16 September 2022 Market Close & Major Financial Headlines: Wall Street Closed Lower Today After FedEx Earnings Warning Of Weakening Global Demand

Summary Of the Markets Today:

- The Dow closed down 139 points or 0.45%,

- Nasdaq closed down 0.90%,

- S&P 500 down 0.72%,

- WTI crude oil settled at $85 up 0.27%,

- USD $109.74 little changed,

- Gold $1683 up 0.38%,

- Bitcoin $19.649 down 0.18% – Session Low 19,370,

- 10-year U.S. Treasury 3.453% Unchanged,

- Baker Hughes Rig Count: U.S. +4 to 763 Canada +6 to 211

Today’s Economic Releases:

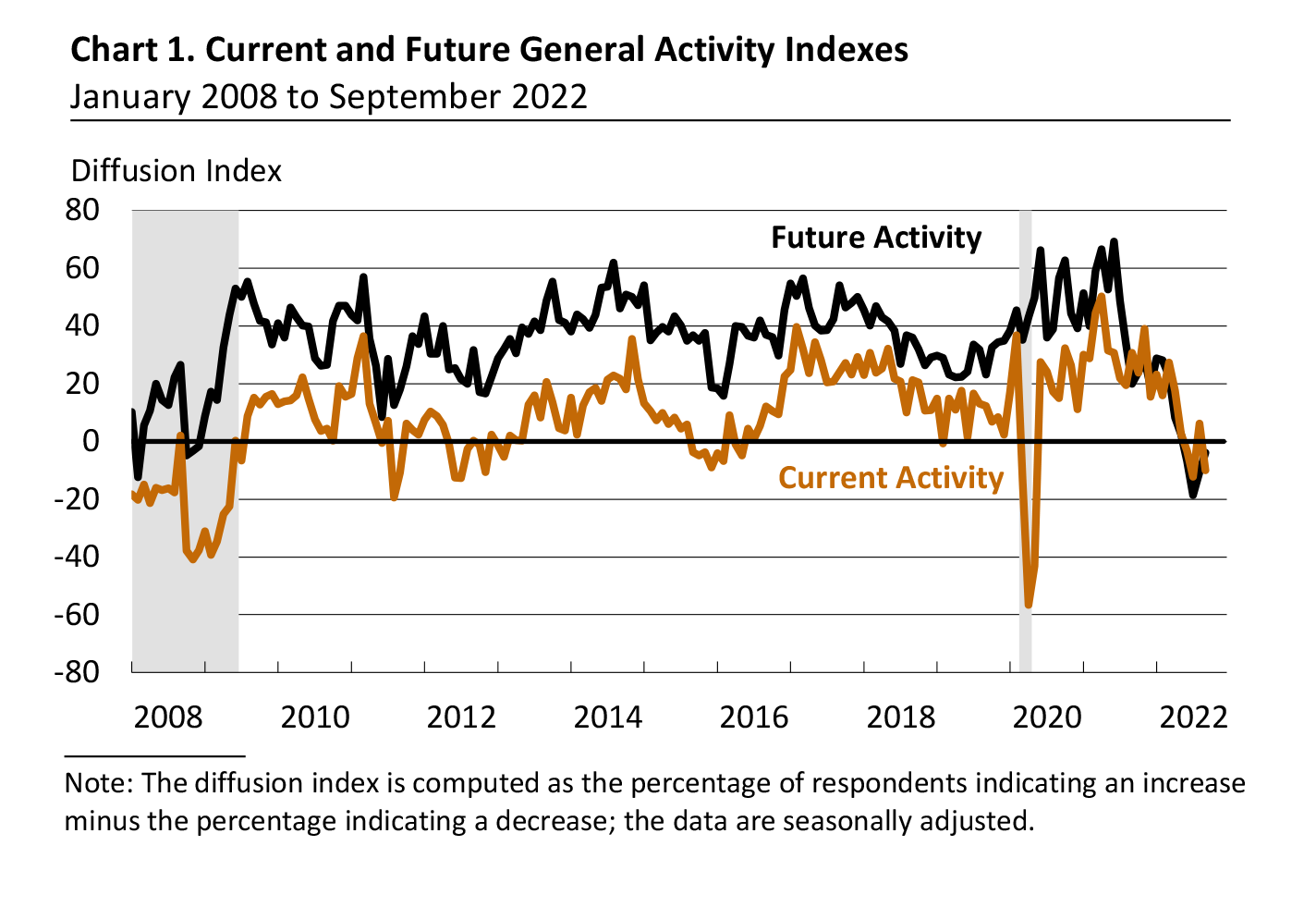

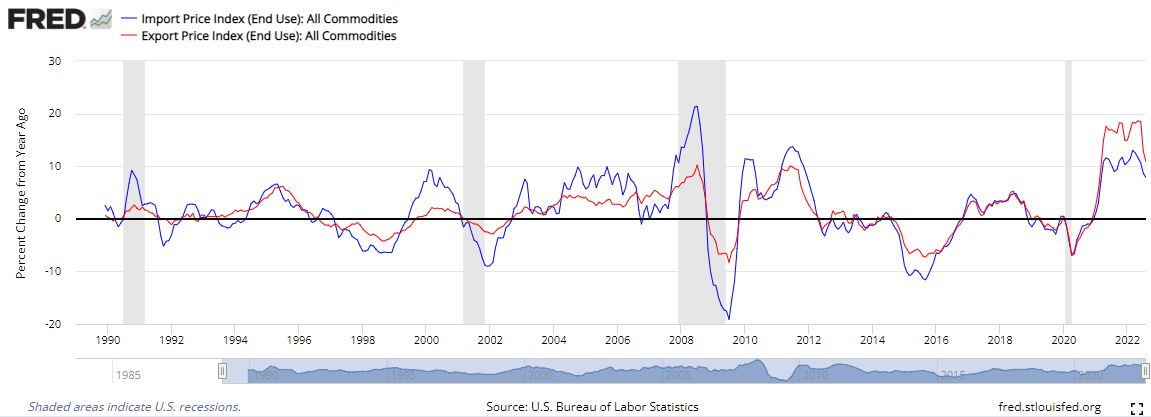

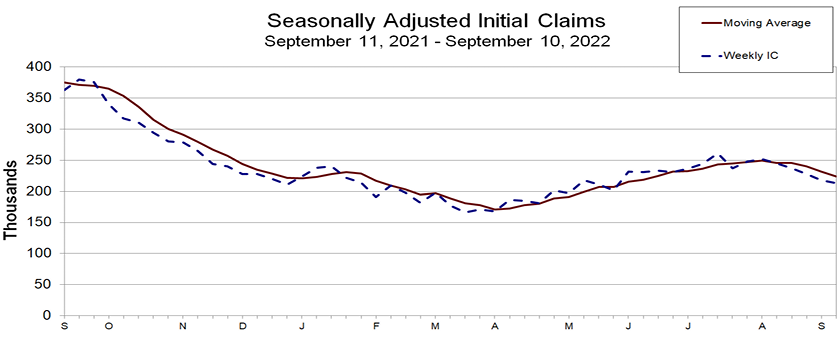

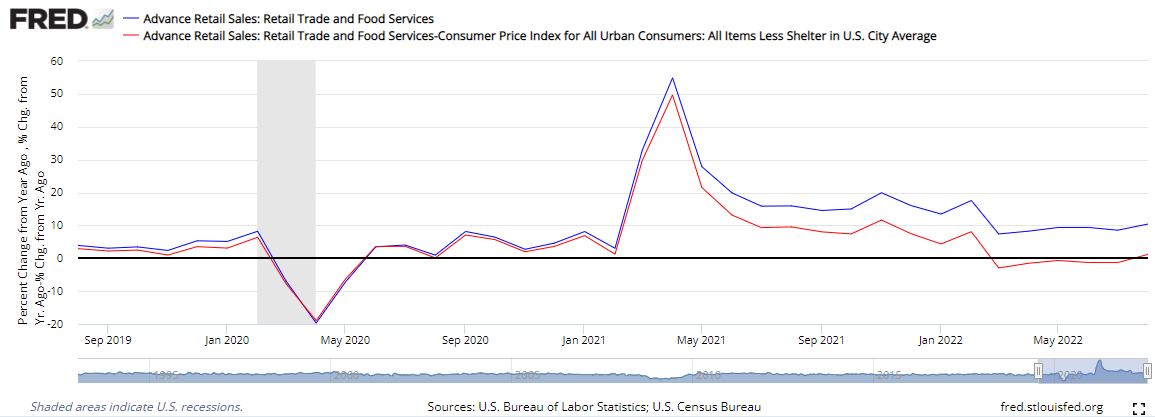

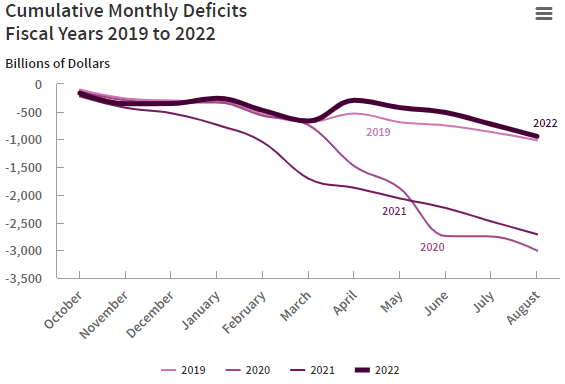

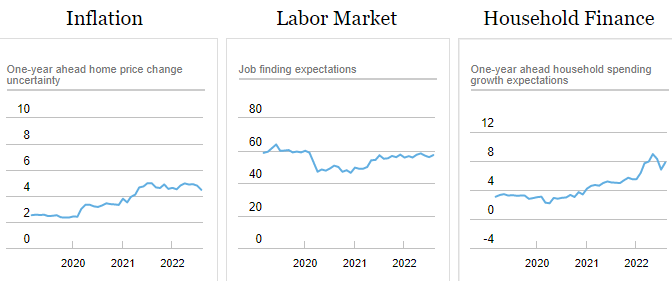

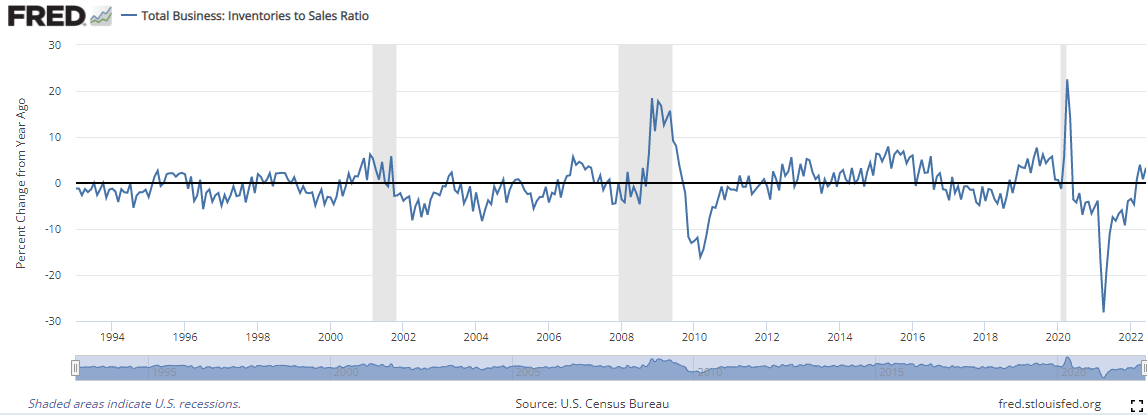

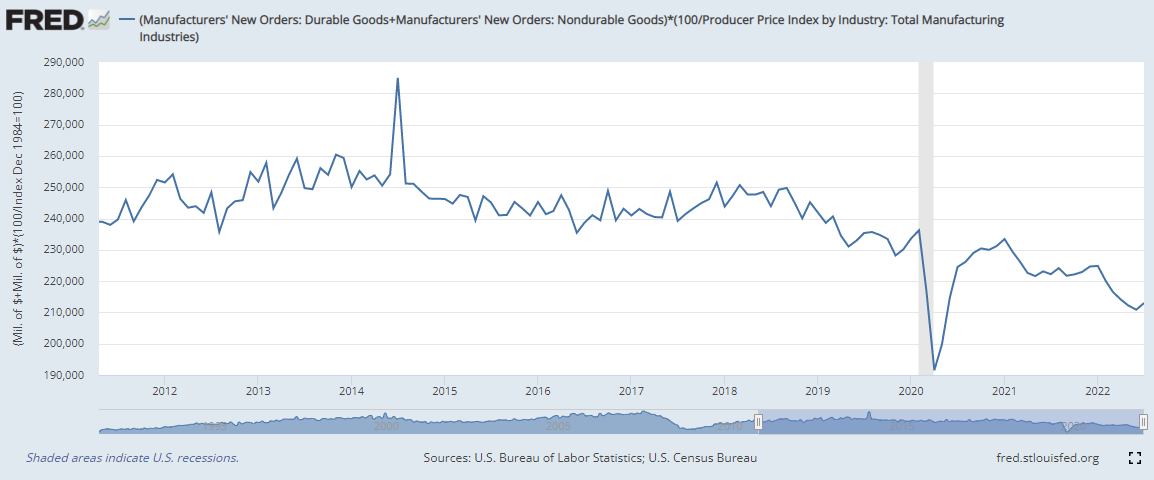

The Atlanta Fed’s GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 0.5% on September 15, down from 1.3% on September 9. After this week’s releases from the US Department of the Treasury’s Bureau of the Fiscal Service, the US Bureau of Labor Statistics, the US Census Bureau, and the Federal Reserve Board of Governors, decreases in the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth from 1.7% and -6.1%, respectively, to 0.4% and -6.4%, respectively, was slightly offset by an increase in the nowcast of third-quarter real government spending growth from 1.3% to 2.0%. What this decline in GDPNow says that the economy was only modestly (and not significantly) improving in 3Q2022 as the previous two quarters in 2022 were in contraction – but it is noteworthy that the data coming at the end of 3Q2022 is weak and may be signaling another contraction in 4Q2022.

- U.S. And EU Nickel Imports From Russia Surge

- Michael Jordan’s ‘Last Dance’ jersey sells for a record-breaking $10.1 million

- London’s Heathrow alters 15% of Monday flights for Queen Elizabeth II’s funeral

- FedEx shares sink after company cites weakening global demand

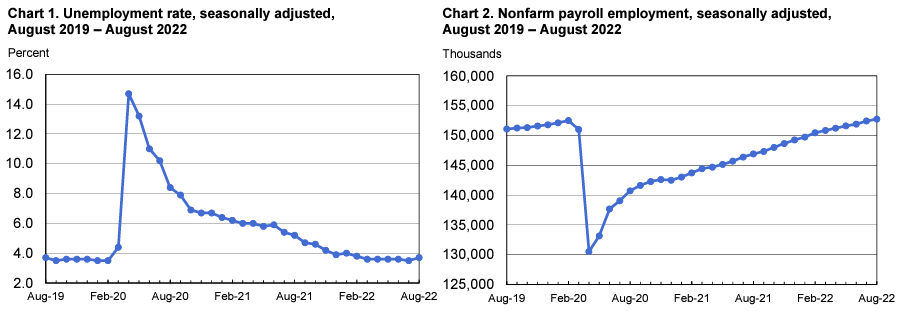

- 1.3 Million Jobs Were Result Of Double-Counting This Year, Heritage Economist Says

- New York City ‘Nearing Its Breaking Point’ With Influx Of Illegal Immigrants From Texas: Mayor

These and other headlines and news summaries moving the markets today are included below.