18 August 2022 Market Close & Major Financial Headlines: Wall Street Opened Mixed And Slowly See-Sawed Moderately Into The Green

Summary Of the Markets Today:

- The Dow closed up 19 points or 0.06%,

- Nasdaq closed up 0.21%,

- S&P 500 up 0.23%,

- WTI crude oil settled at $91 up 2.85%,

- USD index $107.47 up 0.84%,

- Gold $1773 down 0.02%,

- Bitcoin $23,371 up 0.13%,

- 10-year U.S. Treasury 2.875% little changed

Today’s Economic Releases:

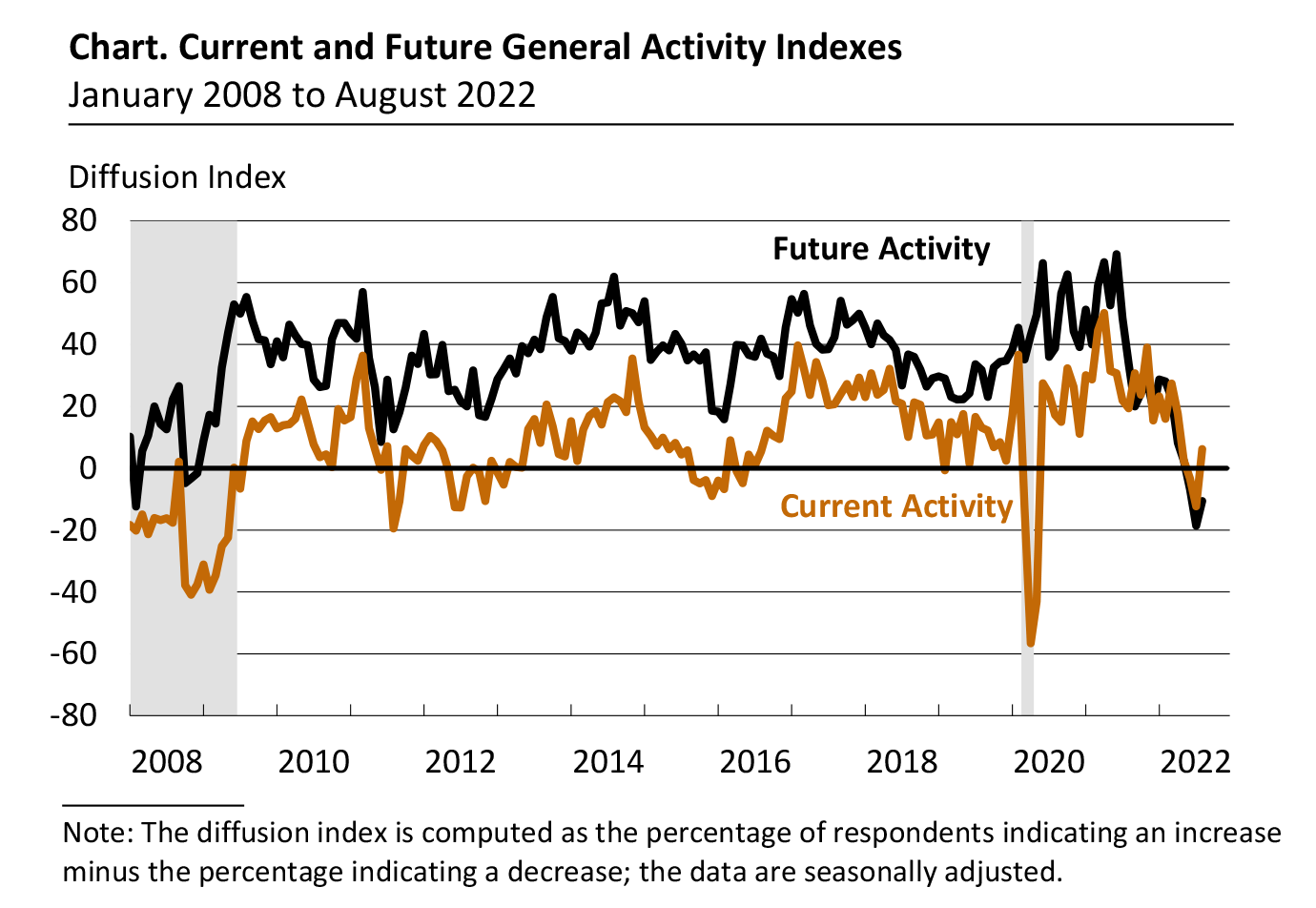

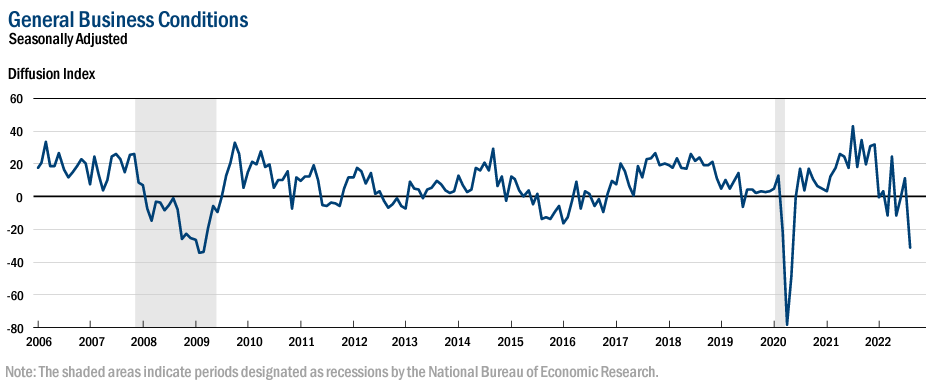

The Philadelphia Fed Manufacturing Index returned to positive territory in August 2022 after two consecutive negative readings, rising 19 points to 6.2 (see Chart below). Most firms (47 percent) reported no change in current activity this month, while the share of firms reporting increases (26 percent) exceeded the share reporting decreases (20 percent). As this is a survey, one would need months of data to begin to believe the economy is improving.

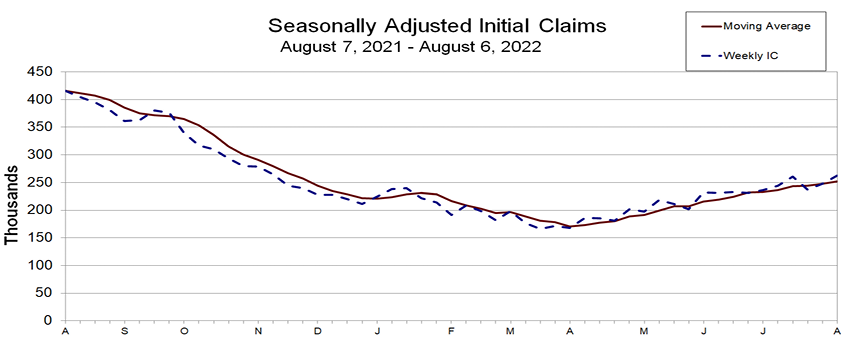

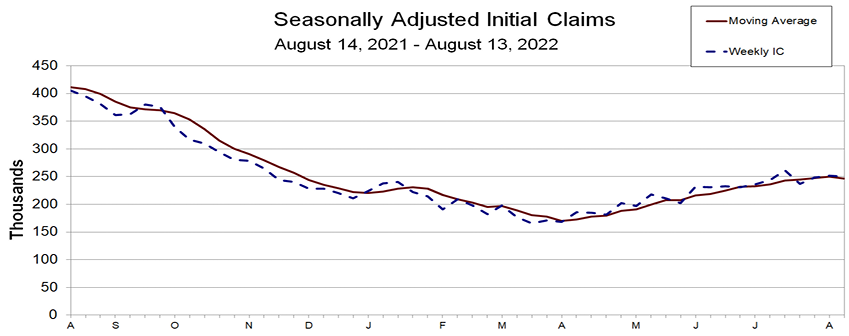

In the week ending August 13, 2022, the seasonally adjusted initial claims 4 week moving average was 246,750, a decrease of 2,750 from the previous week’s revised average. This was the first time in 4 months that the moving average declined,

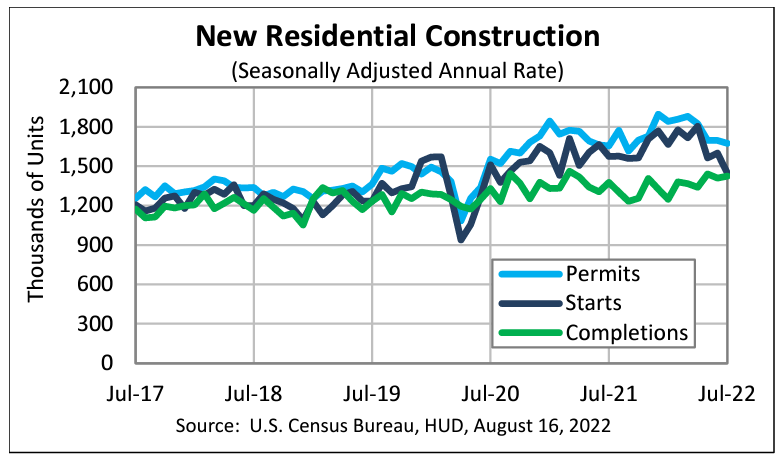

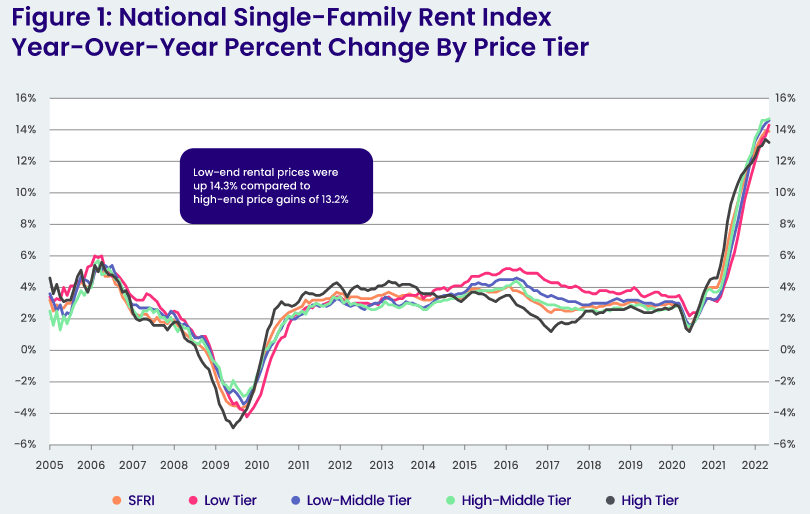

Existing-home sales fell for the sixth consecutive month and were down 5.9% from June and 20.2% year-over-year. The median existing-home sales price climbed 10.8% from one year ago to $403,800. That’s down $10,000 from last month’s record high of $413,800.

A summary of headlines we are reading today:

- China’s Power Crisis Could Spark A Spike In Coal Consumption

- Oil Prices Rally As Traders Focus On Tight Supply Outlook

- Kohl’s cuts guidance, blaming inflation for softer sales from middle-income shoppers

- Home Depot and Lowe’s cite strong demand in earnings reports, but softening could be ahead

- Stocks making the biggest moves midday: Cisco, BJ’s Wholesale, Bed Bath & Beyond, Kohl’s and more

- Home sales fell nearly 6% in July as the housing market slides into a recession

- Beginners guide to financial freedom: 4 steps to starting your investment journey

- Rex Nutting: The Fed is not getting cold feet about wrestling inflation to the ground, so stop misreading its minutes

- Bond Report: 2-year Treasury leads decline in U.S. yields on the dearth of market-moving economic news

These and other headlines and news summaries moving the markets today are included below.