08 NOV 2024 Market Close & Major Financial Headlines: Third Session Continues To Push The Three Main Indexes And Bitcoin To New Historic Highs, Ultimately Closing At New Highs

Summary Of the Markets Today:

- The Dow closed up 260 points or 0.59%, (Closed at 43,989, New Historic high 44,157)

- Nasdaq closed up 17 points or 0.09%, (Closed at 19,287, New Historic high 19,319)

- S&P 500 closed up 22 points or 0.38%, (Closed at 5,973, New Historic high 6,012)

- Gold $2,694 down $11.80 or 0.43%,

- WTI crude oil settled at $70 down $1.89 or 2.61%,

- 10-year U.S. Treasury 4.304 down 0.039 points or 0.898%,

- USD index $104.35 up $0.43 or 0417%,

- Bitcoin $76,740 up $40 or 0.06%, (24 Hours) , (New Bitcoin Historic high 77,221)

- Baker Hughes Rig Count: U.S. unchanged at 585 Canada -6 to 207

U.S. Rig Count is unchanged from last week at 585 with oil rigs unchanged at 479, gas rigs unchanged at 102 and miscellaneous rigs unchanged at 4.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The S&P 500 briefly hit 6,000 for the first time, capping its best week of the year to close at a new record. The Dow Jones Industrial Average crossed 44,000 for the first time during the session. The Nasdaq Composite closed near the flatline. The strong weekly performance was driven by optimism following Donald Trump’s White House victory and the Federal Reserve’s latest interest rate cut. Nvidia officially joined the Dow Jones Industrial Average, replacing Intel. Nvidia’s stock rose 2.9% in after-hours trading on the news, while Intel fell 1.8%. Tesla shares soared over 9%, pushing the company’s market capitalization to $1 trillion. Trump Media & Technology Group stock jumped more than 10% after President-elect Trump said he would not sell his shares in the company. The US dollar and Treasury yields gave up some of their post-election gains, tempering the initial “Trump trade” rush. Disappointment over China’s new fiscal stimulus plan put some pressure on Chinese stocks and oil prices. Next week companies providing quarterly results include Live Nation (LYV), Spotify (SPOT), Home Depot (HD) and Hertz (HTZ). On Monday, November 11 the stock market will be open but the bond market closed in observance of Veterans Day.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

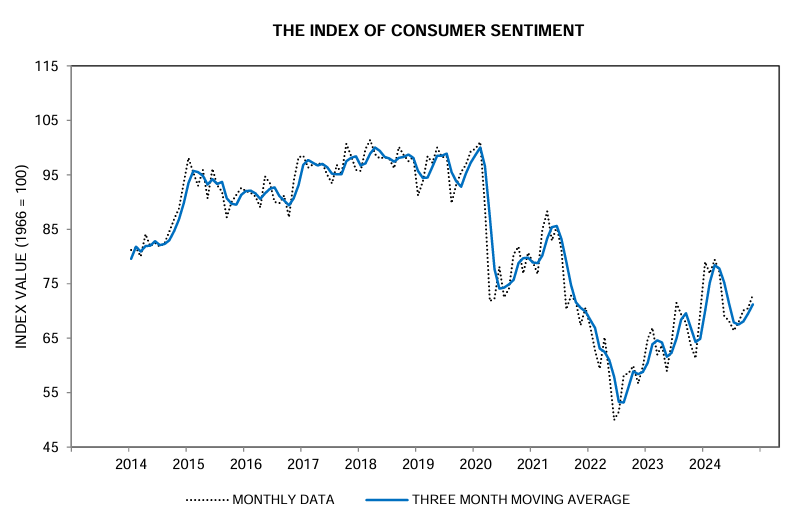

The University of Michigan Preliminary Consumer Sentiment results for November 2024:

Heading into the election, consumer sentiment improved for the fourth consecutive month, rising 3.5% to its highest reading in six months. While current conditions were little changed, the expectations index surged across all dimensions, reaching its highest reading since July 2021. Expectations over personal finances climbed 6% in part due to strengthening income prospects, and short-run business conditions soared 9% in November. Long-run business conditions increased to its most favorable reading in nearly four years. Sentiment is now nearly 50% above its June 2022 trough but remains below pre-pandemic readings. Note that interviews for this release concluded on Monday and thus do not capture any reactions to election results.

[Note: This consumer sentiment survey exemplifies why I dislike surveys – for the most part they are not representative of the population or sector the survey purportedly represents. This survey over the last 3 months attributed the rise in consumer sentiment to Kamala Harris winning the election. I hope in the future, this survey can put on political blinders, and re-examines its methodology to have a more representative sample group. As this is a preliminary survey for September – I expect a significant fall in consumer sentiment if changes are not made to its sample grouping.]

Here is a summary of headlines we are reading today:

- Oil Prices Decline As Hurricane Risk Fades, China Demand Weakens

- U.S. Drilling Activity Still Unmoved Amid Market Uncertainty

- Oil Prices Remain Rangebound Despite Dramatic Week

- Trump Set to Renew Maximum Pressure Policy on Iran

- Dow tops 44,000 for first time, S&P 500 closes at record high to cap election week rally: Live updates

- Tesla hits $1 trillion market cap as stock rallies after Trump win

- Powell and the Fed won’t be able to avoid talking about Trump forever

- The 10-year Treasury yield has been rising. Here’s where BlackRock’s Rick Rieder sees an opportunity

- Stocks making the biggest moves midday: Tesla, Airbnb, Toast, Pinterest and more

- Yields on cash are still ‘well ahead of inflation,’ expert says. Here’s where to put your money now

- The S&P 500 breaks 6,000 and the Dow tops 44,000. Why stocks could keep climbing.

- Oil ends down on the day, up for the week on conflicting supply-demand prospects

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.