26Apr2022 Market Close & Major Financial Headlines: Nasdaq Retreats to New 2022 Low

Quick View of the markets today:

- The Dow declined 2.4%,

- Nasdaq declined 4.0%,

- S&P 500 declined 2.8%,

- WTI crude oil modestly increased $3.50 to $102.07,

- gold up $6 to $1,902,

- Bitcoin down 5.4% to $38,055,

- 10-year U.S. Treasury declined 8 basis point to 2.74%

CoreLogic Deputy Chief Economist Selma Hepp commented on the S&P CoreLogic Case-Shiller National Home Price Index for February released this morning:

The S&P CoreLogic Case-Shiller Index pushed up to a 19.8% increase in February, the second consecutive month of accelerated growth after a winter lull, and another month of the strongest annual increase since the beginning of the data series. Price growth was robust across the country with all 20 metro areas experiencing stronger annual gains than in January. The largest increases in annual gains were in the West Coast markets: Los Angeles, Seattle, San Diego and San Francisco, and also in high tier price segments. While anticipation of mortgage rate increases pulled many buyers in ahead of the spring home buying season, strength in the higher priced segments of the market also suggests that buyers are seeing additional value in homes as a hedge against inflation.

Durable goods year-over-year growth remained fairly stable for March 2022.

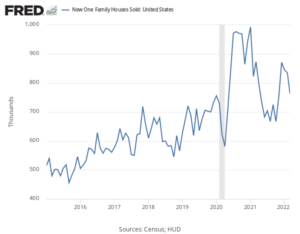

New home sales declined this month – no surprise because of rising interest rates and higher prices.

As usual, we have included below the headlines and news summaries moving the markets today including:

- Germany Could Ban Russian Oil In Days

- Steel Demand Is Dwindling As China Grapples With New Lockdowns

- At least 58% of U.S. population has natural antibodies from previous Covid infection, CDC says

- Poland Confirms Russia To Halt All Gas Delivery Wednesday If Payment Not Settled In Rubles

- Europe Buys Abu Dhabi Crude To Replace Russian Barrels