29 June 2023 Market Close & Major Financial Headlines: Markets Opened Fractionally Lower, Trended Higher, Closing Near Session Highs

Summary Of the Markets Today:

- The Dow closed up 270 points or 0.80%,

- Nasdaq closed flat 0.00%,

- S&P 500 closed up 0.45%,

- Gold $1,916 down $6.10,

- WTI crude oil settled at $70 up $0.28,

- 10-year U.S. Treasury 3.842% up 0.128 points,

- USD Index $103.33 up $0.42,

- Bitcoin $30,617 up $543,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

CoreLogic’s monthly Loan Performance Insights Report for April 2023 shows mortgage performance remained strong with overall delinquencies at minimal levels and serious delinquencies at a 23-year low. 2.8% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.1 percentage point decrease compared with 2.9% in April 2022 and a 0.2 percentage point increase compared with 2.6% in March 2023. So far, there is no indication of stress in the mortgage sector.

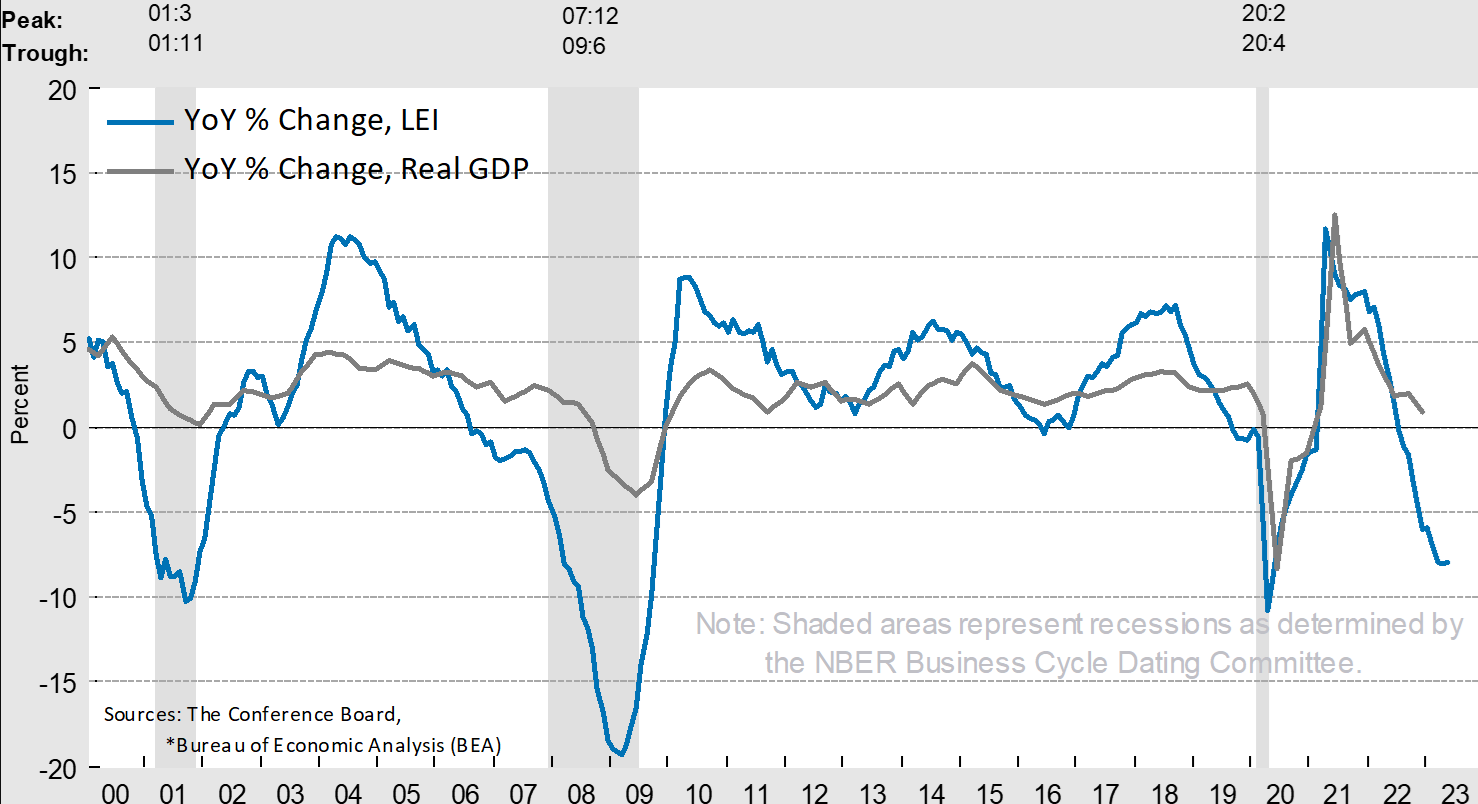

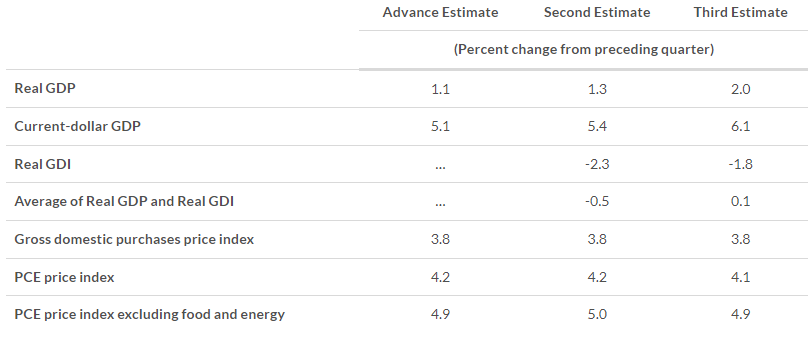

The third estimate of real gross domestic product (GDP) increased at an improved annual rate of 2.0%. In the fourth quarter, real GDP increased 2.6%. The updated estimates primarily reflected upward revisions to exports and consumer spending that were partly offset by downward revisions to nonresidential fixed investment and federal government spending. Imports, which are a subtraction in the calculation of GDP, were revised down. The table below shows the changes in GDP estimates for 1Q2023.

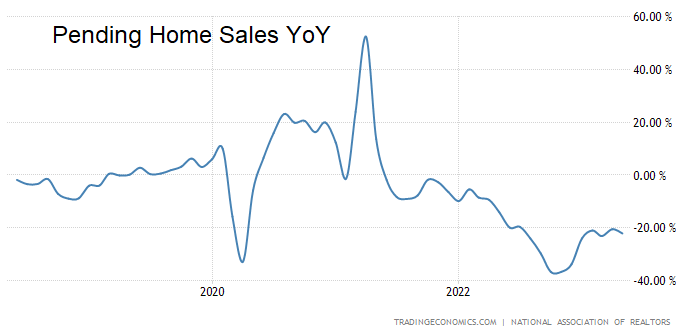

Pending home sales shrunk 2.7% in May 2023 from the previous month and declined 22.2% year-over-year. Existing home sales remain in a depression. NAR Chief Economist Lawrence Yun added:

Despite sluggish pending contract signings, the housing market is resilient with approximately three offers for each listing. The lack of housing inventory continues to prevent housing demand from being fully realized.

In the week ending June 24, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 257,500, an increase of 1,500 from the previous week’s revised average. This is the highest level for this average since November 13, 2021 when it was 260,000. The previous week’s average was revised up by 250 from 255,750 to 256,000.

Here is a summary of headlines we are reading today:

- How Russia’s Failed Coup Could Impact Global Commodities Markets

- Putin’s Plummeting Political Clout Is A Disaster For Xi

- Global Oil Reserves Could Increase Global Temperatures By 0.2°C

- Supreme Court rejects affirmative action at colleges as unconstitutional

- Dow closes 200 points higher as major banks pop on stress test results, GDP revised upward: Live updates

- Virgin Galactic completes first commercial flight in major step for space tourism company

- Fed paper argues ‘bleak’ stock market returns could slide to 2% annually

- Movers & Shakers: Bank of America, Rite Aid stocks rise, Micron and Virgin Galactic shares fall, and other stocks on the move

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.