28 July 2023 Market Close & Major Financial Headlines: The Dow Didn’t Make 14 Sessions In A Row, But Headed For The Third Winning Week As Inflation Eases Again

Summary Of the Markets Today:

- The Dow closed up 177 points or 0.50%,

- Nasdaq closed up 1.90%,

- S&P 500 closed up 0.99%,

- Gold $1,959 up $12.80,

- WTI crude oil settled at $80 up $0.35,

- 10-year U.S. Treasury 3.957% down 0.055 points,

- USD Index $101.64 down $0.14,

- Bitcoin $29,316 down $146,

- Baker Hughes Rig Count: U.S. -5 to 664 Canada +6 to 193

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

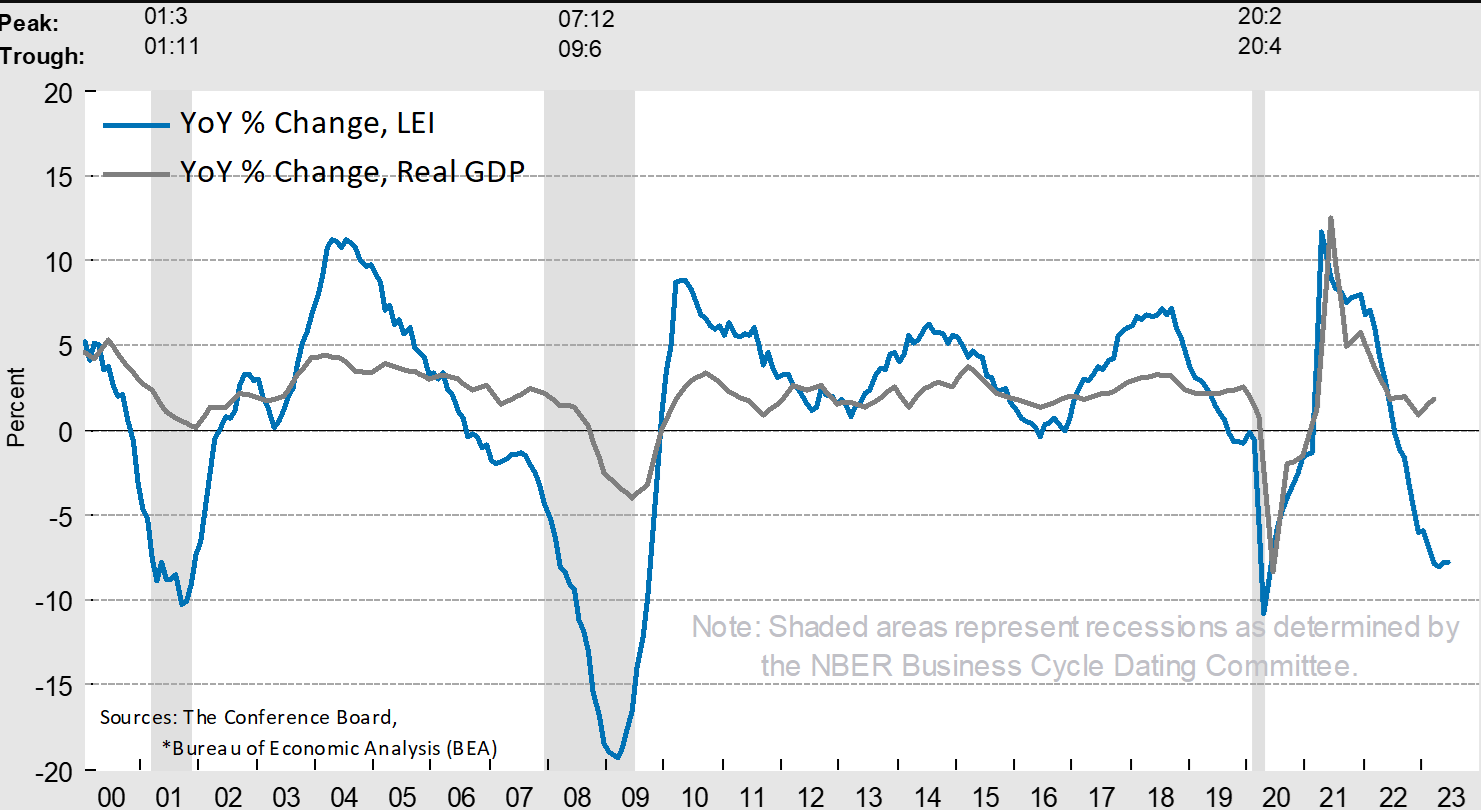

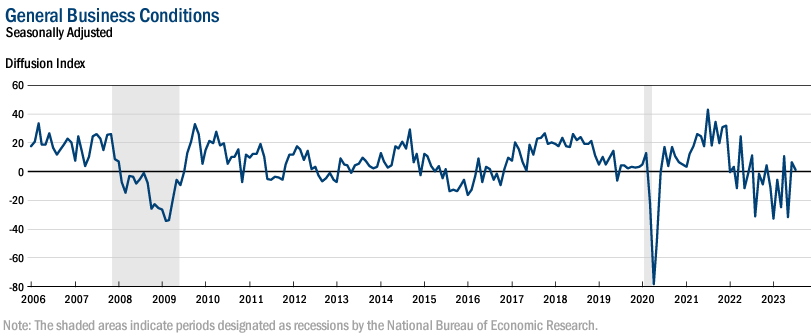

Real personal consumption expenditure growth in June 2023 was 2.4% year-over-year – up from 2.2% YoY in May 2023. Real disposable personal income growth was 4.7% – up from 4.1% in May. Inflation (as measured by the PCE Price Index) was 3.0% year-over-year – down from 3.8% in May. The bottom line is that the economy appears to be accelerating with inflation moderating going into 3Q2023 where some pundits are predicting a recession start. I have yet to see any data or trends which suggest a recession is possible.

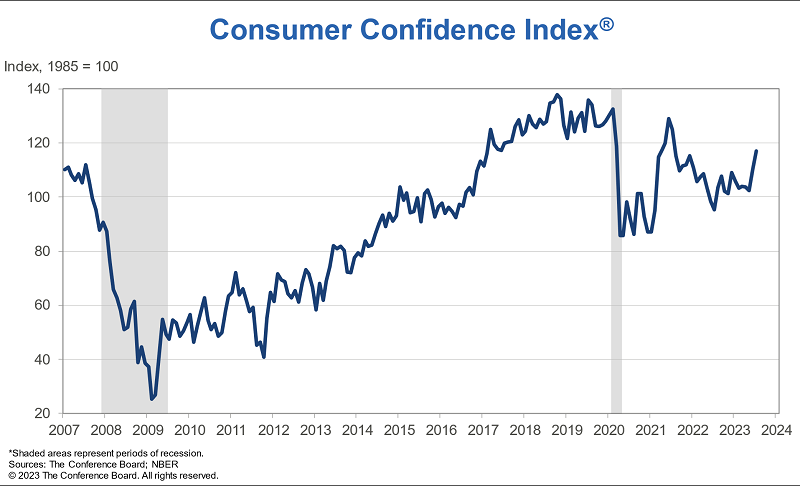

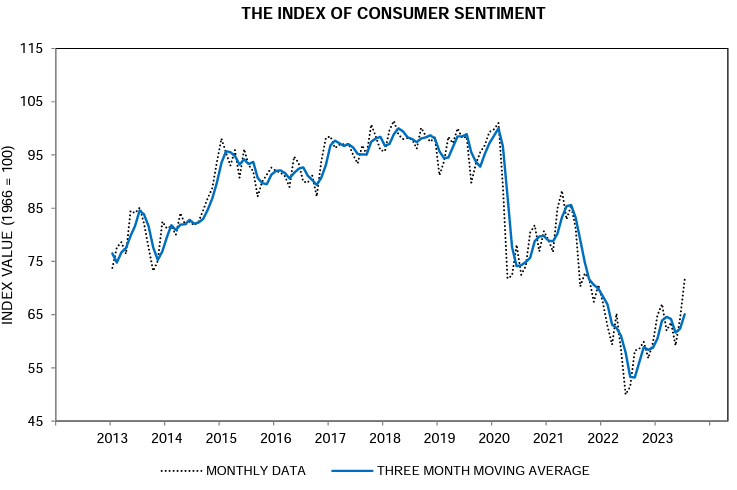

The University of Michigan Consumer sentiment rose for the second straight month, soaring 11% above June and reaching its most favorable reading since October 2021. All components of the index improved considerably, led by a 18% surge in long-term business conditions and 14% increase in short-run business conditions. Overall, the sharp rise in sentiment was largely attributable to the continued slowdown in inflation along with stability in labor markets. However, sentiment for lower-income consumers fell. This group anticipates that inflation and their income prospects will both worsen in the year ahead, highlighting the heterogeneity of views across the population.

Here is a summary of headlines we are reading today:

- New Catalyst Synthesis Paves The Way For Next-Gen Lithium-Air Batteries

- Imperial Oil Earnings Plummet By 72% On Turnaround, Lower Prices

- U.S. Drilling Dips Slightly Amid Rising Oil Prices

- 500 EVs Among The 3000 Cars On Burning Ship Off Dutch Coast

- Rising Gasoline Prices Boost Inflation Concerns

- Bullish Momentum Builds As Oil Markets Tighten

- Hopes Of A ‘Soft Landing’ Fuel Bullish Sentiment

- S&P 500 closes nearly 1% higher on softening inflation data, nabs 3rd week of gains: Live updates

- As Ford loses billions on EVs, the company embraces hybrids

- Key Fed inflation rate falls to lowest annual level in nearly 2 years

- Pentagon Approves Hazard Pay For US Troops In Ukraine, Paving Way For Possible Expanded Presence

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.