08June2022 Market Close & Major Financial Headlines: Wall Street Has Trading Sideways For The last Seven Sessions And Is Range-Bound, Trading Volume Tapering Off As Investors Mull Thoughts Of An Economic Slowdown And Rising Inflation: Stagflation

Summary Of the Markets Today:

- The Dow closed down 269 points or 0.73%,

- Nasdaq closed down 0.73%,

- S&P 500 closed down 1.08%,

- WTI crude oil settled at 122, up 2.690%,

- USD $102.33 flat 0.00%,

- Gold 1853 up 0.17%,

- Bitcoin $30205 down 1.05%,

- 10-year U.S. Treasury up 0.59% / 3.029%

Today’s Economic Releases:

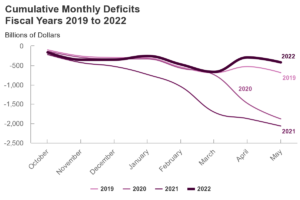

The federal budget deficit was $423 billion in the first eight months of fiscal year 2022, CBO estimates. That amount is about one-fifth of the $2.1 trillion shortfall recorded during the same period in 2021.

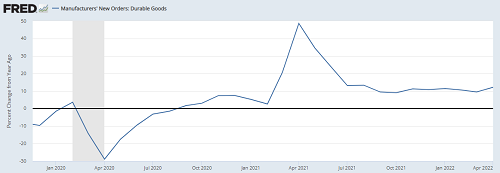

Inventories for wholesalers were up 24% year-over-year from April 2021. However, when one looks at inventories-to-sales ratios – this sector looks healthy.

A summary of headlines we are reading today:

- What Is Fueling The Surge In Gasoline Prices?

- U.S. Natural Gas Prices Drop After Explosion At Freeport [Tx] LNG Terminal

- Spirit Airlines postpones shareholder vote on Frontier deal days after JetBlue sweetens competing offer

- “The Summer Of Starvation”: Soaring Fertilizer Prices Unleash Chaos, Hunger Worldwide

- Market Extra: This hedge fund manager called inflation early. He now says consumer prices will finish 2022 at a level that `screams failure by the Fed’

These and other headlines and news summaries moving the markets today are included below.