24May2022 Market Close & Major Financial Headlines: Wall Street Trades In The Red From The Opening Bell, Snap Warning Drags Equities Into The Red, Stocks Will Sink Further, Economist Rosenberg Says

Summary Of the Markets Today:

- The Dow closed up +0.15% +48 points,

- Nasdaq closed down -2.35%,

- S&P 500 closed down -0.81%,

- WTI crude oil settled at 110, down 0.72%,

- USD $101.75 down 0.34%,

- Gold 1866 up 0.02%,

- Bitcoin up 0.27% to $29331,

- 10-year U.S. Treasury down 0.098% / 2.761%

Today’s Economic Releases:

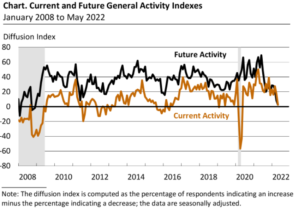

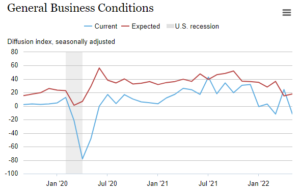

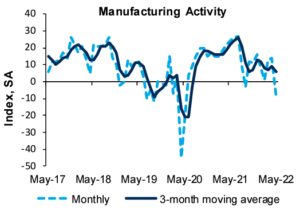

The Richmond Fed reported that their 5th district manufacturing index declined – and fell into recession territory going from an index value of 14 in April to -9 in May 2022.

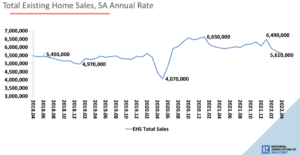

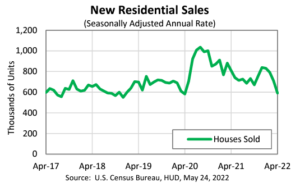

New Home Residential Sales significantly declined in April 2022 to the lowest level since the COVID lockdown / recession. This should be considered a potential recessionary marker.

A summary of headlines we are reading today:

- Stocks Will Sink Further, Economist Rosenberg Says

- Gasoline Prices Are Set To Spike This Week

- Best Buy says softer demand is sticking around, but the company isn’t planning for a recession

- Big-Tech & Bond Yields Plunge As US Macro ‘Snaps’, Gold Gains

- Dalio: “Cash Is Still Trash… But Equities Are Trashier”, Prefers Gold & Bitcoin

These and other headlines and news summaries moving the markets today are included below.