30Sep2022 Market Close & Major Financial Headlines: The Down End To A Bad Week As Stocks Take A Beating

Summary Of the Markets Today:

- The Dow closed down 495 points or 1.70%,

- Nasdaq closed down 1.51%,

- S&P 500 down 1.45%,

- Gold $1669 up $0.50,

- WTI crude oil settled at $80 down $1.56,

- 10-year U.S. Treasury 3.821% up 0.072%,

- USD index $112.15 weakening 0.1%,

- Bitcoin $19,439 down $154,

- Baker Hughes Rig Count: U.S. +1 to 765 rigs

Today’s Economic Releases:

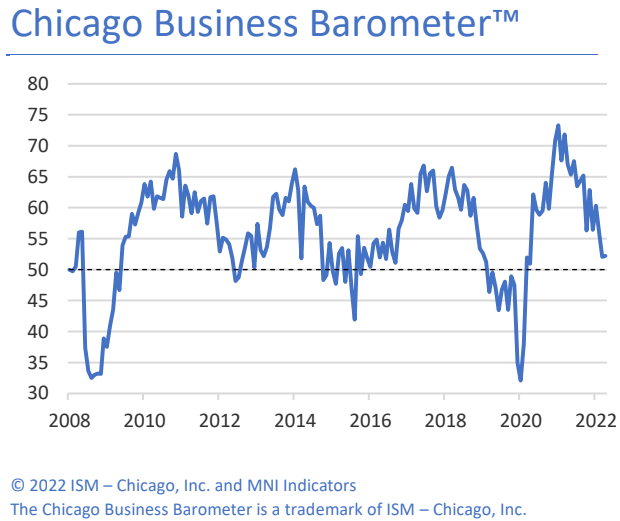

Chicago Business Barometer stabilized in August. The indicator inched up 0.1 points to 52.2. The only sub-indicators to fall were employment and supplier deliveries, while price paid was unchanged from previous month.

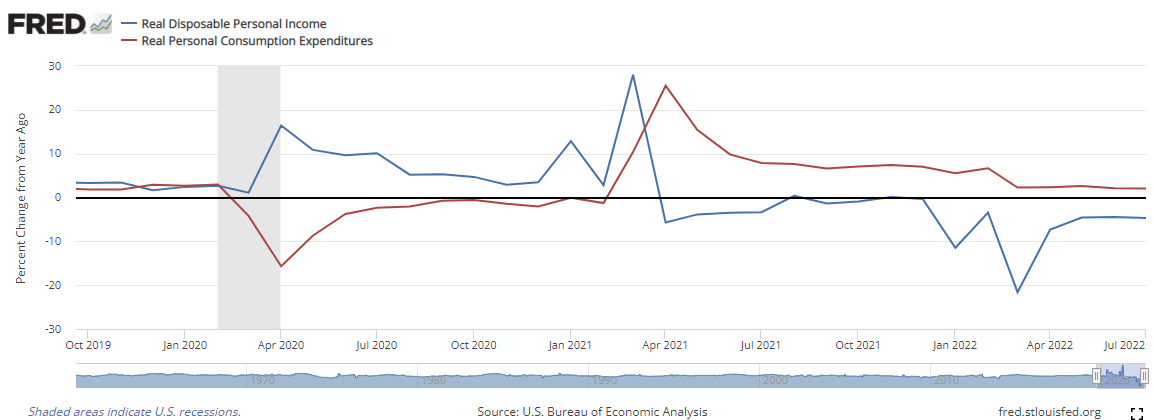

Personal income increased 0.3% at a monthly rate with consumer spending increasing 0.4% in August 2022. When these numbers are adjusted for inflation personal consumption year-over-year growth is up 2.1% whilst income remains in contraction at -4.7% (see graph below). It is interesting that consumption seems to keep on humming whilst income remains underwater.

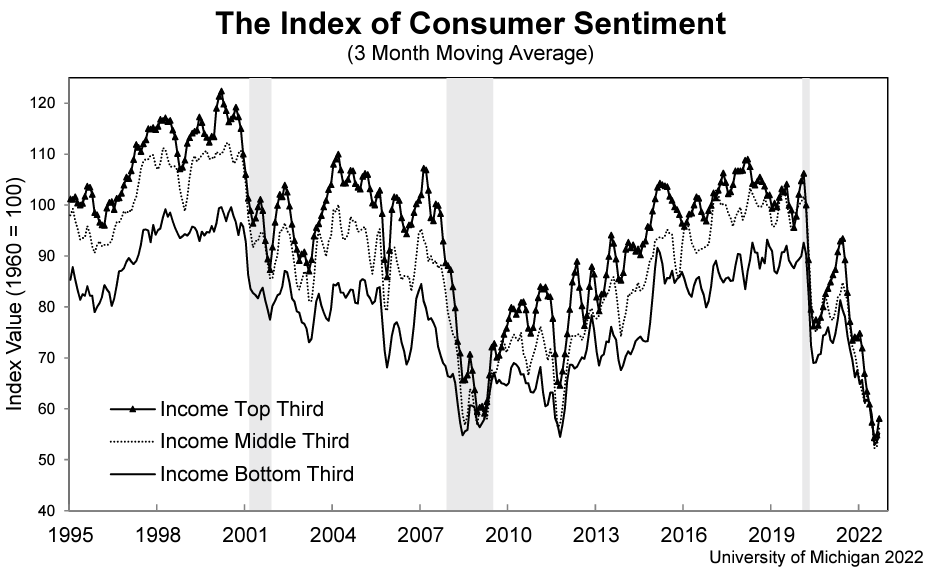

Michigan Consumer sentiment confirmed the preliminary reading earlier this month and was essentially unchanged from the month prior, at less than one index point above August. Buying conditions for durables and the one-year economic outlook continued lifting from the extremely low readings earlier in the summer, but these gains were largely offset by modest declines in the long run outlook for business conditions. As seen in the chart, sentiment for consumers across the income distribution has declined in a remarkably close fashion for the last 6 months, reflecting shared concerns over the impact of inflation, even among higher-income consumers who have historically generated the lion’s share of spending.

A summary of headlines we are reading today:

- Russia Claims EU Sanctions Are Preventing TurkStream Pipeline Maintenance

- OPEC Raises Oil Production To Highest Level In Years

- U.S. Only Lifted Oil Production By 12,000 Bpd In July

- NASA is working with SpaceX to explore a private mission to extend the life of the Hubble telescope

- “Panic Seems To Be In The Air”

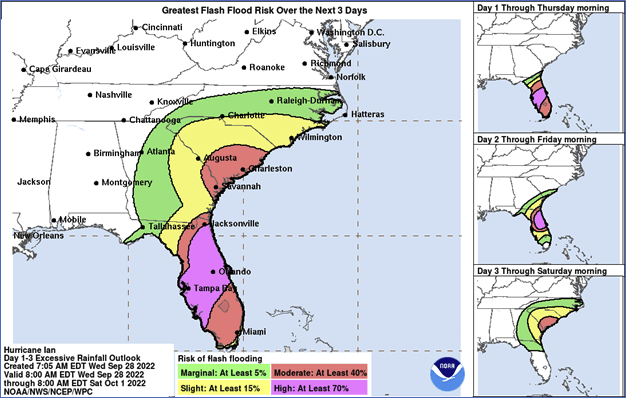

- Thousands Stuck On Cruise Ships After Hurricane Shuttered Florida Ports

- Russia Is Flaring Less And Keeping Natural Gas In The Ground

These and other headlines and news summaries moving the markets today are included below.