22 Feb2023 Market Close & Major Financial Headlines: Wall Street Markets Traded Along The Unchanged Line, Ultimately Closing Mixed As Rate Hike Fears Persist Spooking Investors

Summary Of the Markets Today:

- The Dow closed down 85 points or 0.26%,

- Nasdaq closed up 0.13%,

- S&P 500 closed down 0.16%,

- Gold $1833 down $9.20,

- WTI crude oil settled at $74 down $2.47,

- 10-year U.S. Treasury 3.923% down 0.003 points,

- USD $104.56 up $0.38,

- Bitcoin $23,815 – 24H Change down $672.88 – Session Low $23,612

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

The Federal Reserve issued their meeting minutes of the Federal Open Market Committee‘s meeting on January 31 through February 1, 2023. There was nothing particularly noteworthy in these minutes, Highlights include:

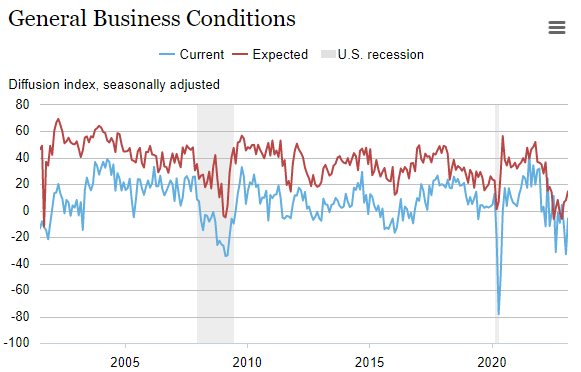

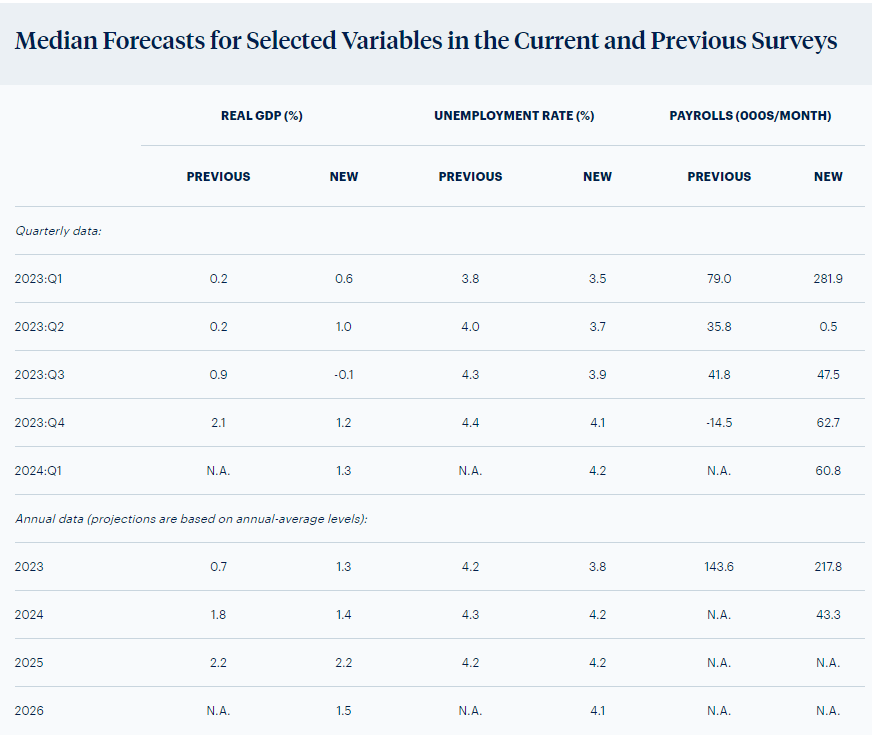

… Participants agreed that cumulative policy firming to date had reduced demand in the most interest-rate-sensitive sectors of the economy, particularly housing. Participants observed that growth in economic activity in 2022 had been below its longer-run trend and expected that real GDP growth would slow further in 2023. …

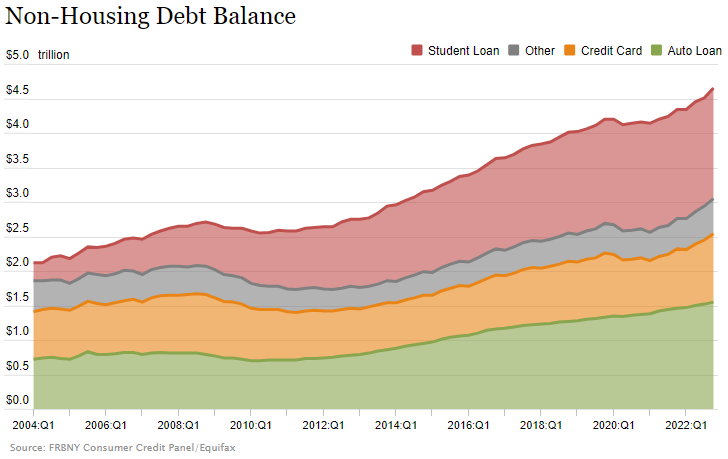

… In their discussion of the household sector, participants observed that real consumer spending had declined in November and December—in part reflecting the tightening in financial conditions over the past year—and anticipated that consumption would likely grow at a subdued rate in 2023. …

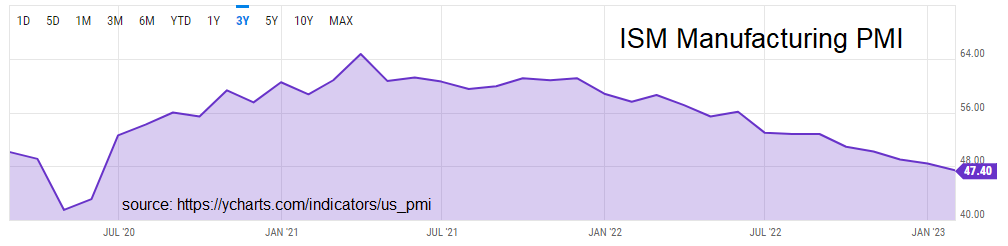

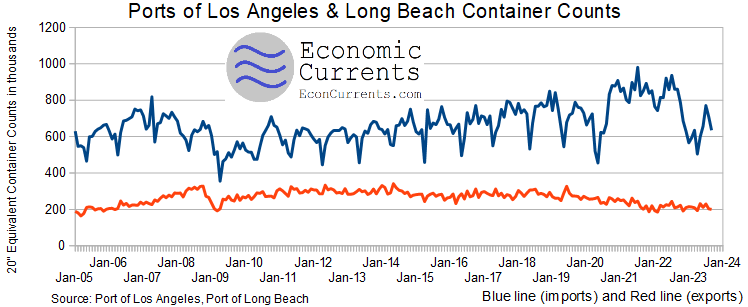

… Regarding the business sector, participants observed that growth in business fixed investment spending had been subdued in the fourth quarter and was being restrained by past interest rate increases. A number of participants commented that supply bottlenecks continued to ease, although supply chain issues remained a challenge in some sectors. …

… Participants agreed that the labor market remained very tight and assessed that labor demand substantially exceeded the supply of available workers. …

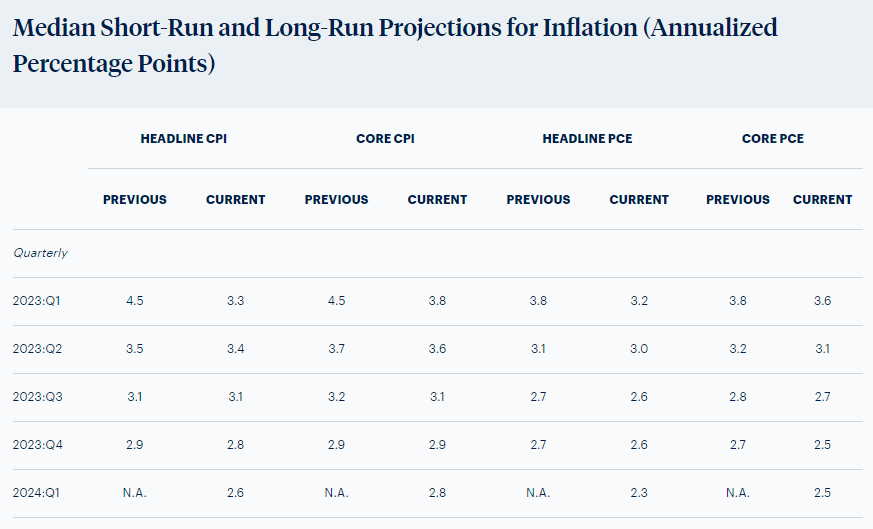

… A number of participants commented that the costs of elevated inflation are particularly high for lower-income households. Participants noted that inflation data received over the past three months showed a welcome reduction in the monthly pace of price increases but stressed that substantially more evidence of progress across a broader range of prices would be required to be confident that inflation was on a sustained downward path. …

… Participants observed that the uncertainty associated with their outlooks for economic activity, the labor market, and inflation was high. Regarding upside risks to inflation, participants cited a variety of factors, including the possibility that price pressures could prove to be more persistent than anticipated due to, for example, the labor market staying tight for longer than anticipated …

A summary of headlines we are reading today:

- Russia May Be Expanding Oil Output Cuts

- WTI Loses Over 3% As Fed Minutes Fail To Calm Markets

- Drilling Giant Chesapeake Cuts Rigs Amid Plunge In U.S Gas Prices

- Morgan Stanley Boosts Global Oil Demand Forecast

- U.S. Natural Gas Prices Have Plunged By Nearly 80% Since August

- Fed minutes show members resolved to keep fighting inflation with rate hikes

- Bitcoin drops 3.5%, Polygon Labs cuts jobs, and Coinbase usage continues to fall: CNBC Crypto World

- More than 1,000 flights canceled as major winter storm threatens to produce historic snowfall

- President Trump Vows To “Clean House Of Deep State”, Warns World War III Has “Never Been Closer”

- FOMC Minutes Suggest Fed Fears Financial Conditions Decoupling, Warns About High Equity Valuations

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.