25 Aug 2023 Market Close & Major Financial Headlines: Wall Street Investors Turn Positive After Fed’s Powell’s Jackson Hole Speech Sending Major Indexes Moderately Higher At The Close

Summary Of the Markets Today:

- The Dow closed up 250 points or 0.73%,

- Nasdaq closed up 0.94%,

- S&P 500 closed up 0.67%,

- Gold $1,942 down $5.20,

- WTI crude oil settled at $80 up $1.00,

- 10-year U.S. Treasury 4.239% up 0.004 points,

- USD Index $104.14 up $0.160,

- Bitcoin $25,650 down $70,

- Baker Hughes Rig Count: U.S. -10 to 632 Canada +1 to 190

*Stock data, cryptocurrency, and commodity prices at the market closing.

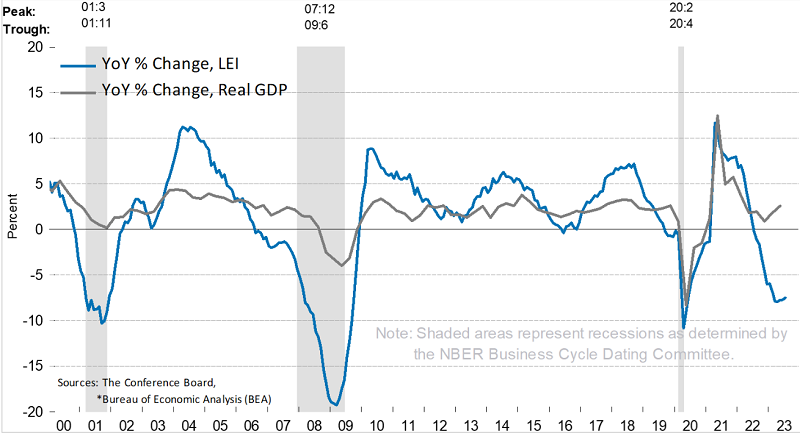

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

According to CoreLogic, annual single-family home rent growth eased for the 14th consecutive month in June 2023, registering a 3.3% gain, which remains in close range of the pre-pandemic growth rate. Lower-priced rentals continue to see more demand and thus greater annual gains than their higher-priced counterparts, a trend that is partially due to declining affordability and one that has been increasingly exacerbated by inflation. Molly Boesel, principal economist for CoreLogic stated:

Annual single-family rent growth has returned to its long-term, pre-pandemic rate, but increases for attached properties were one-and-a half-times that of detached properties in June; this is historically not the case, as both housing types tend to rise at the same pace. However, while rent growth for attached properties lagged that of detached properties in 2020 and 2021, it has outpaced the latter in 2022 to 2023. Rent growth for attached homes is projected to continue to exceed that of detached properties as the market balances.

Fed Chair Jerome Powell’s remarks at the Jackson Hole Symposium delivered reinforcement of past comments regarding inflation and the outlook for interest rate policy. He said, “It is the Fed’s job to bring inflation down to our 2 percent goal, and we will do so. We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

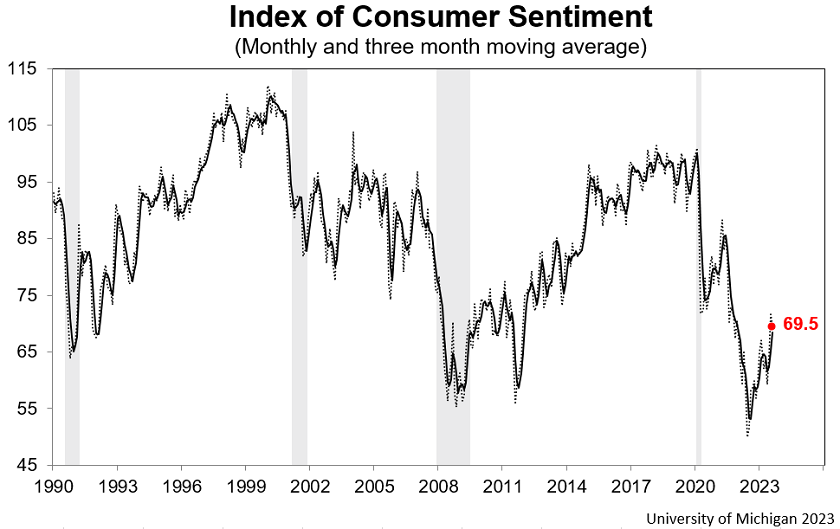

After rising sharply for the past several months, the University of Michigan consumer sentiment moved sideways in August with a small decline that is not statistically different from July. Sentiment reached its second highest reading in 21 months and is now about 39% above the all-time historic low reached in June of 2022. While buying conditions for durables and expectations over living conditions both improved, the long-run economic outlook fell back about 12% this month but remains higher than just two months ago. Consumers weighed a combination of positive and negative factors in the economy, which led to differing offsetting trends across demographic groups. Consumers perceive that the rapid improvements in the economy from the past three months have moderated, particularly with inflation, and they are tentative about the outlook ahead.

Here is a summary of headlines we are reading today:

- Permian Rig Count Drops Amid Rising U.S. Crude Production

- Walmart Drones Set To Take Flight In Dallas

- Bullish Fundamentals Limit The Downside For Oil Prices

- Canada’s Oil Production Continues To Surge

- S&P, Nasdaq close higher, snapping 3-week losing streak as Wall Street shakes off rate hike fears: Live updates

- Fed Chair Powell calls inflation ‘too high’ and warns that ‘we are prepared to raise rates further’

- Stocks making the biggest moves midday: Nordstrom, Hasbro, Hawaiian Electric, Affirm and more

- Wegovy helps reduce heart failure symptoms in obese people, study says

- Tesla Investors Set For $12,000 Payout Each Over Musk’s “Funding Secured” Tweet

- US faces more interest rate rises to cool inflation

- Treasury selloff drives key 5-year yield to highest since 2008

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.