12Dec2022 Market Close & Major Financial Headlines: U.S. Financial Markets Open Higher And Close Near Session Highs

Summary Of the Markets Today:

- The Dow closed up 529 points or 1.58%,

- Nasdaq closed up 1.26%,

- S&P 500 up 1.43%,

- WTI crude oil settled at $73 up $2.39,

- USD $104.97 up $0.20,

- Gold $1792 down $19.30,

- Bitcoin $17,153 up 0.18% – Session Low 16,890,

- 10-year U.S. Treasury 3.613% up 0.046%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

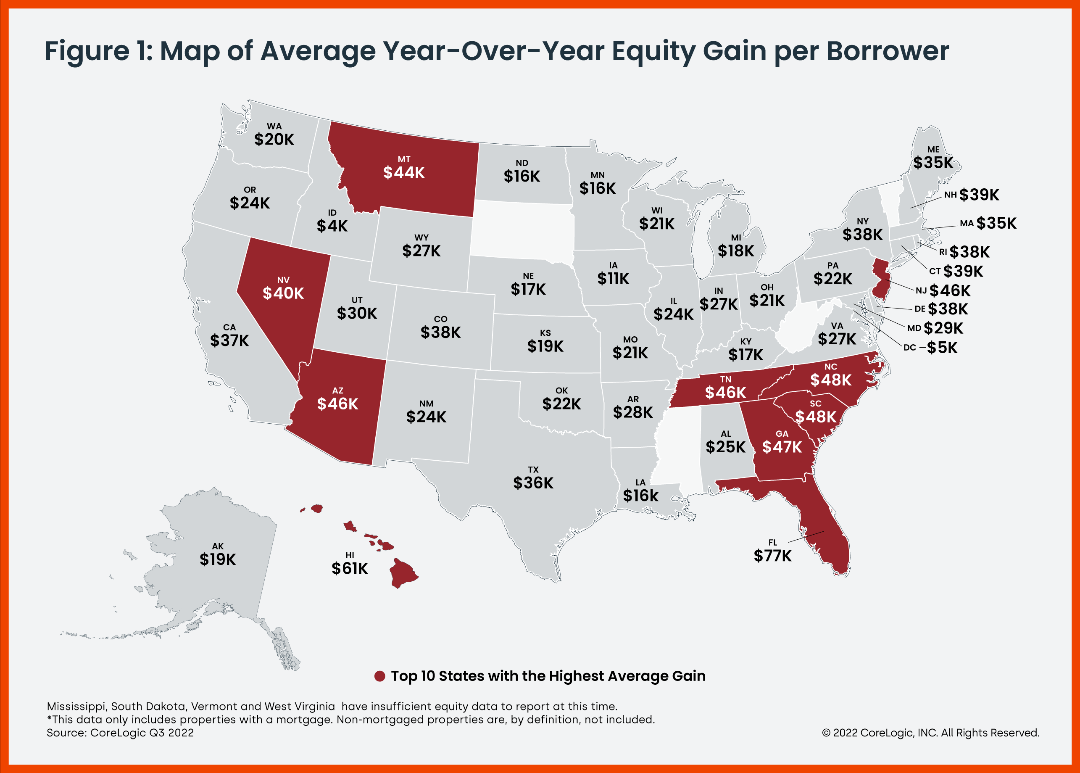

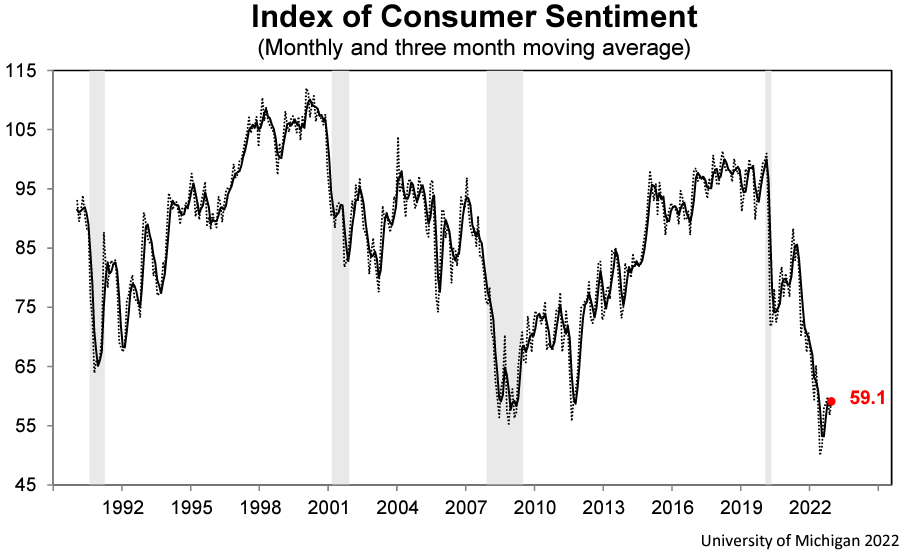

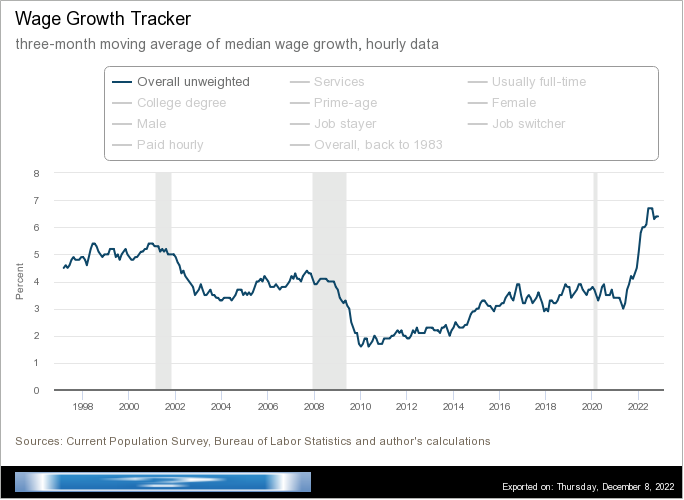

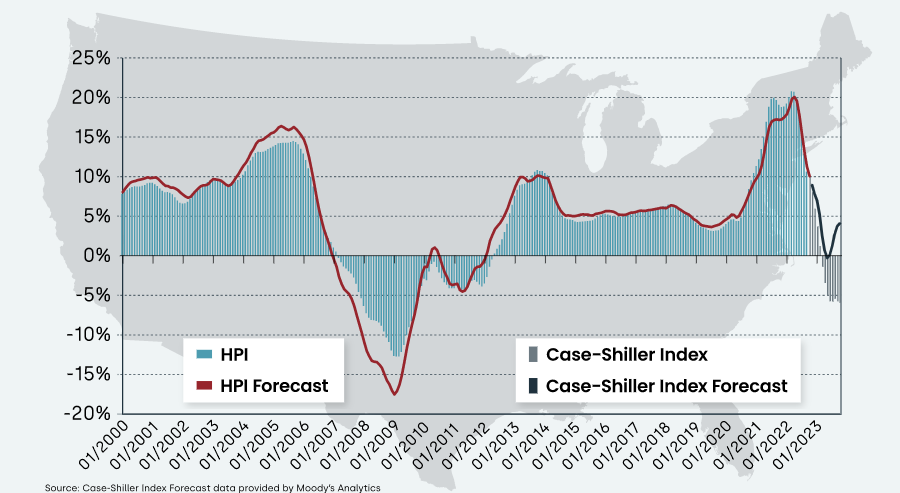

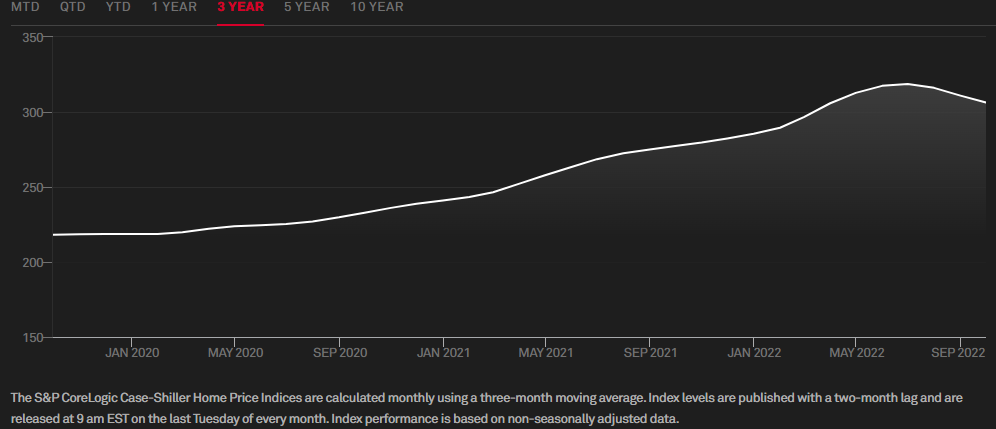

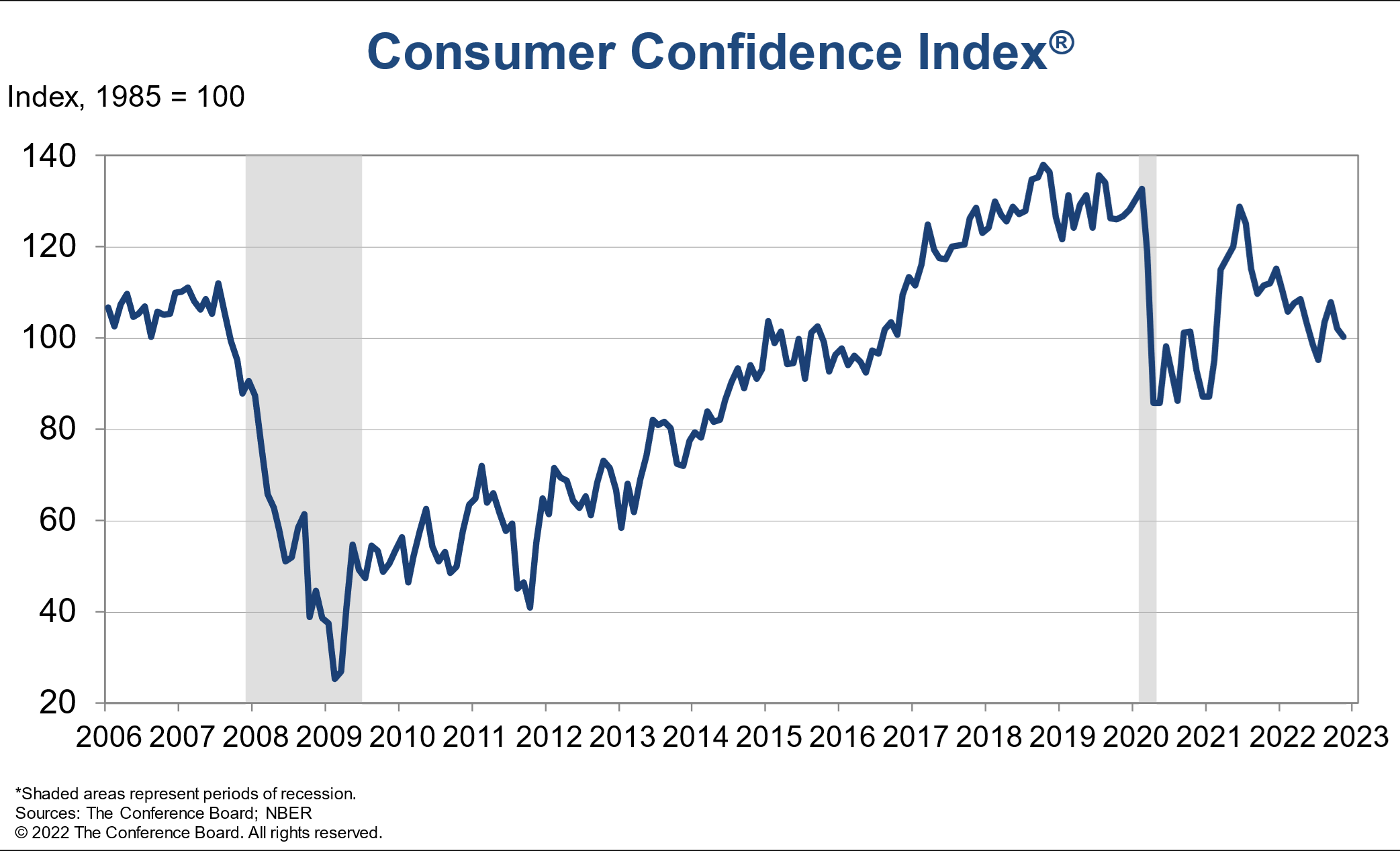

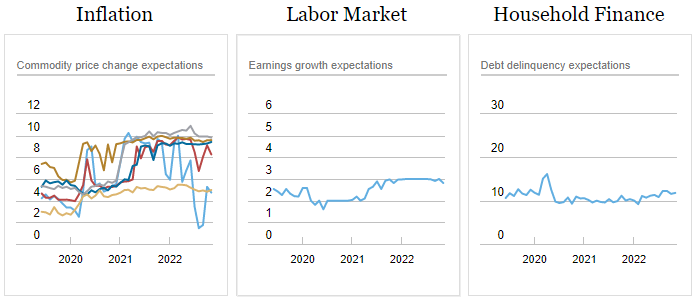

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the November 2022 Survey of Consumer Expectations, which shows that inflation expectations decreased in November at the short, medium, and longer terms. Home price growth expectations continued to decline. Labor market expectations strengthened, while household income growth expectations increased to a new series high. Median inflation expectations decreased at both the one- and three-year-ahead horizons in November to 5.2% and 3.0% respectively.

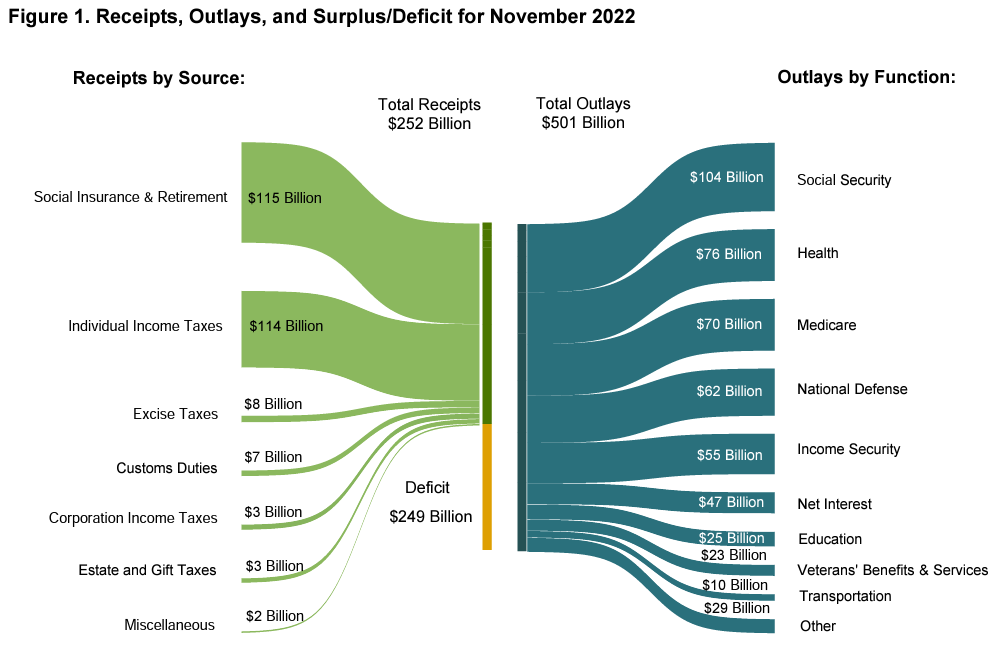

Per the monthly Treasury Statement issued by US Treasury, November has been a deficit month 68 times out of 69 fiscal years since there are no major tax due dates in this month. The deficit in November 2022 was $249 billion.

A summary of headlines we are reading today:

- Steelmakers Worry Prices Could Hit Break-Even Thresholds

- Electric school buses are giving kids a cleaner, but costlier, ride to class

- Gen Z loves Minions, horror, and Dwayne ‘The Rock’ Johnson

- SpaceX launches lunar lander for Japanese venture ispace, which aims to create an economy around the moon

- ‘Early filers’ should wait to submit their tax return in 2023, the IRS warns. Here’s why

- Marijuana industry sales slow down after pandemic surge

- Dovish Fed Will Send Oil Back To $100: BofA

- “Net Energy Gain” – US Scientists Make Breakthrough In Nuclear Fusion

- Market Snapshot: Dow rises 300 points to start a week rich with inflation and central bank news

These and other headlines and news summaries moving the markets today are included below.