Summary Of the Markets Today:

- The Dow closed up 66 points or 0.19%,

- Nasdaq closed up 0.71%,

- S&P 500 closed up 0.43%, (low 4,261)

- Gold $1,887 up $12.10,

- WTI crude oil settled at $84 down $1.98,

- 10-year U.S. Treasury 4.571% down 0.084 points,

- USD Index $105.78 down $0.005,

- Bitcoin $26,759 down $638,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

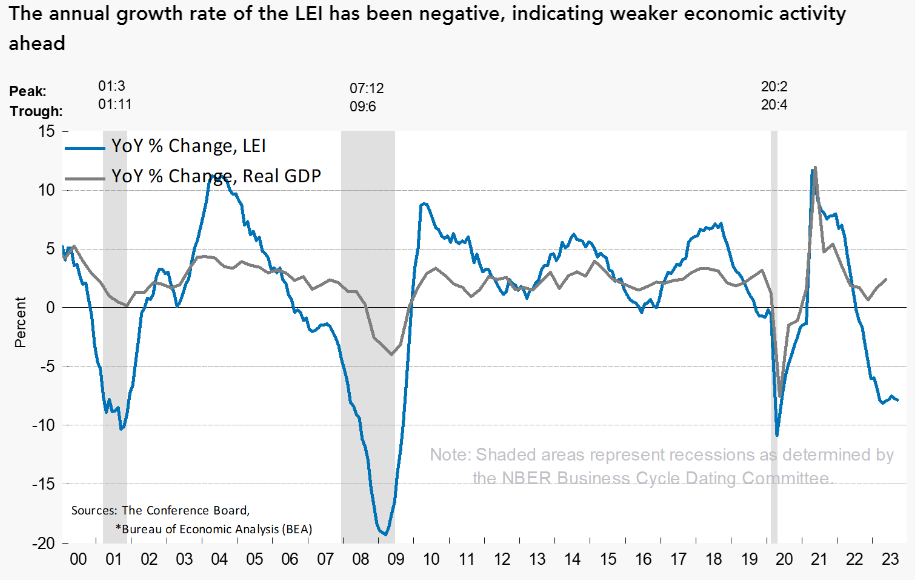

The Producer Price Index for final demand advanced 2.2% for the 12 months that ended in September 2023 (blue line on the graph below). My forecast is that inflation will continue to worsen for the rest of this year.

The meeting minutes for the Federal Reserve’s Federal Open Market Committee (FOMC) minutes for September 19-20, 2023 show participant’s views [major concerns or comments listed below]:

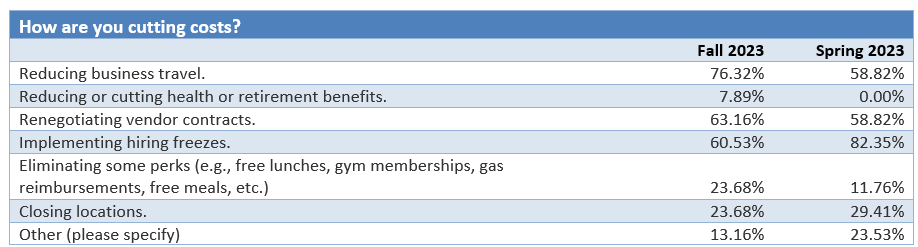

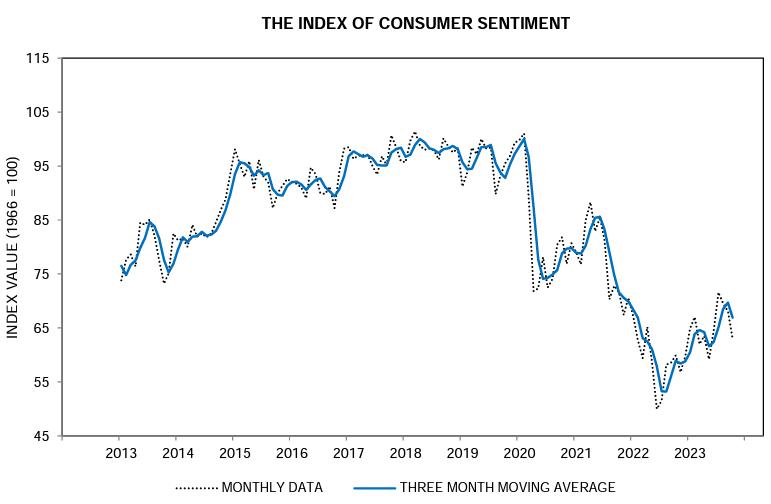

… participants remarked that the finances of some households were coming under pressure amid high inflation and declining savings and that there had been an increasing reliance on credit to finance expenditures. In addition, tighter credit conditions, waning fiscal support for families, and a resumption of student loan payments were viewed by several participants as having the potential to weigh on the growth of consumption.

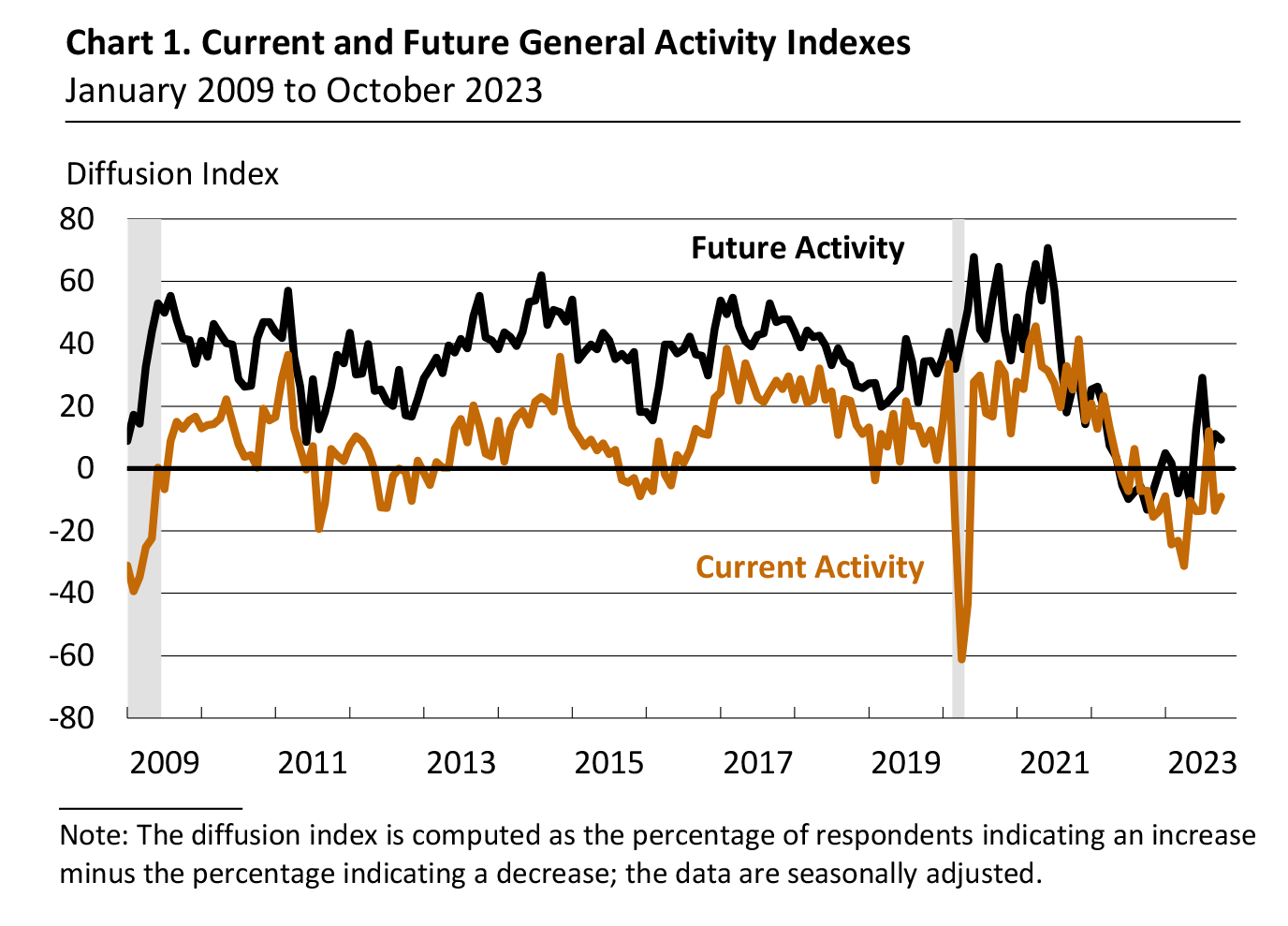

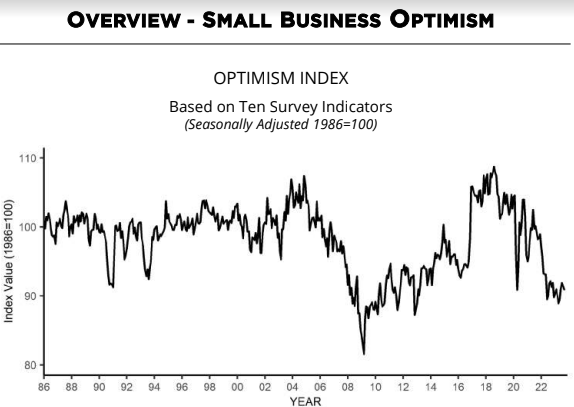

… participants noted improved business conditions from an increased ability to hire and retain workers, better-functioning supply chains, or reduced input cost pressures. A few participants commented that their business contacts had reported difficulties passing on cost increases to customers. Several participants judged that, over coming quarters, business activity would be restrained by tighter financial conditions, such as higher interest rates and more constrained access to bank credit.

… Many participants commented that they expected that the autoworkers’ strike would, in the near term, result in a slowdown in production of motor vehicles and parts and possibly put upward pressure on automobile prices, but that these effects would be temporary.

… Some participants observed that payroll growth remained strong but had slowed in recent months to a pace closer to that consistent with maintaining a constant unemployment rate over time. Most participants commented that the pace of nominal wage increases had moderated, and a few also mentioned that the wage premium for job switchers had come down. They noted, however, that nominal wages were still rising at rates above levels generally assessed to be consistent with the sustained achievement of the Committee’s 2 percent inflation objective, given current estimates of trend productivity growth.

… Several participants remarked that, despite the recent rise in energy prices, food and energy prices over the past year had contributed to a decline in overall inflation. … Participants observed that, notwithstanding recent favorable developments, inflation remained well above the Committee’s 2 percent longer-run objective and that elevated inflation was continuing to harm businesses and households—particularly low-income households.

… Participants generally noted there was still a high degree of uncertainty surrounding the economic outlook. One new source of uncertainty was that associated with the autoworkers’ strike, and many participants observed that an intensification of the strike posed both an upside risk to inflation and a downside risk to activity. A majority of participants pointed to upside risks to inflation from rising energy prices that could undo some of the recent disinflation or to the risk that inflation would prove more persistent than expected.

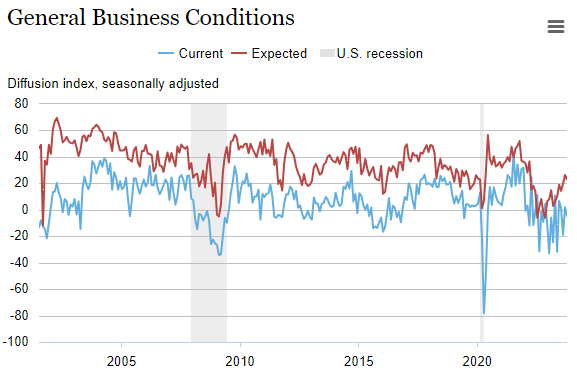

… A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate, while some judged it likely that no further increases would be warranted. All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.

… Several participants commented that, with the policy rate likely at or near its peak, the focus of monetary policy decisions and communications should shift from how high to raise the policy rate to how long to hold the policy rate at restrictive levels.

… A vast majority of participants continued to judge the future path of the economy as highly uncertain. Many noted data volatility and potential data revisions, or the difficulty of estimating the neutral policy rate, as supporting the case for proceeding carefully in determining the extent of additional policy firming that may be appropriate.

Here is a summary of headlines we are reading today:

- New Process Makes Green Hydrogen And Graphene From Plastic

- Israel-Hamas Conflict Sends Shockwaves Through Steel Market

- The Nuclear Microreactor Race Is Heating Up

- Qatar Signs 27-Year Deal To Supply France With LNG

- U.S. Treasury: G7 Price Cap Has Significantly Reduced Russia’s Oil Income

- Fed officials see ‘restrictive’ policy staying in place until inflation eases, minutes show

- Birkenstock slides about 10% in stock market debut after opening at $41 per share

- Days Of Low VIX Numbered As Financial Conditions Turn The Screw

- FOMC Minutes Echo ‘Hawkish Tone’ From Meeting; Fed To “Proceed Carefully”

- The Fed: Fed minutes show officials wary about the outlook and wanting to move carefully

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.