14 October 2022 Market Close & Major Financial Headlines: Wall Street Equities Closed In The Red Losing Half Of Yesterday’s Session Gains Partially Due To So-So Morning Financial Reporting, Trading Volatility, And Bank Earnings

Summary Of the Markets Today:

- The Dow closed down 404 points or 1.34%,

- Nasdaq closed down 3.08%,

- S&P 500 down 2.37%,

- WTI crude oil settled at $86 down $3.42,

- USD $113. little changed,

- Gold $1648 down $28.90,

- Bitcoin $19,230 down 0.73% – Session Low 19,154,

- 10-year U.S. Treasury 4.006% up 0.052%

- Baker Hughes Rig Count: U.S. +7 to 769 Canada +1 to 216

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

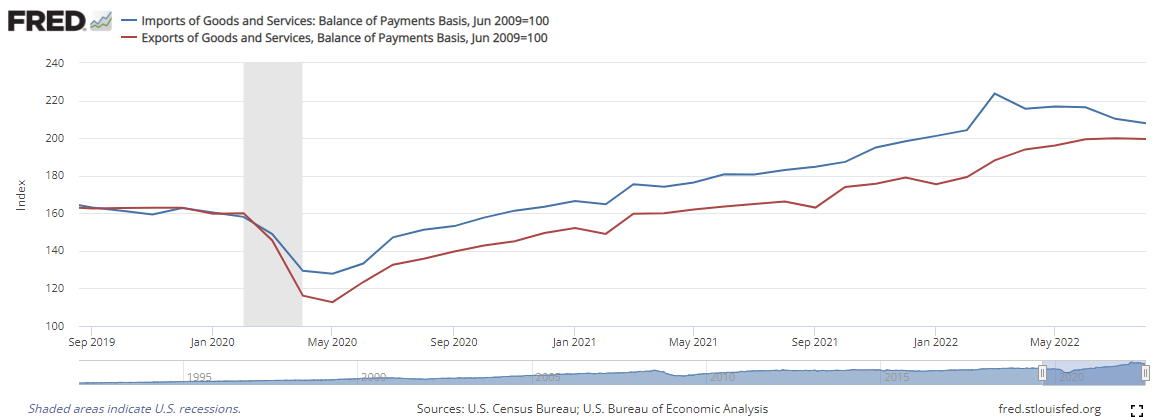

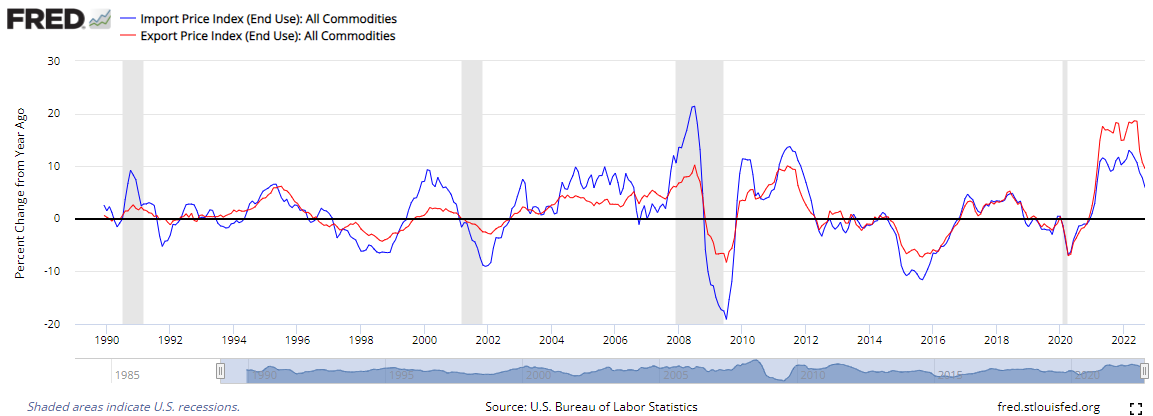

U.S. import price growth fell to 6.0% year-over-year in September 2022 from 7.8% in August – lead by lower fuel and nonfuel prices. Price growth for U.S. exports fell to 9.5% in September from 10.7% in August.

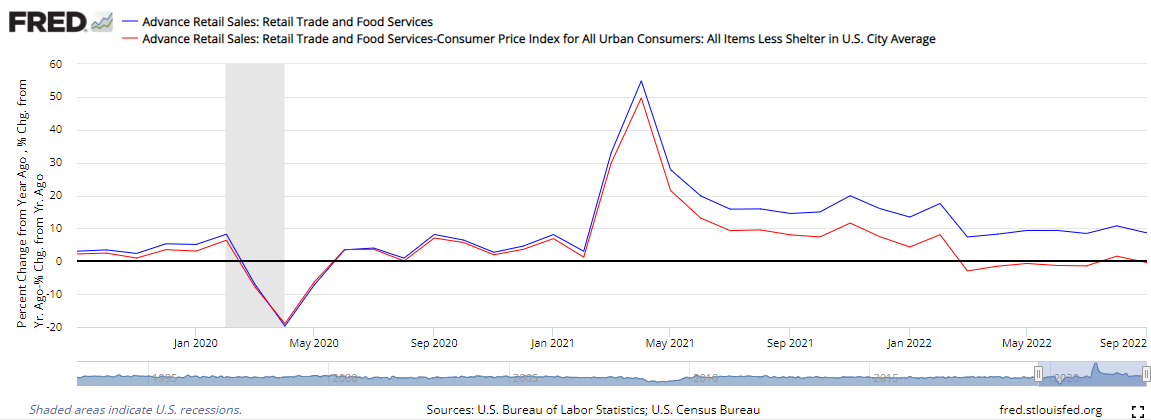

Advance estimates of U.S. retail and food services sales for September 2022 was up 8.2% above September 2021 (blue line on graph below). Total sales for the July 2022 through September 2022 period were up 9.2% from the same period a year ago. Unfortunately, when adjusted for inflation – retail sales fell 0.4% year-over-year (red line on graph below).

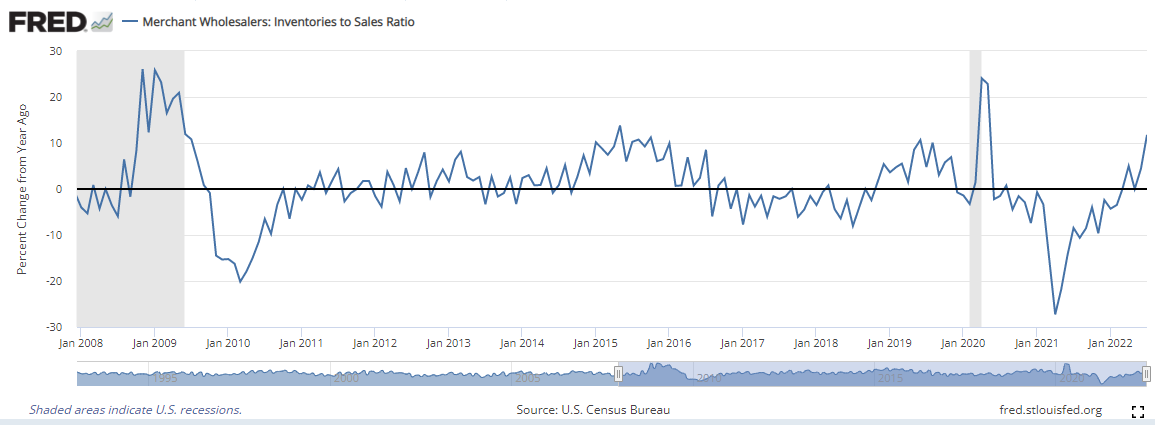

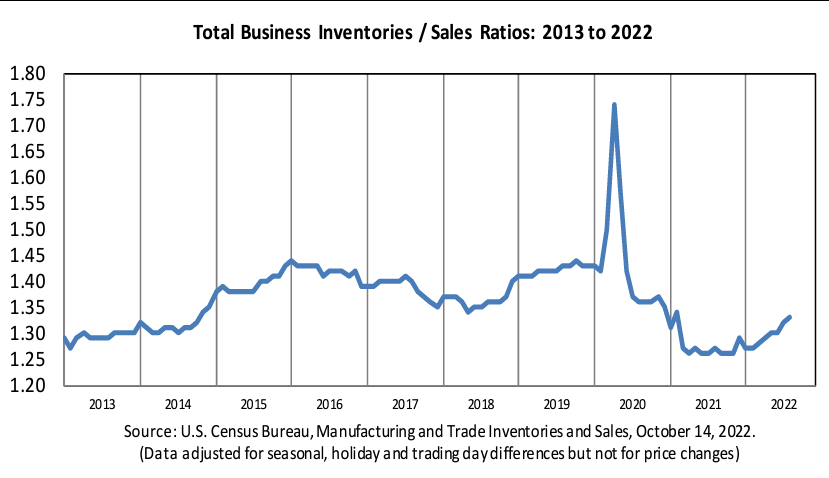

The total business inventories/sales ratio based on seasonally adjusted data at the end of August 2022 was 1.33. The August 2021 ratio was 1.27. Generally speaking, a rising ratio (like what is happening now) is a sign of a slowing economy – but with all the issues in the supply chain – not sure this normally good indicator is saying anything.

A summary of headlines we are reading today:

- U.S. Refiners Are Preparing For A Potential Fuel Export Ban

- U.S. Oil Rig Count Jumps Amid Selloff In Crude

- U.S. Energy Bills See Largest Rise In Decades – More Pain To Come

- Kroger agrees to buy rival grocery company Albertsons for $24.6 billion

- Series I bond interest is expected to fall to roughly 6.48% in November. But that’s still a ‘really good rate,’ experts say

- 3 takeaways from our daily meeting: New market leaders, banks report, Club stocks next week

- Consumer spending was flat in September and below expectations as inflation takes toll

- Americans Are Getting Poorer: Price Inflation Grew Faster Than Wages Again In September

- Market Extra: ‘Growing wealth gap and rising inflation … hurt the global economy at almost every turn,’ Jamie Dimon tells MarketWatch on its anniversary

These and other headlines and news summaries moving the markets today are included below.