Summary Of the Markets Today:

- The Dow closed up 97 points or 0.3%,

- Nasdaq closed up 0.99%,

- S&P 500 up 0.59%,

- Gold $1752 up $11.90,

- WTI crude oil settled at $77 down $3.48,

- 10-year U.S. Treasury 3.696% down 0.062%,

- USD index $106.11 down $1.11,

- Bitcoin $16,542 up $342.90

Today’s Economic Releases:

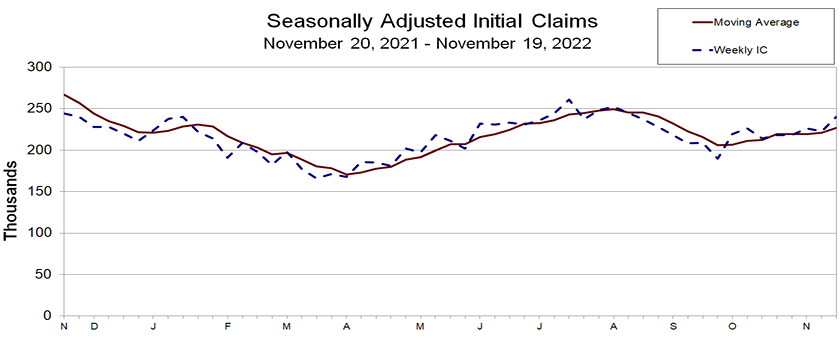

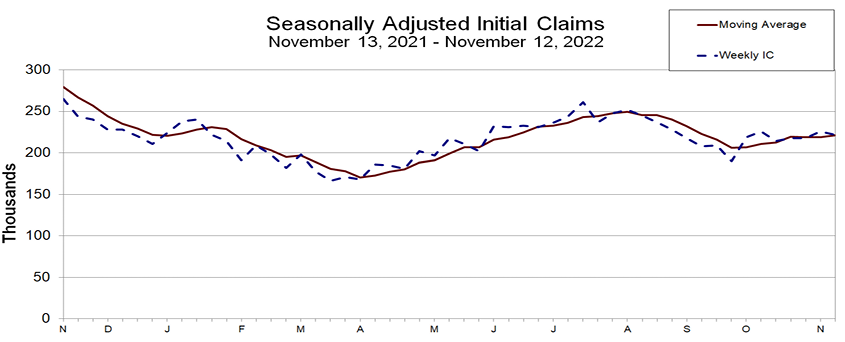

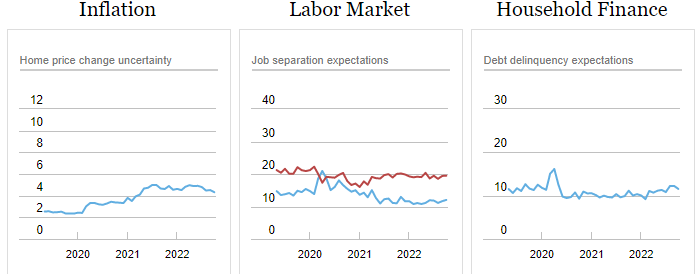

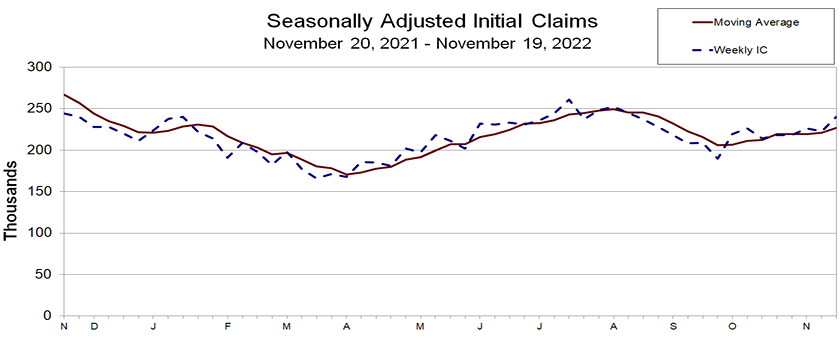

In the week ending November 19, the advance figure for Unemployment Insurance Weekly Claims 4-week moving average was 226,750, an increase of 5,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 221,000 to 221,250. The current increases are likely a result of layoffs in the tech industry.

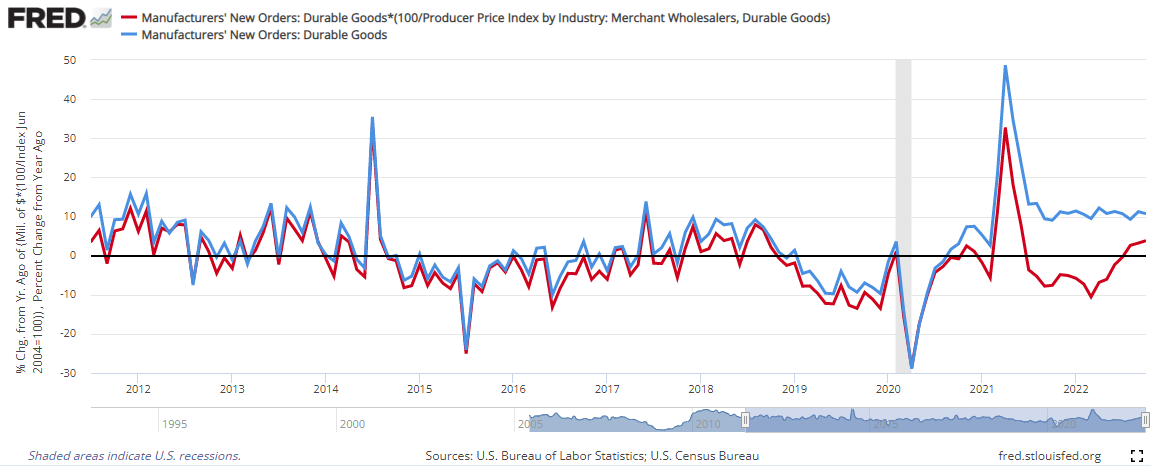

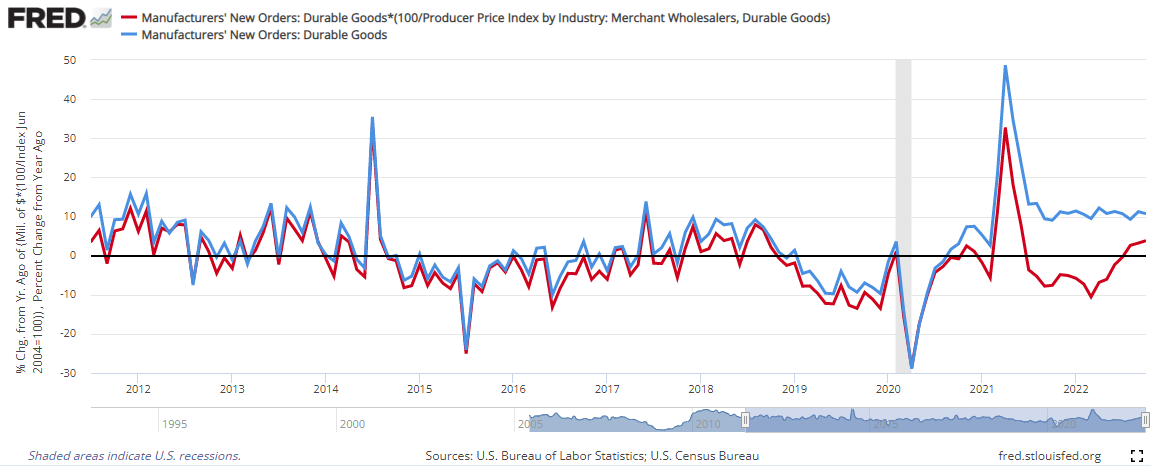

New orders for manufactured durable goods in October 2022 slowed somewhat to 10.7% year-over-year (blue line on graph below). However, inflation adjusted durable goods improved to 3.8% year-over-year as inflation is moderating in the durable goods sector (red line on graph below). The durable goods sector has been improving since March 2022.

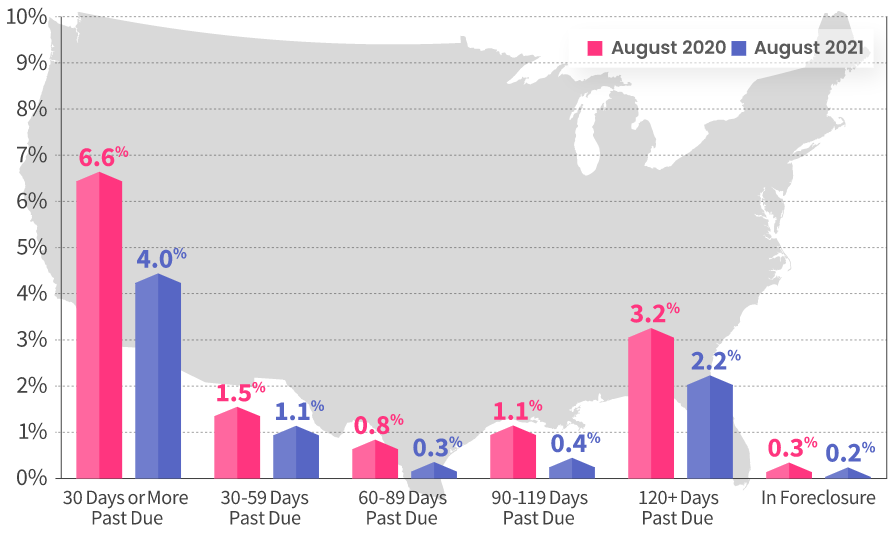

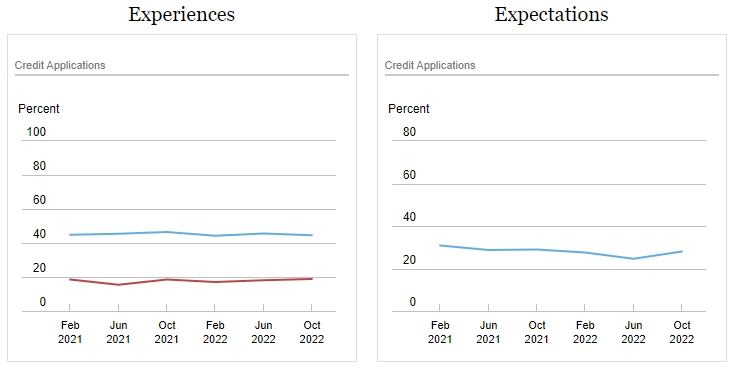

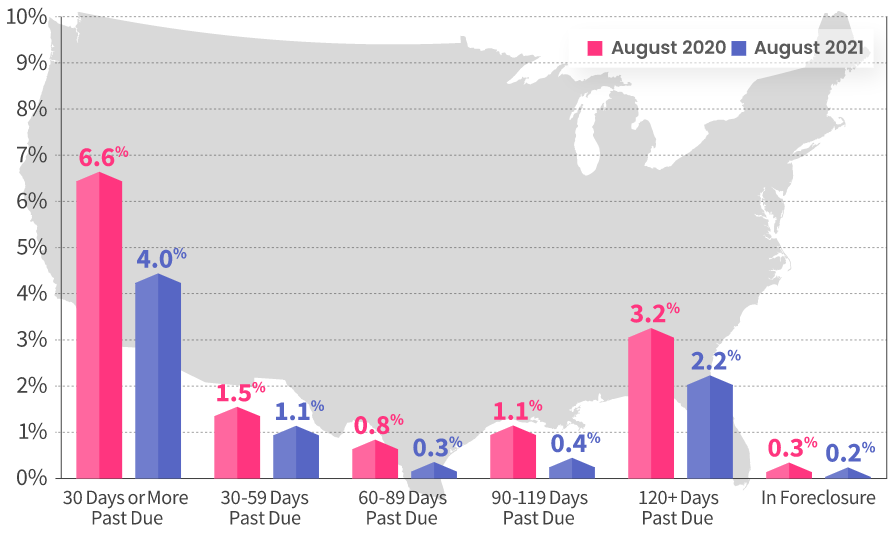

The CoreLogic Loan Performance Insights report shows that in August 2021, 4% of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 2.6-percentage point decrease in the overall delinquency rate compared with August 2020.

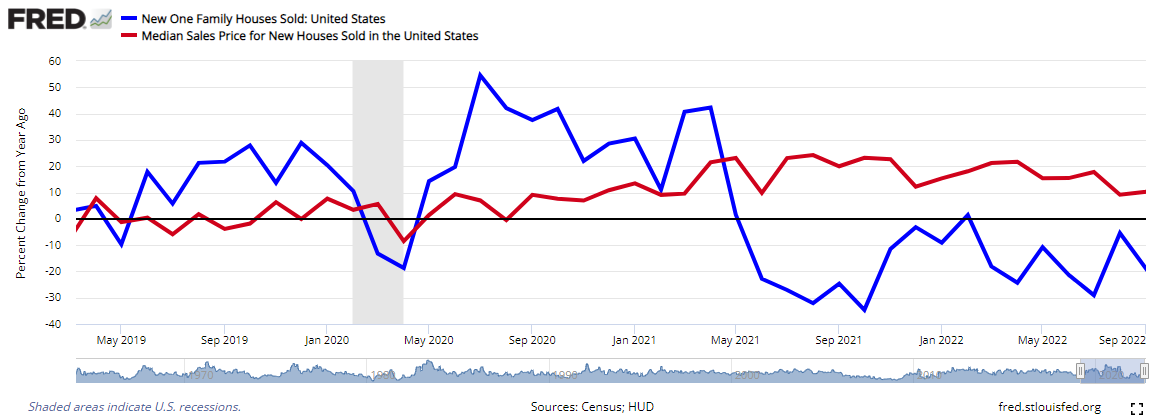

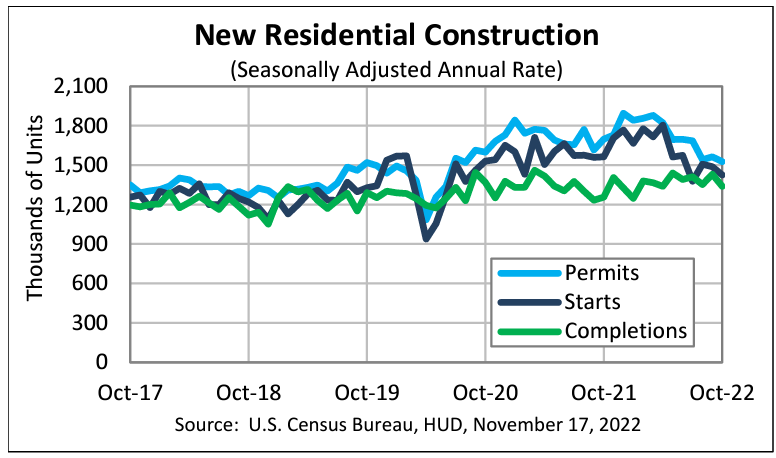

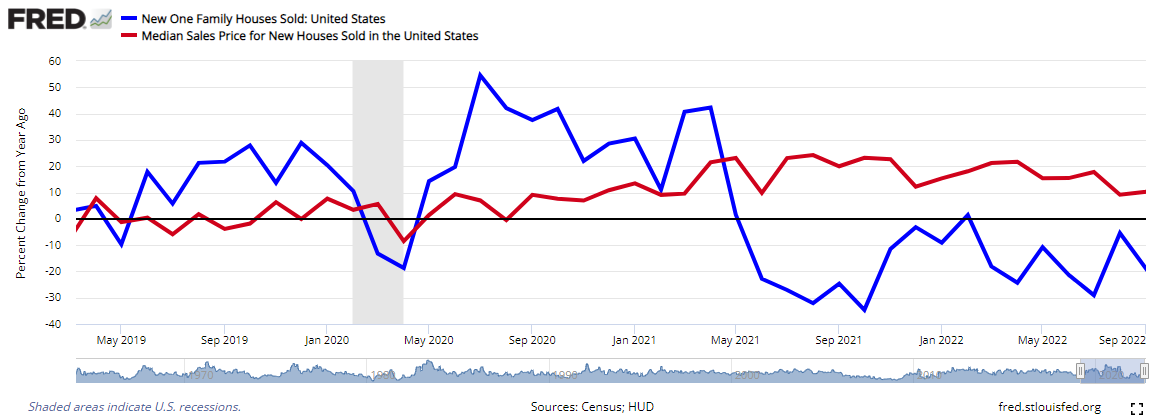

Sales of new single‐family houses in October 2022 is 5.8% below October 2021. Sales Price The median sales price of new houses sold in October 2022 was $493,000. The average sales price was $544,000.

The Federal Reserve’s FOMC released the minutes for their meeting which ended on November 2, 2022. Highlights:

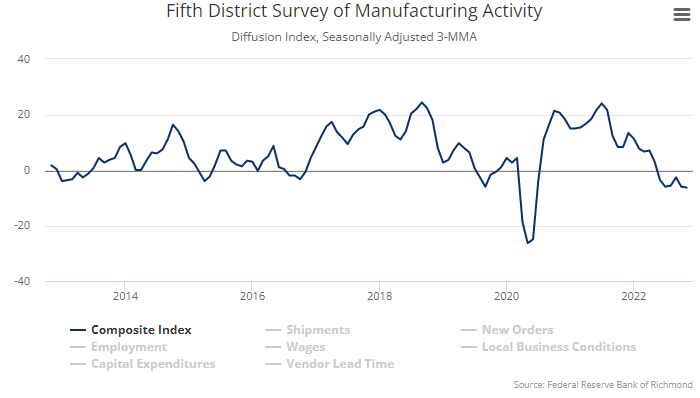

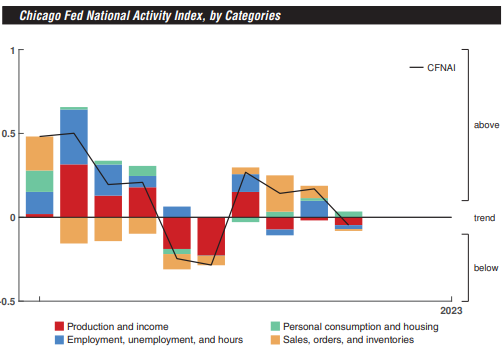

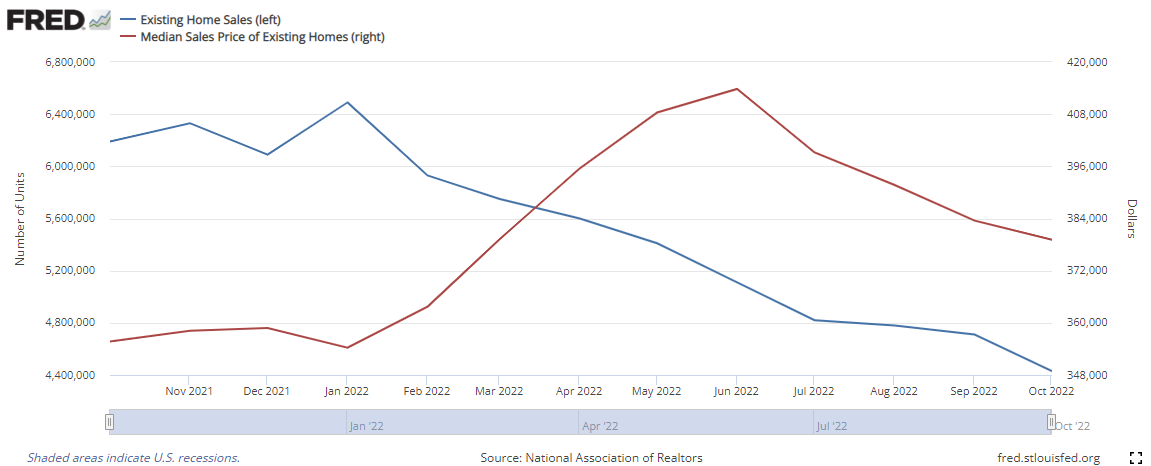

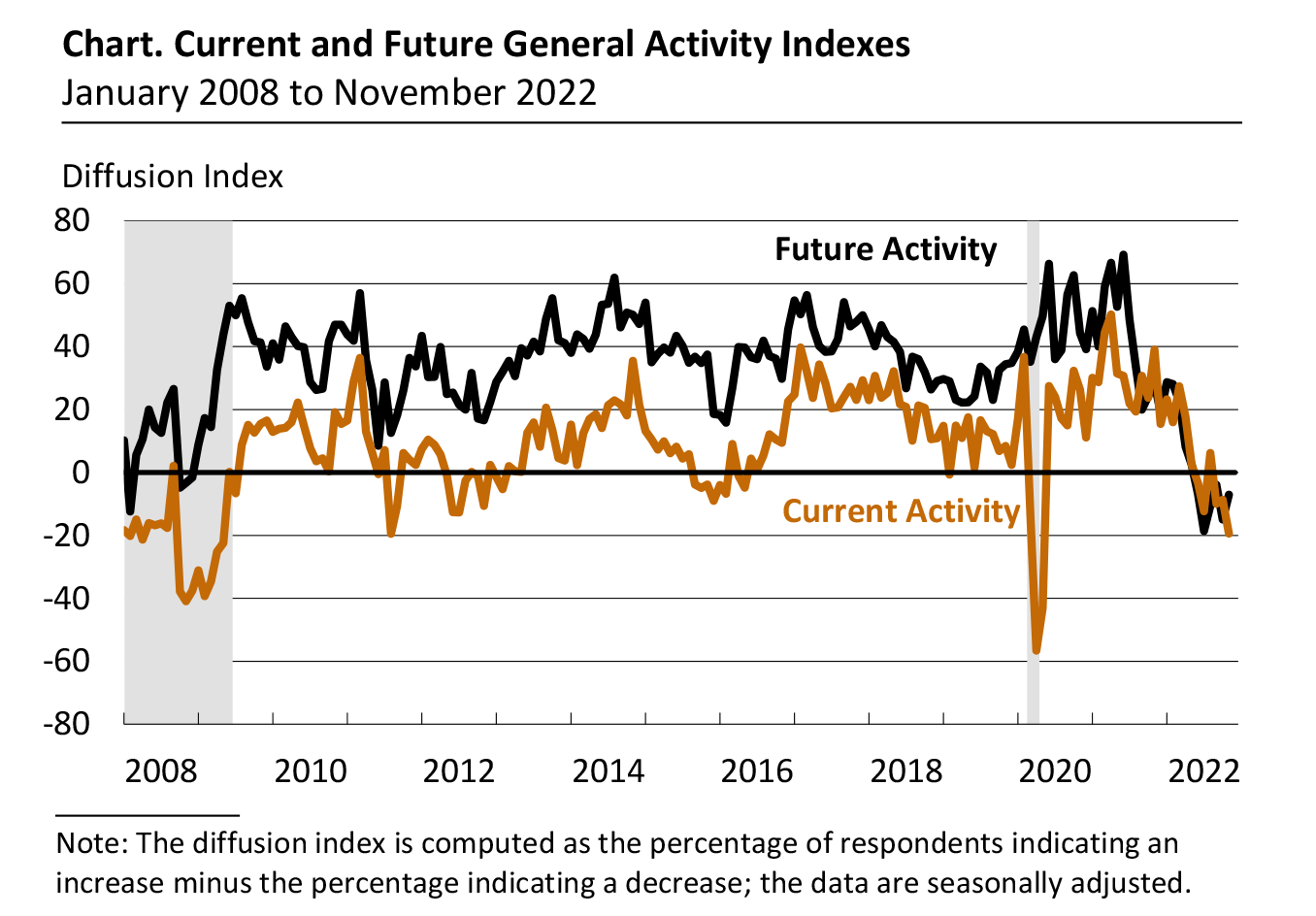

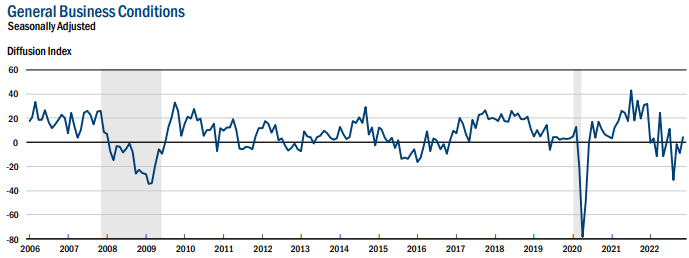

… participants observed that although real GDP rebounded in the third quarter, recent data suggested that economic activity in the near term appeared likely to expand at a pace below its trend growth rate. Participants noted a softening in consumer and business spending growth, and some participants remarked that there had been a notable slowing in interest rate-sensitive sectors, particularly housing, in response to the tightening of financial conditions associated with the Committee’s policy actions. With inflation remaining far too high and showing few signs of moderating, participants observed that a period of below-trend real GDP growth would be helpful in bringing aggregate supply and aggregate demand into better balance, reducing inflationary pressures, and setting the stage for the sustained achievement of the Committee’s objectives of maximum employment and price stability.

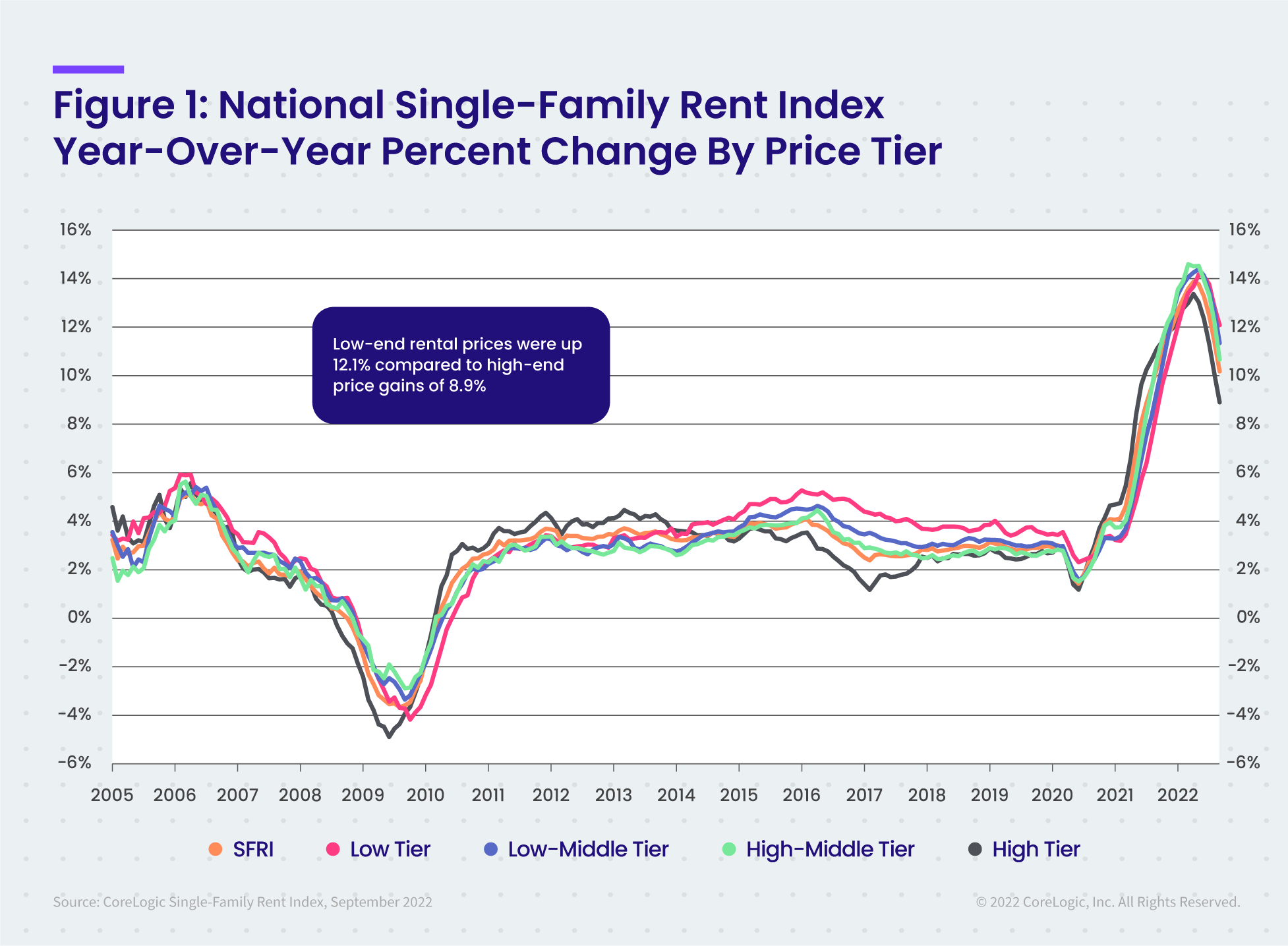

… Participants agreed that inflation was unacceptably high and was well above the Committee’s longer-run goal of 2 percent. Some participants noted that the burden of high inflation was falling disproportionally on low-income households, for whom necessities like food, energy, and shelter make up a larger share of expenditures. Many participants observed that price pressures had increased in the services sector and that, historically, price pressures in this sector had been more persistent than those in the goods sector. Some participants noted that the recent high pace of nominal wage growth, taken together with the recent low pace of productivity growth, would, if sustained, be inconsistent with achievement of the 2 percent inflation objective. Several participants, however, commented on signs of a moderation in nominal wage growth. Participants agreed that near-term inflation pressures were high, but some noted that lower commodity prices or the expected reduced pressure on goods prices due to an easing of supply constraints should contribute to lower inflation in the medium term.

… Participants discussed the length of the lags in the response of the economy to monetary policy actions, taking into account historical experience and the various estimates of timing relationships provided in economic research, as well as the high degree of uncertainty involved in applying the evidence on lags to the current situation. They noted that monetary policy tightening typically produced rapid effects on financial conditions but that the full effects of changes in financial conditions on aggregate spending and the labor market, and then on inflation, likely took longer to materialize. With regard to current circumstances, many participants remarked that, even though the tightening of monetary policy had clearly influenced financial conditions and had had notable effects in some interest rate-sensitive sectors, the timing of the effects on overall economic activity, the labor market, and inflation was still quite uncertain, with the full extent of the effects yet to be realized. Several participants observed that, because of the difficulties in isolating the effects of monetary policy, changes in economic structure, or increasing transparency over time regarding monetary policy decisions, the historical record did not provide definitive evidence on the length of these lags. In addition, some participants noted that the post-pandemic dynamics of the economy may differ from those prevailing prior to the pandemic.

… various participants noted that, with inflation showing little sign thus far of abating, and with supply and demand imbalances in the economy persisting, their assessment of the ultimate level of the federal funds rate that would be necessary to achieve the Committee’s goals was somewhat higher than they had previously expected.

… a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate. A slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.

A summary of headlines we are reading today:

- Is Climate Change Really Fueling A Rise In Dangerous Hurricanes?

- Controversial Russia-Azerbaijan Gas Deal Raises Questions For EU

- MIT Reports Breakthrough In Solid-State Lithium Battery Development

- Mortgage demand rises 2.2% as interest rates decline slightly

- Abortion pill is the most common method to end a pregnancy in the U.S., CDC says

- “The Statement Comes Across As Dovish” – Wall Street Reacts To FOMC Minutes

- Washington Watch: Cannabis banking bill and retirement package both could actually pass Congress by year’s end, analysts say

These and other headlines and news summaries moving the markets today are included below.