19 April 2023 Market Close & Major Financial Headlines: Wall Street Main Indexes Opened Sharply Lower Then After Climbing Into The Green, Slipped Back Into The Red Just Before The Closing Bell

Summary Of the Markets Today:

- The Dow closed down 80 points or 0.23%,

- Nasdaq closed up 0.03%,

- S&P 500 closed down 0.01%,

- Gold $2,007 down $12.50,

- WTI crude oil settled at $79 down $1.70,

- 10-year U.S. Treasury 3.602% up 0.028 points,

- USD $101.96 up $0.21,

- Bitcoin $29,256 down $984,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

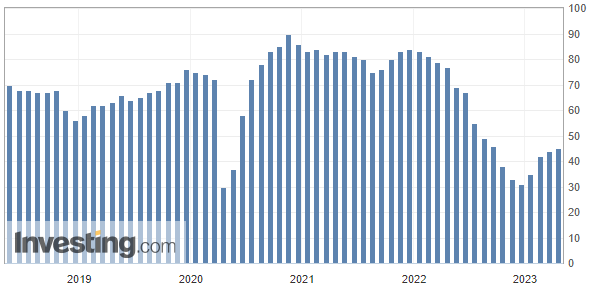

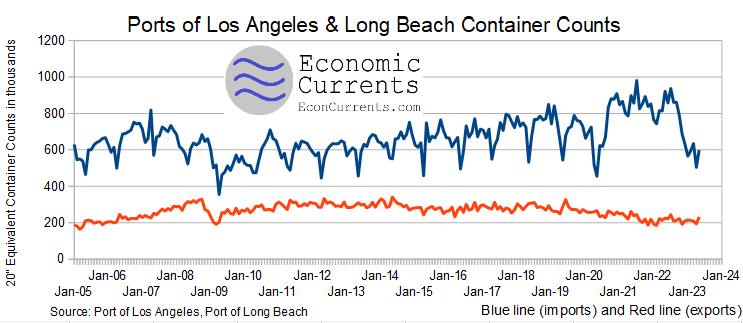

The Ports of Los Angeles and Long Beach are the busiest seaports in the United States, handling over 40% of all inbound containers for the entire United States. In March 2023, imports declined 35% year-over-year whilst exports increased 3% year-over-year. Imports are an economically important data point as it provides a view into personal consumption in the US. However, a year ago, the ports were working off a backlog caused by a supply recovery from the COVID-related logistics surge. I do suspect if one can rationalize away the last year’s surge, that imports are soft in March 2023.

The Beige Book for April 19, 2023, reported that economic activity continued to expand in all 12 Federal Reserve districts. However, the pace of growth slowed in some districts, as businesses reported rising costs and labor shortages. The report noted that

- Manufacturing activity expanded in all 12 districts, but the pace of growth slowed in some districts. Businesses reported rising input costs, including energy, raw materials, and labor. Some businesses also reported difficulty finding qualified workers.

- Retail sales expanded in all 12 districts, but the pace of growth slowed in some districts. Businesses reported rising sales, but they also reported rising costs and labor shortages.

- Residential real estate activity expanded in all 12 districts, but the pace of growth slowed in some districts. Businesses reported rising home prices and demand, but they also reported rising construction costs and labor shortages.

- Nonresidential real estate activity expanded in all 12 districts, but the pace of growth slowed in some districts. Businesses reported rising demand for commercial and industrial space, but they also reported rising construction costs and labor shortages.

- The Beige Book also reported that labor markets remained tight in all 12 districts. Businesses reported difficulty finding qualified workers, and they were raising wages to attract and retain workers.

Overall, the Beige Book reported that economic activity continued to expand in all 12 Federal Reserve districts, but the pace of growth slowed in some districts. Businesses reported rising costs and labor shortages, which were weighing on growth.

A summary of headlines we are reading today:

- Wind Power Has A Profitability Problem

- Investors Turn To Precious Metals Amid Recessionary Fears

- MIT Study: Nuclear Power Shutdown Could Lead To Increased Deaths

- Oil Prices Fall Despite Crude Inventory Draw

- Baker Hughes Q1 Earnings Beat Expectations

- DeSantis and allies ramp up Disney’s fight as more Republicans criticize his tactics

- Sell-off hits bitcoin, and SEC Chair Gensler grilled on crypto in House hearing: CNBC Crypto World

- Earnings Outlook: Derailments, and paid sick leave loom over railroad earnings reports

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.