06 Oct 2023 Market Close & Major Financial Headlines: The Dow Surges Sharply Higher After Wall Street’s Jobs Report; But Is It Enough To Continue A Bull Run?

Summary Of the Markets Today:

- The Dow closed up 288 points or 0.87%,

- Nasdaq closed up 1.60%,

- S&P 500 closed up 1.18%, (low 4,220)

- Gold $1,845 up $12.80,

- WTI crude oil settled at $83 up $0.57,

- 10-year U.S. Treasury 4.795% up 0.079 points,

- USD Index $106.07 down $0.260,

- Bitcoin $27,980 up $484,

- Baker Hughes Rig Count: U.S. -4 to 619 Canada -11 to 180

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for October 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

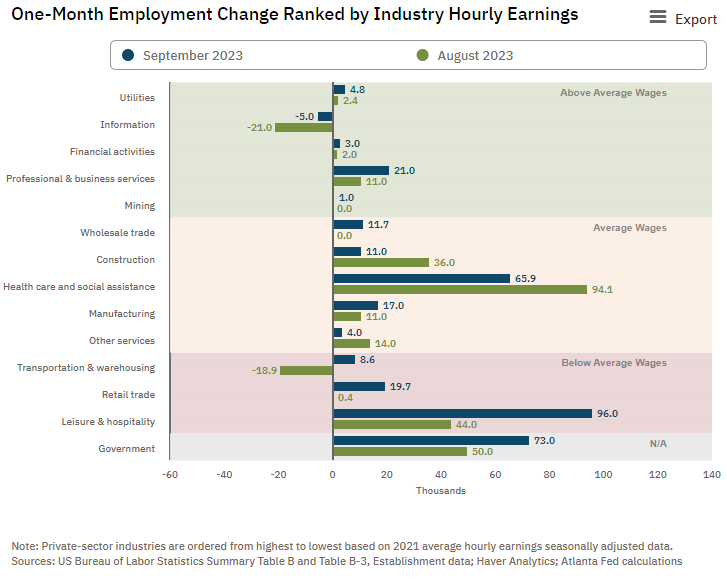

The markets were hoping for small employment gains in expectation that the Fed would stop raising the federal funds rate but instead, the total nonfarm payroll employment rose by 336,000 in September 2023 with the unemployment rate unchanged at 3.8%. The largest job gains occurred in leisure and hospitality (96,000); government (73,000); and health care (65,900). Any job gains over 150,000 is considered enough to provide jobs to those newly entering the workforce. The September employment gain was the second largest of 2023.

Interestingly, the household survey of the employment report showed only 90,000 employment gains against the headline establishment survey gain of 336,000 which throws into question the large gains of the establishment survey.

In August 2023, consumer credit decreased at a seasonally adjusted annual rate of 3.8%. Revolving credit increased at an annual rate of 13.9%, while nonrevolving credit decreased at an annual rate of 9.8%. I personally do not like the Federal Reserve’s methods for calculating changes in growth – I use year-over-year growth to remove the volatility. Using year-over-year methodology, consumer credit growth fell to 4.0% (blue line on the graph below), and adjusting for inflation growth was 2.0% year-over-year (red line on the graph below). The bottom line is that overall consumer credit is growing around the historical average, however, credit card (revolving credit) use has returned to the levels seen in the higher inflation periods of 1970s to 2000.

Here is a summary of headlines we are reading today:

- WTO Forecasts Global Trade Slowdown Amid Economic Headwinds

- U.S. Oil Rigs Decrease for Second Week Running, Gas Rigs Rise

- Central Banks Continue To Boost Gold

- Oil Traders Should Be Weary Of A Bear Trap

- Russia Escalates War With Nuclear Tests And Civilian Killings

- Dow soars nearly 300 points Friday as stocks reverse sharp losses after hot jobs report: Live updates

- Here’s where the jobs are for September 2023 — in one chart

- Wall Street will seek confirmation inflation is easing in the week ahead after Friday’s jobs report

- 10-year Treasury yield rises after strong U.S. jobs report

- Market Extra: Why 5% bond yields could wreak havoc on the market

- Treasury yields are climbing: ‘There’s never really been such an attractive opportunity for fixed-income investments’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.