05August2022 Market Close & Major Financial Headlines: The Dow Opened Down 315 points, Recovering To Close UP At 77 Points After Blowout Jobs Report, A Red-Hot July Jobs Number Has Traders Penciling In Another Jumbo Fed Rate Hike

Summary Of the Markets Today:

- The Dow closed up 77 points or 0.23%,

- Nasdaq closed down 0.50%,

- S&P 500 down 0.16%,

- WTI crude oil settled at $88 dup 0.65%,

- USD $106.55 up 0.75%,

- Gold $1774 down 0.87%,

- Bitcoin $22,961 up 1.96% – Session Low 22,485,

- 10-year U.S. Treasury 2.827% up 0.151%

- Baker Hughes Rig Count: U.S. -3 to 764 Canada -1 to 203

Today’s Economic Releases:

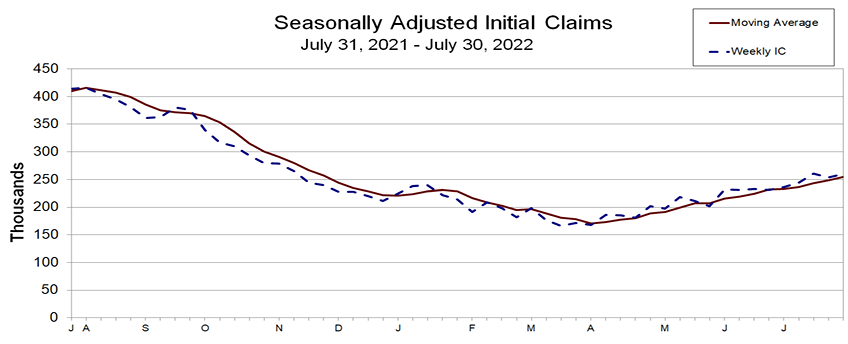

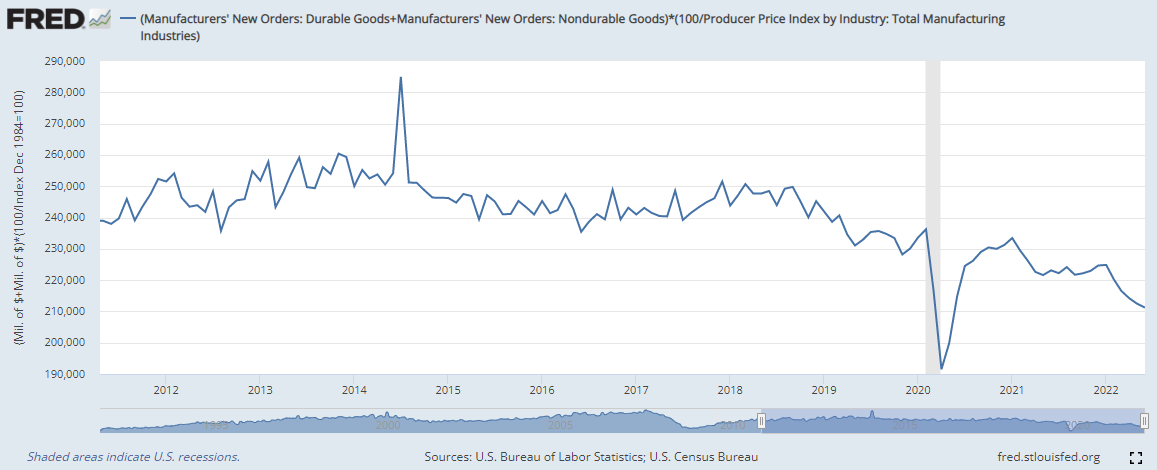

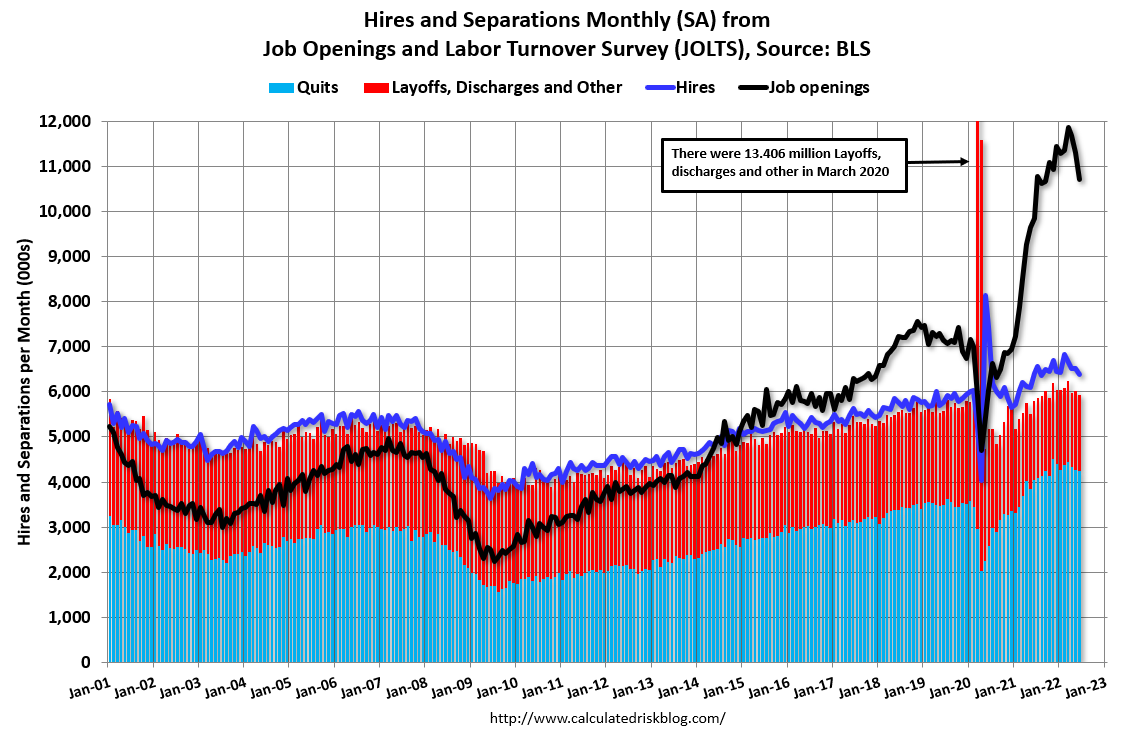

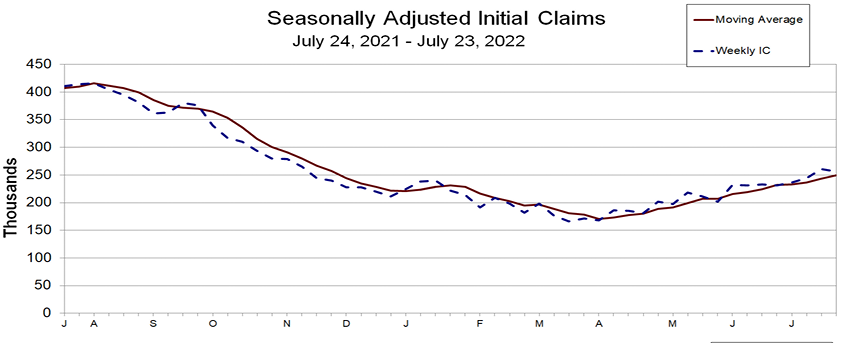

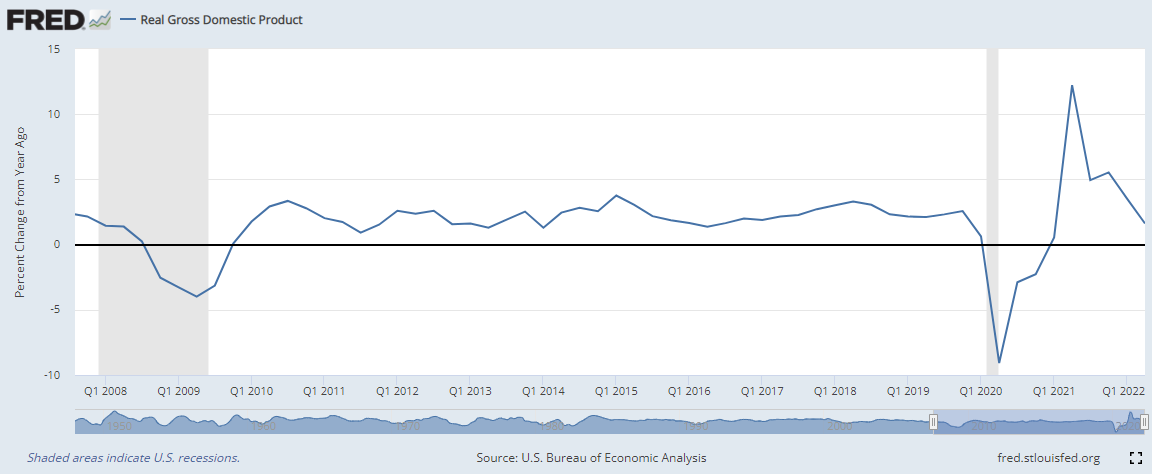

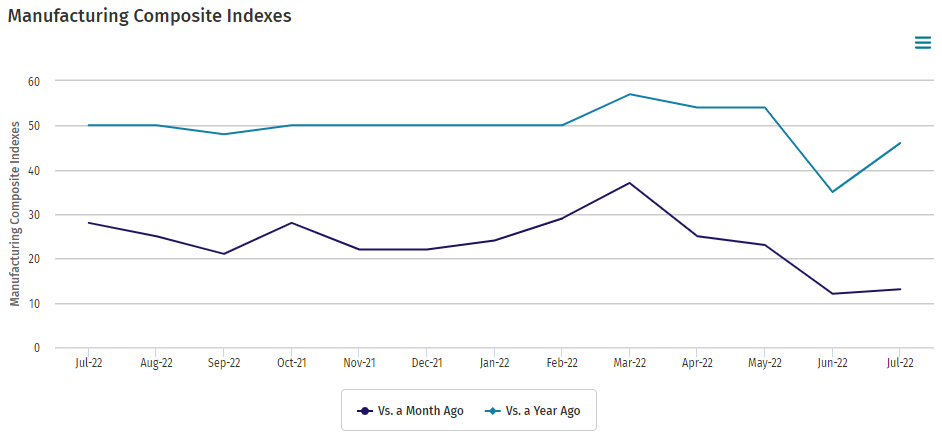

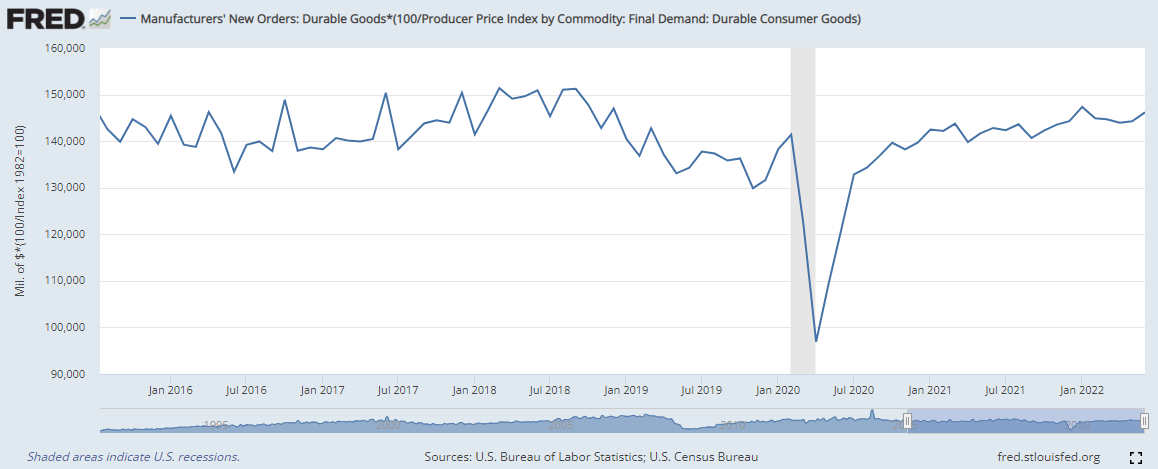

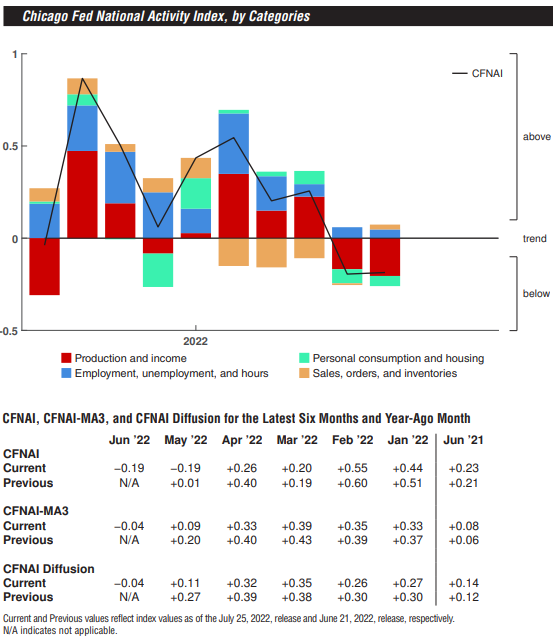

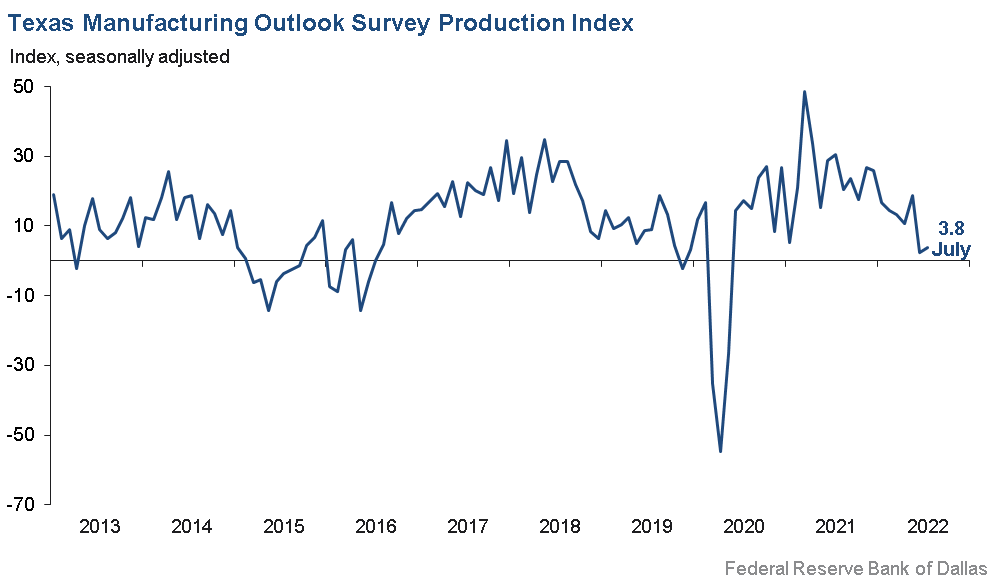

The NBER considers indicators including nonfarm payrolls, industrial production, and retail sales, among others, in designating the start and end of U.S. recessions. Today’s July 2022 BLS employment report is showing nonfarm payrolls are far from recession territory with a significant gain in employment.

- The household survey showed an increase of 179,000 whilst the establishment survey says 528,000.

- The employment/population ratio remains on an improvement trend.

- The unemployment rate modestly reduced to 3.5% – but the larger reason for this slight reduction is that the civilian labor force was reduced by 63,000. In all cases, the establishment survey is volatile – and there can be significant changes month-over-month.

- A strong jobs report will allow the Fed to raise the federal funds rate another 75 basis points.

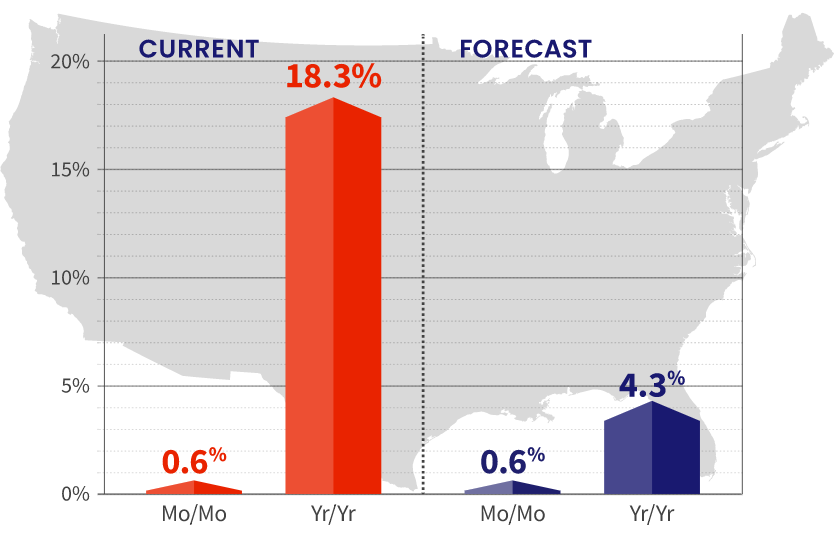

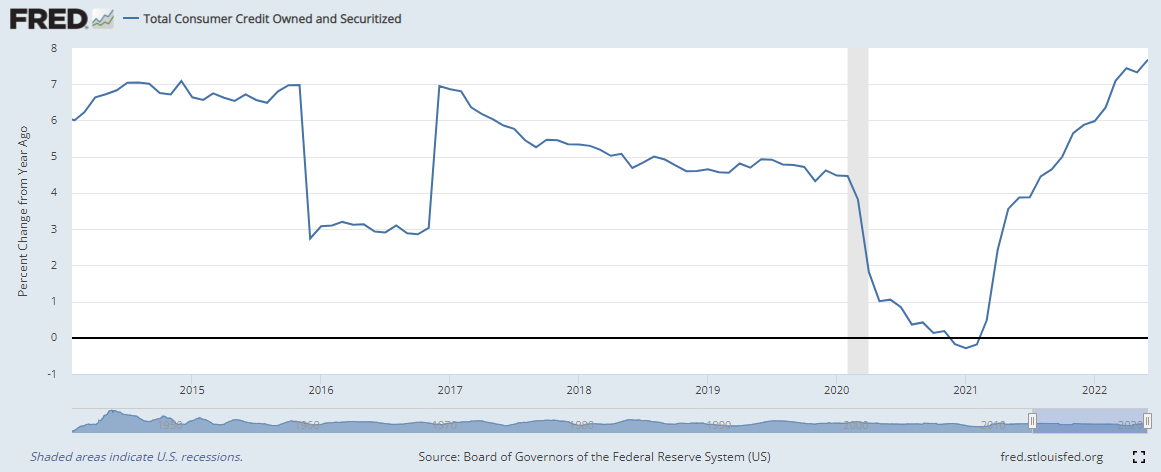

According to the Federal Reserve: “Consumer credit [in June 2022] increased at a seasonally adjusted annual rate of 8.7 percent during the second quarter. Revolving credit increased at an annual rate of 14.6 percent, while nonrevolving credit increased at an annual rate of 6.9 percent. In June, consumer credit increased at an annual rate of 10.5 percent.” Looking at year-over-year growth, credit was up 7.7%.

A summary of headlines we are reading today:

- Russian Refinery Returns To Operations After Drone Strike

- U.S. Drilling Activity Slows As Prices Ease

- AMC plans to issue 517 million shares of preferred stock, under the ticker symbol ‘APE’

- Job Gains & Powell’s Pains Demolish Dovish-Dreams, Spark Market Turmoil This Week

- Firearm Companies Say Packages Shipped With UPS Being Damaged, Disappearing: Reports

- Consumer Credit Surged In June, 2nd Largest Monthly Increase Ever

- Bond Report: Treasury yields surge after blockbuster U.S. July jobs data

- Market Extra: A red-hot July jobs number has traders penciling in another jumbo Fed rate hike

These and other headlines and news summaries moving the markets today are included below.