28 October 2022 Market Close & Major Financial Headlines: Wall Street’s Three Main Indexes Close Up Near Session Highs – DOW Registering Fourth Straight Week Of Gains

Summary Of the Markets Today:

- The Dow closed up 829 points or 2.59%,

- Nasdaq closed up 2.87%,

- S&P 500 up 2.46%,

- WTI crude oil settled at $88 down $0.97,

- USD $110.89 down $0.11,

- Gold $1648 down $17.30,

- Bitcoin $20,620 up $360 – Session Low 20,069,

- 10-year U.S. Treasury 4.014% up 0.057%

- Baker Hughes Rig Count: U.S. -3 to 768 Canada +2 to 212

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

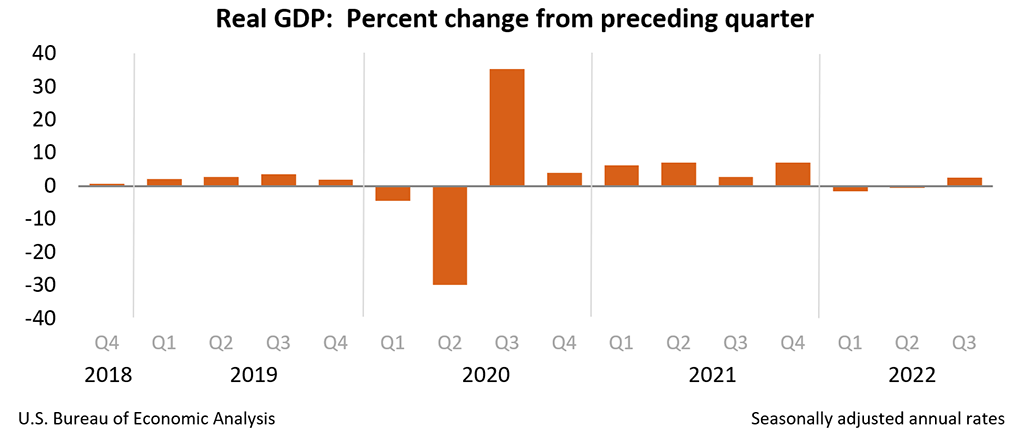

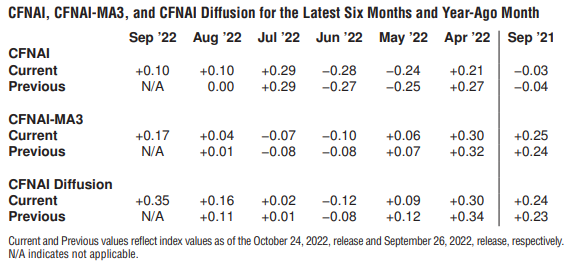

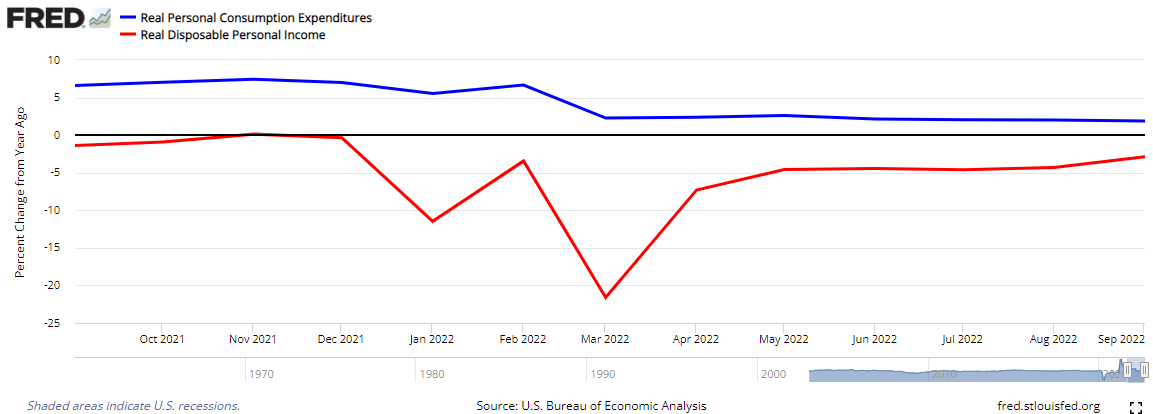

Inflation-adjusted personal income was little changed whilst inflation-adjusted spending increased month-over-month in September 2022. The better way to look at this situation is to analyze year-over-year growth which shows spending remains fairly steady at 1.9% growth whilst income is an improving NEGATIVE 2.9% (see graph below). This tells me economic growth is holding steady. Inflation too is holding steady at 6.2% which means the federal funds rate increases are yet to have an effect.

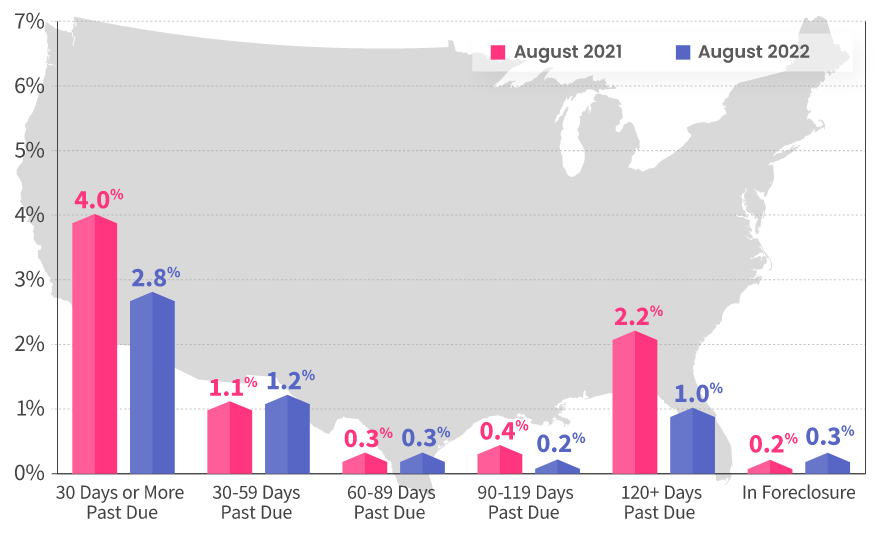

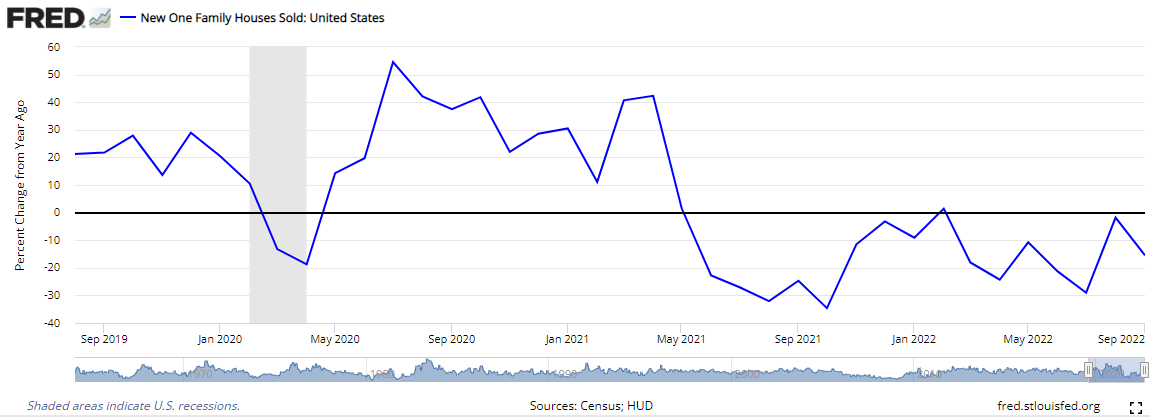

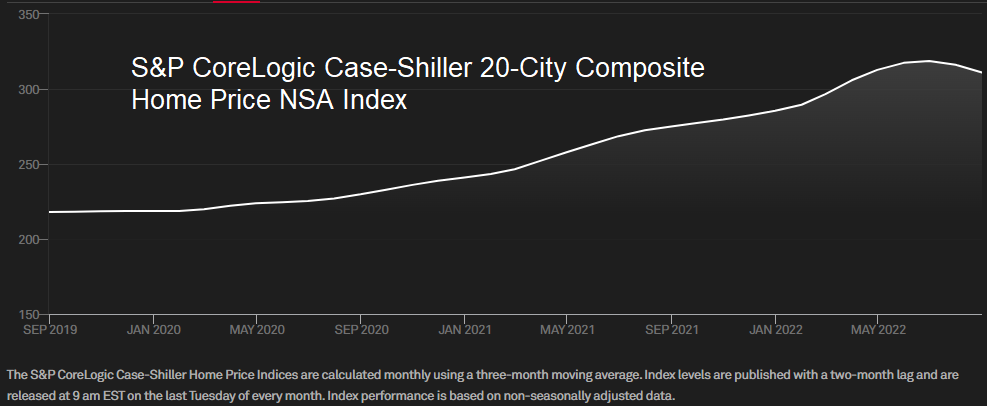

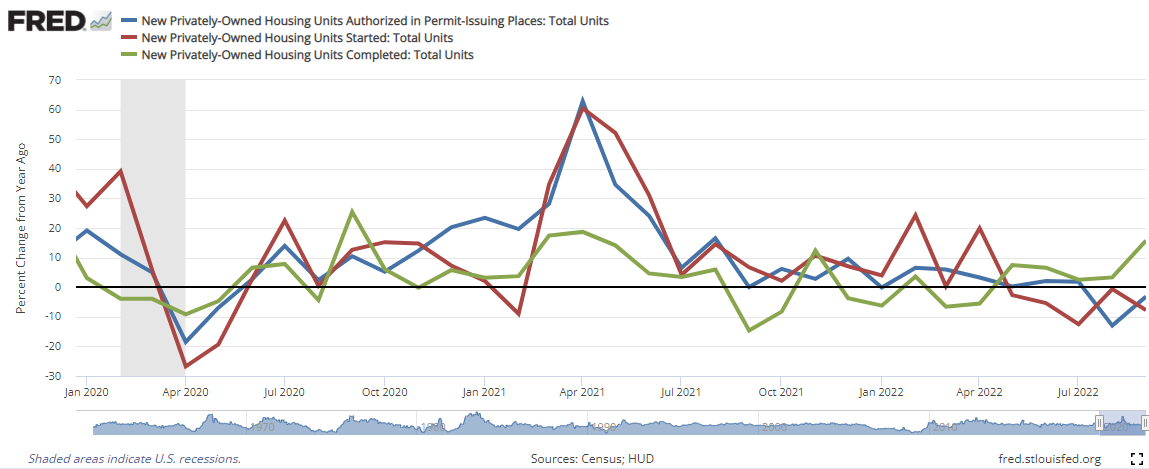

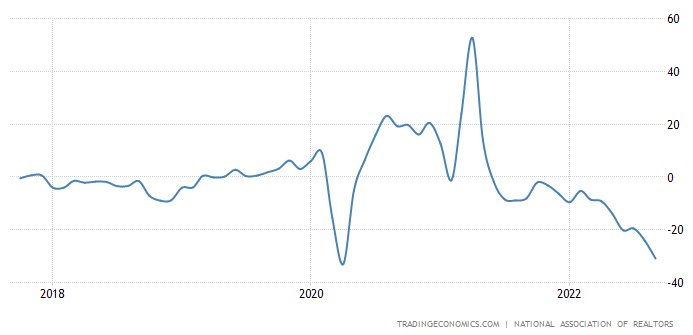

The Pending Home Sales Index (PHSI) year-over-year pending transactions slid by 31.0%. According to the National Association of Realtors, the Federal Reserve’s inflation battle which is resulting in higher interest rates is harming the housing market. No question that the housing market is in a recession.

A summary of headlines we are reading today:

- Zinc Prices Could Slide Further

- Baker Hughes Shows Weak U.S. Drilling Activity

- The Global Semiconductor Shortage Is Now Becoming A Glut

- Pending home sales fell 10% in September, much worse than expected

- More than 40% of U.S. households will owe no federal income tax, down from last year, according to a new analysis

- As US-China Relations Worsen, Expect Supply Chain Chaos

- A $3 trillion loss: Big Tech’s horrible year is getting worse

These and other headlines and news summaries moving the markets today are included below.