22 NOV 2024 Market Close & Major Financial Headlines: Wall Street’s Three Main Indexes Open Mixed Small Caps Finally Closing Fractionally Higher, While The Dow Closes Moderately Higher

Summary Of the Markets Today:

- The Dow closed up 426 points or 0.97%,

- Nasdaq closed up 31 points or 0.16%,

- S&P 500 closed up 21 points or 0.35%,

- Gold $2,708 up $33.10 or 1.23%,

- WTI crude oil settled at $71 up $1.05 or 1.50%,

- 10-year U.S. Treasury 4.416 down 0.016 points or 0.361%,

- USD index $107.53 up $0.56 or 0.52%,

- Bitcoin $99,411 up $1,402 or 1.41%, (24 Hours), (New Bitcoin Historic high 99,789)

- Baker Hughes Rig Count: U.S. -1 to 583 Canada +1 to 201

U.S. Rig Count is down 1 from last week to 583 with oil rigs up 1 to 479, gas rigs down 2 to 99 and miscellaneous rigs unchanged at 5.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The U.S. stock markets closed near its session highs on Friday, with the major indices showing positive momentum. The major indices closed the week with gains exceeding 1%, despite a sluggish start following the post-election rally. Market participants re-calibrated after Nvidia’s earnings, which raised questions about AI’s continued impact on stock prices. For the week, Tesla shares rose almost 4%, while Nvidia experienced a more than 3% dip. Wall Street continues to anticipate President-elect Donald Trump’s cabinet selections, particularly the Treasury secretary position, which could significantly impact market dynamics. Bitcoin maintained its upward trajectory, approaching the $100,000 milestone. The cryptocurrency briefly surpassed $99,500 early Friday, buoyed by expectations of favorable crypto regulations under the incoming Trump administration. Finally, the market awaits a shortened trading week due to Thanksgiving with oil prices increasing amid escalating tensions in the Russia-Ukraine war.

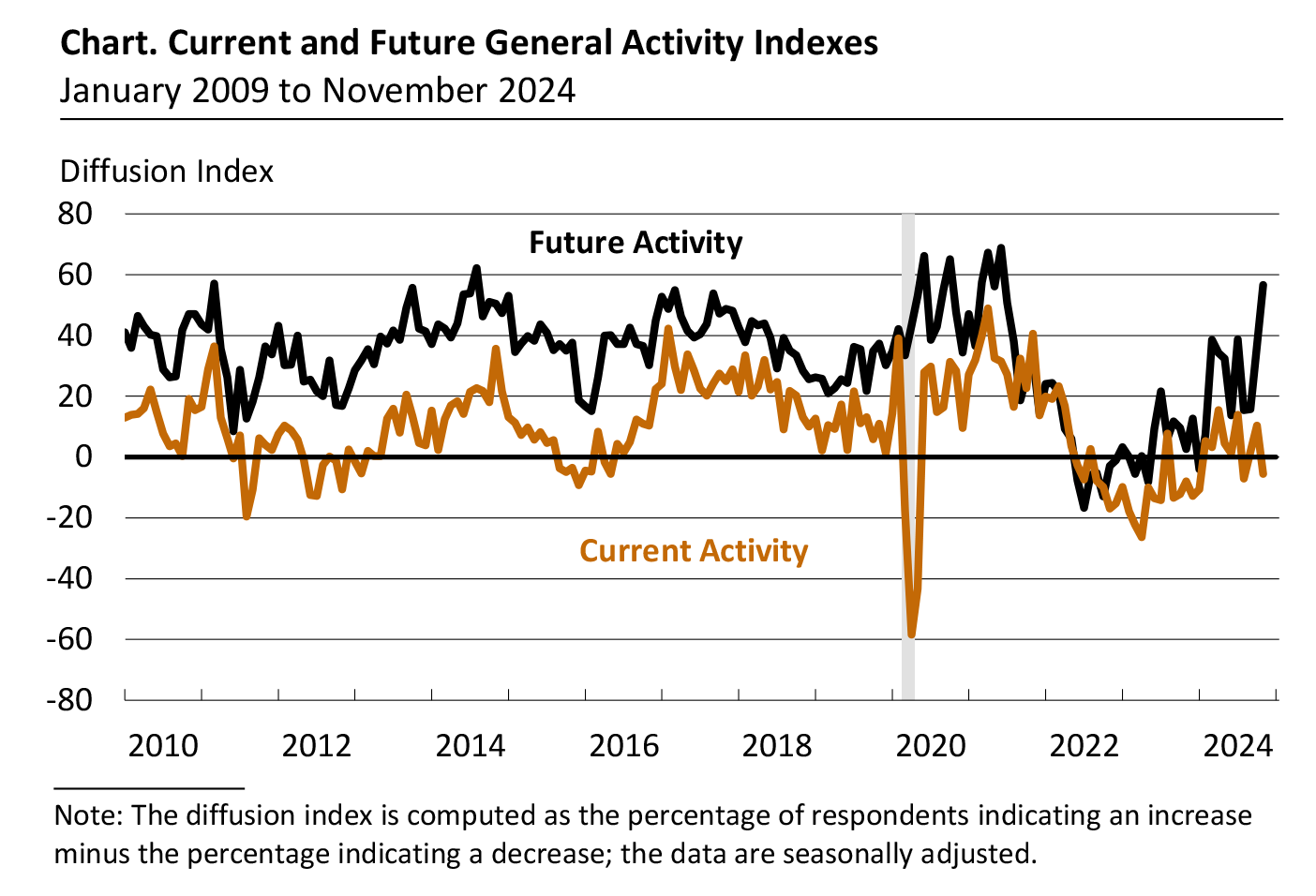

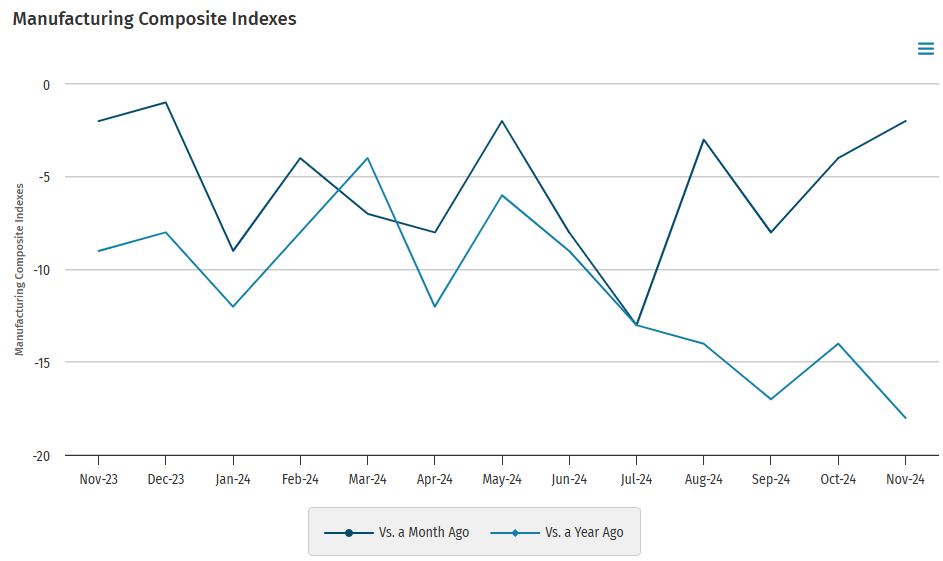

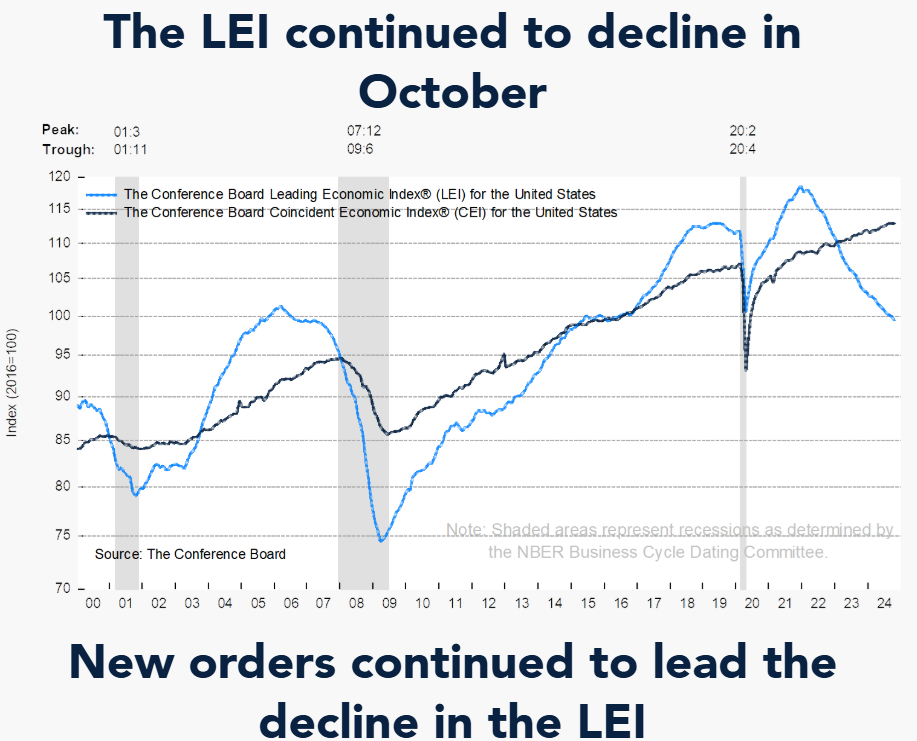

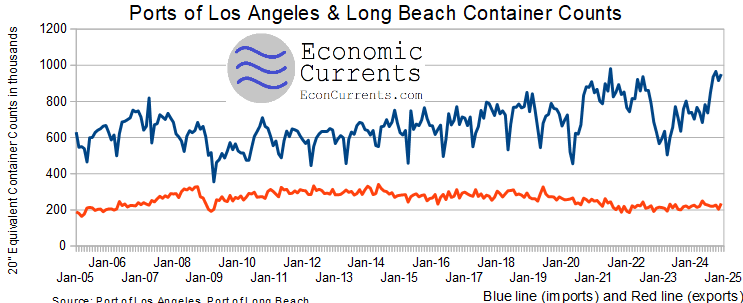

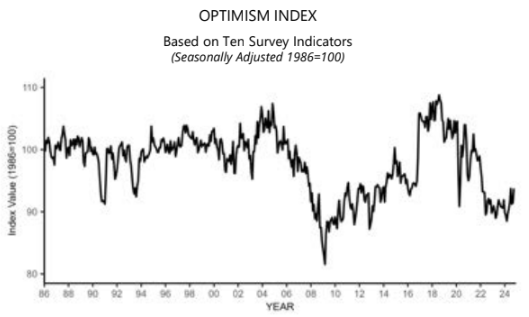

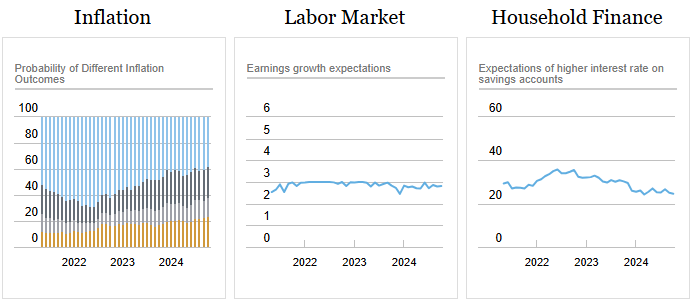

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

No releases today

Here is a summary of headlines we are reading today:

- Iran Escalates Nuclear Tensions with Advanced Centrifuge Installation

- U.S. Drilling Activity Slips Further As Market Volatility Remains

- Texas Pacific Land Replaces Marathon Oil in S&P 500 After ConocoPhillips Deal

- Geopolitical Risk and Supply Outages Underpin Oil Prices

- Is the Russia-Ukraine War Really Escalating?

- ‘I have no money’: Thousands of Americans see their savings vanish in Synapse fintech crisis

- Dow rises more than 400 points for record close, Wall Street posts weekly gain: Live updates

- The case for altcoins and memes as bitcoin, now approaching $100,000, faces a potential correction

- Bitcoin tests $100,000 heading into the weekend: CNBC Crypto World

- Egg Prices Surge Again As Grocers Face Shortages Amid Bird Flu Outbreak

- 2-year Treasury yield has 8th straight week of gains on improved U.S. outlook

- U.S. oil prices score a more than 6% weekly gain on supply risks tied to the Russia-Ukraine war

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.