14 July 2023 Market Close & Major Financial Headlines: Wall Street Rallies Into Fifth Day, Traded Near Unchanged Line, Closed Mixed And Fractionally Lower

Summary Of the Markets Today:

- The Dow closed up 115 points or 0.33%,

- Nasdaq closed down 0.18%,

- S&P 500 closed down 0.10%,

- Gold $1,959 down $4.40,

- WTI crude oil settled at $75 down $1.52,

- 10-year U.S. Treasury 3.824% up 0.063 points,

- USD Index $99.99 up $0.22,

- Bitcoin $30,119 down $1514,

- Baker Hughes Rig Count: U.S. -5 to 675 Canada +12 to 187

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

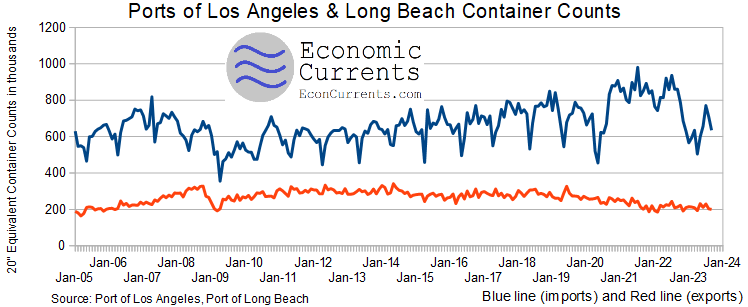

The price index for U.S. imports fell 6.1% year-over-year in June 2023 whilst export prices declined 12.0% year-over-year. The price of fuel imports declined 36.4% year-over-year and agriculture exports declined 9.8%. Trade sector prices are deflating which is normally a sign of a global recession.

Here is a summary of headlines we are reading today:

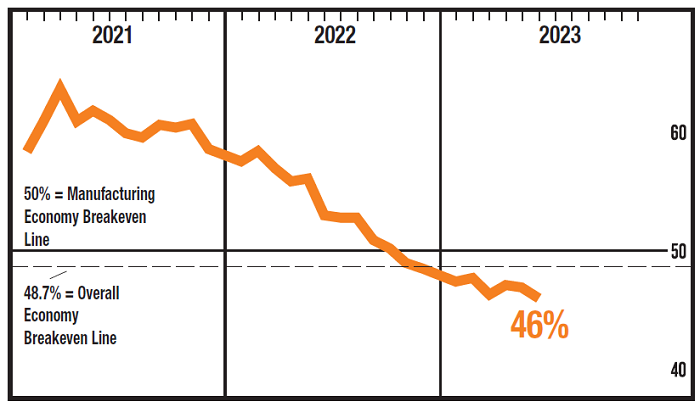

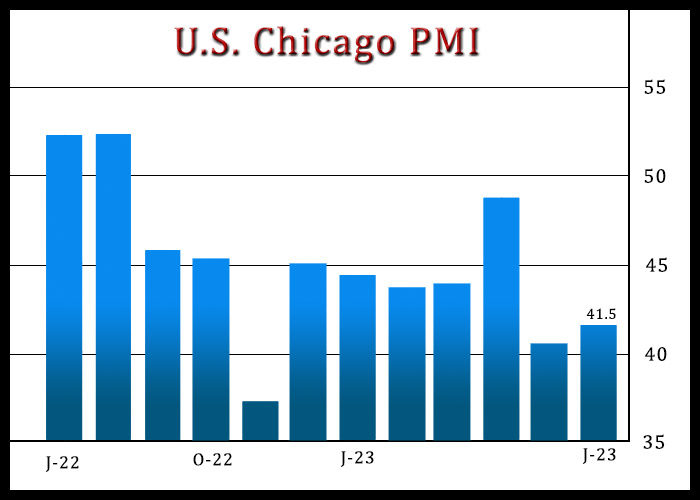

- America’s Manufacturing Slowdown Weighs On Steel Demand

- U.S. Oil, Gas Rigs See More Losses

- Russia Is Preparing To Export Less Oil In August

- U.S. Probes Exxon Contractors In Guyana For Drug Trafficking And Gold Smuggling

- Dow closes 100 points higher Friday on solid earnings, registers best week since March: Live updates

- Dimon says private equity giants are ‘dancing in the streets’ over tougher bank rules

- JPMorgan Chase beats analysts’ estimates on higher rates, better-than-expected bond trading

- Disney CEO Responds To Disney World Attendance Implosion

- Market Extra: The U.S. stock-market rally seems unstoppable, so why does bearishness still persist

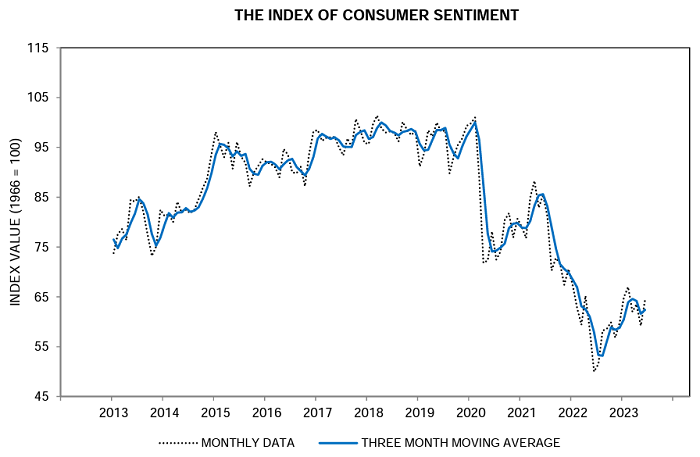

- Market Snapshot: S&P 500 trades down slightly, still on track for weekly gain after bank earnings, consumer-sentiment reading

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.