11Aug2023 Market Close & Major Financial Headlines: NASDAQ Fell For The Second Week In A Row. PPI Inflation Modestly Ticks Up.

Summary Of the Markets Today:

- The Dow closed up 105 points or 0.30%,

- Nasdaq closed down 0.56%,

- S&P 500 closed down 0.11%,

- Gold $1946 down $3.20,

- WTI crude oil settled at $83 up $0.26,

- 10-year U.S. Treasury 4.164% up 0.082 points,

- USD index $102.99 up $0.08,

- Bitcoin $29,358 down $65

- Baker Hughes Rig Count: U.S. -5 to 654 Canada +2 to 190

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Producer Price Index (PPI) for final demand ticked up and advanced 0.8% for the 12 months ending in July 2023 (blue line on the graph below). The increase in final demand prices was led by final demand services (green line on the graph below). We should expect the PPI to rise year-over-year for the remainder of the year as it is being compared to improving inflation conditions that began one year ago.

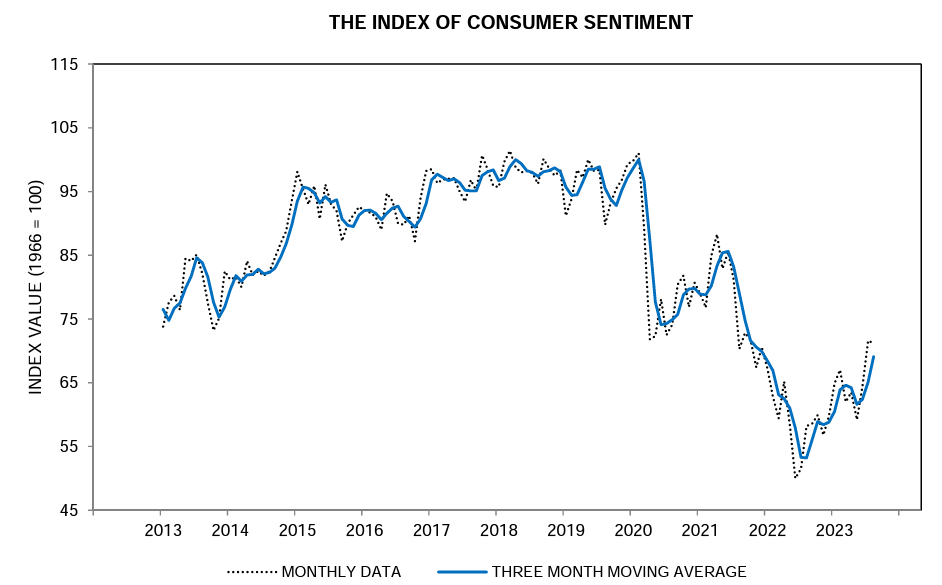

The preliminary University of Michigan consumer sentiment for August 2023 was essentially unchanged from July, with small offsetting increases and decreases within the index. At 71.2 index points, sentiment is now about 42% above the all-time historic low reached in June of 2022 and is approaching the historical average reading of 86. In general, consumers perceived few material differences in the economic environment from last month, but they saw substantial improvements relative to just three months ago.

Here is a summary of headlines we are reading today:

- Economic Chill In China: Domestic Demand And Property Markets Waver

- Indonesia Looks To Attract EV Producers With Zero Export Duty

- The Oil Price Rally Stalls Amid Demand Uncertainty

- Russia May Not Hold Presidential Elections

- U.S. Oil Production Is Bouncing Back

- U.S. judge sends Sam Bankman-Fried to jail over witness tampering

- Trump-appointee David Weiss named special counsel in Hunter Biden probe as DOJ calls for trial

- Hunter Biden Trial Likely As Plea Deal Negotiations Implode

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.