25 OCT 2024 Market Close & Major Financial Headlines: The Dow Records Its Fifth Session Decline While The S&P 500 And Bitcoin Join In Today’s Session Losses After Nasdaq Records A New Historic High

Summary Of the Markets Today:

- The Dow closed down 260 points or 0.61%,

- Nasdaq closed up 103 points or 0.56%, (Closed at 18,519, New Historic high 18,690

- S&P 500 closed down 2 points or 0.03%,

- Gold $2,755 up $5.90 or 0.22%,

- WTI crude oil settled at $72 up $1.48 or 2.08%,

- 10-year U.S. Treasury 4.236 down 0.034 points or 0.273%,

- USD index $104.31 up $0.25 or 0.24%,

- Bitcoin $66,703 down $1,601 or 2.11%, (24 Hours)

- Baker Hughes Rig Count: U.S. unchanged at 585 Canada -1 to 216

U.S. Rig Count is unchanged from last week at 585 with oil rigs down 2 to 480, gas rigs up 2 to 101 and miscellaneous rigs unchanged at 4.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

S&P 500 closed up slightly, ending a three-day losing streak. Major indexes logged weekly losses overall. Treasury yields rose. Uncertainty remains over the Federal Reserve’s next move on interest rates. November US jobs report due next Friday. Tight presidential election a week later. Earnings reports from “Magnificent Seven” tech companies next week from Alphabet, Meta, Microsoft, Apple, and Amazon. Capital One and Discover merger is expected to be completed in early 2025, subject to approvals.. Apple was downgraded by KeyBanc from Sector Weight to Underweight, citing concerns over iPhone sales and upgrades.

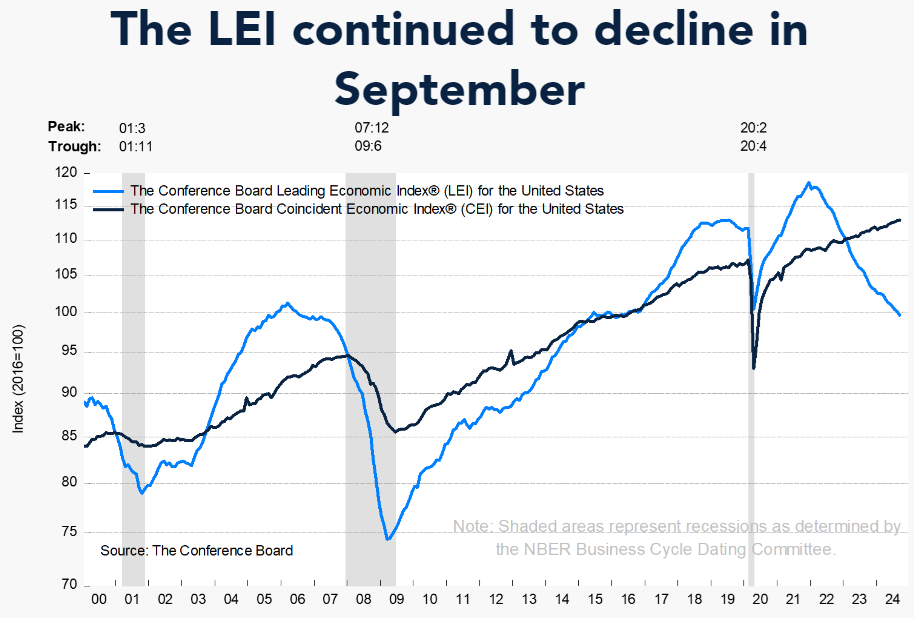

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

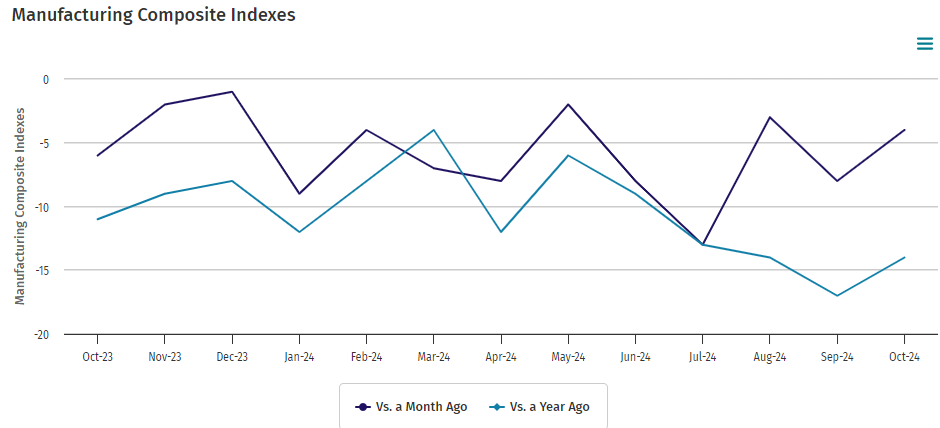

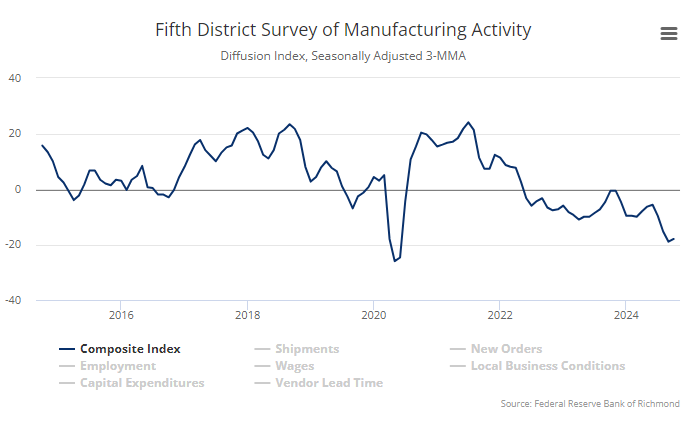

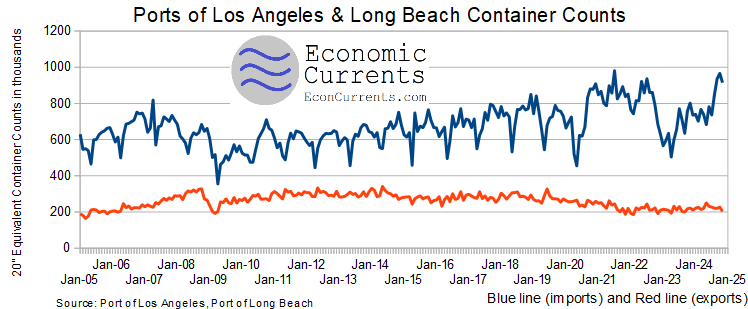

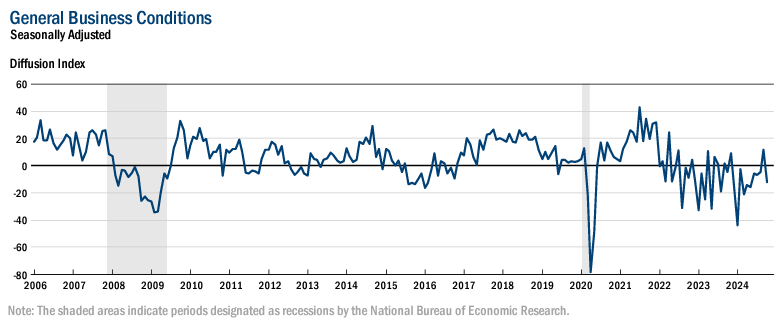

New orders for manufactured durable goods in September 2024 was down 2.1% year-over-year. Manufacturing remains in a recession in the US. Although durable goods import data is not available for September, durable goods imports has averaged growth of $25 billion per month in 2024 – while domestic produced durable goods have been declining at the rate of $5 billion per month in 2024. So the bottom line is that Americans are buying durable goods – just not from US manufacturers. Having said that, the number one exporter in the US is Boeing who is having issues with quality as well as a strike.

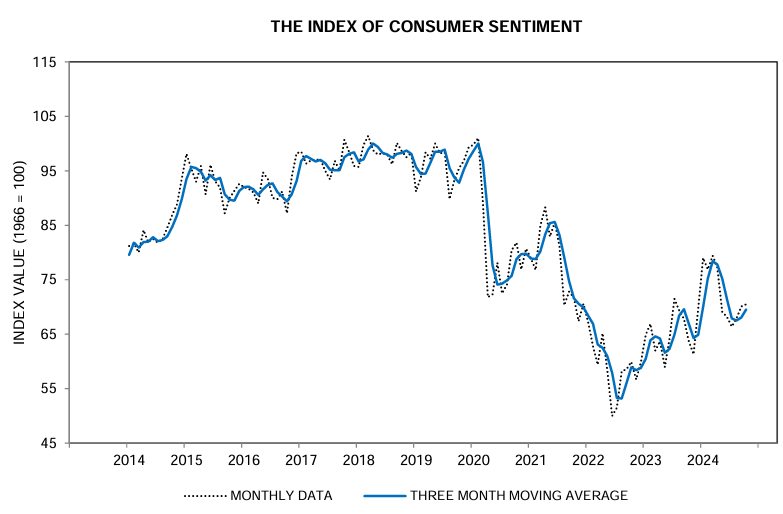

University of Michigan Consumer Sentiment lifted for the third consecutive month, inching up to its highest reading since April 2024. Surveys of Consumers Director Joanne Hsu opinion:

Sentiment is now more than 40% above the June 2022 trough. This month’s increase was primarily due to modest improvements in buying conditions for durables, in part due to easing interest rates. The upcoming election looms large over consumer expectations. Overall, the share of consumers expecting a Harris presidency fell from 63% last month to 57% in October. Sentiment of Republicans, who believe that a Trump presidency would be better for the economy, rose 8% on growing confidence that their preferred candidate would be the next president. In contrast, sentiment declined 1% for Democrats. As usual, Independents remain in between, with a 4% gain in sentiment this month. Regardless of the eventual winner, a sizable share of consumers will likely update their economic expectations based on the results of the election.

Here is a summary of headlines we are reading today:

- TSMC’s Chip Plant In Arizona Achieves Higher Yields Than Taiwan

- Oil Rig Count Dips as WTI Gains 2%

- Israel Targets Hezbollah’s Military, Political, and Economic Power in Lebanon

- Bearish Factors Build in Oil Markets Despite Middle East Tensions

- Nasdaq rises to hit new all-time high Friday as rest of market languishes: Live updates

- Alphabet’s self-driving unit Waymo closes $5.6 billion funding round as robotaxi race heats up in the U.S.

- Tesla shares close at highest in 13 months as post-earnings rally continues

- Microsoft boss gets 63% pay rise despite asking for reduction

- 10-year Treasury yield ends with biggest six-week climb in a year as consumer sentiment rises

- Here’s when Adam Silver thought Warner Bros. Discovery might lose its NBA broadcast deal

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.