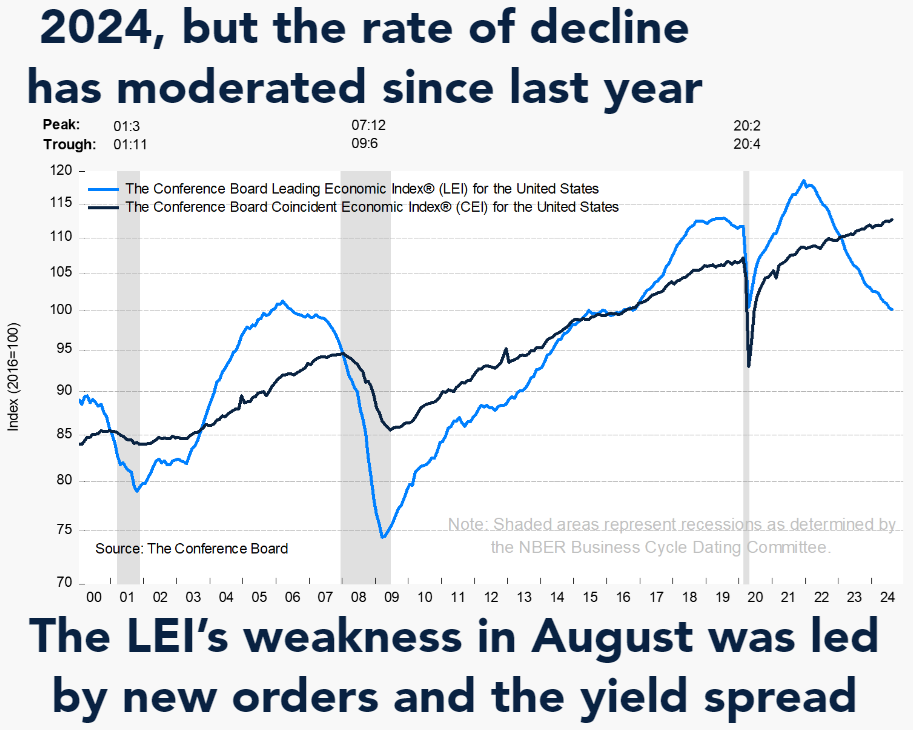

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In August 2024, Real (inflation-adjusted) Personal Consumption Expenditures (PCE) increased from 2.8% to 2.9%. Real Disposable Personal Income decreased from 3.2% to 3.1%. From the same month one year ago, the PCE price index for August 2024 increased 2.2% – down from 2.5% the previous month. Prices for goods decreased 0.9 percent and prices for services increased 3.7 percent. Food prices increased 1.1 percent and energy prices decreased 5.0 percent. Excluding food and energy, the PCE price index increased 2.7 percent from one year ago – up from 2.6% the previous month. The bottom line is that in reality there was no change in income or expenditures – so the projection of no change going forward suggests no change in economic growth in the months ahead. And if one only looks at the PCE price index for inflation one would think we are making progress. But the reality is that the Federal Reserve looks at PCE less food and energy – and that actually increased.

Here is a summary of headlines we are reading today:

- U.S. Oil Drilling Sags: Baker Hughes

- Oil Jumps as Middle East Tensions Ignite Supply Fears

- WTI Houston Crude Prices Gain Prominence as U.S. Oil Exports Jump

- India Says It Won’t Buy LNG From Russia’s Sanctioned Arctic Project

- Dow jumps 100 points to close at a record, major averages extend rally to third week: Live updates

- Wall Street braces for a turbulent October with jobs report on deck next week

- Stocks making the biggest moves midday: Wynn Resorts, Rocket Lab USA, Cassava Sciences and more

- Mystery Of Upward GDP Revision Solved: You Are All $500 Billion Richer Now According To A Revised Biden Admin Spreadsheet

- Former ‘Apprentice’ contestant reduces their stake in Trump Media & Technology

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.