08 Feb2023 Market Close & Major Financial Headlines: Wall Street Main Indexes Opened Fractionally Lower Again, Then Trended Moderately Lower To Close At Session Support

Summary Of the Markets Today:

- The Dow closed down 207 points or 0.61%,

- Nasdaq closed down 1.68%,

- S&P 500 closed down 1.11%,

- Gold $1887 up $1.90,

- WTI crude oil settled at $78 up $1.28,

- 10-year U.S. Treasury 3.638% down 0.038 points,

- USD $103.49 up $0.06,

- Bitcoin $22,840 down $366.35 – Session Low $22.720

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

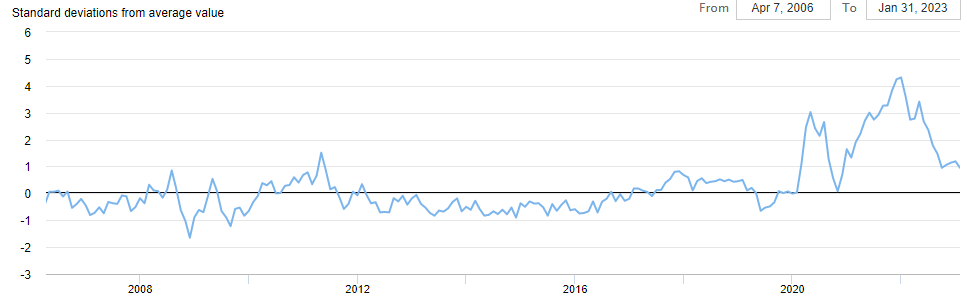

December 2022 sales of merchant wholesalers were up 7.3% (green line on the graph below) year-over-year. However, after the inflation adjustment – year-over-year sales were down 1.7% (red line on the graph below). Sales continue to worsen and should be considered a potential recession flag. The December inventories/sales ratio for merchant wholesalers was 1.36 (blue line on the graph below). The December 2021 ratio was 1.24. A rising ratio is could be a recession flag.

The federal budget deficit was $459 billion in the first four months of fiscal year 2023, the Congressional Budget Office estimates—$200 billion more than the shortfall recorded during the same period last year. Outlays were 9 percent higher and revenues were 3 percent lower from October through January than during the same period in fiscal year 2022. Outlays in fiscal year 2023 were reduced by the shifting of certain payments—totaling $63 billion—from October 1, 2022 (the first day of fiscal year 2023), into fiscal year 2022 because October 1 fell on a weekend. If not for those shifts, the deficit would have been $522 billion, double the shortfall during the same period in fiscal year 2022.

A summary of headlines we are reading today:

- Biden SOTU: Oil Demand Will Last For At Least A Decade

- Aluminum Price Outlook Remains Bearish

- Oil Retreats On EIA Inventory Data

- Alphabet shares fall 7% following Google’s A.I. event

- S&P 500 closes 1% lower, Nasdaq sheds 1.7% on Wednesday amid corporate profit worries

- Wholesale egg prices have ‘collapsed.’ Why consumers may soon see relief

- SpaceX prepares for a massive test this week: Firing all 33 Starship engines at once

- Watch: Bill Gates Says It’s OK For Him To Use Private Jets Because He’s “The Solution” To Climate Change

- Shrinking Money Supply Undercuts “Soft Landing” Narrative

- Bond Report: U.S. bond yields finish mostly lower as traders weigh disinflation and Fed’s need for higher rates

These and other headlines and news summaries moving the markets today are included below.