27Dec2022 Market Close & Major Financial Headlines: Wall Street Opened Sharply Down, Recovered Trading Along The Unchanged Line, And Finally Closed Mixed

Summary Of the Markets Today:

- The Dow closed up 38 points or 0.11%,

- Nasdaq closed down 1.38%,

- S&P 500 down 0.40%,

- WTI crude oil settled at $80 down $0.04,

- USD $104.19 down $0.12,

- Gold $1822 up $18.60,

- Bitcoin $16,656 down 1.08% – Session Low 16,607,

- 10-year U.S. Treasury 3.849% up 0.105%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

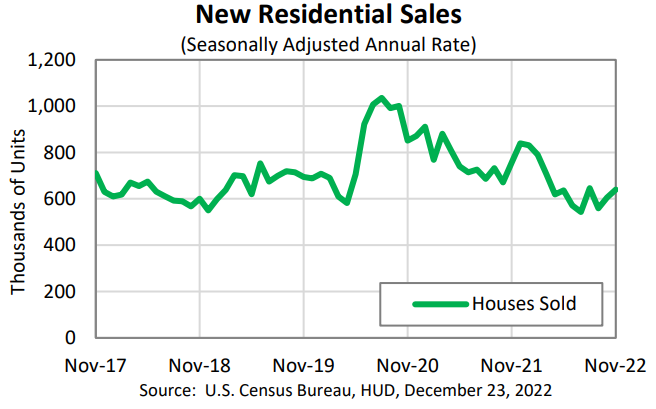

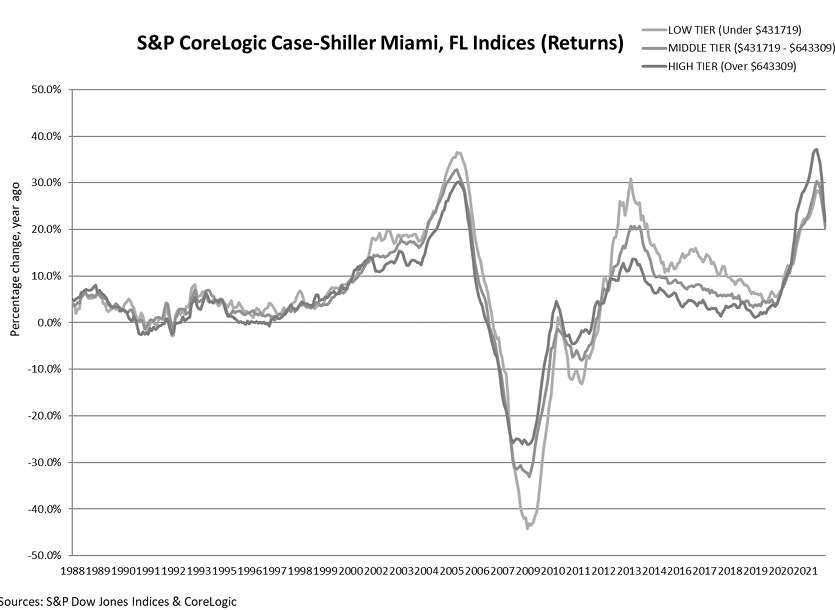

S&P Dow Jones Indices (S&P DJI) shows the 20-City Composite posted a 8.6% year-over-year gain, down from 10.4% in the previous month. CoreLogic Deputy Chief Economist Selma Hepp stated:

As the year wrapped up, housing market indicators continued to weaken. In October, the CoreLogic S&P Case-Shiller Index annual gains slowed to single digits, posting a 9.2% year-over-year increase, the first single-digit increase since November 2020. And while home prices declined for the fourth consecutive month, the rate of monthly slowing eased some in October, down 0.5% compared to September, from 1% drops recorded in the two prior months. With price declines since the spring, home prices are now 3% lower nationally compared to their 2022 peaks — while San Francisco and Seattle continue to lead the 20 metros with 13% and 12% declines, respectively. By spring of next year, home prices in some of the declining markets will also start posting annual decreases.

A summary of headlines we are reading today:

- The U.S. And China Are Rushing To Secure Resources In DR Congo

- GasBuddy: $4 Gasoline Could Return In May

- Christmas Grid Chaos Paves The Way For Transportable Nuclear Plants

- Chinese EV maker Nio cuts delivery guidance for fourth quarter, citing Covid disruptions

- ‘It’s massively welcome.’ What to know about the latest 1099-K tax reporting change for Venmo, PayPal

- Bankman-Fried Criminal Case Assigned To Judge In bin Laden, Epstein-Linked Cases

- DOJ Employed ‘Reverse Spying’ In Attempt To Shut Down Investigation Into Russia Collusion Hoax: Devin Nunes

- Big Spending Bill Is A Big Problem For The Fed’s Inflation Fight

- Futures Movers: U.S. oil ends near unchanged as refineries restart after winter storm

- Market Snapshot: Dow wavers as bond yields rise after investors return from Christmas and look ahead to 2023

These and other headlines and news summaries moving the markets today are included below.